When Should You Outsource Bookkeeping Services

Bookkeeping underpins cash flow forecasting, payroll compliance, VAT reporting under Making Tax Digital, and the preparation of monthly management accounts. Many founders begin with cloud software such as Xero or QuickBooks, assuming transaction coding and bank reconciliation will remain manageable. Over time, volume increases, payroll expands, and reporting expectations grow. The question is no longer whether you can outsource bookkeeping, but when it becomes commercially necessary.

This guide explains when to outsource bookkeeping, how to assess the tipping point, and how outsource bookkeeping services should be structured to deliver financial control rather than basic data entry. The decision affects working capital visibility, lender confidence, and long term profitability.

- When does bookkeeping start costing you more time than money?

- What are the clear signs that you should outsource bookkeeping?

- Why outsource bookkeeping instead of hiring in-house?

- What are the real benefits of outsourcing bookkeeping beyond cost savings?

- What are the risks or downsides of outsourcing bookkeeping?

- Should small businesses outsource bookkeeping earlier than they think?

- How do outsourced bookkeeping services integrate with accounting and tax advisory?

- How do you evaluate whether to outsource bookkeeping services?

- What is the right time to outsource bookkeeping in your business lifecycle?

- Conclusion

- Frequently Asked Questions

When does bookkeeping start costing you more time than money?

How do you calculate the true opportunity cost of doing your own books?

The first trigger is economic. Compare your effective daily revenue to the hours spent reconciling accounts or processing payroll. If two days per month are consumed by admin, calculate the revenue those days could generate elsewhere. This is CEO time displacement, where strategic time is replaced by operational bookkeeping.

When founders ask, should I outsource my bookkeeping, the answer often lies in measurable opportunity cost. If your hourly value exceeds the cost of outsource bookkeeping services, the financial logic becomes clear. This is one of the overlooked benefits of outsourcing bookkeeping, particularly for growing companies.

What are the early operational warning signs?

Operational strain appears before financial distress. Payroll exceeding four to six hours per cycle, month end close drifting beyond ten days, or recurring suspense account balances indicate process breakdown. These are signals that bookkeeping solutions for small business are no longer aligned with transaction volume.

Anxiety around VAT submissions or CIS returns also suggests timing risk. According to HMRC, penalties apply automatically for late VAT submissions under the points based system (source). When compliance becomes stressful rather than structured, it may be time to outsource bookkeeping.

Why does DIY bookkeeping become riskier during growth?

Growth increases complexity faster than most internal systems adapt. Crossing the VAT threshold introduces digital record keeping obligations. Hiring employees multiplies payroll calculations and Real Time Information submissions. Manual spreadsheets fail under scaling pressure.

This is when outsourced bookkeeping for small business becomes strategic rather than administrative. Proper bookkeeping and accounting outsourcing introduces controls, documented workflows, and structured month end procedures. Without these, financial data degrades as volume increases.

READ RELATED ARTICLE: A Starter Guide to Bookkeeping for Small Businesses in the UK

What are the clear signs that you should outsource bookkeeping?

Are repeated bookkeeping errors affecting profitability?

Misclassified expenses distort gross margin. Payroll tax miscalculations create liabilities. Late VAT submissions trigger penalties. Inconsistent reporting undermines funding applications. These are structural issues, not isolated mistakes.

Business owners reviewing outsourcing bookkeeping pros and cons should consider the cost of financial inaccuracies. Reliable outsourced accounting and bookkeeping services introduce segregation of duties and review layers that reduce error frequency. For many, this is when to outsource bookkeeping, because the risk of inaccuracy outweighs the cost of support.

