Are Directors Exempt from Auto Enrolment?

Auto enrolment can become a tricky process as you move up the chain towards becoming a company director. In some cases, directors are treated like any regular worker and must be automatically enrolled into a workplace pension scheme. However, not all directors are required to enrol, some may be exempt from auto enrolment based on their employment status.

In this article we introduce our approach up-front to help accountants and directors navigate auto enrolment for directors, understand auto enrolment exemption rules, and decide whether director exemption auto enrolment applies to their business. We also explain how pension contributions from a limited company work in practice and where business automatic enrolment duties connect with payroll and corporate tax planning.

For contractor-led limited companies, getting guidance from contractor accountants can make auto-enrolment assessments much clearer. So, are directors exempt from auto enrolment? The answer depends on whether they are considered workers under auto enrolment rules. In this article, we explain when directors must be auto enrolled and when they are exempt.

- When Are Directors Exempt from Auto Enrolment?

- Do Directors Need to Auto Enrol?

- When is a Director Regarded as a Worker?

- What is the Definition of a Director?

- Who Has to be Automatically Enrolled?

- Can Directors Receive Pension Contributions from a Limited Company?

- Auto Enrolment Services in Southend

- Frequently Asked Questions

When Are Directors Exempt from Auto Enrolment?

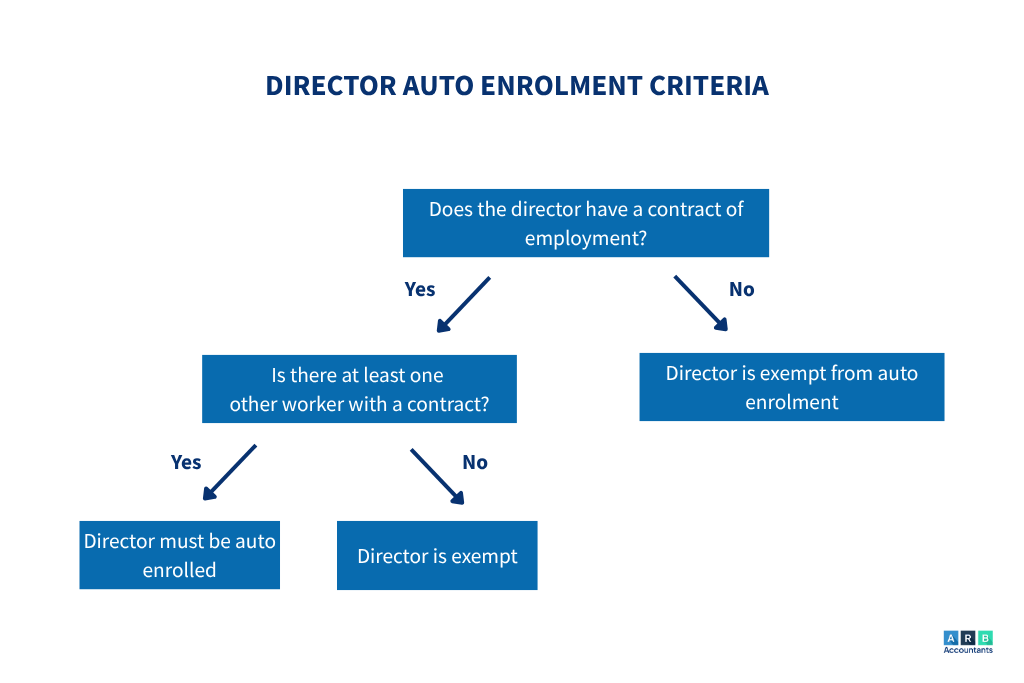

Typically, Directors only need to auto enroll if they are considered a worker, have a contract of employment, and if there is at least one other worker with a contract of employment. If directors are not considered workers, they are usually exempt, even if they have a contract of employment.

Employers and advisers should map the auto enrolment exemption rules early when assessing duties. These rules explain who is exempt from auto enrolment and set the boundary between a company with full business automatic enrolment duties and a director-only company. Understanding the nuance between a director who is an employee and a director who is not is essential, this is often described in guidance about does auto enrolment apply to directors and whether the business counts as an employer for automatic enrolment purposes.

Directors Without an Employment Contract

If a Director does not have an employment contract, they cannot be considered a worker and, therefore, are exempt from auto enrolment.

