How to Register a New Business in UK: A Step-by-Step Guide

Understanding how to register a new business in the UK is not just about paperwork, it is about creating legal credibility with HMRC, banks, suppliers, and customers. From the first day of trading, registration determines how tax is calculated, how risk is managed, and how the business is perceived externally. This is why how to register a new business correctly is a foundational decision, not an administrative afterthought.

This guide explains how to register a new business by clearly outlining legal structures, the role of Companies House, and the function of the certificate of incorporation UK. It also fills gaps many guides overlook, including realistic costs, required documentation, and timing expectations, so founders can make informed decisions without guesswork.

- What Does It Mean to Register a New Business in the UK?

- How Do You Decide Which Business Structure to Choose?

- What Are the Exact Steps to Register a Company UK?

- How Much Does It Cost to Register a Business in the UK?

- How Long Does It Take to Register a Company in the UK?

- What Happens After Your Company Is Registered?

- Common Mistakes and How to Avoid Them

- Conclusion

- Frequently Asked Questions

What Does It Mean to Register a New Business in the UK?

Registering a business means formally notifying the relevant authorities that a commercial activity exists and must comply with UK law. When people ask how to register a business, they are usually referring to creating a recognised legal structure rather than simply invoicing clients or selling products.

There is a clear distinction between trading and registration. Trading can begin informally, but registration creates legal identity, defines tax treatment, and determines liability. Sole traders register with HMRC, partnerships share responsibility across partners, and starting a limited company UK involves incorporation through Companies House. Limited liability partnerships also require incorporation, while sole traders do not become separate legal entities.

Registration affects how profits are taxed, whether personal assets are exposed to business risk, and how contracts are enforced. This is why how to register a company UK is fundamentally different from operating as an individual, even if the commercial activity looks the same on the surface.

How Do You Decide Which Business Structure to Choose?

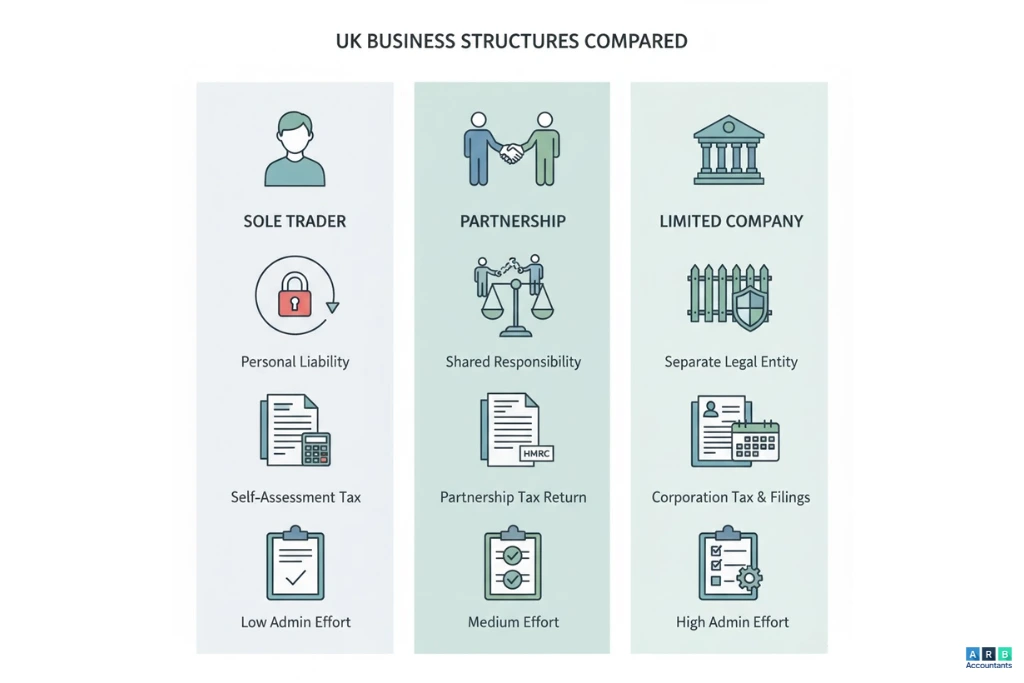

Choosing a structure is one of the most strategic parts of how to register a new business, because it influences compliance burden, funding access, and long term scalability. The main options are sole trader, partnership, and limited company, each designed for different risk and growth profiles.

Sole traders benefit from simplicity and minimal reporting, but face unlimited personal liability and limited access to external finance. Partnerships spread responsibility across multiple individuals but require clear profit sharing and governance agreements. Limited companies provide legal separation between owners and the business, which improves credibility with lenders and investors, but introduces statutory reporting and director duties.

For founders asking how do you register a business in a way that supports growth, limited companies are often suitable when profits will be reinvested or external funding is planned. The decision also affects costs, including how much does it cost to register a business UK and ongoing compliance expenses. Whether do i need to register with companies house depends entirely on this choice, as only incorporated entities appear on the public register.