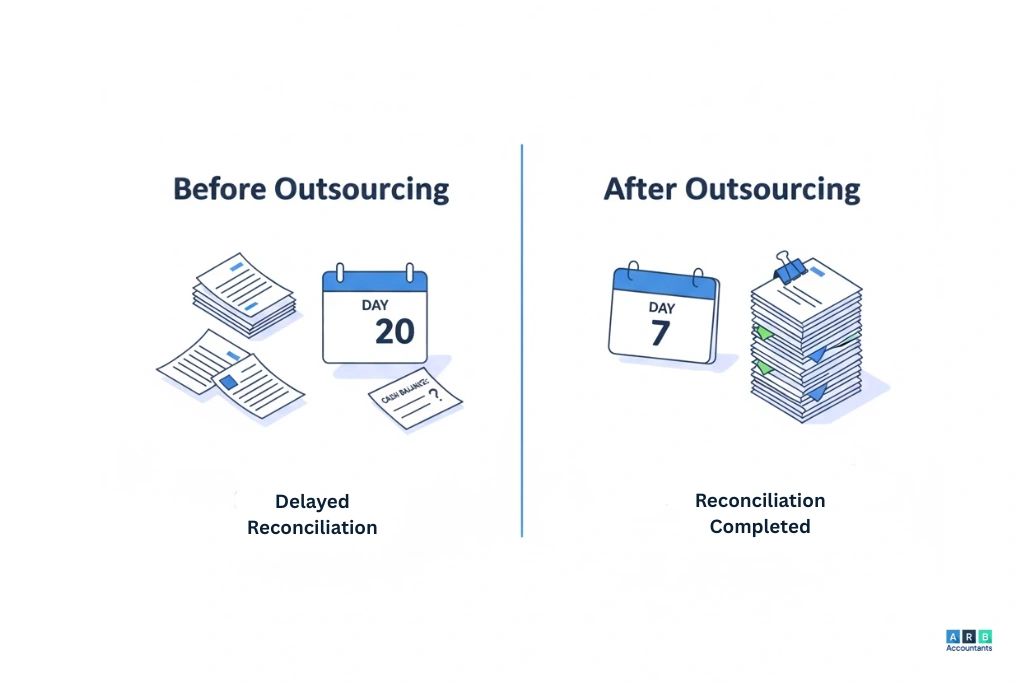

Is your financial data too delayed to make decisions?

If management accounts are unavailable until weeks after month end, strategic decisions rely on outdated numbers. Cash flow surprises replace forecast planning. Small business bookkeeping services should produce timely reconciled reports, not historical summaries.

When founders ask why outsource bookkeeping, the answer often lies in decision latency. Structured reporting from outsourced bookkeeping for small business supports pricing adjustments, hiring decisions, and working capital management.

Has compliance become reactive instead of proactive?

Compliance should be calendar driven and systemised. If VAT returns, RTI payroll submissions, or CIS filings are handled at the last minute, risk accumulates. Bookkeeping solutions for small business must align with regulatory timelines.

Outsource bookkeeping services integrate compliance tracking into the workflow. This reduces last minute exposure and creates audit ready records. For many firms, this is the defining moment to outsource bookkeeping.

If these warning signs sound familiar, structured support from our professional bookkeeping Essex team can stabilise reporting and compliance before risks escalate.

READ RELATED ARTICLE: Benefits of Outsourcing Payroll Services

Why outsource bookkeeping instead of hiring in-house?

What does a full-time bookkeeper actually cost in the UK?

A salaried bookkeeper involves base salary, employer National Insurance, pension contributions, software licensing, and supervision time. Total employment cost exceeds headline salary. Outsourced accounting and bookkeeping services spread expertise across multiple clients, which lowers per business overhead.

How does outsourced bookkeeping compare financially?

Flexible retainers allow cost alignment with transaction volume. Scalable capacity supports seasonal fluctuation. There is no HR overhead. Access to specialist oversight improves technical accuracy. These are measurable benefits of outsourcing bookkeeping.

When does outsourcing become more cost-effective than internal hiring?

If workload fluctuates monthly, outsourcing provides elasticity. If complexity requires payroll, VAT, and reporting expertise, one employee rarely covers all disciplines. In these cases, bookkeeping and accounting outsourcing delivers broader capability at lower structural risk. For many growth focused companies, this is precisely when to outsource bookkeeping and secure long term financial control.

What are the real benefits of outsourcing bookkeeping beyond cost savings?

