Dividend Allowance 2025/26: New Reporting Rules Explained

The dividend allowance 2025/26 sits at the centre of how dividend income is taxed in the UK, particularly for company directors, investors, and shareholders who rely on dividends as part of their income strategy. From April 2025, the interaction between dividend income tax UK rules, dividend tax thresholds UK, and HMRC reporting requirements has become more significant, not because the system is new, but because allowances have been steadily reduced and compliance expectations have tightened.

Dividend income tax UK applies once dividend income exceeds the annual dividend tax allowance 2025/26, with tax rates determined by an individual’s total taxable income. These dividend tax thresholds UK align with income tax bands, meaning dividends are taxed at different dividend tax rates UK depending on whether income falls into the basic, higher, or additional rate band. As the tax-free element has shrunk, even relatively modest dividend income now triggers tax and reporting obligations.

Alongside changes to dividend tax rates UK and thresholds, HMRC has placed greater emphasis on accurate reporting of dividends to HMRC, particularly through Self Assessment. HMRC dividend reporting rules affect not only high earners, but also directors of small limited companies and individuals with multiple income streams. Understanding how dividend allowance changes fit into the wider tax framework is essential for staying compliant and avoiding unexpected tax liabilities from the 2025/26 tax year onward.

- What Is the Dividend Allowance for 2025/26 and Why Has It Changed?

- How Are Dividends Taxed Above the Allowance in 2025/26?

- Why Reporting Dividend Income to HMRC Matters Now

- How Dividend Reporting Rules Tie into Broader UK Tax Policy

- How to Plan Dividend Income Efficiently Under the 2025/26 Rules

- Conclusion

- Frequently Asked Questions

What Is the Dividend Allowance for 2025/26 and Why Has It Changed?

How does the dividend allowance 2025/26 work in practice?

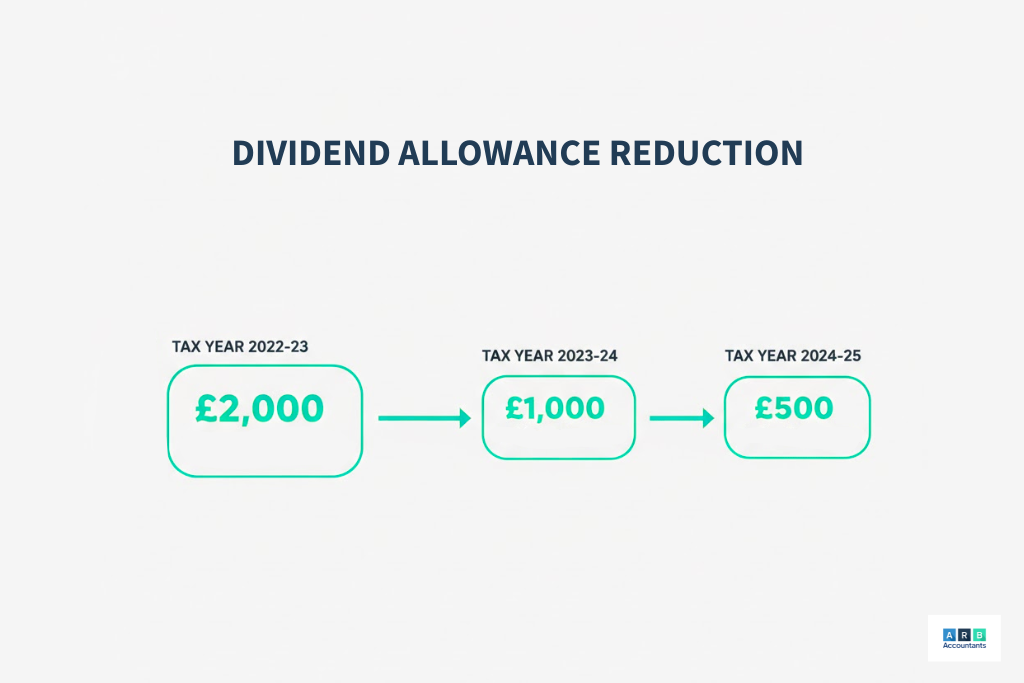

The dividend allowance 2025/26 refers to the amount of dividend income an individual can receive before paying dividend income tax UK. For the 2025/26 tax year, this allowance is set at £500(source). Any dividend income above this figure is taxable, even if it falls within the basic rate band. This allowance applies separately from the personal allowance and does not reduce taxable income; instead, it applies a zero rate of tax to the first portion of dividend income.

