Business Structures UK for Freelancers and Contractors

If you’re a freelancer or contractor in the UK, choosing the right business structure UK option is crucial for your success. Understanding the legal structure of a business can help you avoid costly mistakes and ensure long-term sustainability.

Understanding Business Structures UK

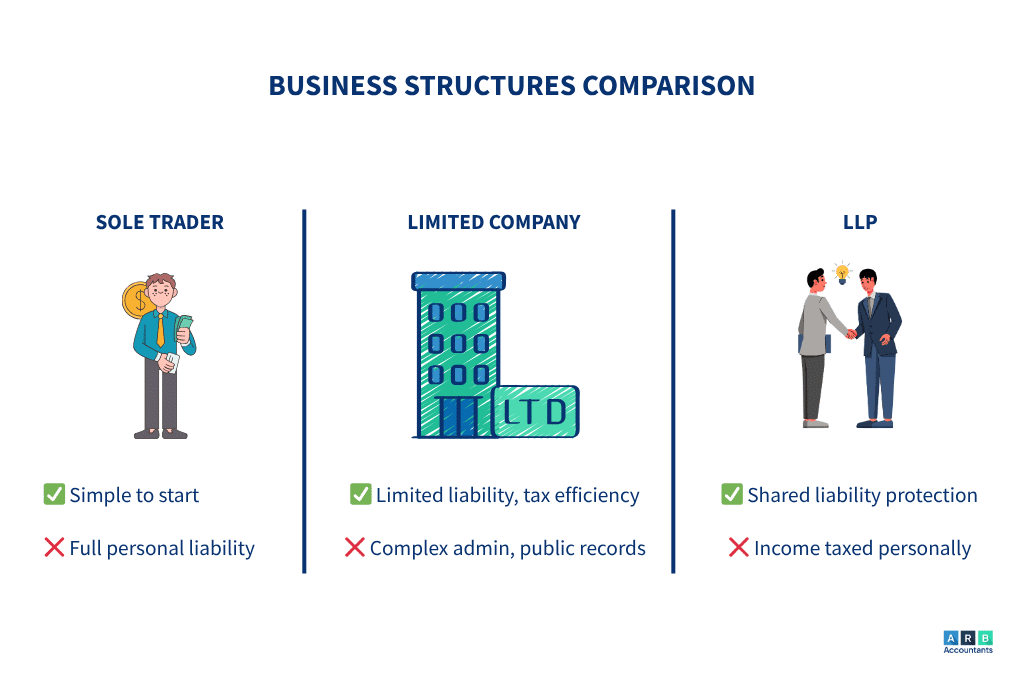

The UK company structures available to self-employed professionals generally fall into three main types: Sole Trader, Limited Company, and Limited Liability Partnership (LLP). Each of these business structures UK options comes with distinct advantages and obligations depending on your needs, tax planning goals, and future growth plans.

If you’re wondering about the best business structure for independent contractors or how to set up as a freelancer in the UK, this guide will help you decide which model fits your situation.

Sole Trader

Also known as being self-employed, a sole trader runs and owns their entire business. This is a suitable business structure for both freelancers and contractors, as they usually work by themselves, for themselves. It’s a simple, flexible business structure UK ideal for freelancers and contractors just starting out in the UK.

Pros of Sole Trader Business Structure

The pros of the Sole Trader business structure for freelancers and contractors are largely related to tax, and governmental registration and compliance.

Fast, simple start up

As a sole trader, you don’t need to register with Companies House, and you start working right away. You do need to register for Self Assessment, however, but this is a quick and simple task. Learn more about Self Assessment in our recent blog.

Fewer (if any) fixed overheads

As you’ll be working for yourself, you’ll have fewer fixed overheads and start up costs than if you were a limited company, which is very beneficial for anyone just starting out.

100% control & organisational flexibility

Working by yourself, for yourself means that you have 100% control over business decisions and organisational flexibility. Run your business as you see fit.

Fewer tax responsibilities & financial information is kept private

Being a sole trader means having fewer tax responsibilities, as you do not have to pay corporation tax, or submit annual accounts to Companies House. Similarly, as you do not have to register with Companies House, your financial information can be kept private.

READ RELATED ARTICLE: How a small business accountant can help grow your business

Cons of Sole Trader Business Structure

The cons of being a sole trader relate to workload and liability, as you’re working for yourself, by yourself.

Personally liable should things go wrong

As sole traders are not registered as a company, and work for themselves, they are personally liable if things go wrong.

Workload & sole responsibility for completion of work

Be careful of accepting more work than you can take on, and be considerate of how many hours you’re willing to work. As a sole trader, it’s easy to be a Yes-Man, taking on more than you can handle.

Fewer tax opportunities & barriers to finance

As the profit that sole traders make is subject to income tax each financial year, it’s more difficult to plan ahead tax-wise. Opportunity barriers are amplified by the fact that lenders are generally more wary of sole traders when considering finance, making it difficult to financially plan ahead and grow as a business

Advice for Freelancers and Contractors

If you’re wondering how to set up as a freelancer UK, starting as a sole trader is the most straightforward option, consult an experienced accountant to make sure that you are compliant with UK regulations.