This is particularly relevant for auto enrolment for director only companies: where all workers are directors and no-one has an employment contract, the organisation typically has no automatic enrolment duties. That distinction is why advisers often label such businesses as “director-only” for AE assessment.

Similarly, if a company only employs Directors without contracts of employment, and employs no other staff, the company is not considered an employer. This means that they are completely exempt from auto enrolment duties.

Directors with an Employment Contract Where there are No Other Workers

Where a Director has a contract of employment, but there are no other contracted workers within a company, they are not classed as a worker themselves and are therefore exempt from auto enrolment.

In plain terms: auto enrolment directors only trigger duties when more than one contracted worker exists. That is why auto enrolment for company directors hinges on the count of contracted employees and the contractual status, not simply board membership.

Even if there are other Directors, or other workers within the company that do not have employment contracts, the sole Director with an employment contract still does not need to be automatically enrolled onto a pension scheme.

Directors with an Employment Contract Who are Not the Only Members of Staff

However, if a Director is not the only member of staff with an employment contract, they are not exempt from auto-enrolment, provided that they fall within the regular auto-enrolment criteria.

This is where directors and workplace pensions intersect: once a director meets the age and earnings thresholds and there is at least one other contracted worker, the business must follow auto enrolment rules for directors and treat the director as an eligible jobholder. Employers should therefore include workplace pension for directors in the scheme selection process and payroll setup.

In the UK, statutory obligations state that unless specific criteria are met, company directors are usually exempt from auto-enrollment. These obligations apply to employees aged 22 to state pension age earning at least £10,000 annually. Directors may differ based on their employment status. If a director is also an employee receiving a salary via PAYE, they are subject to auto-enrollment. However, most limited company directors pay themselves under £10,000 or lack a formal employment contract, so they typically do not qualify—unless they meet the salary, earnings, and age criteria. Directors paid through dividends are not subject to auto-enrollment, as dividends aren’t pensionable earnings.

Do Directors Need to Auto Enrol?

A director must be auto enrolled if they:

- Have a contract of employment AND

- There is at least one other worker in the company with a contract of employment.

If both conditions are met, the director is considered as a worker and must be auto enrolled.

Practically, advisers frame this as a check-list:

- Confirm employment contracts

- Count contracted colleagues

- Test the director against age and earnings

This workflow resolves the question do directors need to be auto enrolled and clarifies whether does auto enrolment apply to directors in mixed-staff firms. ARB Accountants’ approach is to document the evidence trail so the employer can demonstrate why a director was or was not enrolled under the auto enrolment exemption rules.

If you’re unsure how auto enrolment affects your payroll setup, using specialist payroll outsourcing services can help keep everything compliant and error-free.

READ RELATED ARTICLE: Benefits of payroll outsourcing services

When is a Director Regarded as a Worker?

Directors are not always regarded as workers. They are only considered a worker if:

- They have a contract of employment

- At least one other person within the company also has a contract of employment. This can be another director or any other member of staff

If a person is a Director of one company but works for another company as an ordinary worker, they will still be considered a worker for the second company, regardless of whether or not they are considered a Director that is also a worker at the first company.

This is the practical boundary that separates corporate governance (board duties) from employment law (worker status). The Pensions Regulator guidance uses similar logic when explaining why who is exempt from auto enrolment varies with contractual facts.

What is the Definition of a Director?

According to the Pensions Regulator, a Director is defined as anyone that holds office as a Director, but not an individual that is a Director in name only. Within companies, Directors are formally appointed under the Companies Act 2006.

Individuals acting as a Director in the sense of having a decision-making role within the corporate governance of the company are also considered Directors, even if they have not been properly appointed.

I recently took on ARB Accountants for my 23/24 tax return and I wish I had found them earlier! They were prompt at replying to all questions, very helpful and offered brilliant advice to help me streamline my accounts moving forward. Would definitely recommend.

