Cash Flow Planning: A Guide for UK Investors

Cash Flow Planning is a structured way of mapping how money moves through an investor’s financial life over time, rather than looking at finances in isolation. In an investment and wealth context, it brings together projected income, expected spending, asset values and liabilities to show whether long term goals remain affordable. Core elements include a clearly defined cash flow plan, disciplined financial cash planning, long range cashflow strategy planning and ongoing cash flow monitoring, all working together to support informed decision making.

For UK investors, disciplined planning has become increasingly important due to market volatility, changing tax rules, inflation pressure and longer retirement horizons. Investment decisions are no longer just about returns, they are about timing, access to capital and sustainability of income across decades. A structured approach helps investors understand trade offs between growth, income and risk while maintaining financial control.

- What Is Cash Flow Planning and Why Does It Matter for UK Investors?

- How Do UK Investors Build an Effective Cash Flow Plan?

- How Can Investors Monitor and Update Cash Flow Over Time?

- What Are the Most Common Cash Flow Planning Strategies for Investors?

- How Does Cash Flow Planning Influence Investment Decisions?

- What Tools and Techniques Improve Cash Flow Forecast Accuracy?

- What Mistakes Should UK Investors Avoid in Cash Flow Planning?

- How Do Tax and Regulatory Factors Affect Cash Flow Planning in the UK?

- How Can Cash Flow Planning Support Retirement and Long Term Goals?

- How Should Investors Measure the Success of Their Cash Flow Plan?

- What Role Does Cash Flow Planning Play in Holistic Financial Planning?

- Conclusion

- Frequently Asked Questions

What Is Cash Flow Planning and Why Does It Matter for UK Investors?

Cash Flow Planning is a forward looking financial roadmap that projects expected inflows and outflows over different stages of life. It shows how income from employment, investments or pensions aligns with spending, tax liabilities and capital commitments over time. Unlike static snapshots, it is designed to evolve as circumstances and markets change.

This approach differs from basic budgeting or profit and loss tracking. Budgeting focuses on short term expense control, while profit and loss reporting looks backward. Planning looks ahead and answers whether future obligations remain affordable under different conditions. Research from the UK Office for National Statistics shows that over 40 percent of households have less than three months of savings, highlighting how fragile financial positions can be without forward planning (source).

Robust planning improves liquidity management by showing when cash is needed and where it should come from. It also supports capital allocation by clarifying how much can be invested for growth versus held for near term needs. Most importantly, it gives investors confidence to make decisions knowing their long term position has been tested against realistic scenarios.

How Do UK Investors Build an Effective Cash Flow Plan?

Effective Cash Flow Planning starts with clarity, not assumptions. UK investors build a reliable cash flow plan by mapping when money moves, how predictable it is, and whether it is actually available when needed. The goal is not to calculate best-case wealth, but to understand real-world cash availability across time.

Establish Income Sources by Reliability and Timing

The first step is identifying all income sources and grouping them by reliability and payment schedule. Guaranteed inflows such as salaries, pensions, and annuities are treated as predictable. Variable income such as bonuses, dividends, rental income, or investment distributions is logged separately. Each source is entered based on when cash is received, not when it is earned. This distinction is critical for accurate financial cash planning. A year-end dividend cannot fund a mid-year expense. By structuring income this way, investors create a cash flow plan that reflects timing reality rather than headline totals.

Map Core and Discretionary Expenses Over the Planning Horizon

Expenses are then split into essential and discretionary categories. Core costs include housing, utilities, insurance, debt repayments, and basic living expenses. Discretionary spending covers travel, leisure, lifestyle upgrades, and optional purchases. Each expense is projected forward using realistic assumptions for inflation and lifestyle changes. One-off or irregular costs such as education fees, renovations, or major purchases are scheduled explicitly. This step turns lifestyle choices into visible future cash requirements and prevents hidden pressure points that often derail long-term cashflow strategy planning.

Classify Assets by Liquidity and Cash Generation

Assets are reviewed based on how easily they can be converted into cash and whether they generate income. Liquid assets such as cash reserves and listed investments support short-term needs. Illiquid assets such as property, private investments, and pensions are noted for their access constraints. Income-producing assets are separated from growth-focused holdings. This prevents investors from relying on capital that cannot be accessed when required. A strong cash flow plan reflects availability, not just value, which is essential for realistic planning.

