When Should You Switch From Sole Trader To Limited Company?

Many business owners start as sole traders because it’s simple, flexible, and low-cost. But as profits grow, the question of whether to move from sole trader to limited company becomes unavoidable.

The pain point for most self-employed professionals is that their tax bills keep rising as income increases, leaving less cash in hand. Transitioning from sole trader to limited company can unlock tax efficiency, limit liability, and signal credibility to clients. Still, it’s not a one-size-fits-all move. You need to understand profit thresholds, tax structures, and the benefits of incorporating a business before deciding.

At ARB Accountants, we help UK business owners evaluate the right time to incorporate. In this guide, we break down when to make the switch, what triggers the tax savings, and how the limited company versus sole trader comparison plays out at different profit levels.

- Profit Threshold When Tax Savings Kick In

- Sole Trader To Limited Company Tax Comparison

- Limited Liability And Personal Risk Protection

- How Does a Limited Company Improve Business Growth?

- What Are the Admin Costs And Compliance Requirements?

- What Other Triggers Make Switching a Good Idea?

- How Do You Switch From Sole Trader To Limited Company?

- How Do You Stay Compliant After Switching?

- Ltd Co Vs Sole Trader Quick Decision Checklist

- Ready To Switch? Get Expert Guidance From ARB Accountants

- Frequently Asked Questions

Profit Threshold When Tax Savings Kick In

The main trigger for changing from self-employed to limited company status is profitability. The higher your profits, the more tax-efficient a company structure becomes. As a sole trader, all business income is treated as personal income, taxed through Income Tax and National Insurance Contributions (NICs).

In contrast, a limited company pays Corporation Tax on profits, while directors can draw income through a mix of salary and dividends, often reducing the overall tax burden.

This tax efficiency is why entrepreneurs frequently ask: “When should I change from sole trader to limited company?” The answer depends on your annual profit levels. Let’s break it down.

What Happens at £30k Profit?

At around £30,000 profit, the first signs of tax savings emerge. A sole trader or limited company UK comparison shows that, as a sole trader, much of your income is taxed under higher NIC rates. As a company director, however, you can pay yourself a small salary up to your personal allowance threshold, with the rest taken as dividends. This salary/dividend split strategy reduces exposure to NICs and leaves you with more take-home pay.

What Happens at £50k Profit?

Crossing £50,000 profit makes the case for incorporation stronger. At this level, a limited company tax threshold comparison shows a wider gap between sole trader and limited company take-home pay. Sole traders face progressively higher tax bands, while company directors still benefit from Corporation Tax rates plus the lower effective tax rate on dividends. The higher your profit climbs, the clearer the benefits of incorporating a business become.

What Happens at £75k Profit or More?

By the time profits reach £75,000 or beyond, the limited company versus sole trader debate is largely settled. Incorporation provides substantial tax efficiency gains, enabling business owners to retain significantly more income after tax. At this stage, the disadvantages of changing from a sole trader to a limited company, such as additional filing responsibilities and administrative costs, are outweighed by the financial benefits. For high earners, remaining a sole trader usually means paying far more tax than necessary.

Sole Trader To Limited Company Tax Comparison

Understanding the sole trader to limited company transition requires a grasp of how each structure is taxed. Tax efficiency is the main reason many ask, “Should I become a limited company?”

How Are Sole Traders Taxed Through Income Tax And NIC?

Sole traders pay tax on all profits as personal income. This means progressive Income Tax rates plus National Insurance Contributions. NICs, especially Class 4 contributions, take a noticeable chunk of profits once you cross into higher income brackets. For growing businesses, this system quickly becomes costly.

What Taxes Do Limited Companies Pay on Profits And Dividends?

Limited companies pay Corporation Tax on profits. Directors can then distribute earnings as dividends, which are subject to dividend tax rather than NICs. This creates a more favourable structure once profits reach the limited company tax threshold, where incorporation starts to save money.

