Role of Management Accounting in Making Business Decisions

If you’re new to the world of business, and are finding yourself scratching your head each time you have to make an important decision, ask yourself – what is currently informing your decisions? Gut instinct? Educated guesses? A coin toss? It might be time for you to think about hiring an accountant to help you make those big decisions, but this time, in an informed manner.

If you’re a freelancer trying to manage everything alone, working with experienced accountants for freelancers can make decision-making far clearer and far less stressful.

So, how does accounting help managers to make decisions? The role of accounting in decision making lies in helping managers make data-driven, informed decisions in areas such as analysis, targeting, budgeting, planning, trend, and market analysis, and make or buy analysis. It also ensures best practices and regulatory compliances across the board.

Read on to learn more about how accounting can help managers to make better decisions.

- Why is Accounting Important in Decision Making?

- What is the Role of Management Accounting in Decision Making?

- Purpose of Management Accounting

- What Does a Management Accountant Do?

- Financial Accounting vs. Management Accounting

- What Financial Accounting Standards Do Private Companies Use?

- What is the Most Important Role of Management Accounting?

- How Does Management Accounting Help in Decision Making

- Decision Making Process in Management Accounting

- How Management Accounting Helps Managers Beyond Numbers

- Business Forecasting Accountants In Essex

- Frequently Asked Questions

Why is Accounting Important in Decision Making?

The importance of accounting in management lies in its ability to provide objective data that drives effective planning for making good, informed decisions that are less likely to come back to bite you a few months down the road. Not only does it allow managers to accurately keep on top of their financial landscape, but it allows for analysis and effective planning. For those running a limited company, the guidance of contractor accountants helps ensure every decision stays compliant and financially sound.

Accounting information is also important for managers to have to hand when trying to justify decisions to senior management and investors, or when looking for finance. This information will help to prove their point, adding a layer of trust and reliability.

What’s more, having an accountant overseeing company finances and assisting in decision making will ensure that the company is fully compliant with regulations and UK laws. It can be easy to break compliance, either by not knowing what is and isn’t legal or by being tempted for one reason or another. An accountant will ensure that managers’ decisions are fully above board.

It may take longer and might sound boring, but by consulting accounting information before making big decisions, managers are lessening the risks associated with the decision at hand. This is exactly where the role of accounting in decision making becomes a long-term asset.

Absolutely fantastic service. Professional, friendly and efficient. I have recommended ARB to friends, which I would only do if I am totally pleased myself.

What is the Role of Management Accounting in Decision Making?