Integrate Liabilities as Fixed Cash Commitments

All liabilities are then added as fixed outflows. Mortgages, loans, and structured repayments are treated as non-negotiable cash commitments with defined timing. These obligations take priority over discretionary spending in the model. By embedding liabilities directly into the cash flow plan, investors ensure affordability is tested under real conditions rather than optimistic assumptions.

Consolidate Inputs Into a Forward Looking Financial Overview

Once income, expenses, assets, and liabilities are logged, everything is consolidated into a single forward-looking view. This overview shows net cash positions over time, highlighting periods of surplus or shortfall. Accurate consolidation turns raw data into insight, allowing investors to see when action will be required and when flexibility exists. Ongoing cashflow monitoring ensures the model remains aligned with reality as circumstances change.

Translate the Financial Overview Into Strategic Planning and Goals

The completed cash flow plan becomes a decision-making tool. Investors can test whether goals such as property purchases, retirement timing, or increased investment contributions are achievable within projected cash limits. If shortfalls appear, decisions can be adjusted early. This is where Cash Flow Planning shifts from reporting to strategy. By aligning goals with projected cash availability, UK investors reduce risk, improve timing, and make confident financial decisions based on evidence rather than guesswork.

READ RELATED ARTICLE: What Makes a Strong Balance Sheet?

How Can Investors Monitor and Update Cash Flow Over Time?

Cash flow monitoring is not a one off exercise but an ongoing discipline. As markets move and life events occur, projections need to be reviewed to ensure they still reflect reality. Quarterly reviews provide a practical rhythm, with additional updates triggered by events such as major investments, changes in income or shifts in personal circumstances.

Regular monitoring connects planning directly to portfolio management. When projections show future pressure points, investors can rebalance assets, adjust spending or revise assumptions early. This link between monitoring and risk control ensures the cash flow plan remains relevant and actionable rather than a static document.

What Are the Most Common Cash Flow Planning Strategies for Investors?

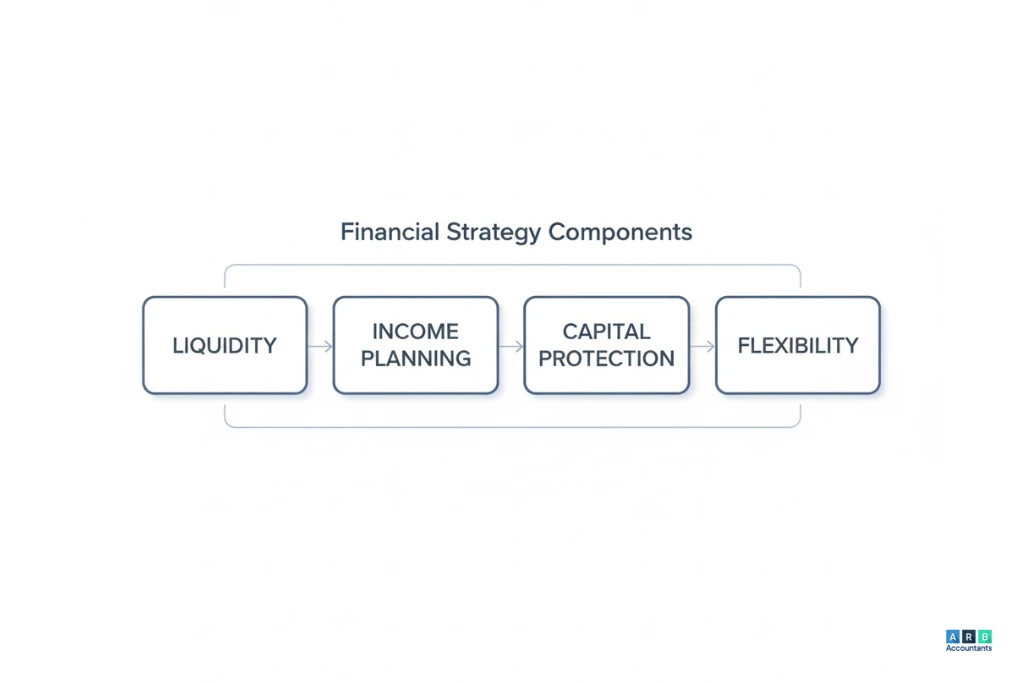

Effective Cash Flow Planning strategies focus on aligning income, capital and timing across different life stages. Within wealth management, cashflow strategy planning is used to ensure that money is available when needed without forcing asset sales at the wrong time. This approach treats cash as a strategic resource rather than idle capital, especially when portfolios must support long term objectives.

