How to Avoid Companies House Late Filing Penalties in the UK

Companies house late filing penalties are one of the most common and avoidable compliance costs faced by UK limited companies. They arise when statutory documents such as annual accounts or confirmation statements are not delivered to Companies House by the legal filing deadline. These penalties follow a fixed structure, escalate quickly for repeat offences, and sit squarely with company directors, regardless of whether an accountant or agent was involved. Understanding how companies house late filing penalties work is critical for meeting statutory obligations, protecting cash flow, and maintaining a clean public record.

Companies house late filing penalties are financial charges imposed under UK company law when accounts or required filings reach Companies House after the deadline. For private companies, penalties currently range from £150 to £1,500 depending on how late the accounts are, with higher penalties for public companies. According to official guidance, penalties double automatically if accounts are filed late in two consecutive financial years, reinforcing why early and accurate filing matters for long term compliance and reputation.

- What Are Companies House Late Filing Penalties and Why Do They Exist?

- How Are Penalties Calculated for Late Filing of Annual Accounts?

- When Exactly Is a Filing Considered “Late”?

- What Are the Director’s Responsibilities for Avoiding Companies House Late Filing Penalties?

- What Systems and Processes Help You Never Miss a Deadline?

- How to Prepare Early and File Accounts Correctly?

- What Counts as Exceptional Circumstances for Challenging a Penalty?

- What Is the Formal Appeal Process for a Late Filing Penalty?

- What Are the Broader Risks If You Ignore Late Filing Penalties?

- Conclusion

- Frequently Asked Questions

What Are Companies House Late Filing Penalties and Why Do They Exist?

What legal framework governs companies house penalties?

Companies house late filing penalties are enforced under the Companies Act 2006. The legal requirement is not optional and applies to all registered entities that are required to submit statutory information. The penalty exists independently of corporation tax, meaning even a company with no tax liability can still face companies house penalties for late delivery of accounts.

Why does Companies House apply late filing penalties?

The policy purpose behind Companies House late filing penalties is to maintain an accurate, current, and reliable public register. Lenders, suppliers, investors, and regulators rely on timely accounts to assess financial position and risk. Late or missing filings weaken trust in the register, which is why penalties are applied automatically rather than assessed case by case.

Which filings trigger penalties and which do not?

Accounts late filing penalties apply to statutory annual accounts only. A confirmation statement late filing penalty does not exist in the same financial sense, but failure to file can result in strike off action. Other statutory returns, such as changes to directors or registered office details, carry separate enforcement consequences rather than fixed monetary penalties. Keeping these obligations distinct is essential when managing overdue accounts Companies House compliance.

How Are Penalties Calculated for Late Filing of Annual Accounts?

How do penalty bands work for private and public companies?

Accounts late filing penalties are calculated based on how many months late the accounts arrive at Companies House. For private companies, filing up to one month late triggers a £150 penalty, while delays of more than six months result in a £1,500 charge. Public companies face higher penalties across the same time bands. This structure explains why a late accounts filing penalty escalates quickly if deadlines are missed.

What happens if accounts are filed late more than once?

If accounts are late for two consecutive financial years, the penalty for the second year is automatically doubled. This applies even if the delay is minor. A company filing accounts two months late for the second year could see a penalty increase from £375 to £750. This repeat offence rule is one of the most overlooked drivers of companies house late filing penalties.

How do account penalties differ from other filings?

Penalties for late filing of accounts are separate from confirmation statement obligations. You can pay companies house late filing penalty amounts even if the confirmation statement is up to date. Understanding this distinction prevents directors from assuming partial compliance reduces exposure.

When Exactly Is a Filing Considered “Late”?

What are the statutory deadlines?

For private companies, accounts must reach Companies House within nine months of the accounting reference date. Public companies have a six month deadline. Missing these deadlines by even one day triggers a late filing penalty companies house rules apply strictly.

Does electronic filing change the timing?