Financial control depends on accurate ledgers, reconciled control accounts, and structured month end reporting. Many businesses first consider whether to outsource bookkeeping for cost reasons, but the deeper value sits in process integrity and decision support. The benefits of outsourcing bookkeeping extend into governance, reporting quality, and risk reduction, which directly influence profitability and lender confidence.

How does outsourcing improve financial accuracy?

Segregation of duties is a core internal control principle. When one individual records transactions, reconciles accounts, and reviews reports, error risk increases. Outsourced accounting and bookkeeping services introduce separation between data entry, reconciliation, and supervisory review. This layered oversight reduces mispostings and control account discrepancies.

Independent review processes also standardise month end close procedures. Structured bank reconciliations, debtor and creditor control reviews, and accrual adjustments create reliable management accounts. For firms evaluating outsourcing bookkeeping pros and cons, the reduction in avoidable adjustments at year end is a measurable advantage. Businesses that outsource bookkeeping often see fewer reclassifications during statutory reporting.

Why does outsourcing give you access to broader expertise?

Bookkeeping rarely exists in isolation. Payroll compliance, VAT treatment, and sector specific reporting standards require specialist knowledge. Outsource bookkeeping services typically include payroll specialists familiar with Real Time Information submissions, VAT professionals who understand partial exemption and reverse charge rules, and certified cloud accounting professionals trained in automation tools.

This breadth of knowledge is difficult to replicate internally within small business bookkeeping services. Outsourced bookkeeping for small business connects daily transaction processing with regulatory updates and software optimisation. According to the Association of Accounting Technicians, over 80 percent of small firms now rely on digital accounting platforms, which increases the need for trained system oversight. Broader expertise clarifies why outsource bookkeeping decisions often extend beyond price.

How can outsourced bookkeeping support strategic growth?

Reliable data enables cash flow forecasting, rolling budget modelling, and KPI tracking. Margin analysis requires accurate cost allocation and revenue recognition. Without clean ledgers, growth planning rests on assumptions.

When businesses outsource bookkeeping, they gain structured reporting that supports scenario modelling and capital planning. Bookkeeping solutions for small business should translate transactional data into insight. This connection between reconciled accounts and forward planning is one of the strongest benefits of outsourcing bookkeeping. It also informs when to outsource bookkeeping, particularly during expansion phases.

READ RELATED ARTICLE: Cash Flow Planning: A Guide for UK Investors

What are the risks or downsides of outsourcing bookkeeping?

What control concerns do business owners have?

Some founders fear reduced visibility, slower communication, or dependency on external teams. These concerns reflect legitimate governance questions. Outsourcing bookkeeping pros and cons must be weighed transparently. If reporting timelines are unclear or data access is restricted, oversight weakens.

Clear service level agreements and shared cloud access mitigate these risks. Businesses that outsource bookkeeping should retain dashboard visibility and approval controls. When evaluating whether should I outsource my bookkeeping, control architecture is as important as pricing.

What are the risks of offshore bookkeeping?

Offshore models may introduce compliance mismatches, quality inconsistency, and data protection exposure under UK GDPR. Regulatory interpretation requires local context, especially for VAT and payroll legislation. Outsourced accounting and bookkeeping services operating within UK compliance frameworks reduce this risk.

Quality inconsistency can also arise where supervision structures are weak. Bookkeeping and accounting outsourcing should include documented review procedures and escalation paths. Without these, cost savings may be offset by correction costs.

How can you mitigate outsourcing risks?

Mitigation begins with a clear scope of work and defined reporting timelines. Cloud software with shared access ensures transparency. Alignment between your bookkeeper and accountant prevents duplication and compliance gaps.

Businesses that outsource bookkeeping effectively treat the relationship as a structured partnership. This clarity determines when to outsource bookkeeping responsibly and whether outsourced bookkeeping for small business will strengthen governance rather than dilute it.

Should small businesses outsource bookkeeping earlier than they think?

Why do small business bookkeeping services scale differently?