How Does Salary vs Dividend Planning Work?

The hallmark of limited company tax planning is the salary/dividend split. Directors usually pay themselves a modest salary and top up with dividends, optimising both tax allowances and NIC savings.

Key points:

- Personal allowance optimisation: Take a salary up to the annual tax-free threshold.

- Dividend allowance: Use the yearly dividend allowance before tax applies.

- National Insurance savings: Dividends are not subject to NICs, unlike sole trader profits.

READ RELATED ARTICLE: Salary vs Dividends: What Is the Best Way to Pay Yourself

Limited Liability And Personal Risk Protection

Another decisive factor in moving from sole trader to limited company is personal risk. As a sole trader, there is no legal distinction between you and your business; debts, claims, or disputes are tied directly to your personal assets. This is one of the key disadvantages of remaining a sole trader as your business grows. In contrast, the benefits of incorporating a business include limited liability, a legal structure that separates business finances from personal wealth, and offers essential protection.

What Limited Liability Means In Practice

Limited liability means that if your company faces financial or legal issues, your personal assets, such as your home, car, or savings, are not automatically at risk. The company exists as a separate legal entity, with its own rights and responsibilities. This is a fundamental reason many business owners ask, “Should I become a limited company?”

When Can Limited Liability Protect You?

There are several real-world scenarios where limited liability can make the difference between business failure and personal financial ruin. For entrepreneurs considering when should I change from sole trader to limited company, these examples highlight the practical value:

- Client disputes: A customer refuses to pay or claims damages for project outcomes. With limited liability, your personal finances remain separate.

- Supplier debts: If your business cannot pay a supplier, creditors can pursue the company, not you as an individual.

- Professional negligence: In service-based businesses, claims for negligence can be limited to the company, shielding personal wealth.

This protective framework reduces risk exposure and provides peace of mind, particularly for businesses working with high-value contracts or in industries prone to liability claims.

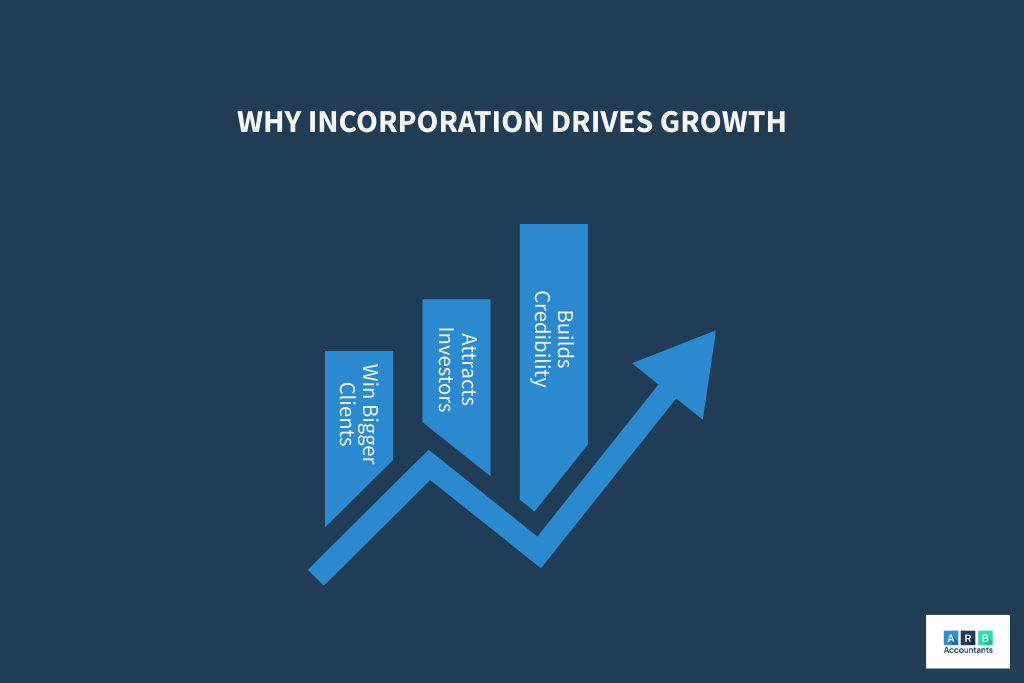

How Does a Limited Company Improve Business Growth?

