CIS Expenses Guide for Construction Workers UK

Many subcontractors struggle to keep track of which costs they can claim under the Construction Industry Scheme (CIS). This is where a clear CIS expenses guide becomes essential. Without proper knowledge, CIS-registered subcontractors risk paying too much tax or missing out on refunds when completing their Construction Industry Scheme (CIS) tax return.

The reality is that margins in construction are already tight. Incorrect expense claims only make things harder. By understanding the rules and following HMRC guidelines, you can reduce unnecessary deductions, claim back legitimate costs, and keep more of what you’ve earned. For a practical checklist, this CIS expenses guide breaks down each claimable cost.

- What is the Construction Industry Scheme (CIS) and why does understanding expenses matter?

- What qualifies as an allowable expense under CIS?

- How should travel, mileage & CIS mileage allowance be handled and claimed?

- Which tools, equipment and protective clothing can be claimed under CIS expenses?

- How are job materials treated differently from labour in CIS expenses?

- Can telephone, internet, meals whilst working, and overnight stays be claimed?

- What evidence should subcontractors retain to support their CIS tax return?

- What are common misconceptions around CIS expenses & how can they be avoided?

- How does understanding these expenses impact your CIS tax return and overall tax efficiency?

- Frequently Asked Questions

What is the Construction Industry Scheme (CIS) and why does understanding expenses matter?

The CIS is HMRC’s system for collecting tax from subcontractors in the construction sector. Under the scheme, contractors deduct tax from subcontractors’ pay before it reaches them. The standard deduction rates are: 20% for registered workers, 30% for unregistered, and 0% for those with gross payment status. Understanding those rates is central to any effective CIS expenses guide.

While CIS helps HMRC collect tax at source, it doesn’t automatically account for your business costs. That’s why a CIS expenses guide is vital as it directly reduces taxable profit and can mean the difference between overpaying or receiving a refund. For example, if expenses are misclassified on a CIS scheme tax return, subcontractors may lose hundreds of pounds in overpaid tax. Industry experts like to stress that many subcontractors miss out simply because they don’t itemise costs correctly. Use this CIS expenses guide to check invoice classification before submission.

For subcontractors who also take on contractor-style projects, getting guidance from specialist contractor accountants can help keep both CIS records and overall tax planning fully compliant.

What qualifies as an allowable expense under CIS?

HMRC applies the “wholly, exclusively and necessarily” test to determine whether a cost is deductible. This means an expense must be directly tied to your construction work.

It’s important to separate labour costs, which are subject to CIS deductions, from materials and other business expenses, which are not. According to GOV.UK, if you don’t distinguish these on invoices, contractors may incorrectly apply deductions on the full amount, including materials, reducing your net pay unnecessarily. A good practice is to itemise invoices clearly, splitting labour from material costs. This ensures deductions only apply where they should and maximises take-home pay. An actionable CIS expenses guide will show sample invoice templates to prevent misclassification.

Examples of allowable CIS expenses include:

- Tools, equipment, and protective clothing

- Materials purchased directly for a job

- Professional fees (accountants, insurances, training)

- Office costs like phone bills, stationery, and software

READ RELATED ARTICLE: Do I need to register for Self Assessment?

How should travel, mileage & CIS mileage allowance be handled and claimed?

Travel is one of the most common areas where subcontractors make mistakes on their CIS tax return. HMRC allows claims for travel to temporary workplaces, defined as assignments expected to last less than 24 months.

The CIS mileage allowance follows HMRC’s standard rates: 45p per mile for the first 10,000 miles in a tax year, and 25p per mile thereafter. Alternatively, subcontractors can claim actual running costs such as fuel, repairs, insurance, and road tax.

An insider tip: choose between simplified expenses (flat mileage rates) or actual vehicle costs depending on your record-keeping and travel patterns. Those with newer, fuel-efficient vehicles often benefit from flat rates, while high-mileage subcontractors may save more by claiming actual costs. Either method directly reduces taxable profit on your hmrc cis tax return, improving cash flow and reducing tax liabilities.

Which tools, equipment and protective clothing can be claimed under CIS expenses?

One of the most practical areas covered in any CIS expenses guide is the treatment of tools, equipment, and protective clothing. HMRC allows subcontractors to claim for items that are wholly, exclusively, and necessarily used for construction work. This includes drills, power saws, safety helmets, steel-toe boots, and other personal protective equipment (PPE) required on-site. The CIS expenses guide also recommends how to depreciate higher-value gear for tax accuracy.

A common misconception among CIS-registered subcontractors is that everyday clothing, like jeans or winter coats, can be claimed. In reality, only specialist clothing such as hi-vis jackets or safety harnesses qualifies. This distinction ensures that personal items for general use are excluded from your HMRC CIS tax return.

For expensive equipment, ARB recommends amortising costs across their useful life rather than claiming them all at once. For example, if you purchase a £1,200 drill set with a five-year lifespan, spreading deductions across those years provides a more accurate tax position. This approach avoids over-claiming in one period and ensures long-term compliance. Using a structured method like this strengthens your CIS scheme tax return and demonstrates professional financial management.

