A Starter Guide to Bookkeeping for Small Businesses in the UK

Bookkeeping for small businesses in the UK is the system that records, organises, and validates every financial transaction a business makes. For UK small businesses, this includes sales, expenses, bank movements, and supporting documents such as invoices and receipts, all maintained in line with HMRC requirements. Core terms like records, transactions, cash basis, accrual basis, and bookkeeping software form the foundation of how to do bookkeeping for small business in a compliant and scalable way.

Getting bookkeeping for small businesses in the UK right from the start protects cash flow visibility, reduces compliance risk, and provides reliable data for growth decisions. HMRC data shows that record-keeping errors remain one of the most common causes of tax penalties for small businesses, highlighting why basic bookkeeping UK processes matter from day one, according to published compliance statistics from HMRC.

What is bookkeeping for small businesses in the UK and why does it matter?

Bookkeeping for small business UK refers to the structured process of recording financial activity in a way that meets legal, operational, and decision making needs. It creates a single source of truth for income, costs, assets, and liabilities, allowing business owners to understand performance beyond bank balances.

How does bookkeeping support HMRC compliance in the UK?

UK bookkeeping is designed around evidence. Every transaction must be traceable to source documents, categorised correctly, and retained for statutory periods. This approach ensures VAT returns, self assessment figures, and corporation tax calculations can be supported if queried.

Why does bookkeeping improve financial clarity for small businesses?

Accurate bookkeeping for small business UK turns raw transactions into usable insight. When records are consistent, trends in margins, cash pressure, and cost leakage become visible, allowing earlier corrective action.

What are the basics of bookkeeping every UK small business must understand?

The basics of bookkeeping focus on consistency, accuracy, and structure. These principles apply whether a business is run by a sole trader or a limited company.

How do you record and categorise transactions correctly?

Every sale and expense must be recorded once, categorised consistently, and linked to evidence. This is a core part of basic bookkeeping UK and underpins how to keep books for a small business without creating reconciliation issues later.

How do audit trails and record retention protect your business?

Audit trails show who recorded a transaction, when it was recorded, and what evidence supports it. Retaining records for HMRC protects the business during enquiries and simplifies year end processes.

How do beginners apply bookkeeping principles in practice?

For bookkeeping for beginners UK, simplicity is critical. Start with a clear chart of accounts, regular reconciliation routines, and documented processes for how to keep accounts for a small business as it grows.

How is bookkeeping different from accounting for small businesses?

Bookkeeping and accounting serve different but connected functions within a financial system.

What outputs does bookkeeping produce for accountants?

Bookkeeping for small business UK produces clean transaction data, reconciled balances, and reliable reports. These outputs allow accountants to focus on interpretation, compliance submissions, and strategic advice.

How does bookkeeping feed into higher level financial decisions?

When bookkeeping is accurate, accounting analysis becomes meaningful. Cash flow forecasting, tax planning, and funding decisions rely on the integrity of bookkeeping data rather than assumptions.

Why strong bookkeeping reduces downstream risk?

Weak bookkeeping multiplies errors at the accounting stage. Strong basics of bookkeeping reduce rework, lower compliance risk, and create confidence in reported figures across the business lifecycle.