Electronic filing counts as delivered only once accepted by Companies House, not when submitted. If accounts are rejected for formatting or tagging errors, they are treated as late unless corrected before the deadline. Postal filings count by receipt date, not posting date, which increases risk.

How do special cases affect deadlines?

First accounts often have extended deadlines, while dormant company late filing penalty exposure still exists if accounts are not delivered on time. LLPs follow similar principles but with their own filing timelines. These variations are a common source of appeal late filing penalty companies house requests, although appeals rarely succeed without exceptional circumstances.

What Are the Director’s Responsibilities for Avoiding Companies House Late Filing Penalties?

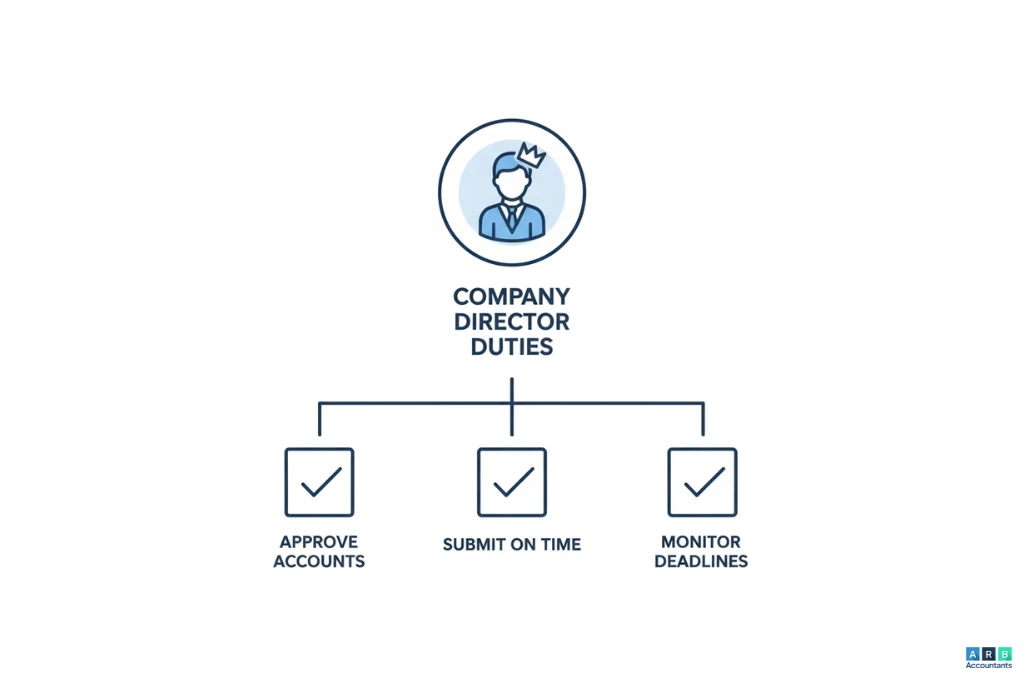

Why are directors legally responsible for statutory filing compliance?

Companies house late filing penalties are imposed on the company, but legal responsibility sits with the directors. Under UK company law, directors have a statutory duty to ensure annual accounts are prepared, approved, and delivered on time. In practice, this responsibility is usually discharged through limited company accountants who manage statutory deadlines, prepare compliant accounts, and submit filings correctly. Where filings are missed or delayed, Companies House applies penalties to the company itself, reflecting the director’s obligation to put effective professional processes in place

What risks arise from repeated filing failures?

Repeated accounts late filing penalties create wider commercial consequences beyond fines. Credit reference agencies monitor overdue accounts Companies House data, meaning late filing can weaken credit scores and affect lending decisions. Ongoing non compliance also damages corporate reputation, particularly for companies dealing with suppliers, landlords, or investors. In serious cases, continued failure to file can increase the risk of director disqualification proceedings, reinforcing why companies house late filing penalties should be treated as an early warning rather than an isolated cost.