READ RELATED ARTICLE: How likely are you to be investigated by HMRC?

How are job materials treated differently from labour in CIS expenses?

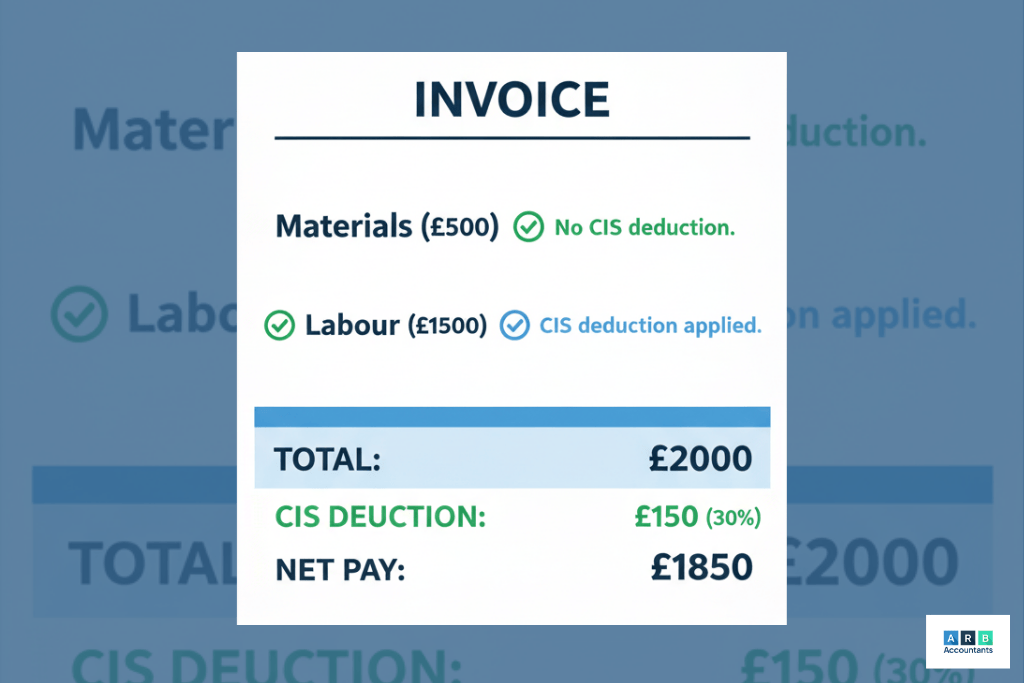

Another crucial distinction in any CIS expenses guide is between materials and labour. Materials such as cement, bricks, or timber are fully deductible and not subject to CIS tax deductions. Labour costs, however, are always subject to a 20% or 30% deduction, depending on the subcontractor’s registration status.

Misclassification often leads to subcontractors paying higher deductions than necessary. For example, if a subcontractor issues an invoice of £2,000 and fails to separate £500 worth of materials, the contractor may incorrectly apply the CIS deduction to the full £2,000. That results in £150 lost in unnecessary tax withholding at the 30% rate.

To avoid this, invoices should be carefully itemised. A best-practice example would be:

- Labour: £1,500 (CIS deduction applied)

- Materials: £500 (not subject to CIS deduction)

- Total invoice: £2,000

This structure ensures CIS is only deducted from the correct portion and that allowable expenses are correctly represented on the construction industry scheme tax return. ARB advises subcontractors to adopt this practice consistently, as it not only improves accuracy but also strengthens records for HMRC reviews. Following a CIS expenses guide when creating invoices reduces the chance of over-deduction.

Can telephone, internet, meals whilst working, and overnight stays be claimed?

Modern subcontractors often overlook day-to-day running costs when considering CIS expenses. Yet a CIS expenses guide should highlight that certain business-related household and subsistence costs are deductible if allocated fairly.

Phone and internet costs, for instance, can be claimed in proportion to business use. If half of your mobile calls are work-related, then 50% of your bill is allowable. This proportional approach prevents over-claiming and ensures compliance with your CIS tax return. What can I claim?

Meals are more restrictive. Everyday food while at home or on-site locally cannot be claimed. However, subsistence during travel to a temporary workplace (less than 24 months at a single site) is allowable. Similarly, overnight accommodation for site-based work away from home can be claimed if properly documented.

A key concept here is dual-purpose expenses. Items like home broadband or personal phones serve both private and business use. In these cases, subcontractors must allocate costs fairly, claiming only the business-related portion. This reinforces accuracy in the HMRC CIS tax return and prevents compliance issues.

What evidence should subcontractors retain to support their CIS tax return?

A reliable CIS expenses guide must emphasise the importance of keeping proper evidence for every claim. HMRC requires subcontractors to back up their CIS scheme tax return with receipts, invoices, mileage logs, and CIS deduction statements provided by contractors

The Payment & Deduction Statement is particularly important. Contractors are legally obliged to issue this each month, and it should detail gross payment, materials claimed, deductions applied, and net pay. Without this document, CIS-registered subcontractors cannot accurately reconcile payments or check if the right tax has been withheld.

