Why Is Cash Flow Forecast Important for a Business?

Why is cash flow forecast important for a business? Running out of cash is one of the biggest reasons businesses fail—even profitable ones. Unexpected expenses, delayed payments, or poor financial planning can leave you struggling to cover costs.

A cash flow forecast helps you anticipate cash shortages, plan for expenses, and ensure your business stays financially stable. In this article, we’ll break down its importance, key benefits, and how to create one effectively.

Read on to learn more about how cash flow forecasting can benefit your business.

Why is the Cash Flow Forecast Important?

There are a variety of reasons to perform a cash flow forecast, but the primary purpose is to understand why cash flow forecast is important for a business—it helps determine how much cash your business has available at any given time and predict future cash availability.

But why does this matter? It’s crucial that you know how much cash your business has on hand (or is predicted to have), to be able to make good, informed decisions. It can also help you to make plans for the future and your company’s growth, or plans for change, purchase, and hiring decisions, which will help you to understand the general health of your business.

Without a cash flow forecast, you might find yourself with a lack of cash and resources available to keep your business moving.

Common Cash Flow Problems Businesses Face

Many businesses experience cash flow problems, making it crucial to understand why is cash flow forecast important for a business. Some common challenges include:

- Late Payments from Clients: Without a clear cash flow prediction, unexpected delays can leave businesses struggling to cover expenses.

- High Operating Expenses: A business cash flow forecast highlights rising costs early, allowing proactive budgeting.

- Poor Financial Planning: Many companies underestimate why cash flow forecasting is important, leading to financial instability.

- Seasonal Revenue Fluctuations: Small businesses with fluctuating sales rely on small business cash flow forecasting to prepare for low-revenue periods.

Recognizing these problems and implementing a cash flow forecast can help businesses maintain financial stability.

READ RELATED ARTICLE: What is the importance of business forecasting?

How Does a Cash Flow Forecast Help a Business?

Now that you understand why cash flow forecasts are important for a business, let’s explore specific ways it can help.

Keep Track of Payments

As part of your cash flow analysis, keeping track of overdue payments can help you to keep an eye on your available cash, and provide you with key insight for future planning. It will also help you to identify any areas of concern in your credit control department so that you can deal with it before it has a chance to have a huge impact on your business.

Understand How Decisions May Impact Your Business

For small businesses in particular, your cash flow taking a hit, for whatever reason, could have a huge impact on your ability to run your business as normal. By performing a cash flow forecast, running various scenarios, you’ll be able to see how those scenarios might affect your business, allowing you to plan confidently and effectively.

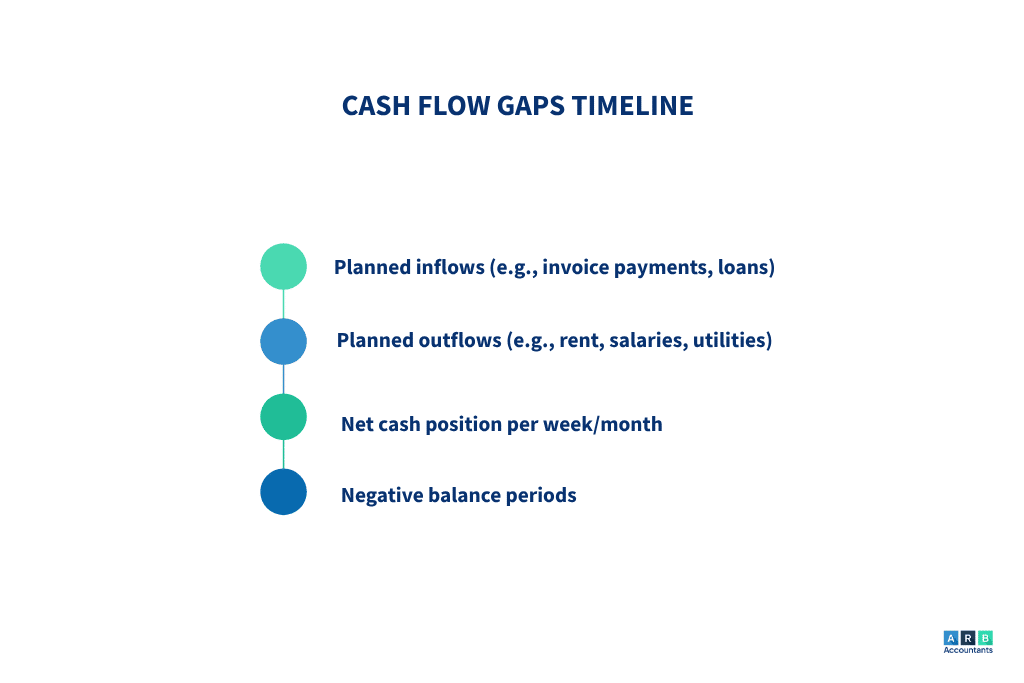

Plan for Cash Gaps

A cash flow forecast should help you to identify any upcoming cash gaps, allowing you to put plans in place in advance to reduce its impact on your business and finances.

Track Goals and Targets

All businesses have goals and targets, many of which are time-sensitive. Cash flow forecasting can help you to understand when you might realistically reach these goals, as well as identifying anything that could stand in the way of you reaching your targets.

Gain Investment

If you want to gain investment for your business, you’ll need to provide potential investors with an idea of what the future of your business looks like financially. This means that you’ll need to use a cash flow forecast, including your best, average, and worst-case scenarios.

