CIS Reverse Charge Explained for Contractors

The CIS reverse charge is a VAT accounting rule that shifts the responsibility for reporting VAT from the supplier to the customer within the construction supply chain. Under the CIS reverse charge VAT rules, subcontractors do not charge VAT on qualifying services, and instead the contractor accounts for it on their VAT return. This domestic reverse charge CIS system sits at the intersection of CIS and VAT, and it directly affects invoicing, cash flow, and VAT compliance for contractors working in the UK construction sector.

Despite being live for several years, the CIS reverse charge is still applied incorrectly by many contractors because it alters long-standing VAT habits, creates uncertainty around invoices, and impacts short-term cash flow. From a compliance perspective, the CIS reverse charge demands tighter controls, clearer supply chain communication, and accurate VAT treatment at the invoice level. The focus here is practical application, cash flow awareness, and reducing HMRC risk through consistent processes.

- What is the CIS reverse charge, and how does it change VAT responsibilities?

- Why was the domestic reverse charge CIS introduced, and what problem is it solving?

- Which construction services fall under the CIS reverse charge rules?

- When does the CIS reverse charge not apply, even if CIS applies?

- How does the CIS reverse charge work in real contractor supply chains?

- How should contractors raise invoices under the CIS reverse charge?

- CIS reverse charge examples for common contractor scenarios

- How does the CIS reverse charge affect VAT returns and cash flow?

- What are the most common CIS reverse charge mistakes contractors make?

- How does Making Tax Digital interact with the CIS reverse charge?

- What should contractors do to stay compliant with CIS and VAT going forward?

- Do contractors need specialist advice for CIS reverse charge compliance?

- Conclusion

- Frequently Asked Question

What is the CIS reverse charge, and how does it change VAT responsibilities?

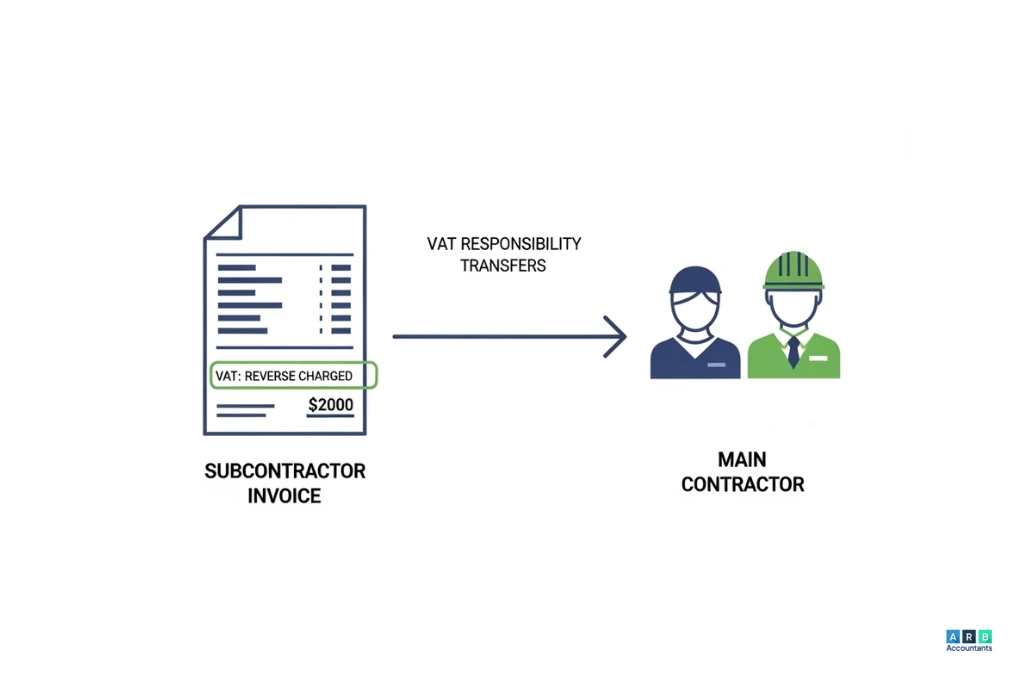

The CIS reverse charge fundamentally changes how VAT is accounted for on certain construction services. Under normal VAT rules, the supplier charges VAT on the invoice and pays it to HMRC. Under the reverse charge CIS system, the supplier does not charge VAT, and the customer records both the output and input VAT on their own VAT return.

How does the CIS reverse charge differ from normal VAT treatment?

With the CIS reverse charge, responsibility moves away from the subcontractor. The contractor receiving the service accounts for VAT instead of paying it to the supplier. This is why CIS VAT reverse charge terminology must be applied consistently on invoices and records. The supplier still reports the net value, but VAT is not collected.

Who charges VAT and who accounts for it?

Under CIS reverse charge VAT rules, subcontractors issue a CIS and VAT invoice without VAT charged, while the contractor accounts for VAT through their VAT return. This applies only where both parties are VAT registered, and the service falls within VAT reverse charge CIS rules. This relationship between CIS and VAT is procedural, not optional.

READ RELATED ARTICLE: Sole Trader VAT Registration: When and How to Register

Why was the domestic reverse charge CIS introduced, and what problem is it solving?

The domestic reverse charge CIS was introduced to combat VAT fraud in the construction industry, specifically, missing trader fraud. This type of fraud occurs when suppliers charge VAT and disappear before paying it to HMRC, leaving a tax gap.