Understanding structure selection ensures how to register a new business aligns with risk tolerance, funding plans, and operational complexity.

What Legal and Cost Considerations Influence Registration Decisions?

Registration decisions should factor in timing, documentation, and statutory fees. Incorporation requires specific company registration documents, including Articles of Association, director details, and a registered office address. Errors here delay approval and extend setup timelines.

Cost awareness is equally important. The companies house registration fee for online incorporation is £12 according to UK government data https://www.gov.uk/limited-company-formation/register-your-company. Additional costs may arise from professional support or compliance setup, but statutory fees remain fixed regardless of business size.

Timing is another practical consideration. Many founders ask how long does it take to register a company because registration often sits on the critical path to opening bank accounts or signing contracts. Accurate information and online submission usually result in approval within one working day.

By viewing registration as a legal and operational framework rather than a formality, founders can approach how to register a new business with clarity, accuracy, and long term intent.

READ RELATED ARTICLE: Business Structures UK for Freelancers and Contractors

What Are the Exact Steps to Register a Company UK?

Understanding how to register a new business in the UK starts with knowing the formal sequence Companies House and HMRC expect. The process is structured, document driven, and designed to create a legally recognisable entity that can trade, pay tax, and enter contracts. Below is a practical walkthrough focused on limited companies, which is the most common structure for growth focused businesses.

1) Choose and Check Your Business Name

The first step in how to register a new business is selecting a company name that is legally acceptable and commercially usable. Your proposed name must be unique, meaning it cannot be the same as or too similar to an existing name on the Companies House register. This is checked using the Companies House name availability search.

There are also restrictions to be aware of. Offensive words are prohibited, and certain terms suggesting government affiliation, regulated professions, or sensitive activities require prior approval. Trademark considerations sit outside Companies House, but checking existing trademarks is strongly advised to avoid disputes after incorporation. This step directly affects how to register a company UK, because name rejection is one of the most common reasons applications are delayed.

2) Prepare Your Company Registration Documents

Before submission, you must assemble all required company registration documents. These form the legal backbone of your company and define how it operates.

Mandatory items include the Memorandum of Association, which confirms the intention of the initial shareholders to form a company, and the Articles of Association, which set out rules on decision making, share transfers, and director powers. You also need details of all directors and shareholders, including service addresses, a registered office address located in the UK, and at least one SIC code that describes your business activity.

Preparing these correctly is a core part of how to register a new business, because inconsistencies between documents often trigger rejections.

3) Register with Companies House

Once documents are ready, the next stage in how to register a new business is formal submission. Registration can be completed online using the government service, by post, or through a formation agent. Online filing is the most common route due to speed and lower cost.

During submission, you pay the Companies House registration fee, upload or confirm your documents, and verify key details. After successful processing, Companies House issues a certificate of incorporation UK, which confirms your company legally exists and includes your company number and incorporation date.

If you are unsure do I need to register with companies house, the answer is yes for limited companies, as incorporation is what creates the legal entity. Errors in names, addresses, or Articles are the main reasons applications are paused or rejected.

4) Register for Corporation Tax and Other Obligations

After incorporation, how to register a new business does not end at Companies House. You must register with HMRC for Corporation Tax within three months of starting to trade. Trading includes activities like issuing invoices or advertising services, not just receiving income.

Depending on your setup, you may also need to register for VAT if turnover exceeds the threshold, or PAYE if you plan to pay salaries. These registrations ensure your business meets ongoing compliance requirements and answers the broader question of how do you register a business beyond incorporation alone.

For founders who want a streamlined approach, a professional company incorporation service can handle filings, checks, and submissions while reducing the risk of delays or errors.

READ RELATED ARTICLE: Do All Businesses Pay Corporation Tax?

How Much Does It Cost to Register a Business in the UK?

A common concern when learning how to register a new business is cost. The base Companies House registration fee is £12 for online filings, £40 for postal applications, and £100 for same day processing. These official fees are published by the UK government and confirmed on GOV.UK .

Beyond this, many founders incur additional costs. These can include accountant fees for document preparation, formation agent charges, registered office services if you do not want to use your home address, and industry specific licences. When people ask how much does it cost to register a business UK, a basic limited company setup typically ranges from £12 to £300, depending on how much professional support is used.

Understanding these costs upfront helps founders plan cash flow and avoid cutting corners that can cause compliance issues later.

How Long Does It Take to Register a Company in the UK?

