How to Close a Limited Company in the UK

Closing or exiting a limited company in the UK involves several steps and important choices. If you’re wondering how to close a limited company, the right approach depends on the company’s financial situation, any outstanding debts, and the future intentions of the directors and shareholders.

Some companies are no longer needed because business has ceased trading, while others may face financial difficulties and are unable to meet their obligations. The process can be straightforward for solvent companies, but more complex if the company owes money it cannot repay. For directors, deciding on how to exit a business effectively is often part of a wider business exit strategy.

Understanding the different ways how to close a limited company is important before starting the process. The most suitable method is determined by whether the company is solvent or insolvent.

- Choosing the Right Method: How to Close a Limited Company

- Eligibility Checklist Before You Apply to Close a Limited Company

- Steps to Voluntary Strike Off When Preparing to Sell a Business

- Members Voluntary Liquidation as a Business Exit Strategy

- Closing Down a Limited Company Through Creditors Voluntary Liquidation

- Making the Company Dormant Instead of Exiting a Business

- Costs and Timelines for Succession Planning in Small Business Closures

- Post Dissolution Obligations and Liabilities When Selling Your Business in the UK

- How ARB Accountants Can Help You Close Your Company

- Frequently Asked Questions

Choosing the Right Method: How to Close a Limited Company

There are three primary methods for closing a limited company: striking off, voluntary liquidation, and compulsory liquidation. The correct choice depends on whether the company can pay its debts in full.

A solvent company can pay all its debts, including tax, suppliers, and any other liabilities, within the next 12 months. An insolvent company cannot pay its bills as they fall due, or its total liabilities exceed its assets.

Strike off is used for solvent companies that have no ongoing business, have settled all debts, and have not traded or changed names in the last three months. This is the cheapest way for those seeking how to close a limited company.

Members Voluntary Liquidation (MVL) is a formal process for solvent companies, often chosen when there are significant assets to distribute in a tax-efficient way. This method is frequently part of succession planning for small business owners who want to pass on or restructure their company.

Creditors Voluntary Liquidation (CVL) is used for insolvent companies where directors choose to close the company because it cannot pay its debts.

READ RELATED ARTICLE: Business structures for freelancers and contractors in the UK

Eligibility Checklist Before You Apply to Close a Limited Company

Companies House has specific requirements that determine if your company can use the strike off. These requirements protect creditors and ensure proper closure procedures.

Your company can apply for strike off if it meets these conditions:

- No trading activity: The company has not traded, sold stock, or entered into contracts for three months

- No name changes: The company name has not changed in the last three months

- All debts settled: Corporation tax, VAT, PAYE, and National Insurance contributions are up to date

- Director approval: More than half of the directors agree to the strike off

- No legal action: The company is not threatened with liquidation or subject to formal creditor arrangements

If your company doesn’t meet these conditions, you’ll need to use Members Voluntary Liquidation or Creditors Voluntary Liquidation instead. In many cases, directors considering preparing to sell a business may choose MVL first to distribute assets efficiently before the sale.

Steps to Voluntary Strike Off When Preparing to Sell a Business

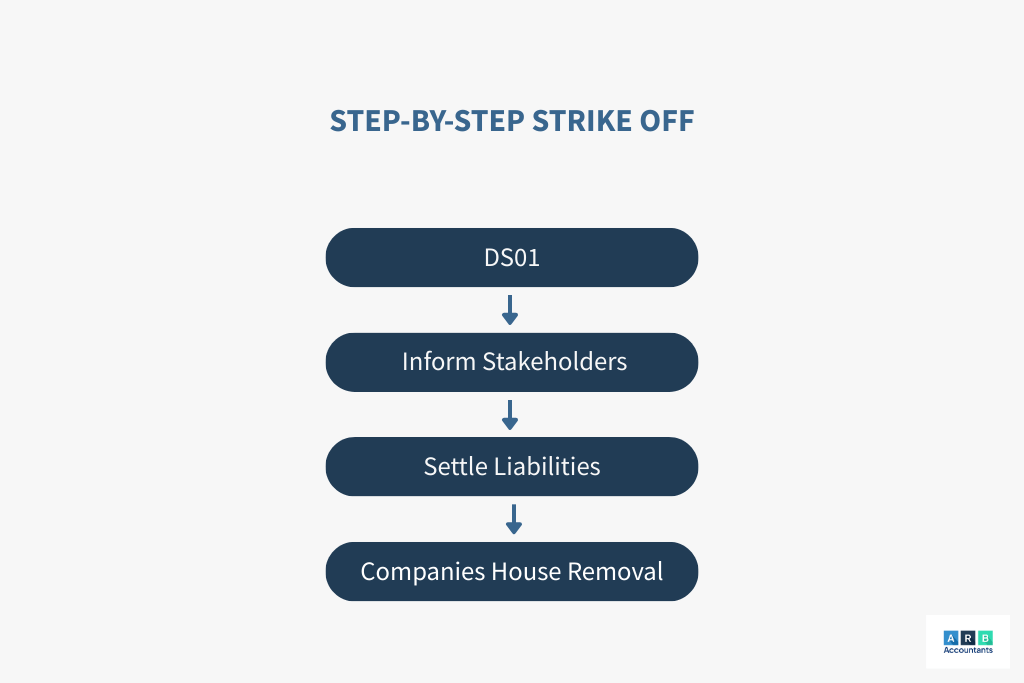

Voluntary strike off dissolves a solvent limited company through Companies House. This process follows specific legal steps and typically takes three to six months. If you’re learning how to close a limited company, this is often the simplest method.

Step 1: Complete Form DS01 and pay the fee. Download form DS01 from the Companies House website. More than half of the directors sign the form. Submit online for £33 or by post for £44.

