Payroll Year End Checklist for UK Employers

A payroll year-end checklist is a structured set of actions UK employers must complete to close payroll correctly at the end of the tax year. In the UK, the payroll year-end falls within the Real Time Information (RTI) framework, which requires accurate and timely reporting through RTI submissions, including the Full Payment Submission, Employer Payment Summary, P60, and P11D. Each of these records is fed directly into HMRC systems and determines an employee’s tax position. A clear payroll year-end checklist reduces the risk of HMRC errors, employee tax issues, and compliance follow-ups. This article is designed as both a practical guide and an actionable checklist framework, helping employers manage payroll year end confidently while aligning with HMRC payroll year end expectations and payroll year-end deadlines.

- What Is the UK Payroll Year End?

- What Are the Key HMRC Payroll Year-End Deadlines Employers Must Meet?

- What Should Be Completed Before Running the Final Payroll of the Tax Year?

- What Is the Final Payroll Submission (FPS) and EPS?

- What Employee Documents Must Be Issued After Payroll Year-End?

- What Are the Most Common Payroll Year-End Errors Employers Make?

- What Are the Consequences of Missing Payroll Year-End Deadlines?

- How Should Employers Prepare Payroll Systems for the New Tax Year?

- A Practical Payroll Year-End Checklist UK Employers Can Follow

- Real World Example: What Happens When Payroll Year-End Goes Wrong?

- How Payroll Year-End Fits Into Wider PAYE and Compliance Planning

- Conclusion

- Frequently Asked Questions

What Is the UK Payroll Year End?

The UK payroll year end falls on 5 April, which marks the end of the tax year for PAYE and National Insurance purposes. This payroll year end date is fixed nationally and applies to all employers, regardless of business size or sector. The new tax year then begins on 6 April, triggering new tax codes, thresholds, and statutory rates.

It is essential to distinguish between payroll year-end and the company’s year-end accounts. Payroll year-end relates specifically to PAYE reporting and employee pay records, while accounts year-end is a financial reporting choice made by the business. HMRC payroll year-end matters because all RTI submissions for the tax year must be reconciled by 5 April. Year-end payroll accuracy ensures PAYE and NIC totals match HMRC records, reducing the risk of discrepancies during reconciliation.

What Are the Key HMRC Payroll Year-End Deadlines Employers Must Meet?

Payroll year-end deadlines follow a strict calendar set by HMRC. The tax year ends on 5 April, and employers must submit their final FPS on or before the date employees are paid, ensuring it is marked as the final submission for the year. Where applicable, an EPS must also be submitted to report adjustments such as statutory payments or employment allowance.

Employers must issue P60S to all employees on payroll by 5 April or by 31 May. P11D and P11D(b) forms, which report taxable benefits and Class 1A National Insurance, must be submitted by 6 July (source). These payroll year-end deadlines affect employees directly, as late or incorrect reporting can delay tax refunds or cause incorrect tax codes. A reliable payroll year-end checklist helps employers meet each deadline in sequence and avoid penalties.

What Should Be Completed Before Running the Final Payroll of the Tax Year?

Preparing before the final pay run is the most critical stage of any payroll year-end checklist. Errors at this point often propagate throughout the entire end-of-year payroll process.

Employee Data and Pay Verification Checklist

Confirm all employee personal details are correct, including names, National Insurance numbers, and addresses. Verify pay frequencies and confirm that all pay elements, including bonuses and overtime, have been processed within the correct tax year. This step supports a clean year-end payroll checklist and prevents reporting mismatches.

Tax Codes and Starter or Leaver Checks

Review tax codes currently applied and ensure starter declarations and leaver records have been processed correctly. Incorrect tax codes at payroll year-end often lead to employee complaints after P60S are issued. This forms a core part of any payroll end-of-year checklist.

Statutory Payments and PAYE Totals Review

Reconcile statutory payments such as SSP, SMP, and other recoverable amounts against payroll records. Review PAYE and NIC totals to ensure they align with expected liabilities. This step ensures end-of-year payroll figures reconcile with HMRC records and support compliance within an end-of-year payroll checklist UK(source).

