How to Pay Capital Gains Tax Online After Sale

Capital Gains Tax (CGT) applies when you dispose of a chargeable asset and realise a taxable gain. For UK property disposals, the reporting framework changed in April 2020, introducing the 60-day reporting rule and the HMRC Capital Gains Tax on UK Property Account. If you need to pay capital gains tax online after selling a residential property, you must use this digital system rather than waiting for your annual Self Assessment return. Understanding how to pay capital gains tax UK now requires familiarity with real-time reporting, disposal dates, and chargeable gain calculations.

Since April 2020, UK residents who dispose of UK residential property must report and pay within 60 days of completion. HMRC confirms that late filing triggers automatic penalties and interest under its compliance regime. The obligation to pay capital gains tax online sits alongside, not instead of, your Self Assessment filing duties. The approach taken here focuses on accurate gain computation before submission, structured documentation, and ensuring you report and pay capital gains tax correctly the first time.

- When Do You Need to Pay Capital Gains Tax Online After Selling a Property?

- How Do You Report and Pay Capital Gains Tax on UK Property Using HMRC’s Online System?

- How to Pay Capital Gains Tax Online Step-by-Step From Account Setup to Confirmation

- How to Calculate the Capital Gain Before You Pay Capital Gains Tax Online

- What Happens If You Miss the 60-Day Deadline to Report and Pay Capital Gains Tax on UK Residential Property?

- Can You Report and Pay Capital Gains Tax Through Self Assessment Instead?

- How to Pay CGT on Property Sale If the Property Was Jointly Owned, Gifted, or Sold by a Non-Resident

- What Payment Options Are Available When You Pay Capital Gains Tax Online?

- How Does ARB Accountants Help Clients Report and Pay Capital Gains Tax Efficiently?

- Frequently Asked Questions

When Do You Need to Pay Capital Gains Tax Online After Selling a Property?

Residential vs commercial property

The 60-day rule primarily applies to UK residential property. If you dispose of a buy-to-let, second home, or inherited residential property, you must report and pay cgt on uk property through the dedicated online account. Commercial property disposals by UK residents are generally reported through Self Assessment unless you choose real-time reporting. This distinction determines whether you must pay capital gains tax online immediately or declare it later in your tax return.

UK residents vs non-residents

UK residents must report and pay capital gains tax on UK residential property within 60 days of completion if tax is due. Non-residents must report and pay capital gains tax on uk property for both residential and certain commercial disposals, even where no tax is payable. The reporting trigger is residence status at the time of disposal, not nationality.