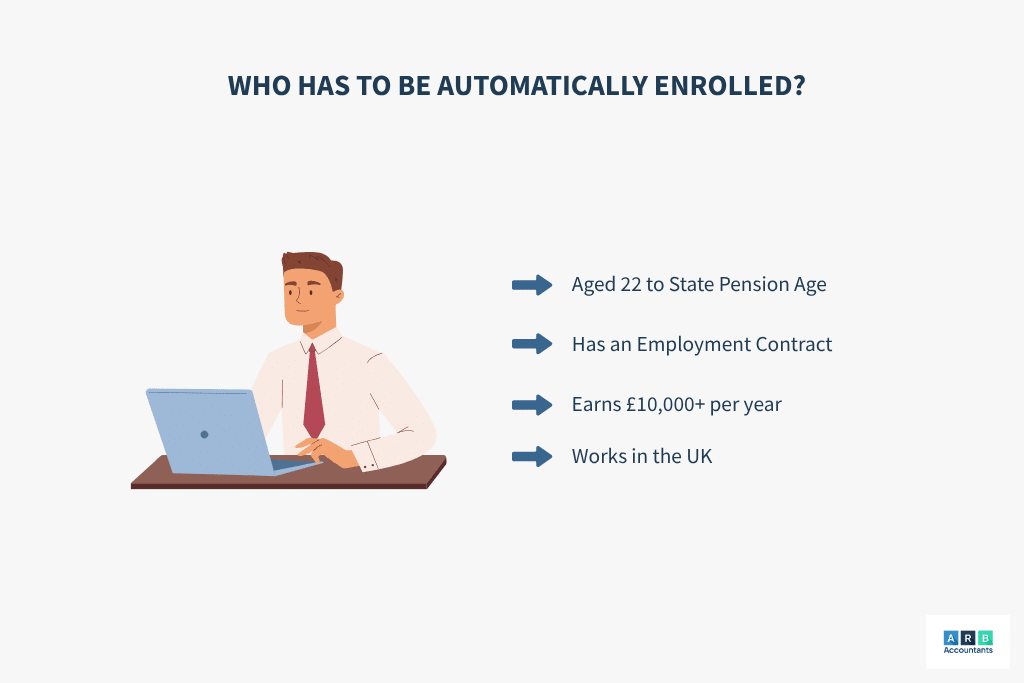

Who Has to be Automatically Enrolled?

Now you know more about auto-enrolment for company Directors, it might be a good idea to ensure that you know who else within a company must also be auto-enrolled.

Where there is more than one contracted worker within a company, employers must auto-enroll anyone that meets the following criteria:

- Classed as a worker

- Aged 22 or over, but below the age of state pension

- Working in the UK under a contract of employment

- Earning over £10,000 per year

Workers that meet the above criteria must be automatically enrolled upon starting work, however, they are able to opt out at any stage.

If an employer is uncertain about are company directors employees or whether are directors considered employees, they should run the employment status checklist and retain signed copies of contracts and job descriptions. This mitigates future disputes about director exemption auto enrolment.

Who Doesn’t Have to be Auto Enrolled?

- An employee has given notice that they are leaving their job, or you, as an employer, have given notice to the employee

- An employee provides evidence of their lifetime allowance protection

- An employee already has an active pension, which the company arranged, that meets the auto-enrolment rules

- An employer receives a one-off payment from a pension scheme that has closed, leaves their job, then returns to the same job within 12 months of payment

- More than 12 months before their staging date, an employee opted out of a pension arranged by the company

- An employee is from an EU member state and is in an EU cross-border pension scheme

- An individual is in a limited liability partnership

- Director that have a contract of employment, and there is at least one other contracted worker within the company

READ RELATED ARTICLE: How to make a voluntary disclosure to HMRC

Can Directors Receive Pension Contributions from a Limited Company?

Yes, directors can usually receive pension contributions from a limited company either via employer contributions or personal contributions that the company reimburses. Employer pension contributions to a director are generally an allowable business expense (subject to the usual “wholly and exclusively” tax test) and count towards the director’s annual allowance. For directors who are not eligible or who are exempt from automatic enrolment, employer contributions remain an option and are separate from pension auto enrolment exemptions. The mechanics are an important planning tool for small businesses and for pension contributions from a limited company are a common method to extract retained profits tax-efficiently.

Our practical recommendation: if a director receives employer pension contributions, keep formal minutes or a board resolution and evidence of the company’s payroll entries so the contribution is clearly documented and defendable for both AE and corporation tax purposes.

Auto Enrolment Services in Southend

ARB Accountants offer auto-enrolment services in Southend and across the UK for all employees, including company directors. We’ll handle the complicated, time-consuming administrative duties associated with auto-enrolment, leaving your team to do what they do best.

Contact us today to see how our expertise in accountancy in Essex can take the stress and hassle out of your company’s auto-enrolment process.