Beyond tax and liability, another overlooked reason for switching from self employed to limited company is the potential for growth. Incorporation enhances your credibility and creates opportunities that sole traders may struggle to access.

Can Being an Ltd Company Help Win Bigger Clients?

In many industries, corporate clients prefer working with limited companies. Procurement policies often require suppliers to be incorporated for compliance and assurance purposes. This means that staying a sole trader could limit your opportunities to secure larger contracts. For growing businesses, the limited company versus sole trader decision can therefore influence client acquisition strategies.

Does a Limited Company Make It Easier to Get Funding?

If expansion is on your horizon, incorporation also strengthens access to funding. Banks, investors, and venture capitalists are more comfortable working with limited companies because they offer transparency through Companies House filings and defined share structures. From bank loans to equity investment, the benefits of incorporating a business include stronger relationships with lenders and financiers.

“ARB Accountants provide a very good service at an affordable price, and the team is always very helpful with the technical questions one might have. I can attest to their professionalism.”

What Are the Admin Costs And Compliance Requirements?

Of course, transitioning from sole trader to limited company isn’t free from challenges. One of the most significant disadvantages of changing from a sole trader to a private limited company is the administrative burden. While incorporation offers tax and growth advantages, it also brings new compliance obligations.

What Filings Are Required With Companies House?

Every limited company in the UK must file a confirmation statement and annual accounts with Companies House. These filings ensure your company’s details remain accurate and transparent. Missing statutory deadlines can result in financial penalties or even legal consequences for directors. Sole traders, by contrast, need only submit a Self Assessment return.

What Responsibilities Do Directors Have?

As a director, you take on fiduciary duties — meaning you must act in the best interests of the company and its shareholders. Responsibilities include keeping accurate records, ensuring taxes are paid, and making decisions that support the long-term success of the company. Understanding these obligations is vital for anyone asking, “How to change from sole trader to limited company?”

How Much Do Software And Accountant Fees Cost?

Another factor is cost. While sole traders can often manage with basic software and minimal professional support, limited companies face more complex reporting and payroll needs. Below is a comparison of typical costs:

| Service | Sole Trader | Limited Company |

|---|---|---|

| Bookkeeping software | Basic package | Advanced features needed |

| Accountant fees | Self Assessment only | Full compliance service |

| Payroll processing | Not required | Monthly PAYE obligations |

Although these costs may seem like disadvantages, most business owners find that the tax savings and growth potential offset the additional expense. At ARB Accountants, we specialise in managing these compliance requirements so our clients can focus on running and expanding their businesses.

What Other Triggers Make Switching a Good Idea?

While profitability and tax efficiency often dominate the discussion on moving from sole trader to limited company, several additional scenarios make incorporation advantageous. For business owners asking, “When should I change from sole trader to limited company?”, these triggers can justify the transition even at lower profit levels.

Does Registering a Limited Company Protect Your Business Name?

One often-overlooked benefit of incorporating a business is legal protection of your trading name. A limited company registered with Companies House automatically secures the name nationwide, preventing competitors from registering the same or a similar name. Sole traders, by contrast, have no formal protection and rely on common law trademark or local business registration, a much weaker safeguard. For growing brands, this protection strengthens credibility and brand consistency.

How Does a Limited Company Help With Partners Or Succession?

Incorporation provides flexibility for partnerships and succession planning. Unlike sole traders, limited companies can issue shares, making it easier to bring in business partners, investors, or future successors. Share structures can also be used to allocate ownership and voting rights strategically, which facilitates smoother transitions or inheritance planning. This structure answers common questions like “Should I become a limited company?” for those considering long-term growth or eventual exit strategies.