Once the dividend tax allowance 2025/26 is exceeded, dividends are taxed according to the dividend tax thresholds UK. These thresholds align with income tax bands, meaning dividend tax rates UK depend on total taxable income rather than dividend income alone. This interaction is particularly relevant for company directors who combine salary and dividends, as small changes in income can push dividends into a higher tax band.

Why has the dividend allowance been reduced over time?

Dividend allowance changes have not happened in isolation. The allowance was £2,000 before April 2023, reduced to £1,000 for 2023/24, and then cut again to £500 from 2024/25 onwards. These reductions remain in place for the dividend allowance 2025/26 and form part of wider changes to dividend tax and personal taxation policy.

The policy rationale behind these cuts, as outlined by GOV.UK, is to increase tax revenues while maintaining the overall structure of dividend taxation. By lowering the tax-

free threshold rather than increasing headline dividend tax rates UK, the government has expanded the number of people affected by dividend income tax UK without altering the underlying tax bands. This approach also increases the importance of accurate HMRC dividend reporting, as more individuals now exceed the allowance and must consider reporting dividends to HMRC even when the tax due is relatively small.

From a practical perspective, these dividend allowance changes mean that dividend tax thresholds UK are reached sooner, compliance risk increases, and dividend income now plays a larger role in overall tax planning decisions for the 2025/26 tax year.

READ RELATED ARTICLE: Salary vs Dividends: What Is the Best Way to Pay Yourself

How Are Dividends Taxed Above the Allowance in 2025/26?

Dividend taxation in the UK becomes relevant once income exceeds the dividend allowance for 2025/26, and the way tax is calculated depends on how dividend income is situated alongside other earnings. Understanding this interaction is essential for anyone receiving dividends regularly, particularly where salary and dividends are combined as part of a wider remuneration strategy.

How do dividend tax thresholds UK work alongside the personal allowance?

Dividend tax thresholds UK determine when dividend income becomes taxable and at what rate. These thresholds sit on top of the personal allowance, which applies first to non-dividend income such as salary or rental profits. Once the personal allowance is used, dividend income is layered on top of the remaining taxable income. This structure means dividend income tax UK is not assessed in isolation, but as part of total income for the tax year(source).

For 2025/26, the dividend tax allowance 2025/26 applies a zero rate to the first £500 of dividend income, but it does not extend tax bands. After this point, dividends are taxed based on the relevant dividend tax thresholds UK, making income sequencing a key factor in accurate tax calculations. These mechanics reflect wider changes to dividend tax policy, where allowances have been reduced, but thresholds remain aligned with income tax bands.

What dividend tax rates UK apply above the allowance?