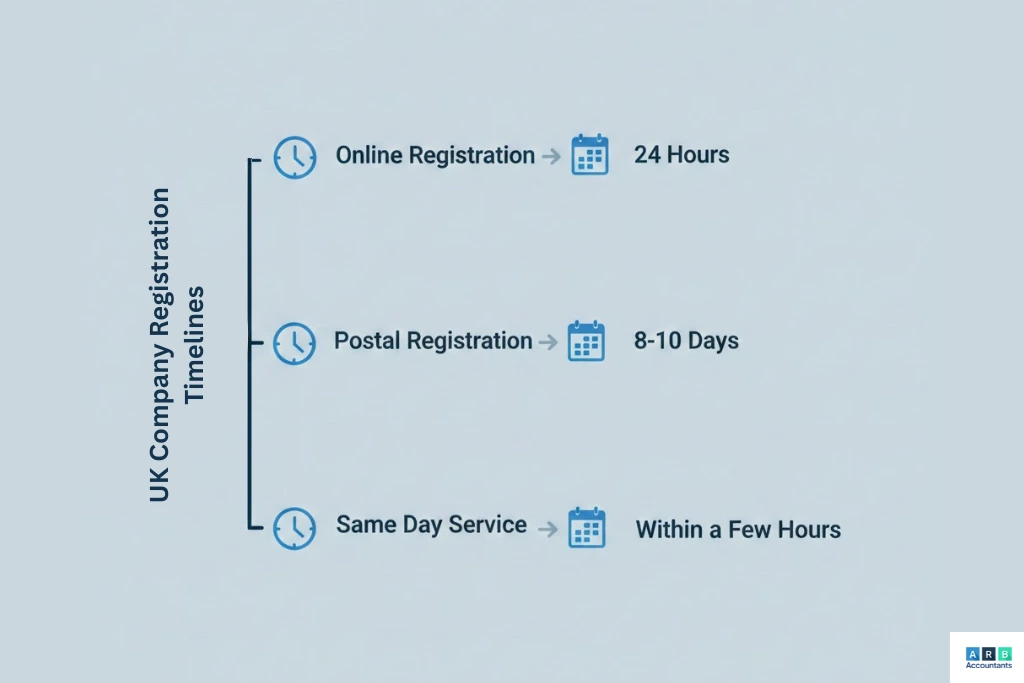

Timeframes are another key part of how to register a new business effectively. Online applications are usually processed within 24 hours, while postal submissions can take 8 to 10 working days. Same day services are available if documents are submitted early and correctly.

When people ask how long does it take to register a company, delays usually come from incorrect SIC codes, name conflicts, or incomplete director details. Real world timelines also vary during peak periods such as the end of the tax year.

To speed things up, ensure documents are finalised before submission, use the online service, and double check consistency across all forms. This is especially important when starting a limited company UK, where incorporation is often time sensitive due to contracts, banking, or funding requirements.

By following each step carefully, founders can move from idea to legally registered entity with clarity, control, and fewer setbacks.

What Happens After Your Company Is Registered?

Once incorporation is complete, many founders assume the hard part is over. In reality, understanding how to register a new business also means knowing what comes next. Registration creates a legal entity, but ongoing compliance and operational setup determine whether that entity can trade safely and sustainably.

Understanding Your Legal Duties

After incorporation, your company enters the statutory compliance cycle. Directors are responsible for filing annual accounts, submitting a confirmation statement, and maintaining statutory registers that record shareholders, directors, and people with significant control. These duties exist regardless of trading activity.

Late or incorrect filings trigger automatic penalties and can escalate into strike off action. According to data referenced by Formations Wise, missed confirmation statements are among the most common compliance failures for new companies. This highlights why how to register a new business should always be viewed as an ongoing process, not a one time event. Compliance protects limited liability status, creditworthiness, and the ability to raise finance later.

Opening Business Bank Accounts and Operational Essentials

Company registration directly affects your ability to operate. Most UK banks require proof of incorporation before opening a business account, which means registration is a gateway to receiving payments and paying suppliers. This is where founders often connect the legal process to the practical question of how to register a business in a way that supports day to day trading.

Beyond banking, early operational steps include arranging appropriate insurance, setting up contracts for clients or suppliers, and putting basic marketing infrastructure in place. These actions sit alongside compliance and reinforce why how to register a new business must align legal structure with commercial intent.

Common Mistakes and How to Avoid Them

One of the most damaging mistakes is choosing the wrong business structure. The tax, liability, and reporting implications differ significantly, especially when starting a limited company UK versus operating as a sole trader. A mismatch here can create avoidable tax exposure or restrict growth options.

Errors in company registration documents are another frequent issue. Missing SIC codes, incorrect registered office addresses, or inconsistent director details often lead to delays or post incorporation corrections. These problems slow down bank account approvals and undermine confidence with third parties.

There is also widespread misunderstanding around do i need to register with companies house. Some founders trade informally without realising that certain activities legally require registration. This can result in retrospective filings, penalties, and reputational risk that could have been avoided with earlier clarity.

Conclusion

Understanding how to register a new business means seeing registration as a structured roadmap rather than a single form submission. From post incorporation duties to operational readiness, each step connects legal compliance with commercial viability, an approach often reinforced by experienced accountants southend on sea supporting early stage businesses.

Clarity around timelines, including how long does it take to register a company, realistic budgeting for how much does it cost to register a business UK, and awareness of the companies house registration fee all support better decision making. When founders approach how to register a new business with accurate documentation, informed structure choices, and ongoing compliance in mind, they create a stable foundation for sustainable growth.