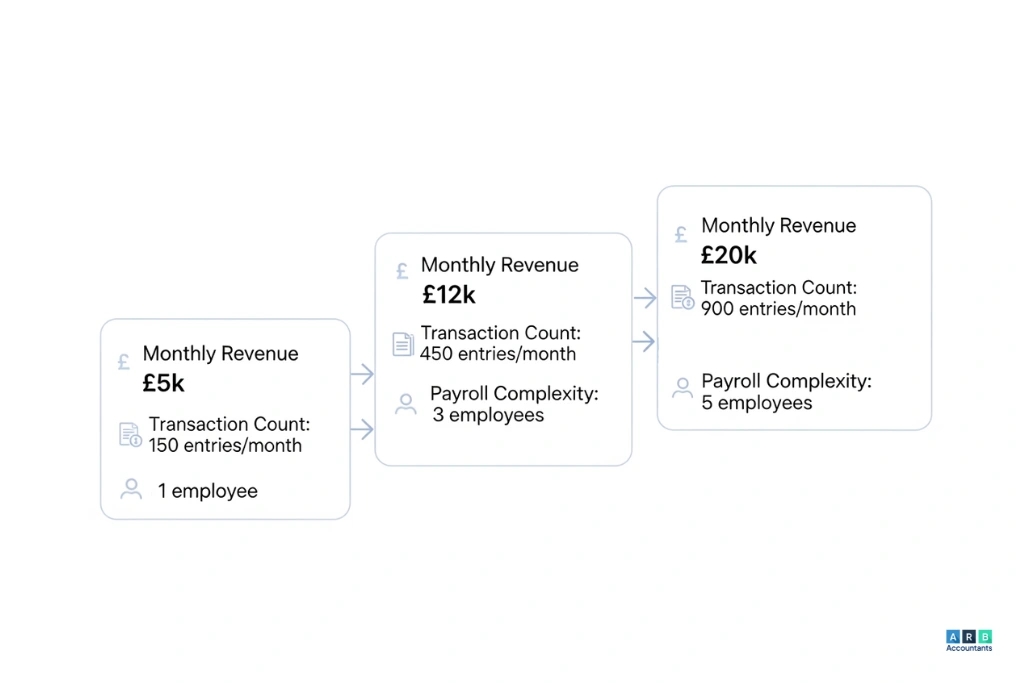

Founder led oversight often limits objectivity. Rapid revenue volatility and lean operational teams magnify cash flow risk. Small business bookkeeping services must adapt quickly to transaction growth and payroll expansion.

What revenue or transaction thresholds suggest outsourcing?

Monthly revenue between £8,000 and £15,000 combined with payroll complexity often signals pressure. VAT registration, more than three employees, or increasing transaction volume compound compliance exposure. These indicators frequently answer the question, should I outsource my bookkeeping.

How does outsourced bookkeeping for small business differ from corporate outsourcing?

Outsourced bookkeeping for small business emphasises relationship led service and advisory access alongside compliance delivery. Cash sensitive forecasting and management reporting cadence differ from enterprise scale models. Understanding this distinction clarifies why outsource bookkeeping decisions vary by lifecycle stage.

Choosing the right accounting bookkeeping service early can prevent scaling issues and ensure financial systems grow with your business, not against it.

How do outsourced bookkeeping services integrate with accounting and tax advisory?