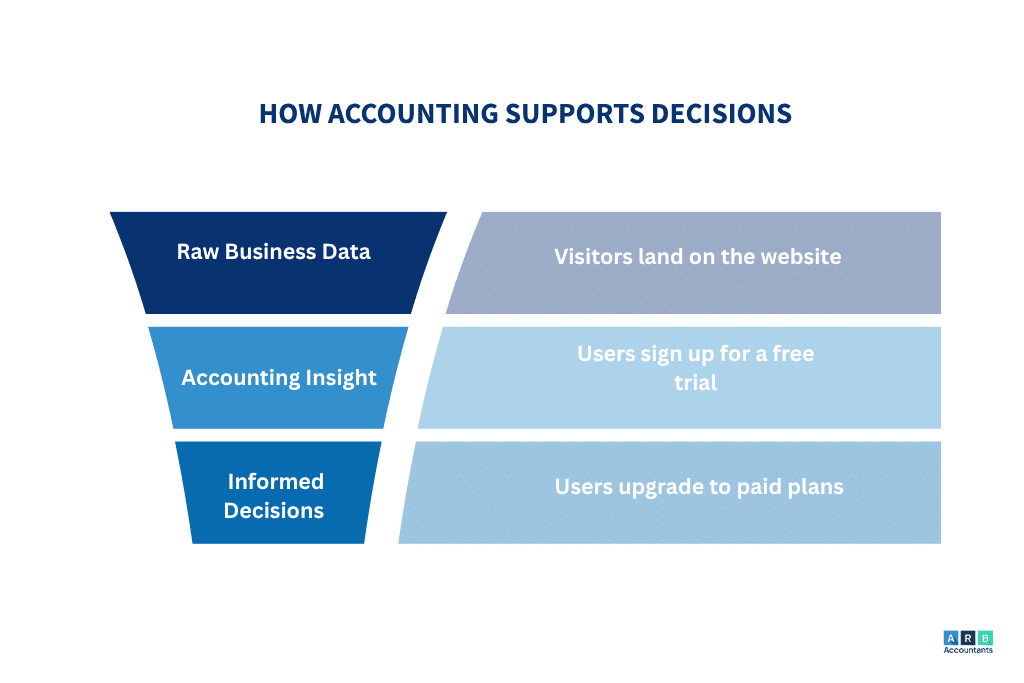

In management accounting decision making, the goal is to provide accurate data that supports strategic choices across departments. Many managers don’t realise it, but management accounting guides the overall business strategy, helping decision makers within a company to make key decisions by simplifying complex financial data. The decision making process in management accounting involves collecting, analyzing, and interpreting financial information to support operational and strategic choices.

The key functions of management accounting include:

- Planning

- Organising

- Collecting business elements

- Forecasting

- Budgeting

- Business performance

Purpose of Management Accounting

The primary purpose of management accounting is to provide managers with timely, relevant, and actionable information to support business decisions. Unlike financial accounting, which focuses on reporting past performance to external stakeholders, the role of management accounting is centered on internal decision-making, helping managers plan for the future and optimize resources.

Management accounting enables managers to identify risks, uncover opportunities, and allocate budgets effectively. It plays a critical role in supporting strategic planning by offering insights into cost structures, revenue potential, and efficiency improvements. The importance of accounting in management cannot be overstated: without accurate management accounting, decision-making becomes reliant on guesswork or incomplete data.

Financial accounting for decision makers complements management accounting by providing historical data, but the role of management accounting goes further, translating numbers into actionable strategies. From forecasting cash flow to planning capital expenditures, management accounting ensures that managers have a clear roadmap for operational and strategic decisions. In essence, its purpose is to empower businesses to make informed choices that maximize performance and long-term growth.

What Does a Management Accountant Do?

The role of a management accountant goes far beyond simply recording transactions. A management accountant is responsible for providing actionable insights that help managers make informed decisions. Their day-to-day responsibilities include budgeting, forecasting, analyzing costs, and monitoring business performance. By evaluating financial data and operational metrics, they ensure that managers have a clear understanding of which areas of the business are profitable and which require attention.

Management accountant responsibilities also extend to preparing detailed reports and dashboards that highlight trends, opportunities, and potential risks. These reports are crucial for managers when evaluating strategies or considering new investments. For example, a management accountant might analyze the profitability of different product lines and advise whether to expand, modify, or discontinue a particular offering.

The role of management accounting is therefore integral to guiding strategic choices. By linking financial data to business operations, a management accountant helps decision-makers understand the implications of their choices. In short, a management accountant acts as both a financial advisor and an operational strategist, providing the information managers need to make decisions confidently and efficiently.

Financial Accounting vs. Management Accounting

| Aspect | Financial Accounting for Decision Makers | Role of Management Accounting |

|---|---|---|

| Primary Focus | Recording, summarizing, and reporting past financial transactions | Providing insights for strategic and operational choices |

| Purpose | Ensures compliance with regulations and standards | Transforms historical data into actionable insights |

| Users | External stakeholders like investors, banks, and regulators | Internal managers and decision makers |

| Data Type | Historical and verified performance data | Analytical, forward-looking, and scenario-based data |

| Example Output | Quarterly profit reports | Departmental or product line profitability analysis |

| Key Activities | Recording transactions, preparing financial statements | Budgeting, forecasting, and planning in management accounting |

| Complementary Role | Lays the foundation with accurate data | Builds strategies based on data-driven analysis |

| Impact on Decisions | Shows past results for compliance and transparency | Supports management accounting decision making for growth |

What Financial Accounting Standards Do Private Companies Use?

Private companies in the UK must follow financial accounting standards that ensure consistency, transparency, and compliance in reporting. Commonly, small and medium-sized enterprises use UK Generally Accepted Accounting Principles (UK GAAP) or International Financial Reporting Standards (IFRS) for SMEs, depending on size and reporting obligations. These standards dictate how financial statements, including balance sheets and income statements, are prepared, ensuring that the information is reliable and comparable.