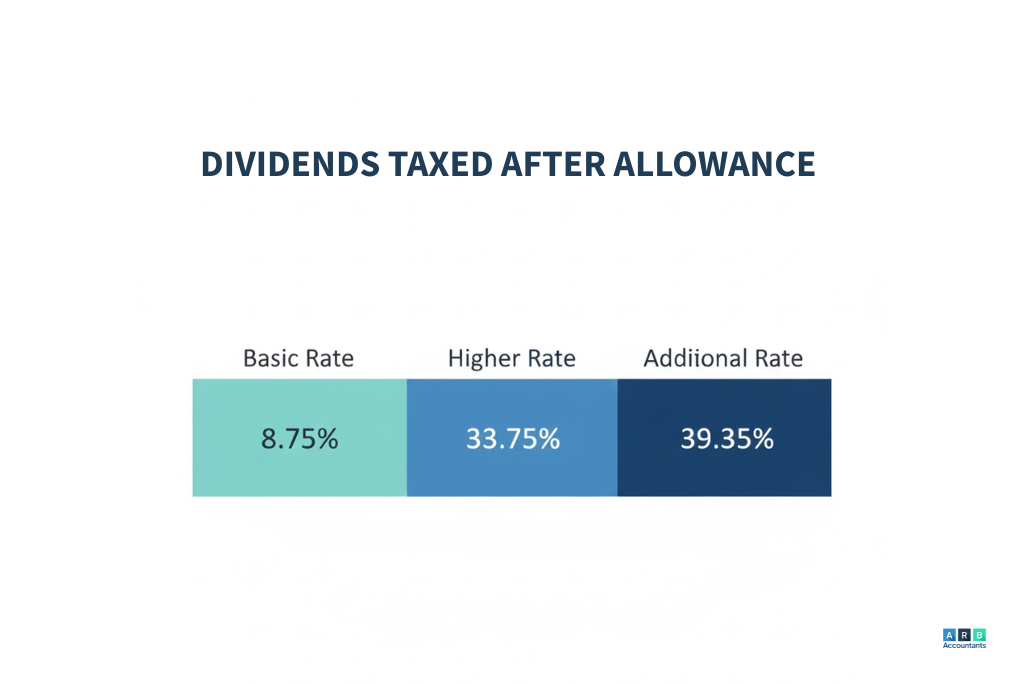

Once dividends exceed the dividend allowance 2025/26, dividend tax rates UK apply according to the taxpayer’s marginal band. Dividends falling within the basic rate band are taxed at 8.75 per cent, those in the higher rate band at 33.75 per cent, and dividends above the additional rate threshold at 39.35 per cent. These rates apply regardless of the source of the dividend, whether from a limited company or investment portfolio.

These dividend tax rates UK have remained stable, but changes to dividend tax allowances mean more individuals are exposed to them. As dividend allowance changes have reduced the tax-free element, dividend income tax UK now affects a broader group of taxpayers, increasing the importance of forecasting total income accurately.

How does total income affect dividend tax in real terms?

Total income determines how dividends are taxed once the dividend allowance 2025/26 is exceeded. For example, if an individual earns a £12,570 salary and £20,000 in dividends, the personal allowance offsets the salary first. The remaining dividend income then fills the basic rate band after the dividend tax allowance 2025/26 is applied. In this scenario, only £500 of dividends are tax-free, with the balance taxed at the applicable dividend tax rates UK. This example highlights how dividend tax thresholds UK and income layering operate together in practice.

READ RELATED ARTICLE: UK Personal Tax Allowance 2025/26: Key Changes & Guide

Why Reporting Dividend Income to HMRC Matters Now

As dividend allowance changes have increased the number of taxpayers affected, HMRC has tightened expectations around compliance and disclosure.

What has changed in HMRC dividend reporting requirements?

Recent changes to dividend tax policy have expanded self assessment triggers, meaning more individuals must now actively engage with HMRC dividend reporting. Even relatively small amounts of dividend income can require action, particularly where total income exceeds reporting thresholds. These changes to dividend tax are not about new taxes, but about improved visibility and data accuracy.

HMRC dividend reporting follows a clear timeline. Dividends must be declared for the relevant tax year, with reporting deadlines depending on whether Self Assessment applies. For those already within the system, reporting dividends to HMRC forms part of the annual return. For others, HMRC may require disclosure through adjusted tax codes or direct notification where thresholds are breached.

Does reporting dividends to HMRC differ without Self Assessment?

Reporting dividends to HMRC differs significantly depending on filing status. Individuals within Self Assessment must include dividend income in their annual return, ensuring dividend income tax UK is calculated correctly. Those outside Self Assessment may still need to report dividends if income exceeds specific limits, triggering HMRC dividend reporting obligations through alternative channels.

From a compliance perspective, understanding how reporting dividends to HMRC works alongside the dividend tax thresholds UK is critical. As dividend allowance changes continue to reduce the margin for error, accurate reporting is now a core part of managing dividend income in line with UK tax rules.

How Dividend Reporting Rules Tie into Broader UK Tax Policy

Dividend reporting rules linked to the dividend allowance 2025/26 are not isolated technical changes. They sit within a wider shift in UK tax policy that focuses on broadening the tax base rather than increasing headline rates. Dividend income tax UK has become more visible as allowances have reduced, bringing more individuals into scope for both tax and reporting obligations.

