How to Choose an Accountant in the UK: A Complete Guide

Selecting the right accountant in the UK is a pivotal decision for both individuals and businesses. An accountant’s expertise ensures compliance with tax regulations, optimises financial strategies, and fosters sustainable growth. Given the complexities of the UK’s tax system and financial landscape, understanding how to choose an accountant can lead to significant benefits, including tax savings and informed decision-making. Knowing what to look for in an accountant is the first step toward making this critical choice.

- What Services Do You Need from an Accountant?

- How to Find an Accountant in the UK

- What Qualifications Should an Accountant Have?

- How to Assess an Accountant’s Suitability for Your Needs

- How to Compare Accountant Fees and Services

- How to Verify an Accountant’s Reputation and Reliability

- How Can I Build a Long-Term Relationship with My Accountant?

- Conclusion

- Frequently Asked Questions

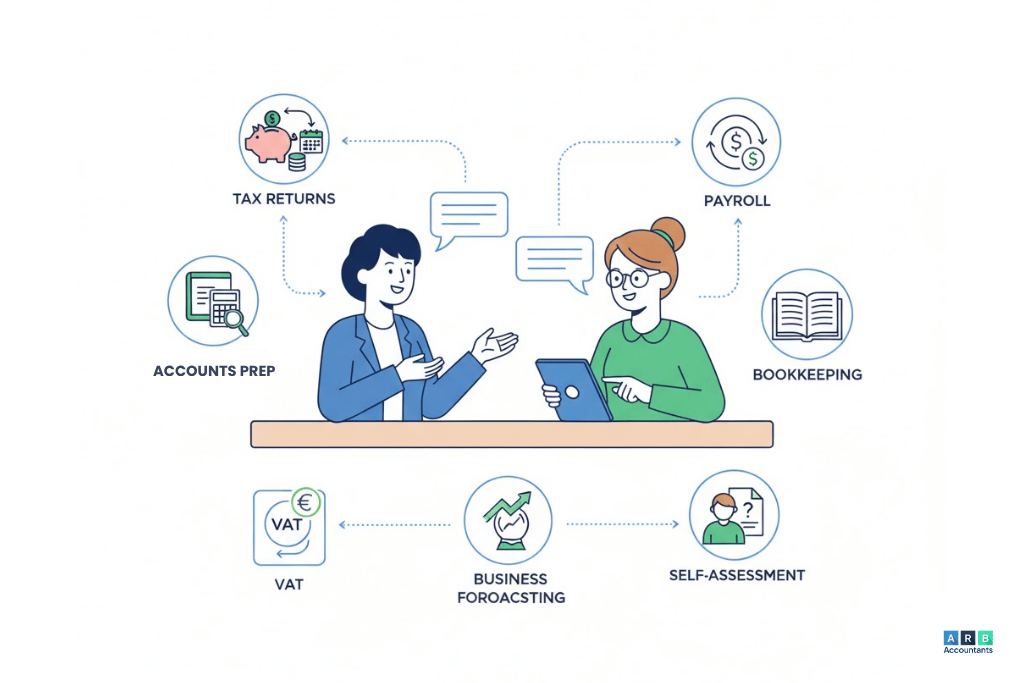

What Services Do You Need from an Accountant?

Personal vs. Business Needs

Identifying the specific services required is the first step in finding an accountant. For individuals, services might include tax return preparation, estate planning, and investment advice. Businesses, on the other hand, may need assistance with bookkeeping, payroll, VAT returns, financial reporting, and audit services. Understanding these needs helps in how to choose an accountant with the appropriate expertise. This also answers the common question, do I need an accountant for my small business, as even small companies can benefit from professional guidance.

Assessing Complexity

The complexity of your financial situation determines the level of service you require. Simple finances may only require basic tax return services, while complex scenarios necessitate comprehensive tax planning and advisory. For example, businesses with international operations or diverse revenue streams might benefit from accountants experienced in international tax planning. This step is crucial in how to choose an accountant who matches your specific financial profile.