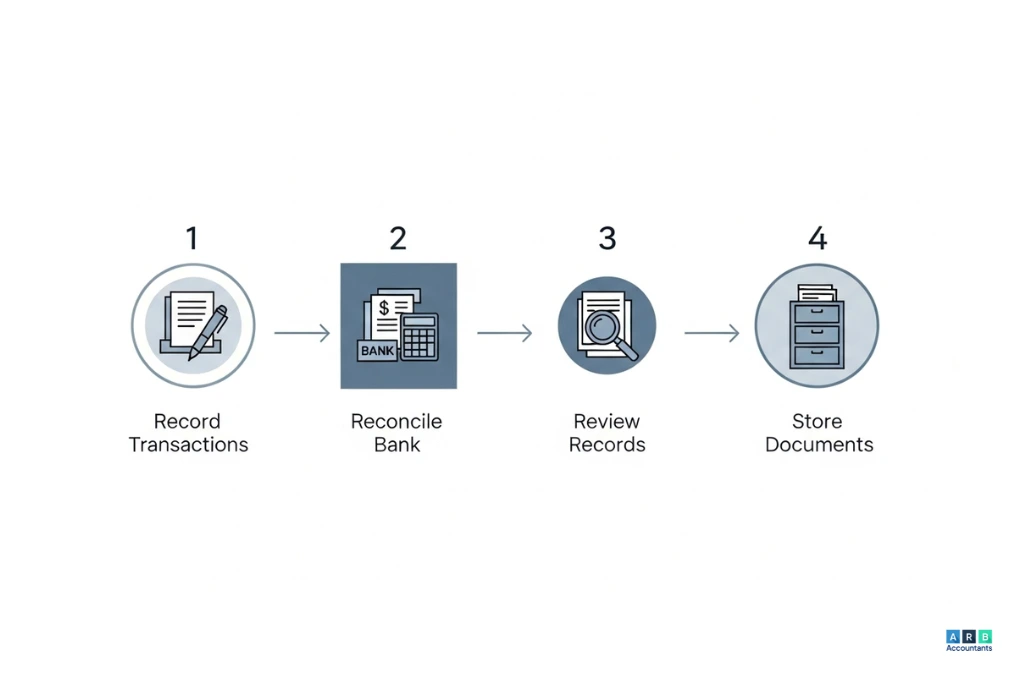

How do you do bookkeeping for a small business step by step?

Bookkeeping for small business UK works best when it follows a structured, repeatable process. Breaking it into clear steps makes how to do bookkeeping for small business easier to manage and reduces errors over time, especially for bookkeeping for beginners UK.

Step 1: Set up the bookkeeping structure

Start by opening a dedicated business bank account and defining standard categories for income and expenses. Choose a record-keeping method that aligns with HMRC requirements. This foundation supports consistent bookkeeping for small business UK and ensures transactions are captured correctly from the start.

Step 2: Record transactions regularly

Sales invoices, purchase bills, and bank movements should be recorded daily or weekly. Regular transaction capture prevents gaps and keeps records accurate. This step reflects the basics of bookkeeping and supports scalable bookkeeping for small business UK as activity increases.

Step 3: Reconcile bank accounts

Reconciliation involves matching recorded transactions with bank statements to confirm balances are accurate. Any discrepancies should be investigated immediately. This step validates data and strengthens how to do bookkeeping for small business without relying on assumptions.

Step 4: Review and categorise entries

Transactions should be checked for correct categorisation and, where applicable, VAT treatment. Reviewing entries helps prevent small errors from compounding and supports basic bookkeeping UK in a compliant way.

Step 5: Carry out regular reviews

Monthly reviews help track cash flow, outstanding invoices, and upcoming liabilities. Following this step by step workflow keeps bookkeeping for small business UK controlled and reliable over time.

How do you keep accounts for a small business accurately?

Accuracy in bookkeeping for small business UK depends on consistency and verification. Transactions should be recorded close to the transaction date using invoices or receipts as source documents. This approach supports how to keep accounts for a small business with reliable data.

Regular reconciliation, usually weekly or monthly, ensures bank balances match recorded figures. In basic bookkeeping UK, this process prevents errors from building up and improves financial visibility. Periodic reviews of uncategorised or duplicate entries help bookkeeping for beginners UK maintain confidence in their records.

How do you keep books for a small business organised over time?

Organisation underpins effective bookkeeping for small business UK. Documents should be stored digitally using clear naming conventions that link each transaction to its supporting evidence. This makes how to keep books for a small business more efficient and audit-ready.

HMRC requires records to be retained for several years, so storage systems must be easy to maintain as volumes grow. Applying the basics of bookkeeping to document management reduces retrieval time and lowers compliance risk.

