AML for Accountants and Why Registration is Required

Money laundering is a serious crime in the UK, and compliance with AML for accountants is mandatory. Bookkeepers and accountants must adhere to anti money laundering supervision HMRC regulations and ensure they are registered with the appropriate authorities. In this article, we explore why bookkeepers need to register for AML, the key requirements, and the consequences of non-compliance.

- Why Do Bookkeepers Need to Register for Money Laundering?

- Who Has to Register for Money Laundering Supervision?

- AML Checks for Accountants UK: What You Need to Know

- How Long Do Anti Money Laundering Checks Take?

- Understanding Anti Money Laundering Supervision HMRC

- What are the Money Laundering Regulations in the UK?

- What is the Punishment for Money Laundering in the UK?

- Bookkeeping Services in Essex

- Frequently Asked Questions

Why Do Bookkeepers Need to Register for Money Laundering?

In 2007 (updated in 2017), regulations came into force to limit the risk of bookkeepers and accountants being used as ‘tools’ for money laundering. AML for accountants ensures that bookkeepers and accountants comply with stringent regulations to protect the financial system.

As such, there are now several obligations required of a bookkeeper in relation to money laundering regulations, however the most important is to be registered with a money laundering supervisor.

Bookkeepers and accountants must register with an anti-money laundering (AML) supervisor; a body granted supervisory authority by Parliament in accordance with the Money Laundering Regulations 2017, in order to ensure compliance and best practice.

Failure to comply with HMRC anti money laundering guidance can result in penalties, including up to two years in prison and an unlimited fine. This makes it essential for all professionals in the industry to register for anti money laundering supervision.

READ RELATED ARTICLE: Bookkeeping Best Practices

Who Has to Register for Money Laundering Supervision?

All accountants and bookkeepers, both employed and self-employed, must register for money laundering supervision if they operate as an accountancy service provider. The HMRC anti money laundering guidance outlines the responsibilities of firms regarding compliance.

According to anti money laundering supervision HMRC, the following professionals must register for AML:

- Auditors

- Accountants

- Tax advisors and consultants

- Payroll agents

- Custom practitioners, freight forwarders, and similar businesses

- Professional bookkeepers

All of these professionals are subject to AML checks for accountants UK to ensure compliance with money laundering laws. Accountants Southend firms work under the same AML rules, so the expectations are consistent across the industry.

AML Checks for Accountants UK: What You Need to Know

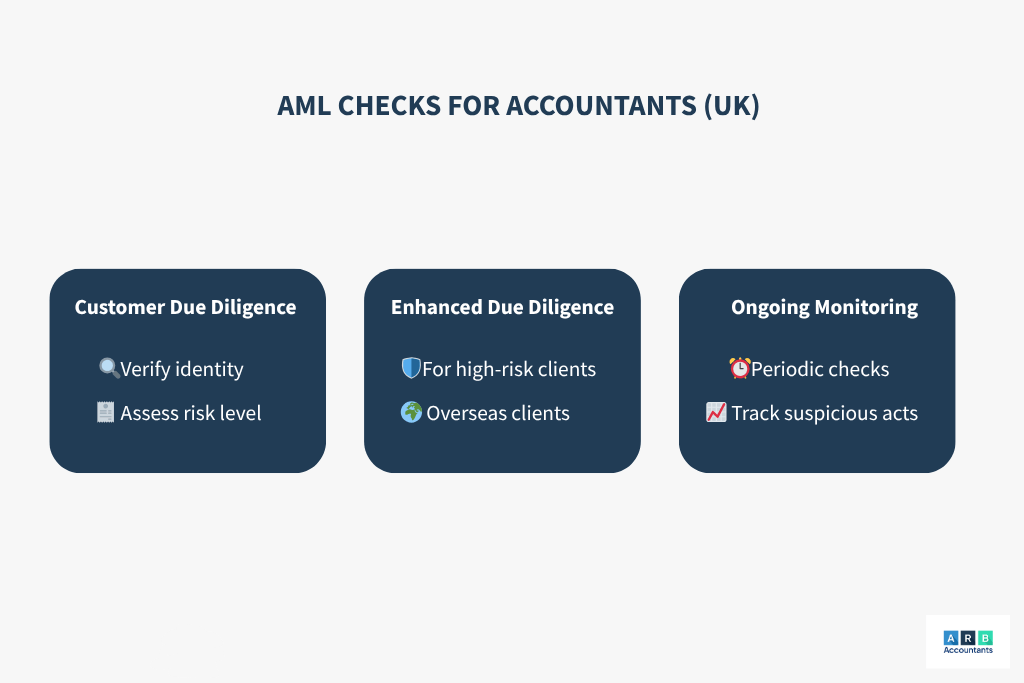

As part of AML for accountants, firms must comply with rigorous AML checks for accountants UK. These checks involve:

- Customer Due Diligence (CDD): Verifying the identity of clients and assessing risk.