For decision makers, understanding these standards is useful because it provides context for the numbers that management accountants analyze. The role of management accounting in decision making involves interpreting financial reports prepared under these standards and converting them into actionable insights. By bridging compliance and strategy, management accountants help managers make informed choices that go beyond just “balancing the books.”

What is the Most Important Role of Management Accounting?

The most important role of accounting in decision making is to conduct a cost analysis that determines the existing expenses and provides managers with insights for forecasting, long-term business planning, and for making important decisions.

A cost-benefit analysis involves various financial metrics, such as revenue earned, or costs saved, as a result of the decision to pursue a particular decision. It can also include intangible benefits and cost effects from a decision, such as customer or employee satisfaction.

READ RELATED ARTICLE: What is the importance of business forecasting?

How Does Management Accounting Help in Decision Making

Understanding how management accounting helps in decision making empowers managers to base strategies on financial insights. Below we have outlined 5 key ways that accounting, specifically management accounting, can help managers to make better, more informed decisions. The role of accounting in decision making becomes especially valuable during this process, as managers evaluate scenarios like:

Cost Benefit Analysis

As mentioned, this is one of the most vital aspects. By comparing the potential gains and losses of a decision, managers can avoid costly mistakes. The role of accounting in decision making here is to quantify options clearly.

Targeting

Managers should analyse the value of each customer segment to detect lucrative opportunities, and where money may be being lost. This helps managers to know where to best invest time, money, and resources in the future in order to bring in value long-term.

Budgeting

Budget-related decisions must comply with company-wide goals and structures, as well as sales history. Accountants can step in to analyse previous activities to identify opportunities for the future, create financial plans for each department, as well as to detect any potential threats.

Trend Analysis

Reviewing trends is an important way that accountants can help managers to make decisions. Decisions can be made by using previous information, identified by accountants, such as:

- Historical pricing

- Sales volumes

- Geographical location

- Customer trends

- Financial data

Planning

All of the above, and more, contribute to the ability to make long-term decisions, and plans for the future. It also allows managers to stay up to date with industry trends, meaning that they can react to market changes quickly, and implement informed strategies that are data-driven, not just blind, panicked reactions.

READ RELATED ARTICLE: How does a balance sheet help in decision making?

Decision Making Process in Management Accounting

The decision making process in management accounting follows a structured approach to ensure that business choices are data-driven and strategically sound. This forms the foundation for cost analysis, revenue assessment, and performance evaluation.

Next, management accounting decision making involves conducting a cost-benefit analysis. By quantifying potential gains and losses, managers can evaluate alternatives and choose the most profitable course of action. Forecasting is another key step, where historical trends, market data, and projected expenses are used to anticipate future outcomes. Planning in management accounting ensures that short-term actions are aligned with long-term objectives, minimizing risk while maximizing efficiency.

Once the analysis is complete, the management accountant presents clear reports and recommendations to the decision-makers. A real-world example could be determining whether to invest in new technology: the accountant would provide cost projections, potential revenue impact, and efficiency gains to guide the final decision. The role of management accounting is therefore central to linking data, analysis, and actionable strategies, allowing managers to make informed decisions confidently.

How Management Accounting Helps Managers Beyond Numbers

While the role of management accounting involves analyzing numbers, its impact extends far beyond spreadsheets. Management accounting helps managers understand the qualitative aspects of their business, enabling smarter decision-making and strategic planning. By identifying trends, such as customer preferences, seasonal sales patterns, and operational bottlenecks, management accountants provide insights that go beyond financial figures.

The role of accounting in decision making also includes advising managers on resource allocation, helping them prioritize investments in areas that offer the highest returns. Management accountants highlight inefficiencies and recommend process improvements that reduce costs while enhancing productivity. This ensures that decisions are not only financially sound but operationally effective.

Additionally, the role of management accounting in decision making includes linking business data to strategic goals. Managers can use this information to adjust plans quickly, respond to market changes, and implement long-term strategies with confidence. How management accounting helps in decision making is therefore both analytical and advisory, providing managers with a clear understanding of the implications of each choice and supporting informed, data-driven, and strategic business decisions.

If you manage rental properties, working with dedicated accountants for landlords can help you understand cash flow, expenses, and long-term financial planning with much more clarity.

Business Forecasting Accountants In Essex

ARB Accountants are chartered accountants in Essex, with a team of business forecasting experts that can help you make better decisions and plans for your business. Get in touch with us today to learn more about how we can help.