READ RELATED ARTICLE: Cash Flow Planning: A Guide for UK Investors

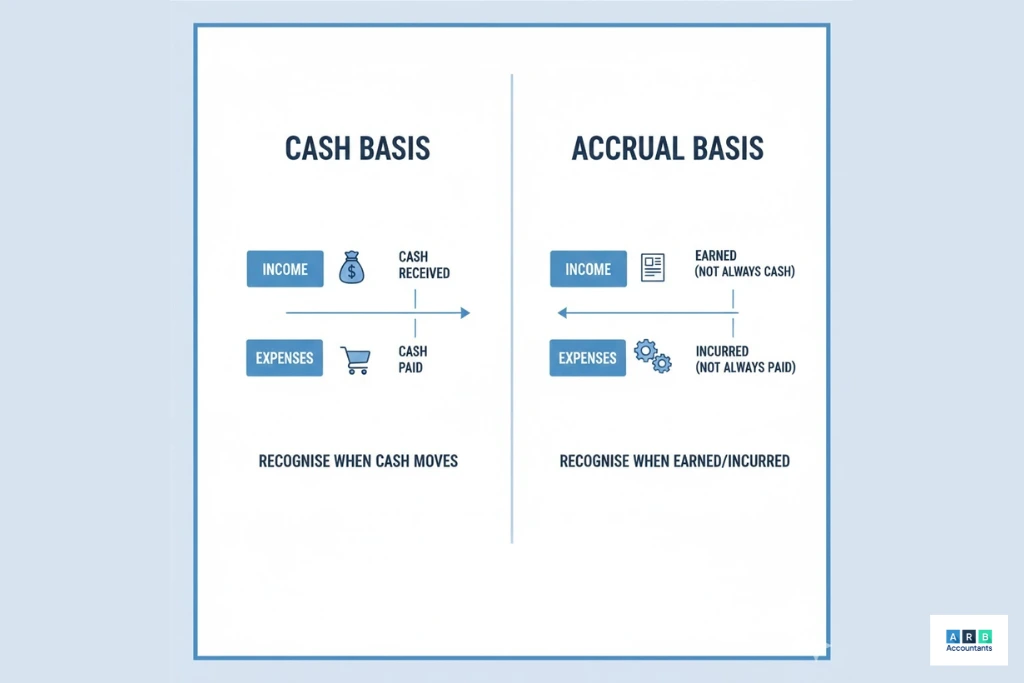

Which bookkeeping method should UK small businesses use and why?

Choosing the right method shapes how transactions are recorded, reported, and reviewed over time. For bookkeeping for small business UK, the decision usually comes down to cash basis or accrual accounting, based on scale, risk, and reporting needs.

Cash basis accounting

Cash basis accounting records income and expenses when money is received or paid. This method is easier to manage and aligns well with bookkeeping for beginners UK who need visibility over cash flow without complex adjustments. It suits early stage businesses with simple transactions and limited credit activity. In basic bookkeeping UK, cash basis reduces administrative effort and supports straightforward reporting.

Accrual accounting

Accrual accounting records income when earned and expenses when incurred, regardless of payment timing. This provides a more accurate view of profitability and obligations, especially where invoices, credit terms, or recurring costs are involved. For bookkeeping for small business UK with higher transaction volumes, accrual accounting supports better planning and performance analysis. It also strengthens how to keep accounts for a small business as financial complexity increases.

Understanding the difference between these methods is a core part of how to do bookkeeping for small business in a way that remains compliant and scalable.