Cash Flow Forecasting Methods

Quality accountants like ARB Accountants will usually be able to help you with cash flow forecasting if you don’t fancy doing it yourself, or if you don’t have the time or resources to do it yourself. However, if you want to go it alone, here are a few methods that might work for you.

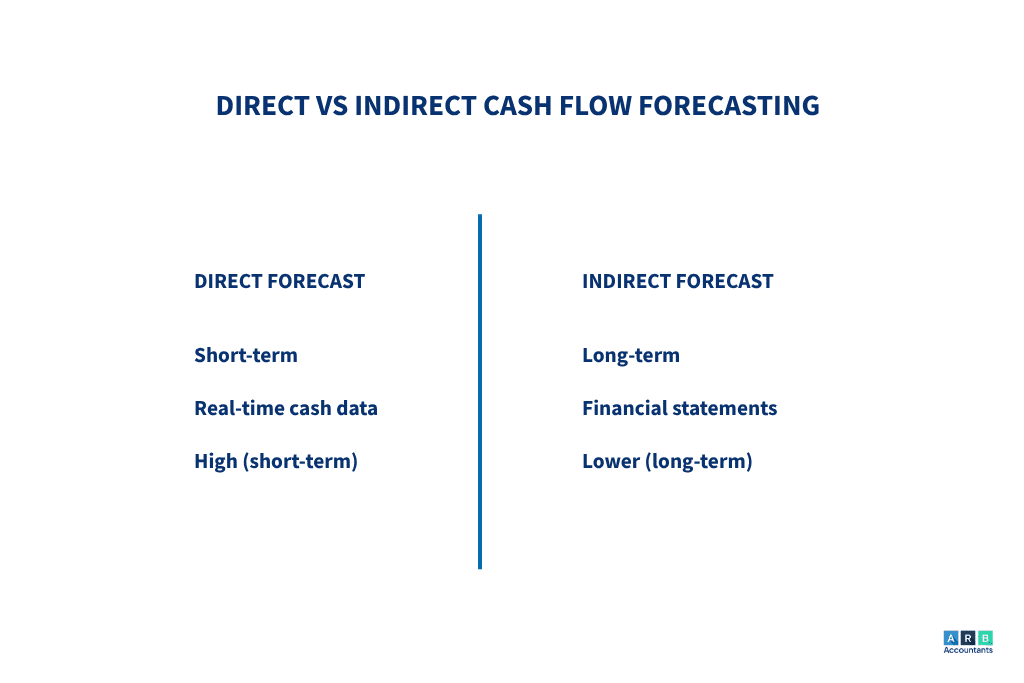

First of all, you’ll need to know if you want to perform a short-term (30 days), medium-term (approx. 13 weeks), or long-term (1-5 years) cash flow forecast. From here, you can decide between direct and indirect cash flow forecasting.

Direct Cash Flow Forecast

A direct cash flow forecast predicts when cash will be coming and going from the business at a specific point in time. It is best for short to medium-term forecasts, and uses information from bills, invoices, taxes, payroll, and creditors.

- Detailed analysis at a granular level

- Easy to understand

- Focuses completely on cash

- Highly accurate in the short-term

Indirect Cash Flow Forecast

An indirect cash flow forecast predicts the movement of cash by using prepared financial statements such as balance sheets and income statements. This process is generally done as part of planning and budgeting, and is best for long-term forecasting. For more information on balance sheets, we’ve also written a very detailed article on how balance sheets help to make business decisions.

Very professional and trustworthy service provided. Having been with several different accountants we have now been with ARB accountants for over three years due to the high quality service and advise provied.Led by Saurabh and his skilled team you will be in safe hands. Not to mention, Prakash has been a godsend!!

How to Create a Cash Flow Forecast for Your Business

To truly understand why is cash flow forecast important for a business, companies must implement a structured forecasting process:

- List Income Sources: Knowing when and how money enters the business is a core reason why cash flow forecasting is important.

- Track Fixed and Variable Expenses: Identifying outgoing cash ensures businesses see the full picture of their cash flow forecast importance.

- Estimate Future Cash Movements: A solid cash flow forecast prevents financial surprises by mapping out anticipated revenue and expenses.

- Choose a Forecasting Method: Whether using direct cash flow forecasting for short-term needs or indirect forecasting for long-term planning, the right approach highlights why cash flow forecasting is important for decision-making.

- Review and Adjust Regularly: A successful business understands that the importance of cash flow forecasting lies in its ability to adapt to change.

A well-structured business cash flow forecast not only ensures smooth operations but also demonstrates why a cash flow forecast is important for a business—it helps businesses grow, plan, and sustain profitability.

READ RELATED ARTICLE: What are monthly management accounts?

How to Improve Small Business Cash Flow Forecasting

Understanding why a cash flow forecast is important for a business is the first step in improving financial planning. Small businesses can enhance cash flow prediction by:

- Using Automated Tools: Digital solutions make it easier to maintain an accurate business cash flow forecast.

- Maintaining a Cash Reserve: One major benefit of a cash flow forecast is identifying when to set aside emergency funds.

- Adjusting Payment Terms: A proactive cash flow forecast helps businesses negotiate better terms with suppliers and customers.

- Regularly Updating Forecasts: Continuous adjustments ensure businesses fully grasp why cash flow forecasting is important in dynamic markets.

By refining small business cash flow forecasting, companies can avoid unexpected financial crises and sustain steady growth.

Business Forecasting with ARB Accountants

ARB Accountants are chartered accountants in Essex, with a team of business forecasting experts that can help you with cash flow analysis to help you to make better decisions and plans for your business. Get in touch with us today to learn more about how we can help.