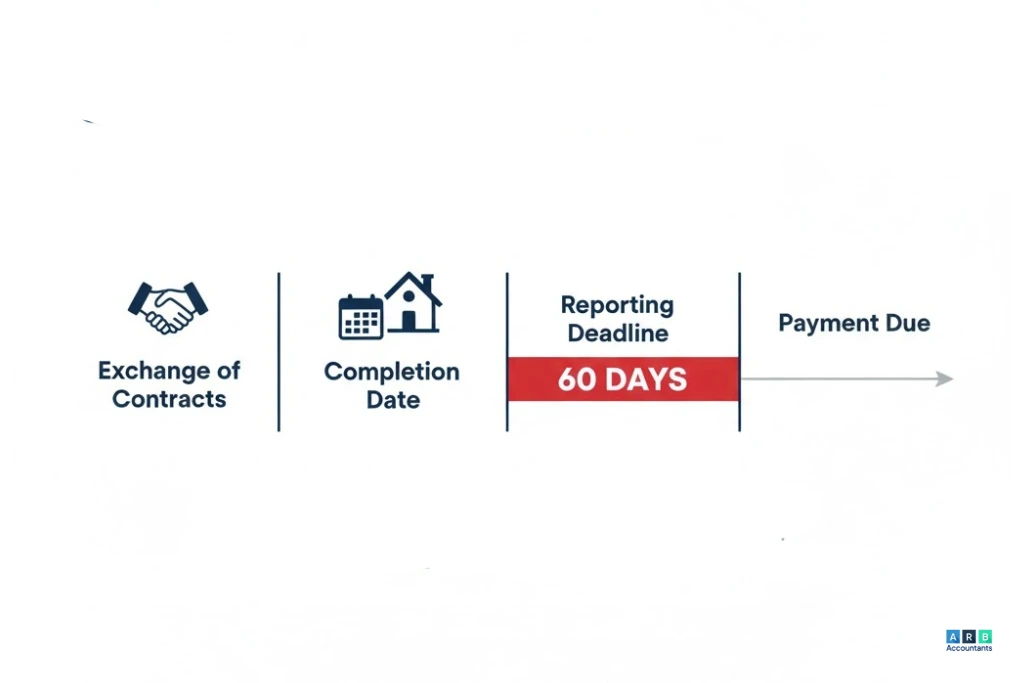

Completion date vs exchange date

For CGT purposes, the disposal date is usually the exchange of contracts date. However, the 60-day reporting window runs from completion. This difference is critical when advising clients on how to pay cgt on property sale, because misidentifying the deadline can lead to avoidable penalties.

60-day reporting rule explained

If there is a taxable gain, you must report and pay your capital gains tax within 60 days of completion. If no tax arises, for example, due to full Private Residence Relief, a report may not be required for UK residents. The obligation to pay capital gains tax online is triggered by the presence of CGT liability, not simply by selling.

When does Self Assessment apply instead?

If you are already within Self Assessment, you must still report and pay capital gains tax on UK property through the 60-day system first. The gain is then included in your annual return for reconciliation.

Timeline overview:

| Stage | Action Required |

| Completion | Disposal completes, 60-day clock starts |

| Within 60 days | Report and pay capital gains tax |

| After reporting | Receive payment reference and settle liability |

| Tax year-end | Include disposal in the Self Assessment return |

READ RELATED ARTICLE: Buy to Let Tax Changes and Landlord Tax Deductions

How Do You Report and Pay Capital Gains Tax on UK Property Using HMRC’s Online System?

To report and pay capital gains tax on UK property, you must use a Capital Gains Tax on UK Property Account. This is a digital service linked to your Government Gateway credentials. The system is separate from your standard Self Assessment login, although it uses the same identity verification framework.

First, sign in or create a Government Gateway account. Then register for the CGT on the UK Property Service. Once activated, you can create a property disposal return, enter disposal details, calculate the provisional gain, and confirm the submission. After submission, HMRC issues a 14-digit reference beginning with X, which is used to pay capital gains tax online through bank transfer, debit card, or open banking approval.

The system allows amendments within the same tax year. However, corrections after 31 January, following the tax year require formal amendment procedures. The obligation to report and pay capital gains tax on UK residential property is considered separate from the final annual tax calculation.

What Details Do You Need Before You Report and Pay Your Capital Gains Tax?

Before you report and pay your capital gains tax, assemble:

- Purchase price, including incidental acquisition costs such as SDLT and legal fees

- Enhancement expenditure, meaning capital improvements that increase the asset’s value

- Incidental costs of disposal, such as estate agent and solicitor fees

- Private Residence Relief eligibility periods

- Lettings Relief, where applicable

These figures determine the chargeable gain. A chargeable gain is the disposal proceeds minus allowable costs and reliefs. Calculating this accurately before you pay capital gains tax online ensures you do not overstate or understate the liability. This structured preparation is essential for anyone assessing how to pay capital gains tax on property efficiently and compliantly.