READ RELATED ARTICLE: Are Directors Exempt from Auto Enrolment?

What Systems and Processes Help You Never Miss a Deadline?

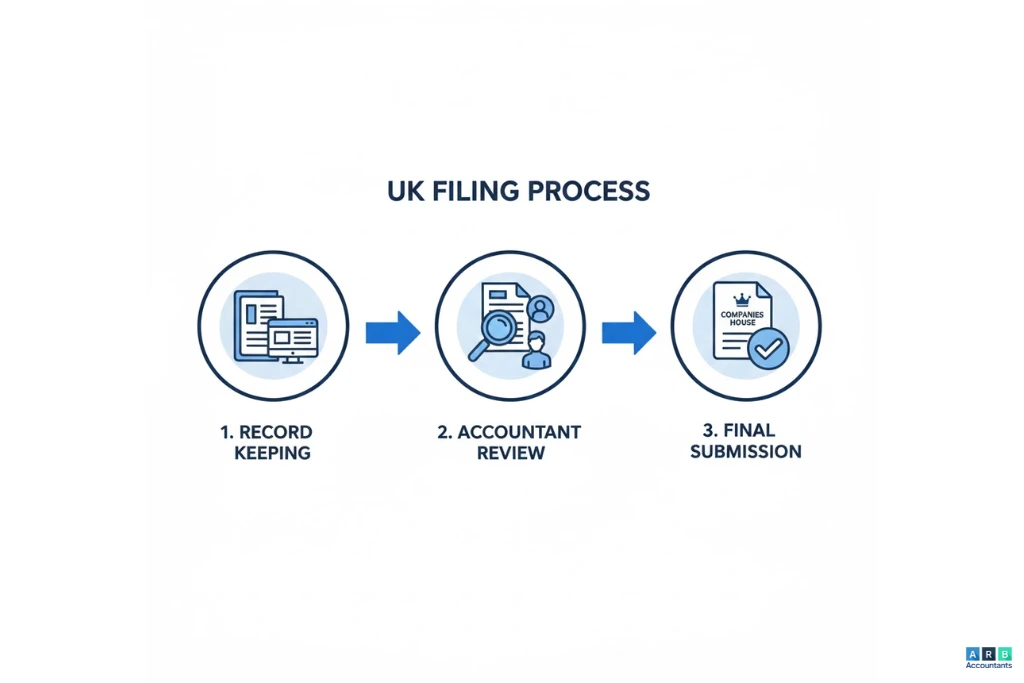

How do directors create reliable statutory deadline management?

Avoiding companies house late filing penalties requires structured statutory deadline management rather than reactive filing. Directors should track the accounting reference date, filing deadline, and approval timeline in a central compliance calendar. Automated reminders linked to these dates reduce reliance on memory and help prevent a late accounts filing penalty caused by oversight.

Which tools reduce filing risk?

Using the Companies House WebFiling service alongside accounts preparation software improves accuracy and timing. Integration allows accounts to be tagged correctly and validated before submission, reducing rejection risk. Clear task ownership is essential, even when work is delegated. Directors should define who prepares, who reviews, and who submits, ensuring accountability remains visible.

How do checklists and audit trails support compliance?

Compliance checklists and document tracking systems ensure all statutory elements are completed before submission. Version control prevents outdated drafts being filed accidentally. An audit trail showing preparation, approval, and submission dates is particularly valuable if a company later needs to appeal late filing penalty Companies House decisions or demonstrate reasonable care.

READ RELATED ARTICLE: End of Year Accounts Limited Company Checklist

How to Prepare Early and File Accounts Correctly?

Why does early preparation reduce penalty exposure?

Preparing accounts well before the deadline is one of the most effective ways to reduce companies house late filing penalties. Early preparation creates buffer time for resolving discrepancies, director queries, or missing documentation. It also prevents rushed submissions that lead to avoidable errors.

How should directors validate submissions?