Specialised Services

Certain accountants specialise in specific industries such as construction, healthcare, or technology. Some offer services like Making Tax Digital (MTD) compliance, forensic accounting, or advisory on complex tax matters. Choosing an accountant with relevant sector experience provides tailored solutions and strategic insight, which is essential for long-term financial growth. Understanding tax advisor vs accountant differences can help ensure you hire the right professional for specialised requirements.

How to Find an Accountant in the UK

Professional Bodies

In the UK, reputable accountants are often members of professional bodies that uphold high standards of practice. Organisations such as the Institute of Chartered Accountants in England and Wales (ICAEW), the Association of Chartered Certified Accountants (ACCA), and the Chartered Institute of Management Accountants (CIMA) offer directories to help individuals and businesses find an accountant. For example, ICAEW provides a directory of over 12,000 firms, simplifying the search for a chartered accountant and assisting with how to choose an accountant effectively.

Online Platforms

Utilising online platforms can make it easier to find a good accountant UK. Websites like Unbiased, IFA Finder, and ExpertMarket offer tools to connect users with accountants based on specific needs and locations. These platforms allow you to filter by expertise, ensuring a strong match with your requirements, which is an important consideration when finding an accountant suited to your needs.

Referrals

Personal recommendations can be invaluable when choosing an accountant. Asking trusted business owners, friends, or family members for referrals often leads to more reliable options. Networking events or professional associations can also provide opportunities to meet accountants who understand the unique financial challenges of your sector. This practical approach often complements the process of how to choose an accountant efficiently.

READ RELATED ARTICLE: What are Monthly Management Accounts?

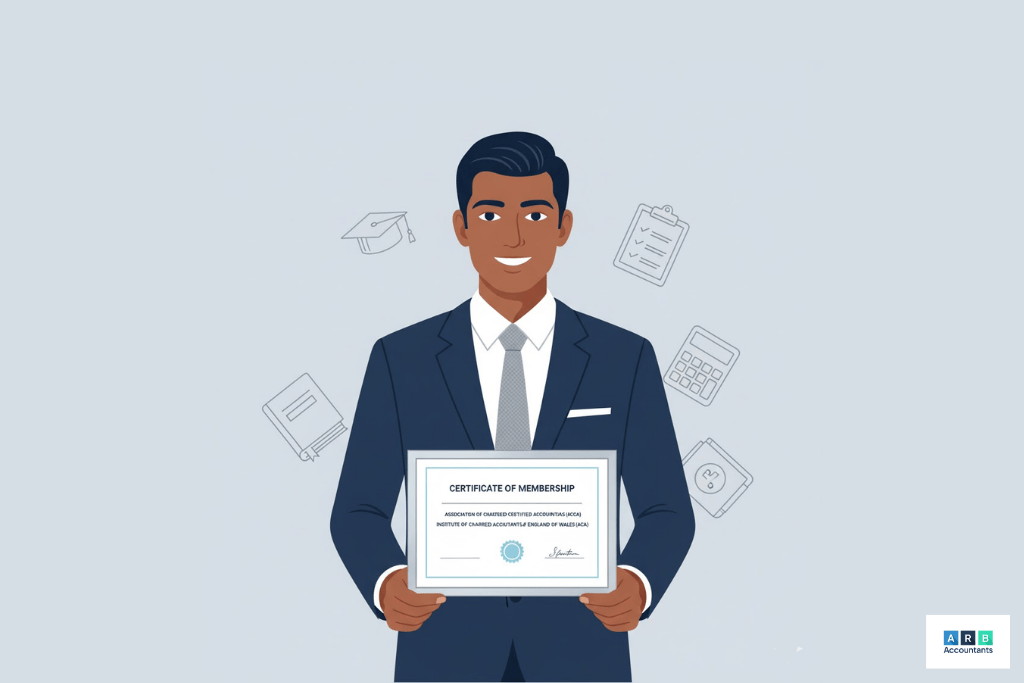

What Qualifications Should an Accountant Have?

When considering how to choose an accountant, qualifications and professional standing should be top priorities.

Recognised Qualifications

- ACA/FCA (ICAEW): Chartered Accountants with ICAEW. ACA indicates less than ten years of experience, while FCA is awarded after ten years or more.