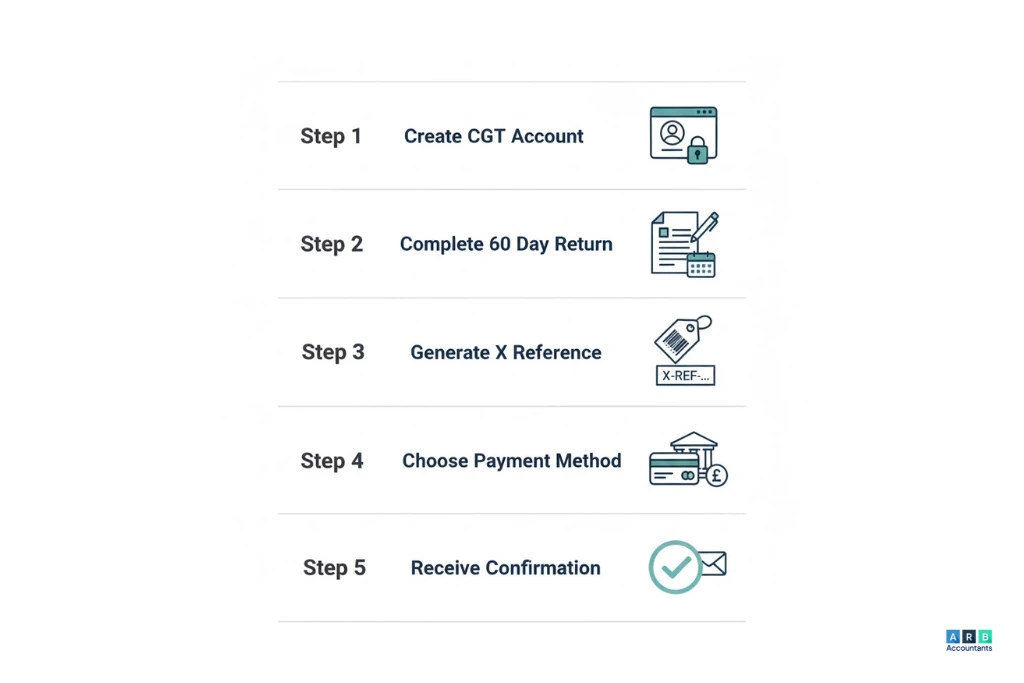

How to Pay Capital Gains Tax Online Step-by-Step From Account Setup to Confirmation

If you need to pay capital gains tax online after selling a UK residential property, you must use HMRC’s Capital Gains Tax on UK Property Account. The objective is to report and pay capital gains tax within 60 days of completion, generate the correct disposal reference, and ensure the liability is correctly allocated.

Step 1: Create or Access Your CGT on UK Property Account

Sign in using Government Gateway credentials and complete identity verification if required. Without activating this account, you cannot report and pay cgt on UK property. This account is separate from Self Assessment and is specifically designed for taxpayers who must report and pay capital gains tax on UK property.

Step 2: Start a New 60 Day Property Return

Select Create a return and enter the disposal details, including completion date, acquisition cost, enhancement expenditure, reliefs claimed, and ownership percentage. This is the formal stage where you report and pay capital gains tax on UK residential property. The system will calculate a provisional liability based on the figures entered.

Step 3: Submit the Return and Generate Your Payment Reference

Review the gain calculation carefully before submission. Once submitted, HMRC will issue a unique 14 digit reference beginning with X. This reference must be used when you pay capital gains tax online. Using your Self Assessment UTR instead will prevent correct allocation.

Step 4: Select a Payment Method and Make Payment

Choose from the approved methods:

- Debit card

- Corporate credit card, fees apply

- Online banking

- Open Banking

Completing payment finalises the obligation to report and pay your capital gains tax within the 60-day window.

Step 5: Verify Confirmation and Retain Records

Once funds clear, your CGT on UK Property Account will show confirmation. At this point, you have successfully paid capital gains tax online. Anyone researching how to pay capital gains taxin the UK or how to pay cgt on property sale should retain confirmation evidence for reconciliation in their annual tax return.

READ RELATED ARTICLE: Do I Need to Register For Self Assessment?

How to Calculate the Capital Gain Before You Pay Capital Gains Tax Online

Accurate computation is the foundation of compliant reporting. Before you pay capital gains tax online, you must determine the chargeable gain using the statutory methodology.

