How Does a Director’s Loan Account Work

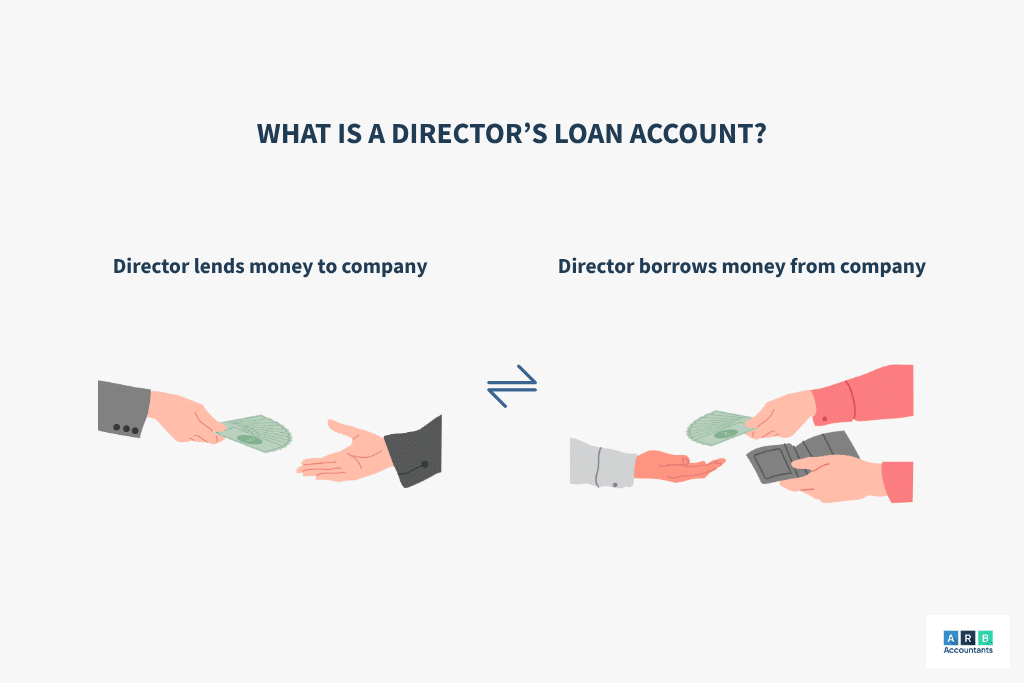

A Director’s Loan is a financial arrangement where a company director either borrows money from their limited company or lends money to it. In practical accounting terms this sits on the director’s current/loan account and is subject to specific UK rules. Notably the S455 corporation tax charge and beneficial loan (benefit-in-kind) rules, which determine tax treatment, P11D reporting and relief under S458 where repayments are made in time.(GOV.UK, GOV.UK Assets)

Understanding how does a director’s loan account work is essential for compliance and financial planning. While these loans can be helpful, they’re tightly regulated and intended for short-term use only.

So, what exactly can a Director’s Loan be used for? There are technically no restrictions on the usage. If a director withdraws money from the company for reasons other than salary, dividends, repaying business loans, or legitimate business expenses, or if a director loans personal funds to the company for start-up costs or financial support—that constitutes a Director’s Loan.

This raises two distinct commercial arrangements that appear in practice:

- A company director loan where the company owes the director (credit balance)

- A company owes money to the director (overdrawn loan/current account). Each has different cashflow, tax and reporting implications covered below.

In this guide, we’ll explain how does a Director’s Loan Account work, acceptable uses, limits on borrowing, repayment timelines, and what happens if a loan is written off.

- Understanding How Does a Director’s Loan Account Works

- What Can a Director’s Loan Account Be Used For?

- How Much Can You Borrow with a Director’s Loan Account?

- How Long Can You Take a Director’s Loan For?

- Can a Director’s Loan be Written Off?

- Can I Re-Take Out a Director’s Loan?

- Importance of Understanding Director’s Loan Accounts

- Tax Advice Southend

- Frequently Asked Questions

Understanding How Does a Director’s Loan Account Works

To comprehend how does a director’s loan account work, it’s important to recognize that it records all transactions between a director and their company that aren’t salary, dividends, or expense reimbursements. This account reflects the financial dealings and obligations between the two parties.

From an accounting control perspective, the director’s loan/current account must show clear timestamps, documentary evidence (invoices, bank transfers, board minutes), and repayment terms. These controls are used to evidence compliance with directors loan repayment rules and to calculate whether a benefit-in-kind directors loan arises for P11D purposes.

What Can a Director’s Loan Account Be Used For?

Director’s Loans are best treated as short-term solutions, as they may incur heavy tax penalties from HMRC if not managed properly. It’s crucial to understand directors loan rules to avoid unintended tax consequences. Director’s Loans are strictly regulated and, but there are no rules on what they can and cannot be used for. However, they should only be used as a short-term loan when absolutely necessary as they can attract heavy taxes from HMRC if repayment terms do not follow strict rules.

Uses for a Director’s Loan – Borrowed by a Director

Directors can, in a pinch, borrow money from their own limited company for whatever reason they choose, other than to cover salaries, dividends, repaying business loans, and for business expenses. This may include:

- Paying back personal loans

- Paying school fees

- Home repairs and renovations

Paying back a Director’s Loan borrowed from the company can be a complex matter. It must be paid back in one of three ways; by dividends, by salary, or by cash.

Practical compliance note, when paying back directors loan by dividends you must ensure the company has distributable reserves and complete board minutes approving the dividend; using salary to clear a loan requires PAYE/NIC treatment. These are common failure points under our directors loan repayment rules checklist.

