MTD for ITSA April 2026: Complete Requirements and Deadline Guide

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) becomes mandatory from April 2026 for sole traders and landlords earning over £50,000, replacing the traditional annual tax return with quarterly digital reporting. If you’ve been filing Self Assessment the same way for years, this shift represents the biggest change to income tax compliance in decades. The question of when does MTD for self assessment start is now definitively answered as April 2026 for the first group.

This guide covers who’s affected by the April 2026 deadline, the exact quarterly submission dates, what software you’ll need, and how to prepare your business for digital record-keeping and reporting. We’ll also walk through exemptions, penalties, and practical steps to ensure a smooth transition before the first quarterly deadline arrives.

- Who Must Follow MTD for ITSA From April 2026?

- Income Thresholds and How to Measure Qualifying Income

- MTD ITSA Start Date and Key Deadlines

- MTD Requirements: Digital Records and Compatible Software

- Step By Step Filing Process Under MTD for ITSA

- Exemptions and How to Apply

- Penalties for Late or Incorrect Submissions

- Frequently Asked Questions

Who Must Follow MTD for ITSA From April 2026?

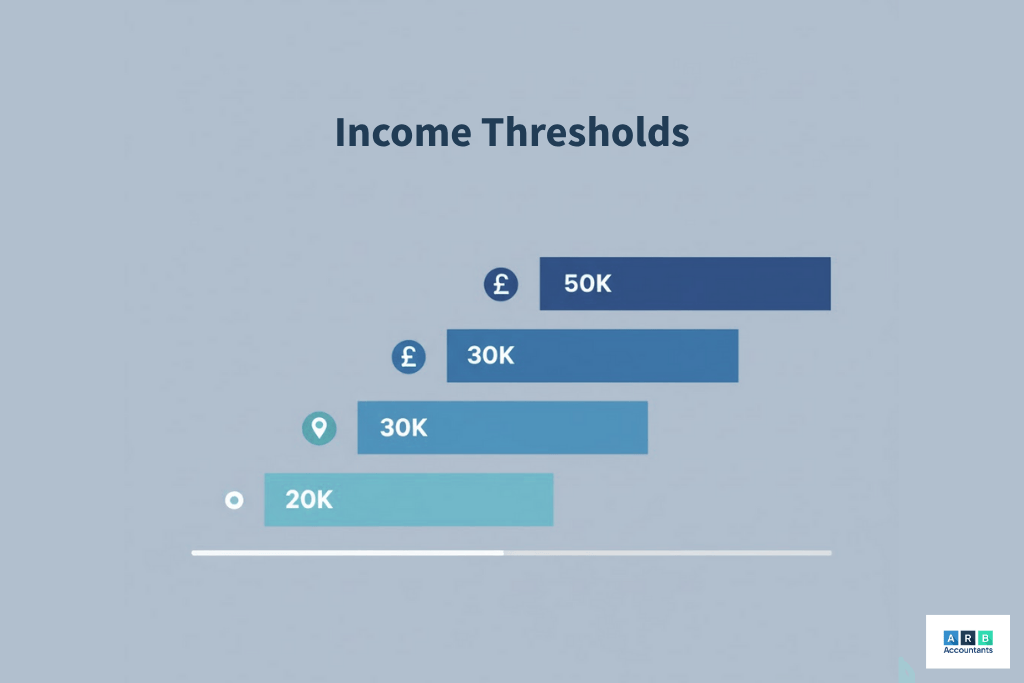

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) becomes mandatory from 6 April 2026 for sole traders and landlords whose qualifying income exceeds £50,000 in the 2024–25 tax year. This marks the initial MTD ITSA start date. The regime replaces the traditional annual Self Assessment process with quarterly digital reporting through compatible software.

HMRC rolls out the MTD requirements in phases based on income thresholds. If your gross business or property income crosses the threshold, you’ll submit four quarterly updates each year plus a final declaration, all through approved software that connects directly to HMRC.

Sole Traders Over £50k Annual Turnover

If your gross trading income from self-employment exceeds £50,000, you’re in scope from April 2026. This is when does MTD for self assessment start for you. HMRC measures this using total receipts before deducting any expenses, so even if your net profit sits well below £50,000, you’re still caught if your turnover crosses that line. You must meet the MTD requirements for digital record keeping.

Multiple sole-trade businesses get combined for the threshold test. A consultancy bringing in £30,000 and a separate retail business generating £25,000 puts you over the limit, even though neither individually hits £50,000.