ARB advises that subcontractors adopt digital record-keeping systems to reduce the risk of losing vital paperwork. Cloud storage platforms allow job-by-job filing of receipts, invoices, and mileage logs, ensuring records are accessible during HMRC checks. A digital-first approach also supports accuracy in compiling the HMRC CIS tax return, while reducing admin time. Subcontractors who keep clear records are in a stronger position to claim refunds and defend their position if challenged. The digital practices above are core parts of our CIS expenses guide for modern subcontractors.

What are common misconceptions around CIS expenses & how can they be avoided?

Misunderstandings about what can be claimed often lead to errors in a cis expenses guide. One widespread myth is that meals are always allowable. In reality, food can only be claimed as subsistence when linked to a temporary workplace. A sandwich purchased at a local site you’ve worked on for two years will not qualify, but a meal bought while staying away for a six-month project would.

Another misconception is that all tools can be deducted in full immediately. While consumables like drill bits or gloves are allowable in the year of purchase, more expensive tools should be capitalised and amortised across their useful life. This spreads the cost fairly and prevents inflated deductions on a single construction industry scheme tax return.

Dual-purpose expenses also cause confusion. For example, if a subcontractor uses their mobile phone for both personal and work calls, they cannot deduct 100% of the bill. Only the business-use portion is valid. Misunderstanding this rule can trigger compliance risks. Correctly allocating expenses avoids over-claiming and strengthens the credibility of a CIS-registered subcontractor during an HMRC review.

READ RELATED ARTICLE: Business structures for freelancers and contractors in the UK

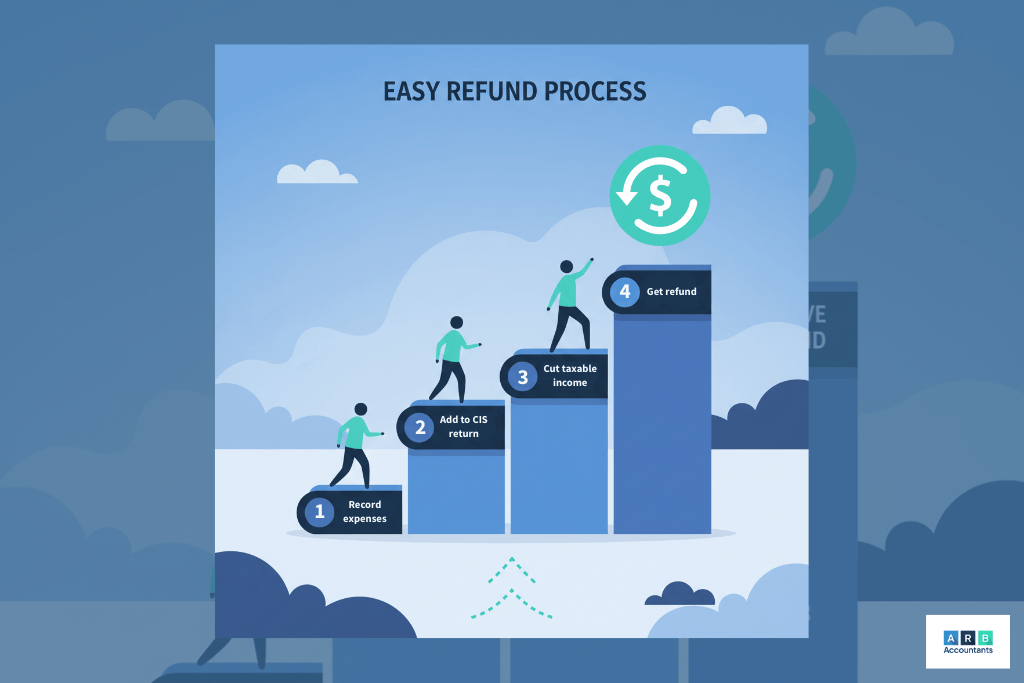

How does understanding these expenses impact your CIS tax return and overall tax efficiency?

The financial impact of getting CIS expenses right is significant. Every pound of allowable cost reduces taxable profit, which in turn reduces tax liability or increases the refund due. Subcontractors who ignore this lose out unnecessarily.

Consider this example: A CIS subcontractor earns £40,000 in a year. The contractor applies 20% deductions, meaning £8,000 is withheld. The subcontractor has £6,000 in allowable cis expenses (tools, mileage, PPE, accommodation). Their taxable profit reduces to £34,000. Based on HMRC’s 20% rate, the actual tax due is £6,800. Since £8,000 was already withheld, the subcontractor is owed a £1,200 refund.

This example shows how overlooked costs directly affect cash flow. Proper use of a cis expenses guide ensures subcontractors can recover funds rather than leave them with HMRC. By consistently applying best practices, ARB accountants in Southend helps clients transform compliance tasks into opportunities for better tax efficiency.

“ARB Accountants have been my accountants for the past 5 years and I can say they are best at what they do, they look after my tax returns, and they make the whole process very easy. Any questions I have are answered in a timely manner, very reasonably priced too, I would definitely recommend them.”