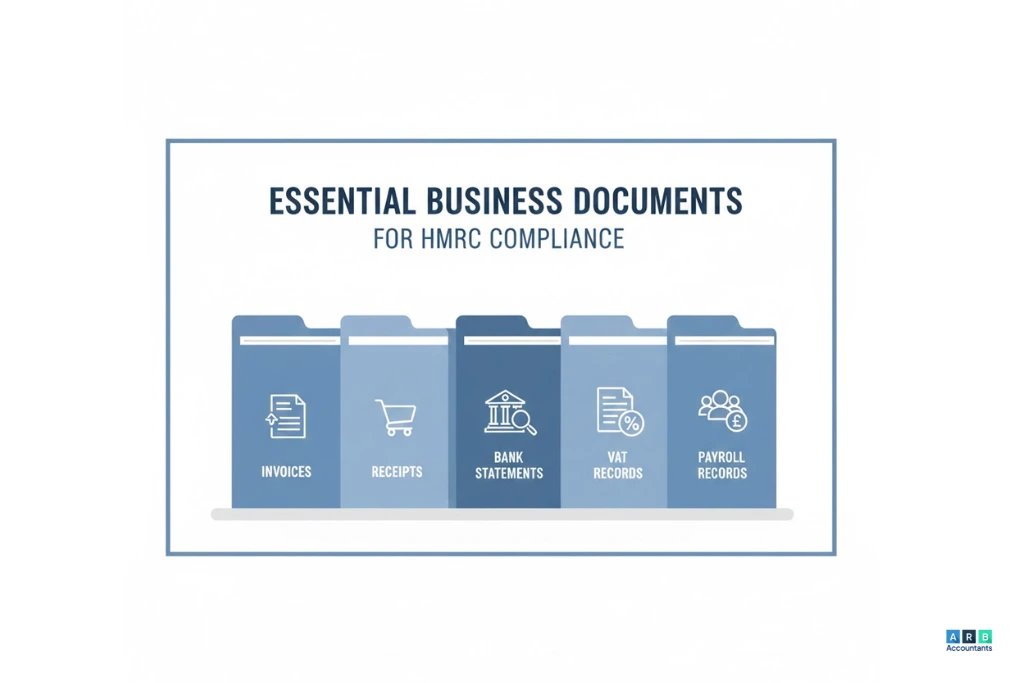

What records does HMRC require small businesses to keep?

HMRC requires UK small businesses to keep clear, complete records to support compliance and reporting.

Sales records

Invoices issued, income received, and credit notes. These form the core of bookkeeping for small business UK and show how revenue is generated.

Expense records

Purchase invoices, receipts, and bills for business costs. Keeping these supports basic bookkeeping UK and accurate profit calculation.

Bank and cash records

Bank statements, cash books, and payment confirmations. Regular reconciliation helps demonstrate how to keep books for a small business properly.

VAT records

VAT returns, input and output VAT calculations, and supporting documents where applicable. These become critical once VAT registered.

Payroll records

PAYE records, payslips, pension contributions, and RTI submissions for businesses with employees.

Supporting documentation

Contracts, loan agreements, and asset purchase records. These provide evidence and support how to keep accounts for a small business during reviews or inspections.

READ RELATED ARTICLE: Sole Trader VAT Registration

What bookkeeping software works best for beginners in the UK?

The best software for bookkeeping for beginners UK prioritises usability, automation, and compliance support. The right tools reduce manual work while reinforcing accurate processes from day one.

Xero

Xero is widely used for bookkeeping for small business UK due to its intuitive interface and strong bank feed automation. It supports VAT reporting, encourages regular reconciliation, and scales well as transaction volume increases. For businesses learning how to keep accounts for a small business, Xero provides structure without unnecessary complexity.

Sage

Sage is a familiar option for UK businesses that want robust compliance features. Its VAT functionality and reporting tools support the basics of bookkeeping while offering depth for growing businesses. Sage suits those moving beyond basic bookkeeping UK but still needing clear guidance.

QuickBooks

QuickBooks combines ease of use with flexible reporting, making it suitable for bookkeeping for beginners UK. Automated categorisation and document capture help businesses understand how to keep books for a small business while maintaining accurate records over time.