- ACCA/FCCA: Members of the Association of Chartered Certified Accountants. ACCA is the base qualification; FCCA recognises extensive experience.

- AAT: The Association of Accounting Technicians qualification ideal for bookkeeping and support roles.

Professional Indemnity Insurance

A reputable accountant should hold professional indemnity insurance, which offers protection against potential errors or omissions in their services. This is a critical marker of accountability and professionalism and often a deciding factor in how to choose an accountant.

Continuing Professional Development (CPD)

Ongoing CPD demonstrates an accountant’s commitment to keeping up with industry changes. This ensures their advice is current, accurate, and effective, which is vital when finding an accountant who can adapt to evolving regulations and industry practices.

How to Assess an Accountant’s Suitability for Your Needs

Initial Consultation

An initial consultation is an excellent opportunity to gauge an accountant’s suitability. Useful questions include:

- “Do you specialise in my industry?”

- “What services are included in your fees?”

- “How do you communicate with clients?”

- “Can you provide references or case studies?”

These questions are fundamental in how to choose an accountant for your specific circumstances and ensure alignment with your business or personal financial goals.

Compatibility Check

Compatibility plays a major role in building trust. Consider:

- Communication Style: Ensure their methods align with your preferences, whether via email, phone, or in-person meetings.

- Availability: Confirm their availability, especially during peak tax seasons, to avoid delays in critical filings.

Technology Use

Modern accounting is powered by technology.

- Software Integration: Check if they use tools like Xero, QuickBooks, or FreeAgent for accuracy and real-time reporting.

- Digital Tools: Evaluate their comfort with cloud accounting solutions to streamline processes and ensure compliance. This can also help when finding an accountant UK who uses modern, efficient systems.

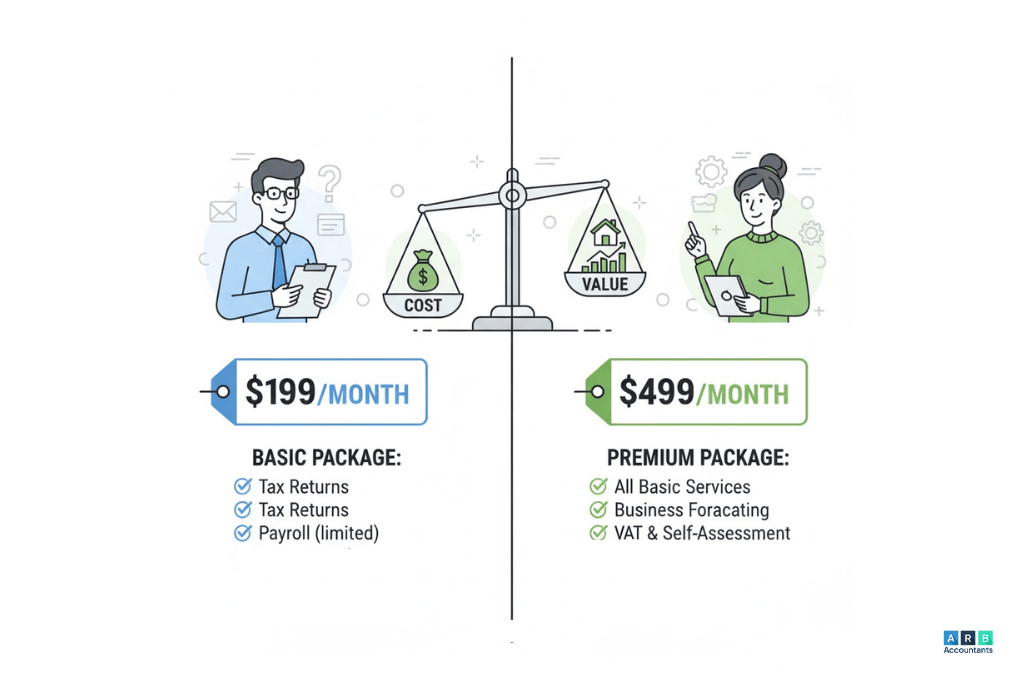

How to Compare Accountant Fees and Services

Understanding how to choose an accountant also means being clear on what you’re paying for.