Do IR35 Rules Mean I Should Become a Limited Company?

For contractors, IR35 rules are a critical consideration. IR35 legislation affects whether income is treated as employment or self-employment for tax purposes. Operating through a limited company can offer tax advantages for contractors who fall outside IR35, whereas sole traders may face higher personal tax and NIC liabilities. Understanding these rules is essential when evaluating limited company versus sole trader structures, particularly in the contracting and consultancy sectors.

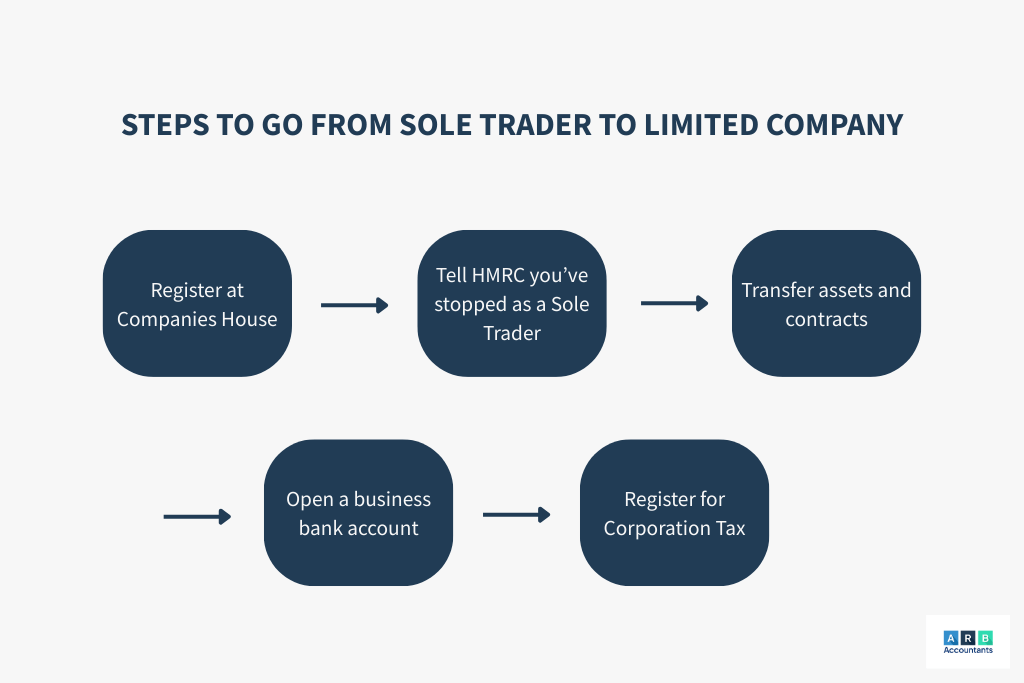

How Do You Switch From Sole Trader To Limited Company?

Once you’ve decided that moving from self employed to limited company is right for your business, a structured approach ensures a smooth transition. ARB Accountants recommend a logical sequence of steps to minimise disruption and maintain compliance.

How Do You Register a Limited Company?

Registering a limited company is straightforward but requires attention to detail. The process with Companies House includes:

- Selecting a unique company name and confirming availability

- Appointing directors and, if applicable, company secretaries

- Submitting incorporation documents online or by post

Completing these steps officially establishes your company as a separate legal entity, enabling limited liability protection and compliance with UK law.

How Do You Tell HMRC You’re No Longer a Sole Trader?

After incorporation, you must notify HMRC that your sole trader status has ended. This involves:

- Informing HMRC of your cessation date

- Completing a final Self Assessment tax return for your sole trader income

- Ensuring any outstanding NIC and Income Tax obligations are settled

Timing is crucial to avoid penalties or overlapping tax obligations.

How Do You Transfer Assets And Contracts?