FreeAgent

FreeAgent is popular with micro businesses and contractors who want straightforward bookkeeping for small business UK. It simplifies day to day record keeping and integrates well with UK tax requirements, supporting consistent and compliant bookkeeping practices.

Can small business owners do bookkeeping themselves or should they outsource?

Bookkeeping for small business UK can be handled in house or outsourced, depending on scale, risk tolerance, and operational maturity. Many owners start by managing records themselves to stay close to cash flow and understand the basics of bookkeeping in practice. This approach often works in the early stages, when transaction volumes are low and the business model is simple. For bookkeeping for beginners UK, hands on involvement can improve financial awareness and discipline.

When does doing bookkeeping yourself make sense?

Self managed bookkeeping for small business UK is usually viable when transactions are predictable, income streams are limited, and compliance obligations are straightforward. Business owners who understand how to do bookkeeping for small business and follow a regular routine can maintain accurate records without external support. This works best when owners clearly separate personal and business finances and apply basic bookkeeping UK principles consistently.

When does outsourcing become the safer option?

Outsourcing becomes relevant when complexity increases or risk exposure rises. Higher transaction volumes, VAT obligations, or time constraints often reduce accuracy. From experience, businesses that delay support too long often struggle with how to keep accounts for a small business once errors accumulate.

A measured approach focuses on risk reduction rather than cost alone, keeping bookkeeping for small business UK aligned with growth, and engaging professional bookkeeping Essex services can ensure compliance and accuracy as businesses scale.

What common bookkeeping mistakes do UK small businesses make?

Mistakes in bookkeeping for small business UK usually stem from inconsistency rather than lack of effort. Poor processes create blind spots that often surface during deadlines, funding reviews, or compliance checks.

Poor bank reconciliation practices

Failing to reconcile bank accounts regularly leads to missing or duplicated transactions. This undermines reporting accuracy and makes how to keep books for a small business far more difficult over time. Regular reconciliation is a core part of the basics of bookkeeping and acts as an early warning system for cash flow issues.

Missed deadlines and mixed personal finances

Late updates and mixing personal and business spending distort financial records and weaken audit trails. These habits increase compliance risk and reduce confidence in reported figures. In bookkeeping for beginners UK, clear separation of accounts and consistent schedules help prevent small errors from becoming structural problems.

Ignoring financial reports and trends

When reports are ignored, bookkeeping becomes reactive rather than informative. Without regular review, trends in costs, margins, and cash position are missed. Connecting reports to decision making ensures bookkeeping for small business UK supports planning, pricing, and cash management rather than existing as a purely administrative task.

When should a small business move beyond basic bookkeeping?

Basic bookkeeping UK supports early operations, but growth introduces new demands that require stronger systems.

VAT registration and compliance expansion

VAT registration increases reporting frequency and accuracy expectations. Businesses must track input and output VAT precisely, which often stretches manual processes. This is usually the point where how to do bookkeeping for small business needs to be reassessed to avoid calculation errors and missed submissions.

Payroll and external funding requirements

Payroll introduces statutory reporting obligations, while funding applications depend on reliable and consistent financial data. These pressures quickly expose weaknesses in how to keep accounts for a small business when records are incomplete, delayed, or poorly structured.

Multiple income streams and operational complexity

As revenue sources increase, categorisation and reporting become more complex. Moving beyond basic bookkeeping UK allows businesses to maintain visibility across income lines, monitor performance accurately, and retain control as operations diversify.

Conclusion

Bookkeeping for small business UK is not just an administrative task, it is a control system that protects compliance, cash flow, and decision making. A structured approach grounded in the basics of bookkeeping helps businesses avoid common risks and adapt as they grow. Understanding how to do bookkeeping for small business, how to keep accounts for a small business, and when to move beyond basic bookkeeping UK creates long term financial resilience.

For tailored guidance and support on bookkeeping for small business UK, ARB Accountants provides expert insights and solutions designed to help small businesses stay compliant and thrive.