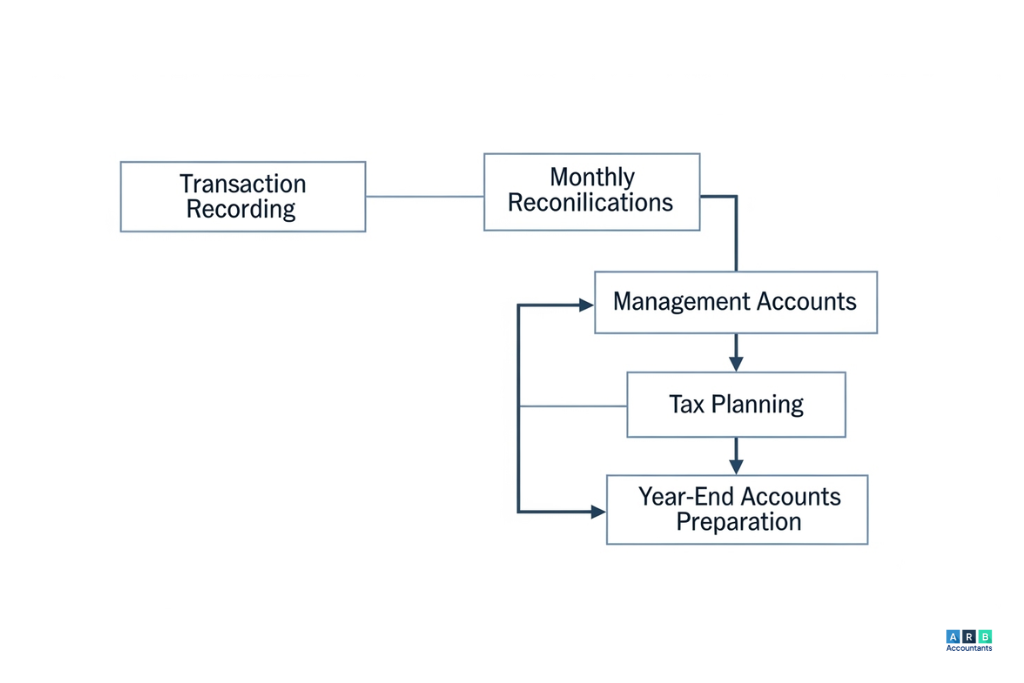

What is the difference between bookkeeping and accounting outsourcing?

Bookkeeping records transactions and performs reconciliations. Accounting interprets data for tax planning and financial strategy. Monthly close procedures differ from year end tax optimisation. Bookkeeping and accounting outsourcing integrates both layers within defined workflows.

Why does alignment between your bookkeeper and accountant matter?

Cleaner year end handovers reduce adjustments. Reduced duplication of work lowers professional fees. Fewer compliance risks improve audit readiness. Accurate tax positioning depends on reconciled ledgers.

How should bookkeeping and accounting outsourcing be structured?

Cloud first systems, monthly management reporting cadence, payroll integration, compliance led workflows, and defined escalation processes create accountability. When businesses outsource bookkeeping within this framework, operational stability and strategic clarity reinforce each other.

READ RELATED ARTICLE: What are Monthly Management Accounts?

How do you evaluate whether to outsource bookkeeping services?

Evaluating whether to outsource bookkeeping requires analysis of internal controls, reporting cadence, and compliance exposure. The decision is not emotional, it is operational. Directors should review ledger accuracy, month end close speed, and VAT submission reliability before choosing outsource bookkeeping services.

What questions should you ask before signing a contract?

Ask which industries the provider understands and how sector specific VAT treatments are handled. Clarify exactly what is included in the monthly scope, including reconciliations, accruals, and management accounts. Confirm who manages payroll and compliance, and how Real Time Information submissions are monitored. Request a reporting calendar that defines delivery timelines. These questions determine whether outsourced accounting and bookkeeping services align with bookkeeping solutions for small business. Clear answers also clarify outsourcing bookkeeping pros and cons and when to outsource bookkeeping responsibly.

What pricing structures are realistic?

Monthly retainers suit stable transaction volumes. Transaction based pricing works for fluctuating activity. Add on payroll services and tiered service levels allow scale. Compare pricing against the internal cost of employment. According to the Office for National Statistics, median UK administrative salaries continue to rise, which impacts hiring decisions. This data informs why outsource bookkeeping can be financially rational. Evaluate outsource bookkeeping services against lifecycle stage and risk profile.

What red flags should you avoid?

Extremely low pricing without defined deliverables often signals limited review processes. No written service agreement weakens accountability. Limited software transparency restricts oversight. Lack of collaboration with your tax adviser undermines bookkeeping and accounting outsourcing. Businesses that outsource bookkeeping should demand integration between financial reporting and tax positioning.