Final Pre Submission System Check

Confirm payroll software settings are correct, backups are taken, and the system is ready to flag the final submission. Completing these checks before the final pay run strengthens the overall payroll year-end checklist and reduces last-minute errors that impact payroll year-end outcomes.

By completing these steps methodically, employers can move into the final submission phase with confidence, knowing their payroll year-end processes are accurate, compliant, and aligned with HMRC requirements.

READ RELATED ARTICLE: UK End of Tax Year: Tax-Planning Tips for Individuals

What Is the Final Payroll Submission (FPS) and EPS?

The final reporting stage is where many payroll year-end issues arise, which is why a payroll year-end checklist must clearly separate FPS and EPS responsibilities. Both submissions sit within RTI reporting, but they serve different purposes and are treated differently by HMRC payroll year-end systems. Understanding how they interact is essential for an accurate year-end payroll and a reliable payroll end-of-year checklist.

What Is an FPS, and When Should It Be Marked as Final?

A Full Payment Submission reports employee pay, tax, and National Insurance details every time employees are paid. At payroll year-end, the FPS takes on additional importance because it must confirm that no further payments will be made in that tax year. Employers must tick the “final submission for year” indicator within the FPS to formally close payroll records.

Common FPS errors include forgetting to apply the final submission flag, submitting the FPS late, or excluding adjustments made after the last regular pay run. These mistakes often cause HMRC to treat the year as incomplete, which can disrupt PAYE reconciliation. A well-structured payroll year-end checklist places this step at the centre of the end-of-year payroll process to prevent misreporting.

When Is an EPS Required Instead of or Alongside an FPS?

An Employer Payment Summary is used to report values that are not included in employee pay lines. EPS submissions are required when claiming statutory payments such as SMP or SSP, reporting CIS deductions suffered, or confirming employment allowance usage. At payroll year-end, EPS errors are common because employers assume the FPS alone is sufficient.

In practice, FPS and EPS often work together. An accurate payroll year-end checklist ensures employers review whether an EPS is required alongside the final FPS. Missing or incorrect EPS submissions can cause PAYE account balances to appear wrong, which creates problems during end-of-year payroll reconciliation and increases follow-up queries. (source)