Fee Structures

- Hourly Rates: Ideal for ad-hoc services or consultations. Rates typically range from £25 to £250 depending on the complexity of work.

- Fixed Fees: Suitable for ongoing services with predictable costs, such as tax returns (often £150–£300+).

- Monthly Retainers: Best for businesses needing regular support, ranging from £60 to £500+ depending on the scope of services.

Value Proposition

Evaluate the value you receive for the price paid:

- Service Inclusions: Ensure the fee covers essential services.

- Additional Costs: Be aware of extra charges for audits, financial planning, or advisory work.

Budget Considerations

Weigh costs against long-term benefits:

- Cost vs. Benefit: Match fees to the value of services provided.

- Investment: Consider potential tax savings and improved financial planning as part of your return on investment.

Carefully following these steps will help anyone confidently approach how to choose an accountant while taking into account qualifications, reputation, fees, and services. For individuals asking, do I need an accountant for my small business, these steps clarify why professional support can make a difference.

READ RELATED ARTICLE: How a Small Business Accountant Can Help Grow Your Business

How to Verify an Accountant’s Reputation and Reliability

When evaluating how to choose an accountant, verifying their reputation is a non-negotiable step. An accountant’s reliability directly impacts your financial security and compliance. Understanding what to look for in an accountant ensures you hire someone trustworthy and competent.

Online Reviews

Platforms

Check Google, Trustpilot, Yell, and the accountant’s own website for reviews. High ratings across multiple platforms are a strong indicator of credibility and are helpful when finding an accountant.

Feedback Analysis

Focus on the content of reviews. Look for patterns related to responsiveness, accuracy, and communication. How an accountant handles negative reviews also reveals their professionalism and accountability. This step is crucial in how to choose an accountant for long-term peace of mind.

Professional Standing

Regulatory Bodies

Verify membership with ICAEW, ACCA, CIMA, or AAT. These organisations enforce professional standards and ethics and assist clients in how to find an accountant UK who meets official requirements.

Disciplinary Records

Check for past disciplinary actions or complaints via regulatory body databases. Avoid accountants with unresolved issues or repeated sanctions. Ensuring a clean professional record is essential in how to choose an accountant confidently.

Client Testimonials

Case Studies

Request case studies relevant to your sector (e.g., construction, property, healthcare) to assess expertise. This is particularly useful when finding a good accountant who understands industry-specific challenges.

References

Speaking directly with current or past clients offers real-world insights into reliability, service quality, and communication style. References help when how to find a good accountant UK is a priority, ensuring you hire someone with proven results.