Landlords With Gross Rents Above £50k

Landlords receiving more than £50,000 in gross rental income from UK properties face the same April 2026 start date. This answers when does MTD for landlords start for this initial group. The test uses total rents received before deducting mortgage interest, repairs, or other allowable expenses.

Joint property owners calculate their individual share of gross rents. If you own three properties 50/50 with a partner and the total gross rents come to £80,000, your personal share is £40,000—below the threshold. However, for those above the limit,Phased Entry for £30k to £50k Band

The regime expands from 6 April 2027 to capture income between £30,000 and £50,000. The ultimate MTD for ITSA is a phased approach. A further extension to £20,000 is planned for April 2028, though this remains subject to confirmation.

READ RELATED ARTICLE: Do I need to register for self-assessment?

Income Thresholds and How to Measure Qualifying Income

HMRC assesses the £50,000 threshold using your most recent complete tax year’s figures, based on gross income before expenses. Getting this calculation right determines whether you’re in scope and when does MTD for self assessment start for you.

The focus on gross income rather than taxable profit catches many people by surprise. A business with £60,000 turnover but only £15,000 profit after expenses still falls into MTD for ITSA because the gross figure triggers the requirement.

Trading Income Calculation

Include all business receipts before any cost of sales, overheads, or capital allowances. Commission, fees, and other trading receipts count toward the threshold regardless of whether you’ve actually collected payment by year end.

Accruals basis traders include invoiced amounts. Cash basis traders include amounts received. Either way, you’re measuring total gross receipts from your business activities.

Property Income Calculation

Use total gross rents received or due before deductions like mortgage interest, insurance, or maintenance costs. For jointly owned property, each owner uses their share of the gross rents to determine if they individually meet the threshold for MTD for ITSA.

Property owned through a partnership doesn’t count toward your personal MTD threshold until partnerships are brought into scope separately. Keep business property income distinct from any property held in a corporate structure.

Mixed Income Scenarios

For threshold testing, add your qualifying gross trading income and your qualifying gross property income together. If the combined total exceeds £50,000, you’re in scope from April 2026, even if neither source individually crosses the line. This combined total determines your MTD for ITSA start date.

Other income types don’t count toward the MTD threshold:

- Employment income

- Pension income

- Dividends

- Savings interest

The regime currently applies only to business and property income reported through Self Assessment. This is the scope of MTD for ITSA.

MTD ITSA Start Date and Key Deadlines

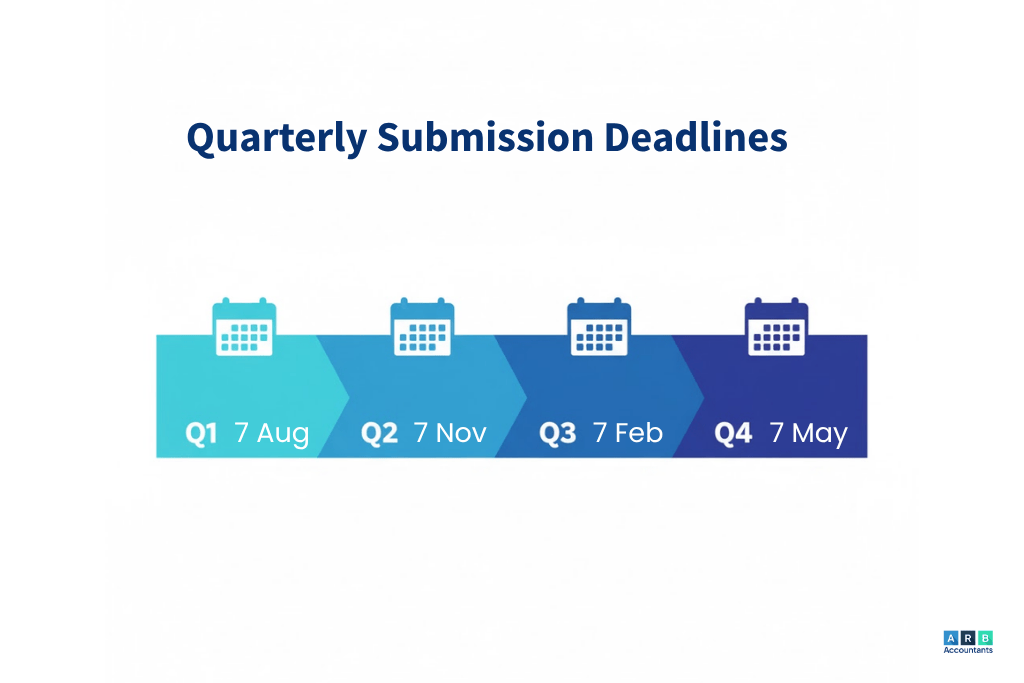

Quarterly updates replace the annual Self Assessment return for in-scope income, with four submissions during the tax year followed by a year-end final declaration. Each update summarises your income and expenses for that three-month period.