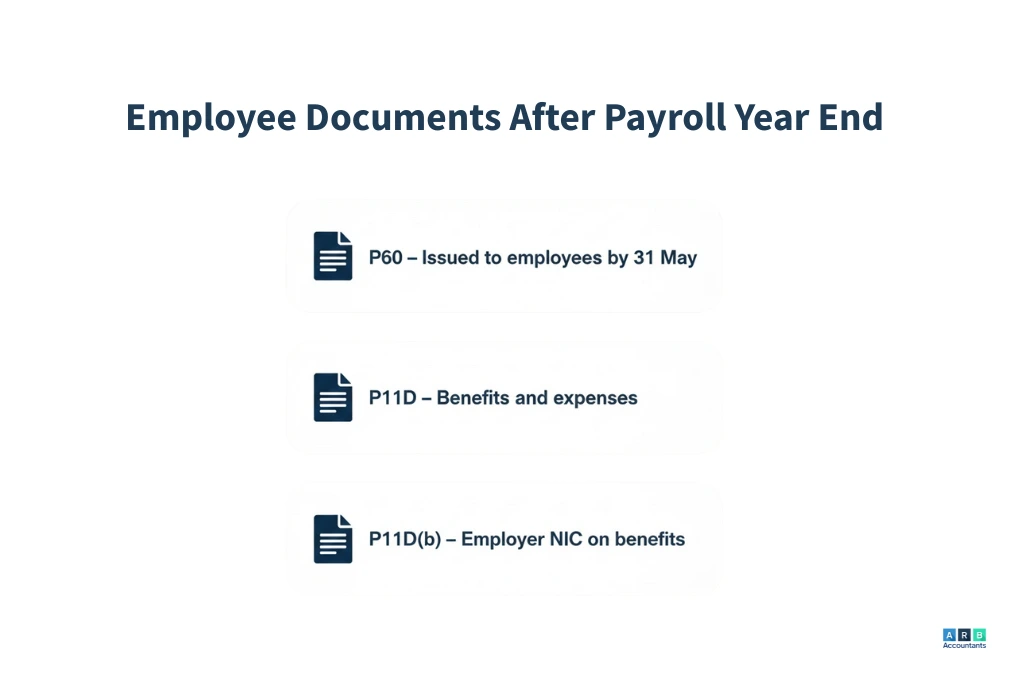

What Employee Documents Must Be Issued After Payroll Year-End?

Once payroll reporting is closed, employers move into employee documentation. This stage is a core part of any year-end payroll checklist because employees rely on these documents for personal tax records and future employment.

Who Needs a P60 and What Should Employers Check Before Issuing It?

A P60 must be issued to every employee who is on payroll as of 5 April. Before issuing P60S, employers should confirm that pay, tax, and National Insurance totals match final RTI submissions. Inaccurate P60 data can lead to incorrect tax codes or delayed refunds for employees. Including P60 checks within a payroll year-end checklist protects both employer credibility and employee trust.

When Should P45S Be Issued for Employees Who Left Earlier?

Employees who leave before 5 April should already have received a P45 at the time of leaving. Payroll year-end does not replace this obligation. However, employers should review leaver records to ensure P45S were issued correctly and reported through RTI. This step connects leave processing with payroll year-end controls and supports a clean end-of-year payroll checklist UK.

When Are P11D and P11D(b) Required for Benefits and Expenses?

P11D forms report taxable benefits provided to employees, while P11D(b) reports the associated Class 1A National Insurance liability. These forms are due after payroll year-end but rely on accurate payroll data. Benefits reporting fits into a payroll year-end checklist because errors often stem from inconsistent benefit tracking earlier in the year (source).

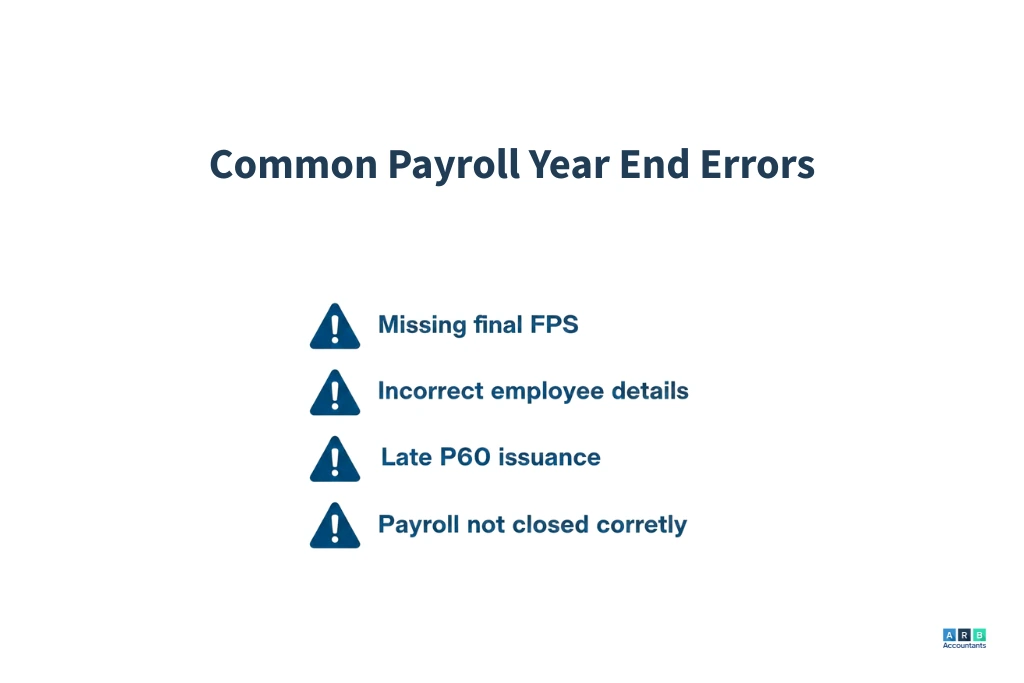

What Are the Most Common Payroll Year-End Errors Employers Make?