What is the right time to outsource bookkeeping in your business lifecycle?

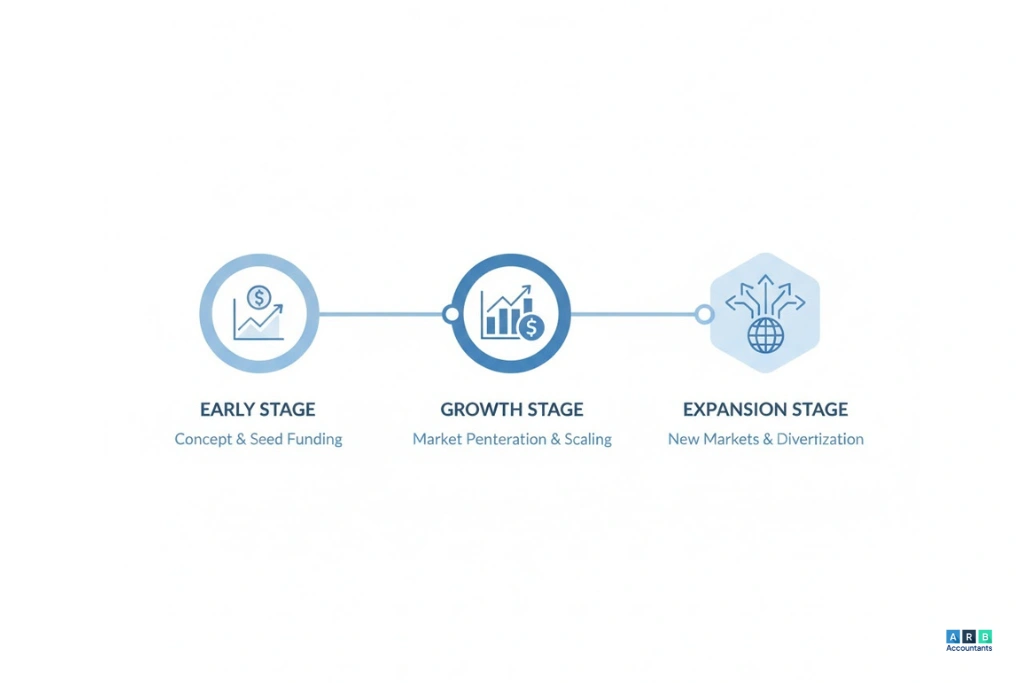

At startup, early system design prevents structural errors and allows founders to focus on revenue generation. During growth, increased payroll, VAT complexity, and investor reporting accelerate the need for outsourced bookkeeping for small business. At stabilisation, structured forecasting and margin optimisation support expansion or exit planning. These transition points answer should I outsource my bookkeeping and highlight the long term benefits of outsourcing bookkeeping within small business bookkeeping services.

Conclusion

The decision to outsource bookkeeping should be driven by financial clarity, compliance risk, and strategic capacity, not just cost. When bookkeeping begins to limit growth, delay decisions, or create avoidable risk, outsourcing becomes an operational investment rather than an expense.

The right outsourced bookkeeping services provide structure, accuracy, and financial insight that supports sustainable growth for small and scaling businesses alike. Work with experienced professionals at ARB Accountants, hire an established accountant Southend businesses rely on, ensure that bookkeeping aligns with tax planning, compliance obligations, and long term financial strategy rather than operating in isolation.

Frequently Asked Questions

Is it cheaper to outsource bookkeeping or hire in-house?

Is it cheaper to outsource bookkeeping or hire in-house?

How much does it cost to outsource bookkeeping in the UK?

How much does it cost to outsource bookkeeping in the UK?

Can I outsource bookkeeping but keep accounting in-house?

Can I outsource bookkeeping but keep accounting in-house?

What is included in outsourced bookkeeping services?

What is included in outsourced bookkeeping services?

When should a small business hire a bookkeeper?

When should a small business hire a bookkeeper?

Is outsourcing bookkeeping safe?

Is outsourcing bookkeeping safe?

.