Step 2: Notify interested parties within seven days. Send a copy of the DS01 form to creditors, employees, shareholders, pension providers, and HMRC. Failure to notify these parties can result in criminal prosecution and company restoration.

Step 3: Wait for the Gazette notice and objection period. Companies House publishes a notice in The Gazette, which is the UK’s official public record. Any person or organisation can object during the two months following publication.

Step 4: Receive confirmation of dissolution. If no objections arise, Companies House publishes a final notice confirming dissolution. The company’s legal existence ends on this date, and it’s removed from the register.

For directors interested in what happens when you sell your business, the strike-off process is not appropriate; selling the company requires different legal steps compared to dissolution.

Members Voluntary Liquidation as a Business Exit Strategy

Members Voluntary Liquidation (MVL) is a formal closure process for solvent companies with significant assets to distribute. An MVL is managed by a licensed insolvency practitioner and offers tax advantages over a strike off.

Tax treatment differences

Strike off distributions over £25,000 are typically taxed as income. MVL distributions are treated as capital gains, which may qualify for Business Asset Disposal Relief at a 10% tax rate.

When MVL makes sense

Companies with substantial cash reserves, property, or other valuable assets benefit from MVL’s capital gains treatment. This option is often part of a business exit strategy or succession planning for small business where owners want to withdraw profits before closing.

Business Asset Disposal Relief eligibility

Shareholders who owned at least 5% of shares and voting rights for two years before liquidation may qualify for the reduced 10% capital gains tax rate on qualifying gains up to the lifetime limit.

The insolvency practitioner handles asset realisation, debt settlement, and final distributions to shareholders. Typical fees range from £2,000 to £5,000 for straightforward cases.

Closing Down a Limited Company Through Creditors Voluntary Liquidation

Creditors Voluntary Liquidation (CVL) is the formal process for closing insolvent companies that cannot pay their debts. This process protects creditors’ interests and brings the company to an orderly end.

Pass the winding up resolution

Directors propose a special resolution requiring 75% shareholder approval by share value. Directors also call a creditors’ meeting to explain the financial situation.

Appoint an insolvency practitioner

Creditors approve or nominate the insolvency practitioner who takes control of the company and oversees asset sales.

Asset realisation and creditor payments

The practitioner sells company assets and distributes proceeds in legal priority order – secured creditors first, then preferential creditors like employees, finally unsecured creditors.

The process typically takes six to twelve months. Directors may face investigation for their conduct before liquidation, and misconduct can lead to disqualification proceedings. For directors considering how to sell your business UK, CVL is not a viable route as it only applies to insolvent businesses.

Making the Company Dormant Instead of Exiting a Business

Making a company dormant is an alternative to permanent closure for companies that aren’t currently trading but may be used again. Dormant companies remain on the Companies House register but carry out no business activity.

Ongoing obligations

Dormant companies file simplified annual accounts and confirmation statements each year. No profit and loss account is required, just a balance sheet with notes.

Cost comparison

Dormancy involves ongoing annual costs of £50-£200 for accountant fees, while strike off is a one-time cost of £33-£44 plus potential professional fees of £0-£150.

Dormancy works well for protecting company names or maintaining corporate structure during temporary business pauses. The company can resume trading at any time without re-incorporation costs, making it part of some owners’ flexible business exit strategy.

READ RELATED ARTICLE: What Makes a Strong Balance Sheet?

Costs and Timelines for Succession Planning in Small Business Closures

Different closure methods have varying costs and timeframes. Understanding these helps you choose the most appropriate option for your circumstances (source).

| Method | Government Fees | Professional Costs | Typical Duration |

|---|---|---|---|

| Strike Off | £33 online / £44 post | £0-£300 | 3-6 months |

| MVL | Standard filing fees | £2,000-£5,000+ | 2-6 months |

| CVL | Standard filing fees | £4,000-£7,500+ | 6-12 months |

Factors affecting duration: Unresolved tax matters, property sales, creditor objections, and asset complexity can extend timelines. HMRC clearance and final account preparation also impact completion dates.

Strike off is the fastest and cheapest option for eligible companies. MVL offers tax benefits but costs more. CVL handles insolvent situations but takes the longest and costs the most.

READ RELATED ARTICLE: How a Small Business Accountant Can Help Grow Your Business?

Post Dissolution Obligations and Liabilities When Selling Your Business in the UK

Company dissolution terminates the legal entity, but certain obligations persist for former directors and shareholders.

Record keeping requirements: Company records, including accounts, contracts, and statutory registers, are retained for six years after dissolution. This responsibility typically falls to former directors.

Company restoration risks: Dissolved companies can be restored to the register if creditors, shareholders, or other interested parties apply. Restoration reverses dissolution and may require filing outstanding returns and paying penalties.

Common restoration triggers include unresolved claims, assets remaining in the company name, or procedural errors during dissolution. Court applications for restoration cost more than administrative restoration through Companies House.

These risks should be part of your consideration when planning how to exit a business or thinking about what happens when you sell your business.

How ARB Accountants Can Help You Close Your Company

ARB Accountants provides company closure services, including strike-offs, MVLs, and CVL advice. The accountancy firm Essex handles compliance requirements and paperwork for Southend-on-Sea and Essex businesses.

Fixed-fee services: ARB offers transparent pricing for company closure services with a same-day response to client queries. The team uses cloud-based systems for efficient document management and is regulated by ACCA.

Whether you’re exploring how to close a limited company, looking into succession planning for a small business, or need guidance on preparing to sell a business, ARB Accountants can support you. For guidance on the most suitable closure method for your company, contact ARB Accountants through their consultation page to discuss your specific circumstances.