Payroll year-end concentrates multiple reporting obligations into a short timeframe, which increases risk. Common errors include failing to mark the final submission indicator, using outdated employee records, miscalculating statutory payments, or not rolling payroll software into the new tax year correctly. These issues often arise because payroll year-end tasks differ from routine processing. A structured payroll year-end checklist reduces reliance on memory and helps employers manage year-end payroll consistently.

What Are the Consequences of Missing Payroll Year-End Deadlines?

Missing payroll year-end deadlines can trigger penalties, compliance notices, and PAYE account discrepancies. HMRC payroll year-end enforcement focuses on accuracy as well as timeliness. Incorrect reporting can result in employee tax records being wrong, which damages employer relationships and increases support queries. Repeated issues also raise the risk of HMRC follow-ups. This is why payroll year-end deadlines are enforced strictly and why a payroll year-end checklist is not optional for compliant employers managing payroll year-end responsibilities.

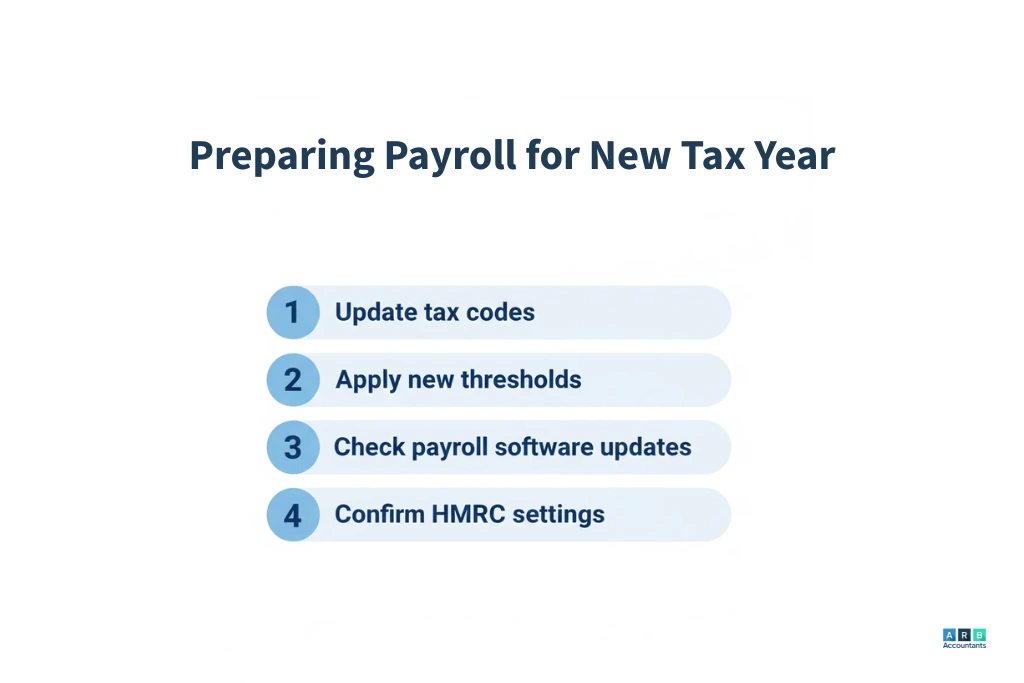

How Should Employers Prepare Payroll Systems for the New Tax Year?

Preparing payroll systems correctly after year-end payroll is a compliance step, not an admin task. The transition from one tax year to the next is where HMRC payroll year-end data becomes the foundation for future PAYE accuracy. A payroll year-end checklist should treat system preparation as a controlled process, not a software button click.