How Do Investors Structure Cash Flow Planning Across Financial Life Stages?

One core principle is maintaining an emergency liquidity buffer that protects the portfolio from short term shocks. This buffer reduces the risk of drawing from growth assets during market downturns. Another strategy involves sequencing asset withdrawals in a tax efficient order, drawing from taxable, tax deferred and tax free sources in a way that preserves long term value. Liability driven planning is also used, where predictable income needs are matched to assets designed to deliver stable cash flows.

These strategies change across financial lifecycles. Pre retirement planning prioritises accumulation and flexibility, while post retirement planning focuses on sustainability and income reliability. A well structured cash flow plan makes these transitions visible and manageable through forward projections rather than assumptions.

How Does Cash Flow Planning Influence Investment Decisions?

Cash Flow Planning directly shapes investment selection by clarifying whether an opportunity fits the investor’s liquidity profile. Assets that appear attractive on returns alone may introduce cash strain if their income timing does not match spending needs. Planning highlights this mismatch early and prevents decisions that create pressure later.

How Do Investment Structures Align With Cash Requirements?

Dedicated portfolios are one example of alignment between cash needs and asset structure. By matching known liabilities to predictable income streams, often using bonds, investors can reduce uncertainty around future obligations. This separation of income focused assets from growth focused assets improves decision confidence and supports disciplined capital allocation. The result is a portfolio that serves purpose, not just performance.

What Tools and Techniques Improve Cash Flow Forecast Accuracy?

Cash Flow Modelling Software

Time based modelling tools connect income, expenses, assets and liabilities into a single cash flow plan. Assumptions update automatically, improving financial cash planning and reducing manual forecasting errors.

Scenario Analysis

Different outcomes are tested by adjusting inputs such as investment returns, inflation and spending growth. This supports cashflow strategy planning by showing how sensitive the plan is to change.

Stress Testing

Adverse conditions such as market declines or higher living costs are applied to assess whether the cash flow planning strategy remains sustainable under pressure.

Integrated Tax and Portfolio Modelling

Forecasts improve when tax rules and portfolio behaviour are reflected within projections. This ensures cash flow planning decisions are based on realistic net outcomes.

Ongoing Cash Flow Monitoring

Actual results are compared against projections and the cash flow plan is updated regularly, keeping financial cash planning accurate as circumstances change.

Working with cash flow forecasting specialists can further enhance accuracy and provide expert insights for more reliable financial planning.

READ RELATED ARTICLE: How Does a Cash Flow Forecast Help a Business

What Mistakes Should UK Investors Avoid in Cash Flow Planning?

Over optimistic return assumptions

Assuming consistently high investment returns can hide future funding gaps. This weakens a cash flow plan by overstating available capital and undermines realistic financial cash planning.

Ignoring tax and inflation impacts

Failing to model tax liabilities and inflation distorts real purchasing power. Cash flow planning must reflect post tax outcomes to remain accurate over long time horizons.

Relying only on historical data

Past performance does not guarantee future results. Building projections purely on historical trends weakens cashflow strategy planning and increases exposure to unexpected change.

Failing to update projections regularly

Outdated assumptions lead to poor decisions, especially when markets or personal circumstances shift. Ongoing cash flow monitoring is essential to keep the plan relevant.

No contingency or margin for error

Plans without buffers break down when assumptions fail. A strong cash flow planning strategy includes flexibility to absorb shocks and adjust decisions before risks escalate.

Treating planning as prediction rather than control

Effective Cash Flow Planning focuses on managing outcomes through review and adjustment, not forecasting certainty.