Why is dividend reporting aligned with wider fiscal policy?

The requirement for consistent HMRC dividend reporting supports government objectives around transparency and revenue protection. As dividend allowance changes have lowered the tax-free threshold, more taxpayers now cross dividend tax thresholds UK, even with modest dividend income. This has expanded the population required to engage with reporting dividends to HMRC, particularly through Self Assessment or PAYE adjustments.

Alongside changes to dividend tax, income tax thresholds have been frozen rather than increased in line with inflation. This policy, often referred to as fiscal drag, means that dividend income tax UK applies to a growing number of people each year. According to analysis reported by The Guardian, threshold freezes have quietly increased tax receipts without altering dividend tax rates UK, making reporting accuracy a central part of compliance rather than an administrative afterthought.

What does this mean looking ahead to future tax years?

From an advisory perspective, the dividend allowance 2025/26 signals a longer term direction rather than a temporary measure. With the dividend tax allowance 2025/26 already at £500, there is limited scope for further reductions without fundamentally changing how dividends are taxed. However, continued freezes to dividend tax thresholds UK or adjustments to reporting rules remain realistic possibilities for 2026/27 and beyond.

For taxpayers, this means HMRC dividend reporting is likely to remain an area of scrutiny. Dividend allowance changes have already increased the importance of record keeping, timing, and income forecasting. Future changes to dividend tax may not raise rates, but they are likely to increase the proportion of dividend income subject to tax and reporting.

READ RELATED ARTICLE: UK End of Tax Year: Tax-Planning Tips for Individuals

How to Plan Dividend Income Efficiently Under the 2025/26 Rules

Planning around the dividend allowance 2025/26 now requires a balance between compliance and efficiency. Effective planning focuses on managing taxable income within existing rules rather than avoiding reporting obligations.

How can tax-efficient wrappers reduce dividend tax exposure?

Using tax-efficient wrappers, such as ISAs and SIPPs, remains one of the most effective ways to reduce dividend income tax in the UK. Dividends within these wrappers do not count towards the dividend tax allowance 2025/26 and fall outside HMRC dividend reporting requirements. This approach reduces exposure to dividend tax rates in the UK while simplifying the reporting of dividends to HMRC.

Does timing dividend declarations still make a difference?

Timing remains relevant despite dividend allowance changes. Declaring dividends in different tax years can affect which dividend tax thresholds UK apply, particularly where income fluctuates. Careful timing can keep dividend income within lower bands, reducing the impact of changes to dividend tax without breaching reporting rules.

How should company directors balance salary and dividends?

For company directors, balancing salary and dividends remains central to managing net income. Salary uses personal allowance and pension thresholds, while dividends interact with the dividend allowance 2025/26 and dividend tax thresholds UK. A practical example is a director taking a modest salary and spreading dividends to remain within the basic rate band, reducing exposure to higher dividend tax rates UK while maintaining compliant HMRC dividend reporting.

Effective planning under the dividend tax allowance 2025/26 is no longer about eliminating tax, but about understanding how income sources interact. As reporting dividends to HMRC becomes unavoidable for more taxpayers, structured planning remains the most reliable way to manage tax exposure under the current rules.

Conclusion

The dividend allowance 2025/26 marks a significant point in how dividend income is taxed and reported in the UK. With the dividend tax allowance 2025/26 now set at a much lower level, dividend allowance changes have brought more investors and directors into the scope of dividend income tax UK and HMRC dividend reporting. Understanding how dividend tax thresholds UK and dividend tax rates UK interact with total income is now essential rather than optional.

Changes to dividend tax have not increased headline rates, but they have increased the need for accurate reporting of dividends to HMRC and forward planning. For directors, investors, and shareholders, the dividend allowance 2025/26 reinforces the importance of structured income planning and awareness of compliance triggers. By understanding reporting rules and how dividend income fits into the wider tax picture, taxpayers can manage their obligations confidently while navigating the evolving UK dividend tax landscape.