Start with disposal proceeds, meaning the sale price or market value if transferred to a connected party. Deduct the acquisition cost, including Stamp Duty Land Tax and legal fees incurred at purchase. Then deduct enhancement expenditure, defined as capital improvements that add enduring value, not routine maintenance. Finally, deduct selling expenses such as estate agent and solicitor costs.

The remaining figure is reduced by the Annual Exempt Amount, which for the 2024 to 2025 tax year is 3000 pounds according to HMRC guidance. The taxable portion is charged at 18 per cent for basic rate taxpayers and 24 per cent for higher and additional rate taxpayers on residential property gains. This calculation informs how to pay capital gains tax on property and determines whether you must report and pay capital gains tax on uk residential property within the deadline.

Worked Example of Paying CGT on a Property Sale

Assume a property is sold for 400000 pounds. It was purchased for 250000 pounds. Improvement costs total 20000 pounds. Selling expenses are 10000 pounds.

| Stage | Amount |

| Disposal proceeds | 400000 |

| Less acquisition cost | 250000 |

| Less enhancement costs | 20000 |

| Less selling expenses | 10000 |

| Gain before exemption | 120000 |

| Less Annual Exempt Amount | 3000 |

| Taxable gain | 117000 |

If taxed at 24 per cent, CGT payable equals 28080 pounds. Pre-calculation ensures you report and pay capital gains tax accurately and avoid underpayment penalties.

What Happens If You Miss the 60-Day Deadline to Report and Pay Capital Gains Tax on UK Residential Property?

Failure to report and pay capital gains tax on UK residential property triggers automatic penalties. HMRC applies an initial late filing penalty, followed by daily penalties if the delay exceeds three months. Interest accrues separately on unpaid tax.

It is important to distinguish between failure to report and failure to pay. A return submitted late but paid promptly still incurs filing penalties. Conversely, submitting on time but delaying payment generates interest and a potential surcharge. Behaviour-based penalties can apply where HMRC considers the inaccuracy to be careless or deliberate.

Anyone unsure how to pay capital gains tax UK should act before the 60-day deadline, because penalties escalate rapidly once the obligation to report and pay cgt on UK property has been missed.

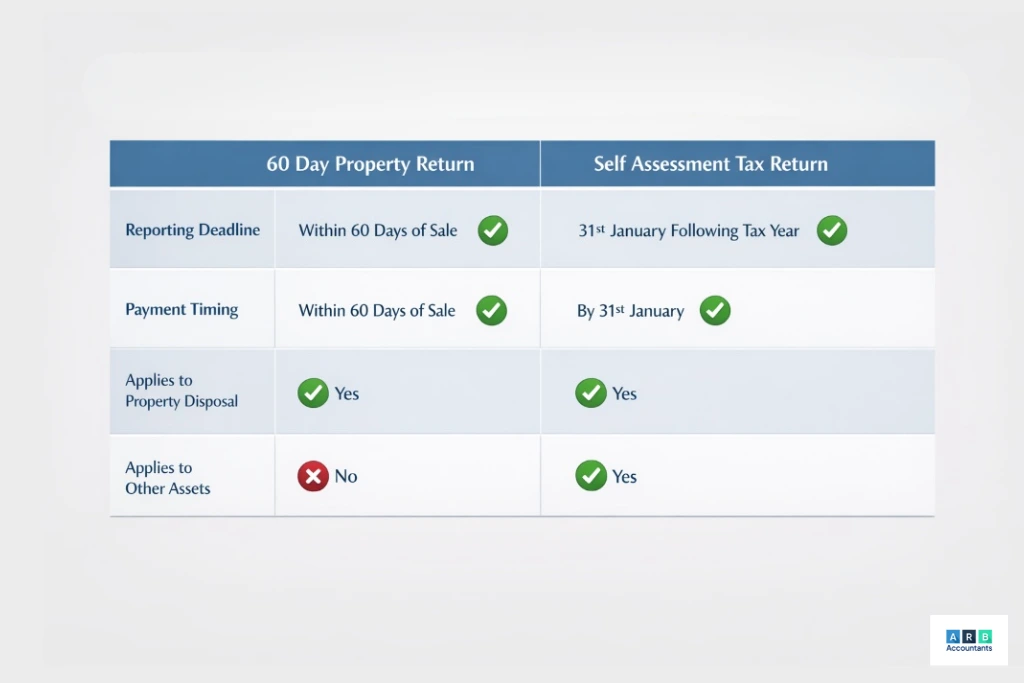

Can You Report and Pay Capital Gains Tax Through Self Assessment Instead?