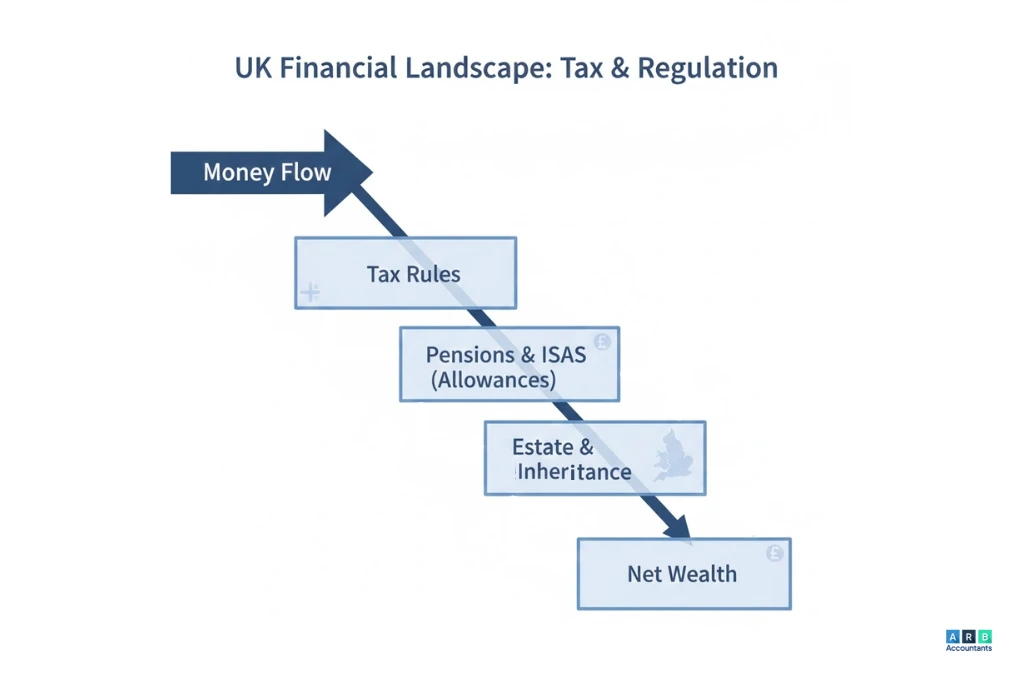

How Do Tax and Regulatory Factors Affect Cash Flow Planning in the UK?

Cash Flow Planning in the UK must operate within a defined tax and regulatory environment that directly affects investor outcomes. Tax on investment income, including dividends and interest, reduces net inflows and needs to be modelled accurately over time. Capital gains timing also matters, as disposals triggered to fund spending can create avoidable tax liabilities if not planned around allowances and tax years.

How Should UK Taxes and Inflation Be Reflected in Cash Flow Projections?

Pensions introduce additional complexity, as tax treatment differs between accumulation and drawdown phases. Tax free lump sums, income tax bands and lifetime allowance considerations all influence how income is accessed. Modelling also needs to reflect inflation assumptions and future changes to UK tax brackets, as static projections quickly lose relevance. Data from the Office for National Statistics shows that long term inflation has averaged above two percent over the past decade, reinforcing the need to test real purchasing power over time, source . A robust cash flow plan brings these variables together so regulatory impact is visible rather than assumed.

How Can Cash Flow Planning Support Retirement and Long Term Goals?

Cash Flow Planning is a practical tool for testing whether retirement income remains sufficient under different conditions. By projecting income and expenditure across retirement years, investors can assess sustainability rather than relying on headline portfolio values. This modelling approach shows when income gaps may appear and how long assets are expected to last.

How Does Cash Flow Modelling Improve Retirement Outcomes?

Planning enables drawdown sequencing decisions that balance tax efficiency with income stability. It also allows for explicit modelling of long term care costs and irregular expenses that are often overlooked. Legacy goals can be tested alongside income needs, ensuring gifts or inheritances do not compromise later life security. This structured approach aligns spending, tax and capital preservation into a single framework, rather than treating retirement decisions in isolation.

How Should Investors Measure the Success of Their Cash Flow Plan?