How Are New Tax Codes Applied After the year-end?

New tax codes are issued by HMRC through P9 notices and must be applied at the start of the new tax year. These codes reflect changes in allowances, benefits in kind, or adjustments from earlier tax periods. Applying outdated codes after payroll year-end leads to incorrect deductions and employee complaints.

Payroll software usually imports P9 notices automatically, but employers must verify that updates have been successfully applied. A payroll year-end checklist should include a tax code validation step, ensuring no employees are carried forward with emergency or temporary codes unless explicitly instructed by HMRC.

What Statutory Rate and Threshold Changes Must Be Updated?

Each tax year introduces changes to statutory rates and thresholds. National Insurance contribution thresholds, Statutory Sick Pay, Statutory Maternity Pay and other statutory payments are updated annually. National Minimum Wage changes may also align closely with the new tax year and affect payroll calculations.

Failure to update these values distorts deductions from the first pay run of the new year. This is why payroll year-end is inseparable from end-of-year payroll planning. Employers should confirm that payroll software has applied current rates and that manual overrides from the previous year have been removed.

How Do Employers Reopen Payroll for the New Tax Year Correctly?

Reopening payroll involves rolling the system forward to the new tax year, clearing cumulative figures, and locking the prior year data. A controlled roll forward prevents historical data contamination and supports accurate reporting.

Best practice includes running test payroll calculations before live payments, reviewing payslips for anomalies, and performing audit checks against expected PAYE and NIC values. These steps ensure that payroll year-end transitions into compliant year-end payroll processing for the new period.

A Practical Payroll Year-End Checklist UK Employers Can Follow

This payroll year-end checklist is structured to support the payroll end-of-year checklist, year-end payroll checklist and end-of-year payroll checklist UK intent.

Pre-year-end checks

Final payroll submission checks

Post year-end documentation checks

New tax year setup checks

This payroll year-end checklist connects operational steps with payroll year-end deadlines and HMRC payroll year-end expectations.

Real World Example: What Happens When Payroll Year-End Goes Wrong?

A small UK employer completes year-end payroll but forgets to mark the final FPS submission. HMRC does not close the tax year and issues estimated PAYE liabilities. An EPS for statutory sick pay recovery is submitted late, creating a mismatch on the PAYE account.

Employees receive incorrect tax summaries, triggering refund delays. The employer spends weeks correcting submissions, responding to HMRC letters and reconciling PAYE balances. The time cost outweighs the effort of following a payroll year-end checklist, showing why structured year-end payroll controls matter.

How Payroll Year-End Fits Into Wider PAYE and Compliance Planning

Payroll year-end is one stage in continuous PAYE compliance, not a one off event. Accurate year-end payroll data supports correct tax codes, Real Time Information accuracy and employee trust throughout the year.

Missed payroll year-end deadlines create downstream compliance risks, including HMRC follow-ups and audit exposure. A payroll year-end checklist aligns payroll processes with broader compliance planning, ensuring end-of-year payroll outcomes support ongoing reporting obligations and long-term PAYE accuracy.

READ RELATED ARTICLE: Benefits of Outsourcing Payroll Services

Conclusion

Why Every UK Employer Needs a Clear Payroll Year-End Checklist

A payroll year-end checklist turns a high-risk compliance period into a controlled process. UK payroll obligations involve fixed deadlines, mandatory submissions, and employee documents that must align precisely with HMRC payroll year-end requirements. Treating payroll year-end as a checklist-driven exercise reduces reliance on memory and prevents rushed corrections after the fact.

A structured payroll year-end checklist brings clarity across FPS and EPS submissions, employee documentation, and PAYE reconciliation. It ensures payroll year-end deadlines are met in sequence rather than reactively. This approach supports accurate year-end payroll outcomes and avoids compounding errors that affect the new tax year. Employers who use a payroll year-end checklist consistently spend less time dealing with HMRC queries and more time running payroll with confidence.