Many taxpayers assume they can wait until 31 January and settle everything through Self Assessment; however, this is not always correct. If you dispose of a UK residential property that creates a chargeable gain, you must report and pay capital gains tax on UK residential property within 60 days of completion. Self-assessment does not replace this obligation.

Self-assessment is still required if you are already within the tax return system. The 60-day Capital Gains Tax on UK Property Account submission creates an initial calculation and payment. The same gain must then be included in your annual tax return, where the liability is finalised against total income and other gains. This reconciliation ensures that when you pay capital gains tax online, the payment is credited against your overall tax position.

If you only dispose of non-property assets, such as shares, you may use the real-time Capital Gains Tax service or report through Self Assessment without a 60-day property return. This distinction matters for anyone researching how to pay capital gains tax uk or how to pay capital gains tax on property, because property disposal does not allow you to wait until January.

HMRC confirms that UK residents must report and pay capital gains tax on UK property within 60 days, even if they also complete a Self Assessment return. The practical approach is to treat the 60-day return as a compliance checkpoint, not an optional step. Once submitted, you still need to report and pay your capital gains tax through your annual return to align totals correctly.

If you are unsure how your 60 day return integrates with your annual filing, our self-assessment tax return services ensure your Capital Gains Tax reporting is reconciled accurately and submitted on time.

How to Pay CGT on Property Sale If the Property Was Jointly Owned, Gifted, or Sold by a Non-Resident

Ownership structure changes the reporting framework but does not remove the need to pay capital gains tax online where applicable. Each legal owner must calculate their own share of the gain and report and pay cgt on UK property separately. The 60-day return is individual, not collective, even if the property was jointly owned.

Joint Ownership and Spouse Transfers

For married couples or civil partners, ownership is usually treated as equal unless evidence shows otherwise. Each spouse must report and pay capital gains tax on uk property for their share. Transfers between spouses are generally no gain, no loss for Capital Gains Tax purposes, meaning no immediate tax arises. However, if the asset is later sold to a third party, both individuals must assess their portion correctly.

Gifts, Deemed Disposal and Non-Residents

Gifts to children or other connected parties are treated as disposals at market value. Even without cash proceeds, you may still need to report and pay capital gains tax because a deemed disposal occurs. This often surprises taxpayers who are researching how to pay cgt on a property sale in non-standard situations.

Non-residents must submit a non-resident Capital Gains Tax return for UK property disposals. They are still required to report and pay capital gains tax on uk residential property within 60 days, even if no tax is ultimately due. Trusts and corporate trustees follow a similar framework but with separate identification and reporting credentials. In all these cases, the obligation to pay capital gains tax online depends on residency status, ownership share, and disposal type.