Uses for a Director’s Loan – Loaned by a Director

Similarly, a limited company can borrow money from one of its directors as a short-term urgent loan. This may include:

- Business expenses

- Start-up fees

- To help sustain the business during times of financial difficulties

When a Director loans money to their business, that money can be claimed back tax-free at any point. Unlike when a Director borrows money from their company, it does not need to be paid back as salary or dividends. It can simply be withdrawn from the account, as long as it is properly documented. Any interest can be charged as a business expense.

Can a director loan money to his company? Yes. A director providing cash to the company is recorded as a liability (loan from director) or credit to the director’s account (company director loan). These arrangements can be interest-bearing or interest-free; if interest is below the HMRC official rate, the difference may create a benefit-in-kind directors loan requiring P11D reporting.(GOV.UK, KPMG)

How Much Can You Borrow with a Director’s Loan Account?

There’s no legal cap on the amount you can borrow. However, exceeding £10,000 triggers additional tax implications, emphasizing the importance of understanding directors loan rules. Shareholders should also be contacted for larger loans to seek approval. It should also be taken into account that there are different tax rules on Directors’ Loans depending on how much is borrowed.

How much directors’ loans can I take? Legally there isn’t a statutory “cap”, but practical tax consequences begin once aggregate loans to participants exceed £10,000 (the threshold relevant for benefit-in-kind tests and P11D reporting). Larger or persistent overdrawn positions attract S455 corporation tax (the section 455 charge) and must be actively managed.] (GOV.UK, GOV.UK Assets)

Anything above £10,000 will be treated as a Benefit in Kind, which must be reported by Self-Assessment, and you may also have to pay tax on the loan at the official rate of interest.

How Long Can You Take a Director’s Loan For?

To avoid penalties, the loan must be repaid within 9 months and 1 day after the company’s year-end. Failure to do so may result in overdrawn directors loan account tax charges. Any unpaid Director’s Loans after this time are subject to a 32.5% corporate tax charge, although this can be claimed back once the loan is fully repaid.

However, claiming back this corporation tax can be a lengthy process as you are only eligible for this from 9 months after the end of the accounting period in which the loan was paid back in full. As such, it’s best to ensure that Directors’ Loans are paid back in full within 9 months of the year-end.

Practical rule when asking “when does a directors loan have to be repaid?”, remember the 9-month trigger is counted from the company’s accounting period end (not from the drawdown date). This timing drives cashflow planning: if paying earlier than the 9 months, you avoid a S455 liability and the subsequent administrative burden of claiming S458 relief later.] (GOV.UK Assets)

READ RELATED ARTICLE: Do all businesses pay corporation tax?

Can a Director’s Loan be Written Off?

Yes, but it must be formally waived and reported as a dividend under the Income Tax Act 2005. This action affects the director’s loan account and must be handled in accordance with directors loan rules. The amount written off must also be included in the Director’s Self-Assessment tax return, and similarly treated as a dividend.

However, when Director’s Loans that are written off are treated as dividends, HMRC may argue that writing off a loan comes under the definition of ‘emoluments from an office or employment and will seek to collect Class 1 NIC from the company.

Can a directors loan be written off? Technically yes, but the accounting and tax consequences are material: the write-off is normally taxed as a distribution; if the director is also an employee, HMRC can recharacterise it as employment income (with NICs consequences). The write-off also reduces company net assets and must be reflected in the accounts and in shareholder minutes.] (GOV.UK, ACCA Global)

Can I Re-Take Out a Director’s Loan?

Some directors attempt a “Bed and Breakfasting” approach—repaying a loan in full, then immediately taking out another. However, directors loan rules stipulate a 30-day gap to prevent tax avoidance.

This, however, cannot be done on loans over £10,000; a period of 30 days must pass before another Director’s Loan can be taken out, otherwise, HMRC will tax this as Business in Kind. Similarly, loans over £15000 taken out after this 30 day period may still attract tax.

It can be argued that HMRC has no way of proving the Bed and Breakfast approach, however, patterns of behaviour can be picked up if this approach is used frequently. As such it is better to not risk it and only use Director’s Loans legitimately, and as a last resort.

Importance of Understanding Director’s Loan Accounts

Grasping how does a director’s loan account work is vital for any company director. Mismanagement can lead to overdrawn directors loan account tax liabilities and other financial complications. Proper adherence to directors loan rules ensures compliance and financial health of the company.

Our approach at ARB Accountants is to treat director loan positions as a governance and cashflow task:

- Log every transaction

- Set explicit repayment milestones consistent with directors loan repayment rules

- Run a benefit-in-kind check against the HMRC Official Rate of Interest (ORI) annually

- If S455 arises, plan S458 relief timing and document board approvals, this reduces errors in year-end CT600 filing and in directors’ Self Assessment

As a new business with not much knowledge, ARB took the time to break down and explain everything to me in a lot of detail. Even now, I still call for advice and nothing is ever too much hassle. I would definitely recommend ARB to everyone, very friendly, professional and reliable!

Tax Advice Southend

At ARB Accountants, we provide tailored tax advice to businesses and individuals across Southend and the UK. Whether you’re dealing with a director loan to company or navigating directors loan interest implications, our experts are here to assist. Our experienced Chartered Accountants are able to provide you with bespoke advice regarding your business taxes, including advice regarding Director’s Loans.

With us, you can be sure that your business is fully compliant with legislation, and that you’re making the most of the allowances and tax reliefs available to you.

Claim a free 60-minute consultation with our experienced accountants in Southend-On-Sea to see how we can help.