The deadlines fall roughly one month after each quarter ends. Missing these dates triggers penalty points under HMRC’s new regime, so building reliable processes matters from the start.

| Quarter | Period Covered | Submission Deadline |

|---|---|---|

| Q1 | 6 Apr – 5 Jul | 7 Aug |

| Q2 | 6 Jul – 5 Oct | 7 Nov |

| Q3 | 6 Oct – 5 Jan | 7 Feb |

| Q4 | 6 Jan – 5 Apr | 7 May |

| Final Declaration | Whole tax year | 31 Jan (following year) |

The first quarter runs from 6 April to 5 July, with the update due by 7 August. This first submission is critical after the MTD ITSA start date. You’ll submit a summary of income received and expenses incurred during those three months through your MTD-compatible software. This defines the rhythm of MTD for ITSA.

The figures don’t get finalised or adjusted at this stage, quarterly updates focus on in-year reporting rather than final calculations. If you spot an error in Quarter 1, you can correct it in the Quarter 2 submission without penalty, provided you act promptly.

The second quarter covers 6 July to 5 October, due by 7 November. By this point, you’re halfway through the tax year and building a clearer picture of your annual position.

Quarter 3 runs from 6 October to 5 January, with a deadline of 7 February. This quarter often includes Christmas trading periods for many businesses, plus year-end property income for calendar-aligned landlords.

The final quarter covers 6 January to 5 April, completing the tax year. The 7 May deadline gives you one month after the year end to prepare your fourth quarterly update.

After submitting all four quarterly updates, you prepare an end-of-period statement and final declaration by 31 January following the tax year. This replaces the traditional Self Assessment return and crystallises your tax position for the year, including any adjustments, reliefs, capital allowances, and other items not captured in the quarterly updates.

READ RELATED ARTICLE: Accounting for Landlords: Bookkeeping Best Practices

MTD Requirements: Digital Records and Compatible Software

MTD for ITSA requires digital records and functional compatible software that maintains digital links and submits updates directly to HMRC. Manual-only spreadsheets fall short unless you connect them through approved bridging software

The software handles three core functions: maintaining digital records of income and expenses, preserving those records in digital format, and transmitting quarterly updates and final declarations to HMRC via API.

Transaction Level Data to Capture

Record all income receipts, allowable expenses, and VAT where applicable at transaction level. Each transaction needs a date, description, amount, and appropriate category to satisfy HMRC’s MTD requirements.

You don’t have to scan and digitally store every paper receipt, though many businesses find it helpful. The critical requirement is that each transaction gets recorded digitally in your software, with sufficient detail to support your tax position if HMRC enquires later.

Bridging Software Options

You can connect spreadsheets to HMRC through approved bridging software as a transitional solution. The bridging software reads your spreadsheet data and formats it for HMRC’s systems, letting you maintain your existing workflow while meeting the digital submission requirement.

This approach introduces potential technical risks, broken links, version conflicts, or data mismatches that fully integrated solutions avoid. Bridging works best as a short-term stepping stone rather than a permanent arrangement for MTD for ITSA.

Native Cloud Platforms Like Xero and QuickBooks

Cloud accounting platforms with full MTD capabilities provide integrated workflows, automatic bank feeds, and fewer technical risks than bridged solutions. The platforms handle record-keeping, quarterly submissions, and final declarations within a single environment.

ARB Accountants maintains certified partnerships with both Xero and QuickBooks, offering streamlined setup, training, and ongoing support tailored to MTD for ITSA requirements. Choosing the right platform from the start saves time and reduces compliance risk as the regime matures.

Step By Step Filing Process Under MTD for ITSA

Following a structured path from registration through quarterly submissions to year-end declarations keeps you compliant and reduces the risk of penalties or errors. Each step builds on the previous one.

The process might feel unfamiliar at first, particularly if you’re used to gathering records once a year for your accountant. MTD for ITSA shifts the rhythm to quarterly engagement, which actually helps many businesses maintain better financial oversight throughout the year.

Sign Up With HMRC

Create or use your existing Government Gateway account and enrol for the MTD for ITSA service before your first mandatory quarterly deadline. HMRC’s online portal walks you through the registration process, which typically takes 10–15 minutes if you have your details ready.