Cash Flow Planning should be measured using clear performance indicators rather than intuition. Liquidity ratios show whether short term obligations can be met without disrupting investments. Net cash surplus or deficit highlights whether current assumptions remain viable. Comparing actual inflows and outflows against projections reveals where assumptions need adjustment.

Which Metrics Indicate a Strong Planning Framework?

Consistent tracking allows investors to see trends rather than one off variances. Measurement feeds directly into iterative improvement, where assumptions are refined and decisions adjusted before problems emerge. This discipline turns planning into an ongoing process rather than a static document. Regular cash flow monitoring ensures that corrective action is taken early, supporting long term stability.

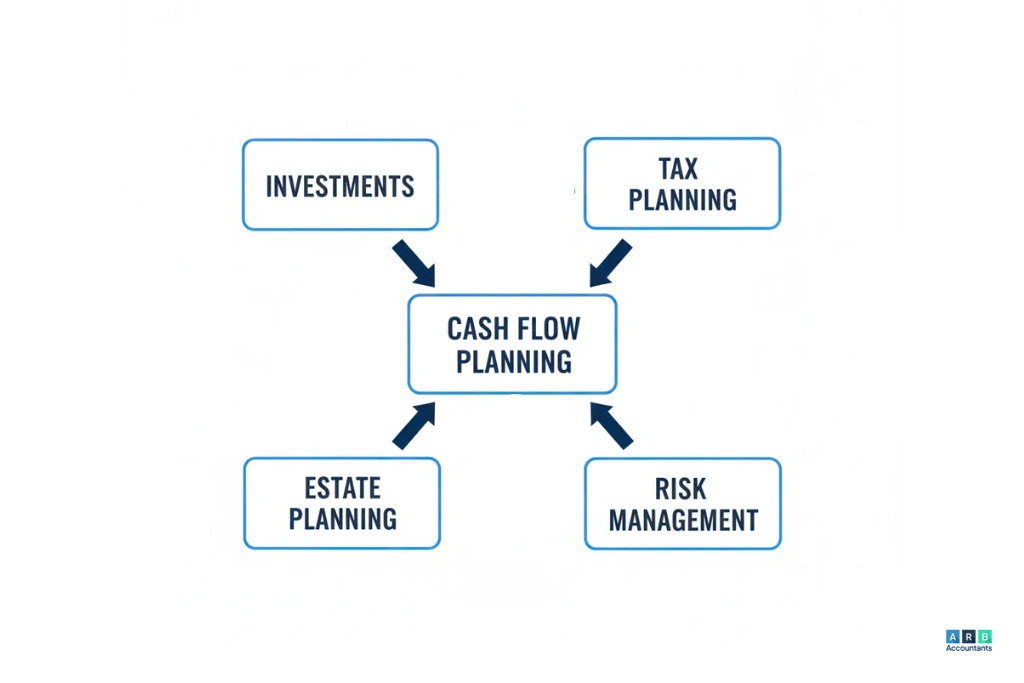

What Role Does Cash Flow Planning Play in Holistic Financial Planning?

Cash Flow Planning acts as a foundation that connects individual financial decisions into a coherent structure. It links risk management by showing how market volatility affects income sustainability. It supports estate planning by testing the affordability of lifetime gifts and future tax liabilities. Tax efficiency improves when timing and sequencing decisions are modelled rather than guessed.

How Does Cash Flow Planning Integrate With Broader Wealth Strategies?

Within holistic frameworks, financial cash planning provides the data layer that informs strategic choices. It supports wealth optimisation by aligning assets with purpose, not just return targets. When combined with a defined cashflow strategy planning approach, it ensures that growth, income and protection decisions reinforce each other. A clearly articulated cash flow planning strategy allows investors to adapt as circumstances change while keeping long term objectives intact.

Conclusion

Disciplined Cash Flow Planning gives UK investors clarity in an environment shaped by market uncertainty, inflation and complex tax rules. It supports confident investment decisions by showing how assets, income and spending interact over time. It also protects capital by reducing forced sales and guides lifestyle choices, particularly around retirement timing and income sustainability.

By combining structured modelling with regular review, investors can move from reactive decisions to informed strategy. Working with a our qualified accountants Southend professionals can elevate this process, turning Cash Flow Planning into a foundation for stronger long term financial outcomes.