Directors should always check receipt and acceptance notifications after submission. A submission is only successful once Companies House confirms acceptance. If accounts are rejected, the clock does not pause. This is a common reason penalties for late filing of accounts arise even when companies believe they filed on time.

How does early filing protect cash flow?

Early acceptance prevents the need to pay companies house late filing penalty charges and avoids doubling of penalties in future years. It also supports smoother corporation tax planning and reduces the likelihood of a dormant company late filing penalty where directors assume inactivity removes filing obligations.

What Counts as Exceptional Circumstances for Challenging a Penalty?

What does Companies House accept as a reasonable excuse?

Companies House accepts exceptional circumstances only where events genuinely prevented filing. Accepted examples include serious illness, bereavement, fire, or natural disasters that directly disrupted records or access. These principles apply consistently across companies house penalties and are published in official guidance. According to GOV.UK, most appeals are rejected because the criteria are narrowly applied.

Which reasons are not accepted?

Common reasons that do not succeed include accountant error, forgetting the deadline, software issues, or pressure of work. These explanations do not remove the obligation to pay companies house late filing penalty amounts once triggered. The same applies where companies attempt to link appeals to confirmation statement late filing penalty misunderstandings, as these filings are treated separately.

When is paying the penalty unavoidable?

Where no exceptional circumstances exist, directors must pay companies house late filing penalty charges promptly. Attempting to delay payment can escalate enforcement and distract from restoring compliance. Addressing root causes early is more effective than disputing penalties without evidence.

What Is the Formal Appeal Process for a Late Filing Penalty?

How do you formally appeal companies house late filing penalties?

The appeal process for companies house late filing penalties is structured and time bound. Directors must submit an appeal after the penalty notice is issued, usually within the stated deadline on the notice. Appeals are submitted in writing and reviewed against strict statutory criteria rather than discretionary judgment.

What information must an appeal include?

An appeal letter must clearly state why the accounts were filed late and provide evidence supporting exceptional circumstances. Relevant dates, the accounting reference date, and proof of disruption must be included. Simply stating financial pressure or adviser error will not support an appeal late filing penalty Companies House decision.

What happens after an appeal is submitted?

Companies House reviews the appeal against published guidance and either upholds or cancels the penalty. If rejected, the company must pay companies house late filing penalty charges promptly to avoid further enforcement. The review focuses on evidence, not intent, which explains the high rejection rate.

What Are the Broader Risks If You Ignore Late Filing Penalties?

What enforcement actions go beyond financial penalties?

Ignoring companies house late filing penalties can trigger escalation beyond fines. Companies House may initiate strike off action, pursue prosecution, or refer cases linked to persistent non compliance for director disqualification consideration. These risks apply even where penalties for late filing of accounts remain unpaid.

How effective is enforcement in practice?

Public reporting shows that while millions of pounds in companies house penalties are issued annually, only a portion is collected. A Financial Times analysis highlighted that enforcement prioritises register integrity over penalty recovery, meaning non payment does not prevent strike off or legal action.

Why does late filing damage reputation and credit standing?

Overdue accounts Companies House records are visible to lenders, insurers, and suppliers. Repeated accounts late filing penalties can reduce creditworthiness, delay funding decisions, and signal governance weakness, even for otherwise profitable companies.

Conclusion

Avoiding companies house late filing penalties requires a structured and proactive compliance approach. Directors must understand statutory deadlines, plan early around the accounting reference date, and use systems that prevent late accounts filing penalty exposure. For many businesses, working with experienced limited company accountants helps translate statutory requirements into practical filing processes that reduce risk. Robust processes reduce the need to appeal and protect against confirmation statement late filing penalty confusion.

When issues do arise, knowing when an appeal is valid and when to pay companies house late filing penalty charges helps contain risk. For companies seeking long term compliance certainty, engaging accountants southend on sea with strong Companies House knowledge can support consistent filing and protect both the company and its directors from escalating enforcement and reputational harm.