You’ll receive a confirmation and unique identifiers that your software uses to link to your HMRC account. Keep these credentials secure, they’re the gateway to all your future submissions under MTD for ITSA.

Connect Approved Software

Choose HMRC-recognised software from the official compatibility list and authorise it to interact with your HMRC account. The software will prompt you through the authorisation process, which creates a secure connection between your records and HMRC’s systems.

Once connected, your software can retrieve obligations, submit updates, and receive acknowledgements automatically.

Submit Quarterly Updates

Upload your income and expense data through the software each quarter, summarising the three months’ activity. The software formats the data to HMRC’s specifications and transmits it via API, giving you an instant confirmation receipt.

You’re not required to include final adjustments, capital allowances, or reliefs at this stage. Quarterly updates focus on in-year income and expenses, saving the detailed calculations for the end-of-period process.

Review End Of Period Statement

At year end, review the software-generated end-of-period statement and HMRC’s calculations. This statement consolidates your four quarterly updates and adds any year-end items not captured earlier.

Take time to review carefully, this is your opportunity to spot and correct any discrepancies before finalising. Your accountant can help verify that all reliefs and allowances have been claimed and that the figures match your actual position.

File Final Declaration

Confirm all figures are complete and accurate, then submit the final declaration by 31 January following the tax year. This last step is the culmination of the MTD for ITSA process. Once submitted, you’ll receive a calculation showing your total tax liability, payments on account, and any balance due.

Ready to simplify your MTD for ITSA transition? Get your free MTD for ITSA readiness consultation and discover how ARB Accountants can handle your quarterly submissions, software setup, and compliance monitoring with fixed-fee transparency.

Exemptions and How to Apply

Only limited exemptions exist, and you’re required to apply and receive HMRC approval before relying on one. The bar for exemption sits high, HMRC expects most taxpayers to comply digitally with MTD for ITSA.

If you believe you qualify, apply as early as possible. HMRC reviews each case individually, and processing can take several weeks, particularly as the April 2026 deadline for MTD for ITSA approaches.

Digital Exclusion Claims

If age, disability, or lack of internet access due to remote location prevents digital engagement, you can apply with supporting evidence. HMRC considers factors like availability of assisted digital support, access to public internet facilities, and whether reasonable adjustments would enable compliance with MTD for ITSA.

The exemption isn’t automatic, you make a clear case and provide evidence. If granted, you’ll continue filing on paper, but HMRC may review your circumstances periodically.

Religious Objection Route

If your religious beliefs prevent you from using electronic systems, you can apply for exemption. HMRC will want to understand the specific religious principles at stake and why no workaround exists.

Few applications succeed on religious grounds alone, particularly where the objection relates to general technology use rather than specific theological concerns.

Income Below £30k After 2027

When does MTD for self assessment start for those in the lower band? When the threshold reduces to £30,000 in April 2027 and potentially £20,000 in April 2028, those below the new threshold fall out of scope and can revert to traditional Self Assessment. If you’ve already joined MTD for ITSA voluntarily or were previously mandated, you’ll formally exit the regime.

Consider your projected income trajectory when planning. If you’re hovering around the threshold, joining voluntarily at a convenient time may make more sense than waiting for a mandatory start during a busy trading period.

Penalties for Late or Incorrect Submissions

MTD for ITSA introduces a points-based late submission regime alongside existing penalties for inaccuracies and late payment. The new system aims to encourage consistent compliance while allowing for occasional genuine mistakes without immediate financial penalty. This penalty regime is part of the MTD requirements.

The system is less forgiving than the old Self Assessment regime, where you could often file a few days late without immediate consequence.

Points System Overview

Each late quarterly update earns one penalty point. Once you accumulate a threshold number of points (currently two points for quarterly obligations), HMRC issues a financial penalty and your points total resets.

Points expire after a period of compliant behaviour if you submit on time consistently, earlier points drop off your record. This rewards getting back on track after a slip.

Financial Penalty Triggers

Fixed monetary penalties of £200 apply once you reach the points threshold, with additional penalties for continued non-compliance. Late payment of tax attracts its own penalty and interest regime, distinct from late filing penalties. MTD for ITSA requires both timely filing and payment.

You can file on time but still face late payment penalties if you don’t settle your tax bill when due.

Appeal Process

You can appeal penalties if you have a reasonable excuse, serious illness, bereavement, technology failure beyond your control, or other circumstances that prevented timely compliance. Submit appeals within HMRC’s time limits (typically 30 days) and provide evidence supporting your position.

HMRC considers each appeal on its merits. Vague explanations or simple forgetfulness rarely succeed, but genuine unforeseen circumstances often do.