Accountants can also help with Self Assessment, making sure that your submission is made on time, and is accurate so that you don’t incur any fines down the road.

Check out our pages for freelancers and contractors for more information about how professional accounting could benefit your business.

Limited Company

A Limited Company is a separate legal entity registered with Companies House and is one of the most common UK company structures, especially suitable for those looking to scale or seek investment.

This business structure could be a good option for experienced freelancers or contractors that are considering growing their business, taking on employees, or considering external investment opportunities.

Pros of Limited Companies for Freelancers and Contractors

Losses are limited

Owners’ losses are limited to what they have invested. Similarly, personal assets and income are irrelevant.

Retain assets and profits made after tax

Unlike sole traders, limited companies are able to retain assets and profits made after tax. This can help you to invest back into the business, which is ideal if you’re looking to grow your business.

Easier to attract investment

If you’re looking for investment to grow your business, being a limited company is hugely beneficial as you’re able to sell shares in the business. What’s more, many lenders consider incorporated companies to be a safer investment option than sole traders.

Cons of Limited Companies for Freelancers and Contractors

More financial responsibilities and administrative duties

As an incorporated company, you have more financial, accounting, and administrative responsibilities than sole traders. If you’re new to the game, this can be a complex field to navigate and could result in fines if not done correctly.

More rigid tax rules

Similarly, limited companies have more rigid tax rules than sole traders. When a business makes a loss, it can only use that loss against its own profits, whereas sole traders can use the loss to decrease their income tax.

Less privacy/more scrutiny

As limited companies are registered at Companies House, their finances and company information is readily available for anyone to see on the Companies House website. Parts of your annual accounts, your registered address, and director’s details are all made publicly available.

Advice for Freelancers and Contractors

If you’re new to bookkeeping and accounting, and are thinking about becoming a limited company, consider using a chartered accountant to stay on top of your company’s finances. Not only does this reduce your administrative duties, letting you get back to running your business, but it ensures compliance with UK tax regulations and accurate submissions to HMRC. Many contractors choose this path when setting up a limited company for contracting UK as it offers both credibility and tax efficiency.

Check out our page on Limited Companies for more information.

Limited Liability Partnership (LLP)

An LLP combines flexibility with liability protection. It’s a recognised business structure UK, acting as a separate legal entity like a limited company, but structured like a partnership.

Pros of LLPs for Freelancers and Contractors

Protection of personal assets

A limited liability partnership protects members’ personal assets from the liability of the business, as LLPs are a separate legal entity.

Flexibility

As the operation of the partnership and distribution of profits is determined by members of the LLP, there is greater flexibility in the management of the business.

LLPs are deemed a legal person

A limited liability partnership is deemed to be a legal person, meaning that contracts can be signed using the business name, it can employ staff, rent or lease property, and it can be held accountable where necessary.

Cons of LLPs for Freelancers and Contractors

Lack of privacy

Like in limited company structures, financial accounts must be submitted to Companies House, where it is made publicly available. This includes personal income of members of the partnership.

Income is considered personal income (taxed accordingly)

All business income is considered personal income, like with sole traders, and is taxed as income tax.

Profit cannot be retained

Similar to sole traders, profits cannot be retained after tax, therefore you might find it difficult to source income for growth and investment as an LLP.

Advice for Freelancers and Contractors

Not sure how to set up as a contractor UK? If you’re going into business with others and want protection without forming a limited company, LLP might be the right fit. LLPs are best for partnerships needing flexibility and protection. Always consult an accountant to assess if this is right for your business.

READ RELATED ARTICLE: What can an accountant do for your business?

Choosing the Right Business Structure in the UK

Whether you’re launching your career or scaling an existing operation, choosing from the available business structures UK—Sole Trader, Limited Company, or LLP—requires a solid understanding of the legal structure of a business. Each structure has different implications for tax, liability, and administrative responsibilities.

We help you explore the best business structure for independent contractors and guide you through every step, from how to set up as a freelancer UK to setting up a limited company for contracting UK.

I began working with Saurabh in early 2021 after a recommendation from a friend and colleague. He has overseen the transition of my business from freelance sole trader, to a limited VAT registered company. I had previously taken care of my own accounts so I can’t make a comparison to other accountants, but for me he has been professional, punctual, pleasant to work with, and has saved my business time and money. We’ve dealt with one or two teething problems regarding company formation and getting everything registered properly with HMRC, and in all cases he has helped me to tackle the issues allowing me to focus on my clients. I would highly recommend Saurabh to all freelance professionals wishing incorporate their business.

Get advice from chartered accountants in Westcliff on Sea

ARB Accountants provide a range of accountancy services in Southend and across Essex. We also provide accounting advice for freelancers and contractors, including choosing the right business structure.

Get in touch with us today to claim your free 60 minute consultation to see how ARB Accountants could benefit your business.