Transferring assets and contracts from your sole trader to a limited company requires careful planning:

- Assets may be sold or gifted to the company; proper records must be kept for tax purposes

- Contracts with clients or suppliers may need novation agreements to reflect the new legal entity

- Communicate changes to customers to maintain trust and avoid confusion

Do You Need a New Business Bank Account?

Limited companies require a separate business bank account to maintain a legal distinction from personal finances. Required documentation typically includes:

- Companies House registration certificate

- Director identification and proof of address

- Articles of association

A company account simplifies payroll, tax payments, and financial reporting.

What Taxes Must You Register For?

Your new limited company must register for relevant taxes, including:

- Corporation Tax within three months of starting trading

- VAT if turnover exceeds the registration threshold or voluntarily for cash flow benefits

- PAYE for employees, including directors taking a salary

Who Should You Notify After Switching?

After incorporation, communicate changes to all stakeholders:

- Update invoices and contracts to reflect company details

- Notify suppliers, customers, and service providers

- Inform insurers and professional bodies if applicable

READ RELATED ARTICLE: Sole Trader VAT Registration: When and How to Register

How Do You Stay Compliant After Switching?

Compliance is key to protecting your limited company status. Directors transitioning from sole trader to limited company must understand ongoing obligations.

What Annual Accounts And Statements Are Required?

Limited companies file annual accounts and confirmation statements with Companies House. Deadlines depend on the accounting reference date, but typically involve:

- Submitting financial accounts, including the balance sheet and profit/loss statement

- Filing confirmation statements to update company information

What Payroll Deadlines Must Directors Meet?

Directors paying themselves a salary must comply with PAYE obligations:

- Monthly Real Time Information (RTI) submissions to HMRC

- Annual payroll reporting and P60 issuance

- Ensuring correct tax and NIC deductions

What Paperwork Is Needed for Dividends?

Paying dividends requires careful record-keeping:

- Accurate accounting entries to reflect distributions

These compliance steps ensure the company operates legally and benefits fully from the limited company tax threshold advantages and other incorporation benefits.

Ltd Co Vs Sole Trader Quick Decision Checklist

Deciding to move from sole trader to limited company involves more than just reviewing profits. While the limited company tax threshold often triggers the conversation, other factors such as risk, growth ambitions, and professional image are equally important. For business owners asking, “Should I become a limited company?” or “When should I change from sole trader to limited company?”, a structured checklist can provide clarity.

Use this practical decision-making framework to assess readiness:

- Annual profits: Are your profits consistently above the point where limited company versus sole trader tax advantages apply?

- Risk exposure: Does your business face client disputes, supplier debts, or professional liability? Moving from self employed to limited company offers limited liability protection.

- Growth plans: Do you intend to attract investors, partners, or larger clients? Incorporation supports these ambitions and enhances credibility.

- Administrative capacity: Are you prepared to handle the disadvantages of changing from a sole trader to a private limited company, including statutory filings, payroll, and dividend administration?

- Professional image: Would a limited company improve your market perception, particularly when competing with other incorporated businesses in the UK?

This checklist helps clarify whether the timing and business conditions justify a switch from sole trader to limited company.

Ready To Switch? Get Expert Guidance From ARB Accountants

Transitioning from sole trader to limited company is a pivotal decision with long-term financial and operational implications. At ARB Accountants, we guide UK business owners through every step, ensuring a smooth and compliant transition. Our approach combines insider knowledge of sole trader or limited company UK rules, practical tax planning, and hands-on experience with incorporation processes.

We offer a fixed-fee structure for company formation, accounting, and ongoing compliance, so clients can plan with certainty. Based in Essex and Southend, our team provides tailored advice on how to change from sole trader to limited company, handling everything from Companies House registration to HMRC notifications, asset transfers, and payroll setup. Book a free consultation today to evaluate your readiness and discover the benefits of incorporating a business for your specific situation. Let ARB Accountants help you make an informed decision, optimise tax efficiency, and protect your personal assets as you scale. Contact us now.