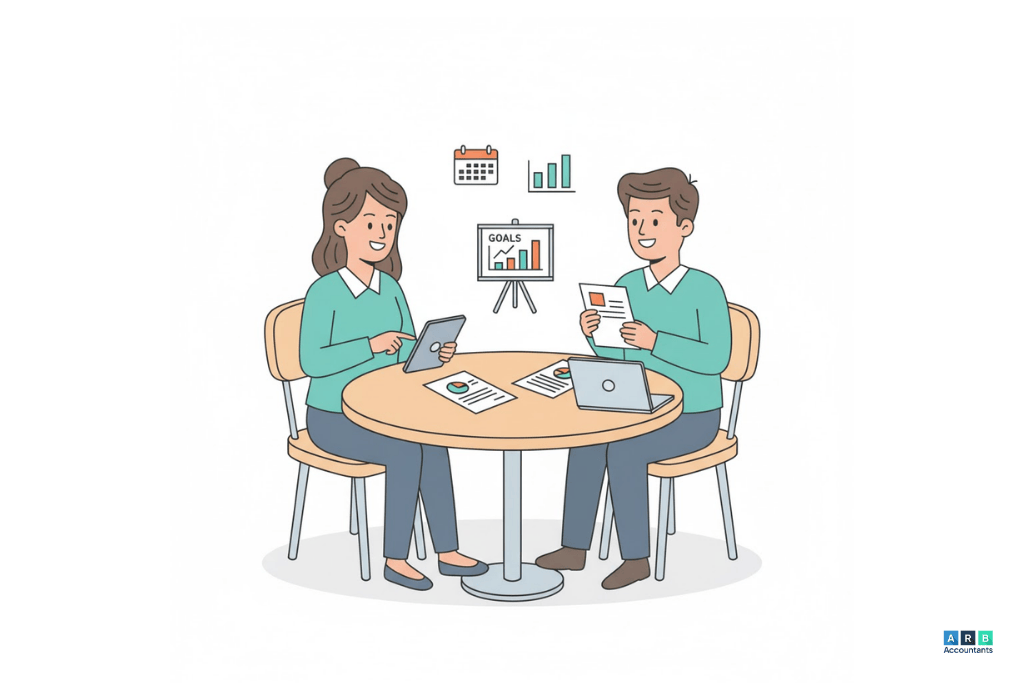

How Can I Build a Long-Term Relationship with My Accountant?

Compare fee models (hourly, fixed, retainer), what’s included, and likely ROI (tax savings, time reclaimed). Transparent scope beats the lowest price, a consideration when finding an accountant that offers value.

Selecting the right accountant is only the first step; maintaining a productive, long-term relationship ensures your finances remain optimised, compliant, and strategically aligned with your business goals. Knowing how to choose an accountant helps shift the relationship from a compliance function to a strategic partnership. A strong working relationship transforms the accountant from a contractor into a trusted adviser who understands your cash flow mechanics, tax levers, and growth constraints.

How Often Should We Communicate and What Should Those Meetings Cover?

Set a cadence of scheduled meetings monthly for active trading businesses, quarterly for steady-state firms, and at least twice yearly for smaller personal clients. Use these meetings to review management accounts, cash-flow forecasts, upcoming tax deadlines, and action items (e.g., capital allowance claims, payroll changes, or VAT adjustments). Formal agendas and pre-sent management packs keep calls efficient and measurable. Regular structured meetings are key in how to choose an accountant effectively.

How Do I Keep the Dialogue Open and Useful?

Agree channels and response SLAs up front: client portal for documents, email for non-urgent queries, and phone/video for urgent, time-sensitive issues. Ask your accountant to explain recommendations in plain English and record decisions in shared notes. Transparency about costs and scope reduces scope creep and builds trust vital factors when finding an accountant for long-term collaboration.

How Can the Accountant Be More Proactive (Not Just Reactive)?

A proactive accountant flags tax-efficient timings (e.g., pension contributions, dividend timings), suggests process automation to cut admin time, and runs scenario modelling for investment or growth plans. Expect periodic health checks: a tax-efficiency review, a software checklist (bank feeds, reconciliations), and a risk assessment for HMRC enquiries. Firms that proactively advise typically deliver measurable savings and smoother compliance. Proactivity is a critical consideration in how to choose an accountant wisely.

How Should I Measure Their Performance?

Use simple KPIs: deadlines met, accuracy of forecasts, number of actionable recommendations implemented, and time saved on admin. Hold an annual performance review and compare actual outcomes (tax savings achieved, cash-flow improvements) against agreed objectives. If the accountant misses core KPIs repeatedly, that’s a trigger to renegotiate scope or consider alternatives. Performance measurement is a key part of how to find a good accountant.

How Do Feedback and Continuous Improvement Work in Practice?

Create a short, private feedback loop after major deliverables, a one-page scorecard is usually enough. Share constructive, specific feedback (e.g., “clarify jargon in reports” or “respond within 48 hours to payroll queries”) and expect an action plan. Continuous improvement is a two-way street: invest in your bookkeeping practices too so the accountant can focus on advisory. This ensures that when finding an accountant UK, both sides benefit from an evolving, productive relationship.

Conclusion

A long-term relationship with an accountant is earned through regular, structured communication, proactive advisory, measurable performance checks, and an honest feedback loop. Many UK small businesses lose significant time to finance admin and an increasing number outsource accounting to reclaim capacity. Investing in the right accountant is a productivity and growth decision, not just a compliance cost. Keeping in mind how to choose an accountant ensures you make a strategic decision that supports business growth and financial efficiency. Partner with ARB Accountants and turn your finances into a growth engine.