- Enhanced Due Diligence (EDD): Required for high-risk transactions, such as dealings with clients in high-risk jurisdictions.

- Ongoing Monitoring: Ensuring financial transactions remain compliant with regulations.

Failing to complete these checks as outlined in HMRC anti money laundering guidance can lead to severe legal consequences.

Firms that specialise in investigations, such as tax investigation accountants, also follow strict AML checks because their clients often present higher compliance risks.

We have been with ARB accountants for the past two years. They are very knowledgeable and turned things around for us in a short space of time. The team has been proactive in managing deadlines whilst being flexible to our schedule and way of work. Would highly recommend!!!

How Long Do Anti Money Laundering Checks Take?

A common question among professionals is, “How long do anti money laundering checks take?” The answer varies depending on the complexity of the client’s transactions and risk profile.

- Basic AML checks for accountants UK typically take a few hours to a couple of days.

- Enhanced due diligence for high-risk clients can take several weeks.

- Delays may occur if additional verification is required under HMRC anti money laundering guidance.

To avoid delays, firms should ensure all necessary documentation is readily available when completing AML for accountants procedures.

Understanding Anti Money Laundering Supervision HMRC

The anti money laundering supervision HMRC framework ensures that financial professionals meet legal obligations. Under these regulations, bookkeepers and accountants must:

- Register for AML supervision through an approved body.

- Conduct AML checks for accountants UK to verify client identities.

- Report suspicious activities as required by the HMRC anti money laundering guidance.

Non-compliance with anti money laundering supervision HMRC can result in significant penalties, making it crucial for firms to follow best practices.

What are the Money Laundering Regulations in the UK?

As well as registering with an anti-money laundering supervisor, accountants and bookkeepers must also adhere to various other money laundering regulations.

Due Diligence

In line with changes to money laundering regulations in 2020, accounting and bookkeeping professionals must now consider new high-risk factors when assessing the need for due diligence as outlined in HMRC anti money laundering guidance, such as:

- If there are transactions between parties in high-risk third countries

- If the customer is a beneficiary of a life insurance policy

- If the customer is a third-country national seeking residence rights or citizenship in exchange for transfers of assets

- In cases on non-face to face business relationships or transactions without safeguards

As part of AML checks for accountants UK, professionals must also conduct Customer Due Diligence (CDD) to ensure corporate ownership structures are properly documented.

There is also E-Money Thresholds for CDD regulations in which accounting and bookkeeping professionals must comply with. Recent amendments to regulation 38 means that professionals can only forgo CDD in situations where:

- The maximum amount stored electronically is €150 (£125)

- The payment method used is not reloadable, or has a monthly limit of no more than €150 (£125), which can only be used in the UK

- The payment method is only used to purchase goods and services

- Anonymous electronic money cannot be used to fund the payment method

Reporting Discrepancies to Companies House

Regulation 30A requires accounting and bookkeeping professionals to report any discrepancies to Companies House in relation to the information in which they or their firm hold on their customers compared with the information held by Companies House.

Crypto Assets Activities

Accountants and bookkeepers involved in crypto transactions must comply with Money Laundering Regulations (MLRs) and register for AML supervision.

What is the Punishment for Money Laundering in the UK?

Money laundering offences are listed under Part 7 of Proceeds of Crime Act 2002, money laundering offences include:

- Concealing criminal property

- Arranging criminal property transactions

- Acquiring, using, or possessing criminal property

- Failing to disclose suspicious activity

Penalties range from significant fines to up to 14 years of imprisonment, depending on the severity of the offence and whether drugs are involved. Non-compliance with anti money laundering supervision HMRC can also lead to business restrictions, preventing firms from offering financial services.

Bookkeeping Services in Essex

ARB Accountants offers a range of bookkeeping services in Essex, including management reporting, preparation of tax returns, cash flow analysis, and more.

We know how important bookkeeping is, and how time consuming it can be. Among the trusted accounting firms in Essex, ARB Accountants won’t let you down. Let us handle your bookkeeping, whilst you get back to running your business.