Are Staff Gifts Tax Deductible?

Are Christmas Bonuses Employee Gifts Tax Deductible?

If you give a cash bonus to your employees, it counts as earnings, so you will need to add that to the employee’s payroll and deduct the relevant tax and National Insurance. Many employers wonder, are staff gifts tax deductible when it comes to bonuses. The answer is yes, but only if the bonus is part of the regular pay and taxed accordingly

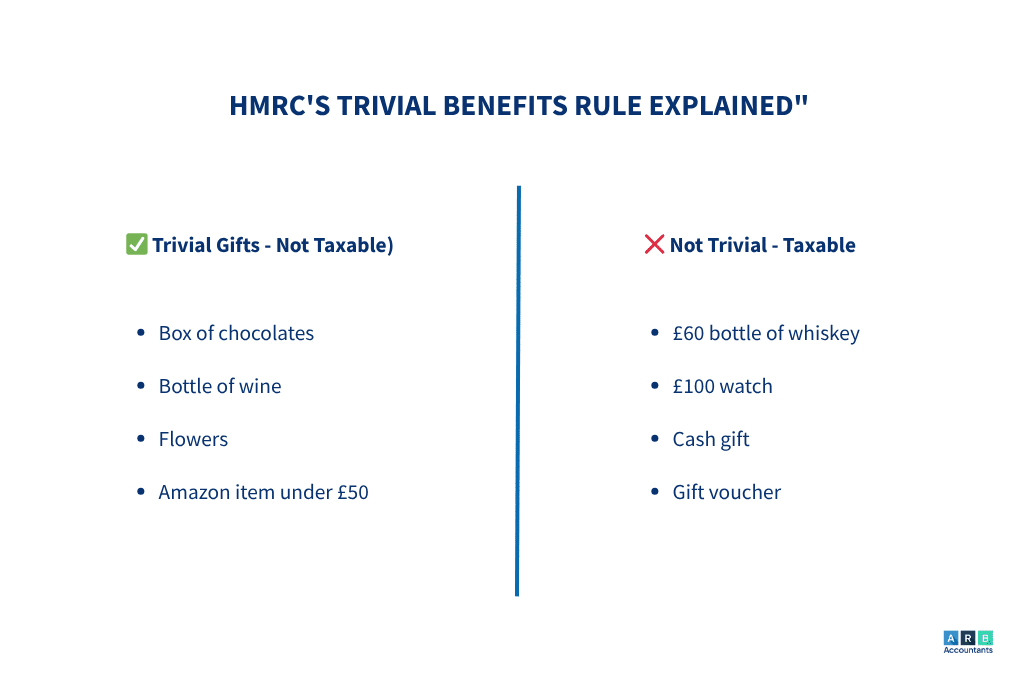

If you provide your employees with gifts such as chocolates, a bottle of wine, etc., there are no tax implications if the gift is considered “trivial” by HMRC. However, are staff gifts tax deductible when they are seen as trivial? Generally, anything up to £50 is considered trivial, and thus not subject to tax. There is no set monetary limit for trivial gifts, but typically up to £50 would be deemed acceptable by HMRC.

READ RELATED ARTICLE: Benefits of payroll outsourcing services

Are Staff Gifts Tax Deductible at Christmas Party?

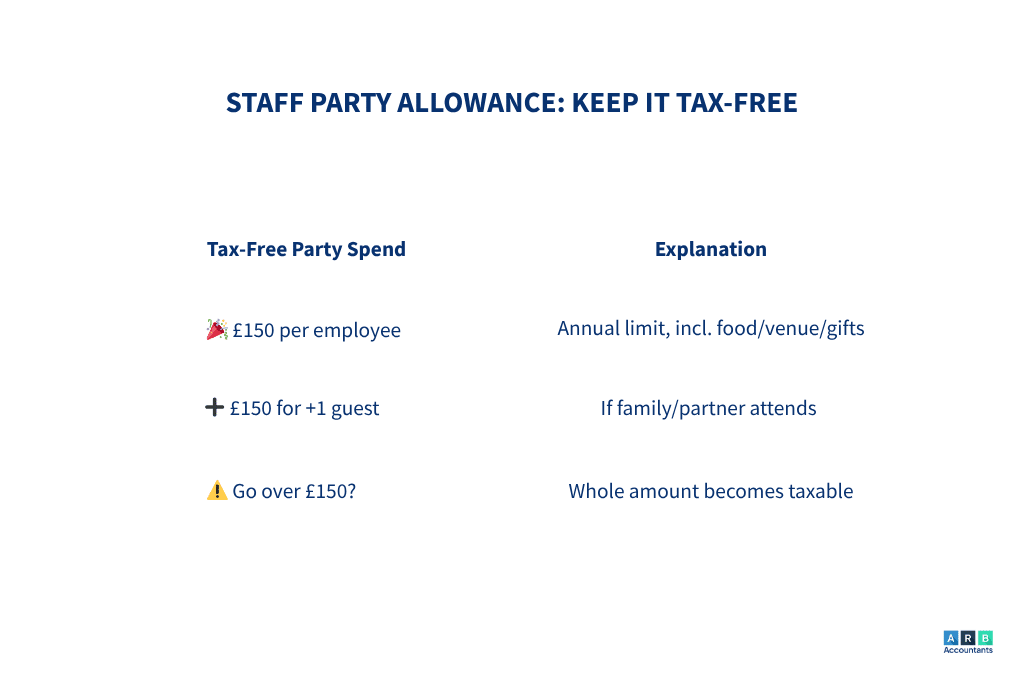

You can spend up to £150 per year per head without any tax implications, which raises the question, are staff gifts tax deductible in relation to party expenses?. The £150 is the annual limit, so if you have more than one party in a year, the total spent per person for the year should be less than £150. If it goes over £150, the whole amount becomes taxable. In this case, the answer to are staff gifts tax deductible is yes, provided you stay within the limits. Additionally, you can claim an extra £150 per person for each employee if they bring along a partner or family member. To claim the £150 exemption, the party must be open to all employees.

A very helpful company . They have explained things my previous accountant didn’t and I cannot recommend them highly enough.

Are Gifts to Employees Tax Deductible on Christmas?

These are treated as business entertainment and are disallowed for tax purposes unless the following three conditions are met:

- The gift must carry a business logo and be branded as advertising. The logo should be on the gift itself, not just on the wrapping paper.

- The value of the gift must be less than £50.

- The gift must not be food, drink, tobacco, or vouchers.

So, are staff gifts tax deductible if they are given to clients? In this case, the tax treatment is different from gifts to employees, as the focus is on business branding.

UK employee gifts, like Christmas presents, are normally not taxed if they meet specific conditions. If the gift is below cost (less than £50) and is neither cash nor a cash voucher, it is normally not taxed according to the ‘trivial benefits’ rule. However, if the gift exceeds this threshold or is cash, it may be taxable and subject to National Insurance contributions.

VAT on Christmas Gifts to Your Clients

You can claim the VAT on business gifts made to customers if the value of the gift does not exceed £50. This limit applies over a 12-month period. However, if you’re wondering are staff gifts are tax deductible under VAT rules, you’ll need to account for output VAT on the value of the gift if it exceeds £50 in a year.

For more information, please contact us on 01702 345 207 or email us at info@arb.accountants