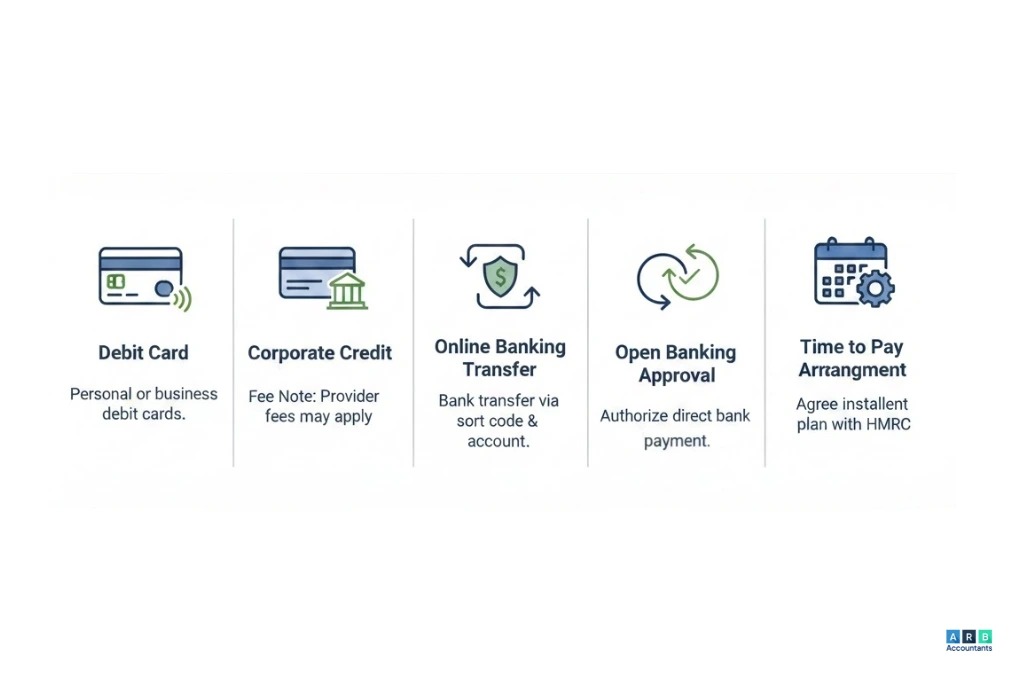

What Payment Options Are Available When You Pay Capital Gains Tax Online?

Once the return is accepted, the focus shifts to settlement. When you pay capital gains tax online, HMRC provides several structured payment routes that align with the 14 digit property disposal reference.

Card payments allow immediate settlement. Corporate credit card payments attract processing fees, which must be factored into cost planning. Bank transfers typically clear within three working days, so timing must be considered if you are close to the deadline to report and pay capital gains tax.

Open Banking approval enables direct account authorisation without manually entering details. Overseas bank transfers are permitted, but currency conversion timing can affect when funds reach HMRC. Anyone asking how to pay capital gains tax uk from abroad should confirm processing windows in advance.

In cases of cash flow pressure, a Time to Pay arrangement may be available. This allows structured instalments instead of immediate full settlement. It differs from deferred proceeds instalment rules, which apply where sale consideration is received over time. Choosing between immediate payment and instalments requires forecasting income tax, dividend tax, and other liabilities to avoid compounding interest. A considered strategy ensures that when you pay capital gains tax online, the method chosen supports wider tax efficiency rather than creating further exposure.

How Does ARB Accountants Help Clients Report and Pay Capital Gains Tax Efficiently?

Strategic advisory by our Southend accountants goes beyond helping clients pay capital gains tax online. The focus is on reducing risk, preserving allowances, and ensuring compliance when clients report and pay their capital gains tax obligations.

Pre-Sale Forecasting And Relief Planning Before You Report And Pay Capital Gains Tax On UK Property

Before clients report and pay capital gains tax on UK property, forecasting models calculate expected gains using disposal proceeds, base cost adjustments, enhancement expenditure, and allowable incidental costs. This determines whether clients will need to report and pay capital gains tax on UK residential property and at what marginal rate.

Relief eligibility reviews cover Private Residence Relief, Lettings Relief where applicable, and loss utilisation strategies. Spousal planning before exchange allows beneficial interest transfers so couples can legitimately use two annual exemptions before they report and pay CGT on UK property.

Income tax band modelling ensures the gain does not unintentionally push a taxpayer into higher residential CGT rates. This planning stage directly influences how to pay capital gains tax on property efficiently and how to pay capital gains tax UK without overpayment.

Documentation reviews verify completion statements, SDLT records, and capital improvement evidence. This reduces enquiry risk and supports accurate figures when clients report and pay your capital gains tax.

According to HMRC statistics, residential property CGT receipts exceeded £7 billion in recent years, highlighting the financial scale of compliance obligations.