How does VAT fraud affect the construction sector?

Construction has historically been one of the highest risk sectors for VAT fraud due to complex supply chains and subcontracting. According to HMRC, the UK VAT gap was estimated at 5.4 per cent of total VAT liabilities, representing billions in lost revenue, with construction identified as a key risk area (source).

What does this mean for contractor compliance?

The CIS reverse charge removes the incentive for fraud by ensuring VAT never passes through the subcontractor. For contractors, this increases compliance responsibility and requires tighter checks before invoices are processed. The CISreverse charge, therefore, links policy intent directly to day-to-day contractor behaviour.

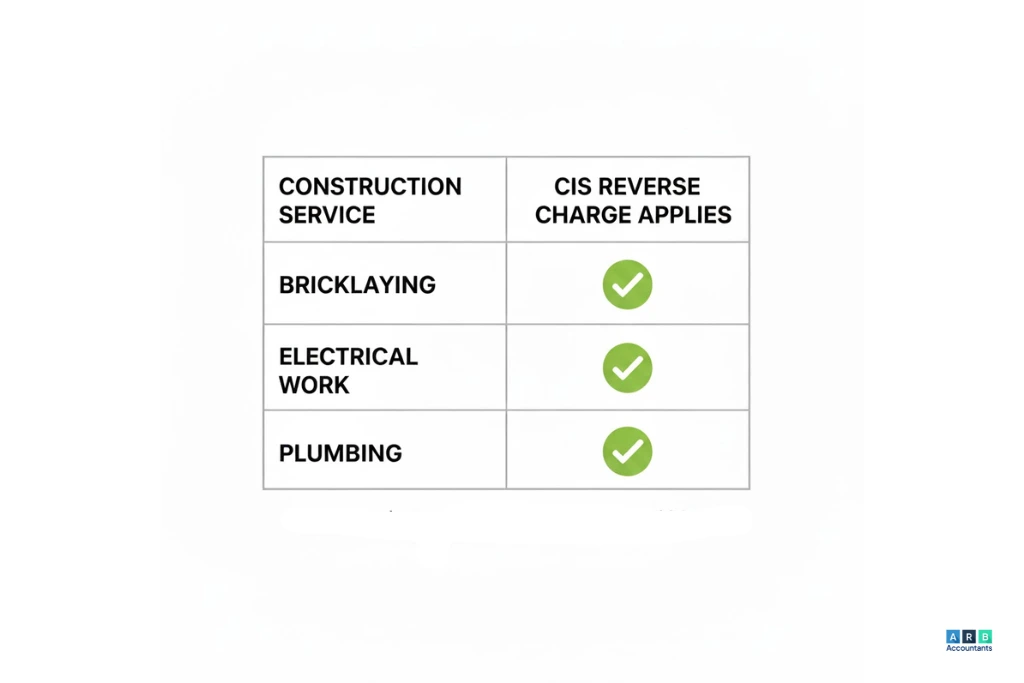

Which construction services fall under the CIS reverse charge rules?

Not all construction work is affected by the CIS reverse charge. Only services that are already within CIS and are standard or reduced-rated for VAT fall under CIS VAT rules.

What types of work are covered?

Services such as building, demolition, repairs, alterations, and installation work generally fall under reverse charge cis rules. Labour only and labour plus materials contracts are included, although reverse charge VAT on materials follows specific allocation rules within the invoice.

Where is the boundary drawn?

Supplies that are outside CIS, professional services, or purely materials without installation are not covered. The CIS reverse charge applies only where both parties are VAT registered, and the supply is reported under CIS.

When does the CIS reverse charge not apply, even if CIS applies?

There are limited but critical scenarios where CIS applies but the cis reverse charge must not be used. These exceptions depend on customer status, VAT rating, and contractual relationships.

End users and intermediary suppliers

The cis reverse charge does not apply where the customer is an end user, meaning construction services are for their own use and not onward supply. Intermediary suppliers connected to end users can also fall outside the cis reverse charge, but only where written notification is provided before invoicing.

VAT rating and service scope

Zero rated and reduced rated supplies can sit outside the cis vat reverse charge depending on the nature of the service. The VAT liability of the work, not just CIS status, determines whether the reverse charge cis applies.

Connected party relationships

Transactions between connected parties require additional scrutiny. HMRC expects consistent VAT treatment and commercial substance. Contractors should verify relationships before issuing a cis and vat invoice to avoid misapplication.

How does the CIS reverse charge work in real contractor supply chains?

The CIS reverse charge changes how VAT flows through construction supply chains by shifting VAT accounting responsibility from subcontractors to contractors. In a typical CIS reverse charge arrangement, a subcontractor supplies qualifying services to a main contractor but does not charge VAT. Instead, the contractor records the VAT on their return under reverse charge CIS rules. This applies even where multiple subcontractors sit between the original supplier and the end client.

How do responsibilities differ between contractors and subcontractors?

Under CIS reverse charge VAT rules, subcontractors remain responsible for correct CIS reporting, while contractors take responsibility for VAT accounting. In multi-layer chains, errors occur when parties assume responsibility sits elsewhere. Clear communication around CIS and VAT treatment is critical before work begins, especially where payment applications pass through several parties.

READ RELATED ARTICLE: CIS Expenses Guide for Construction Workers UK

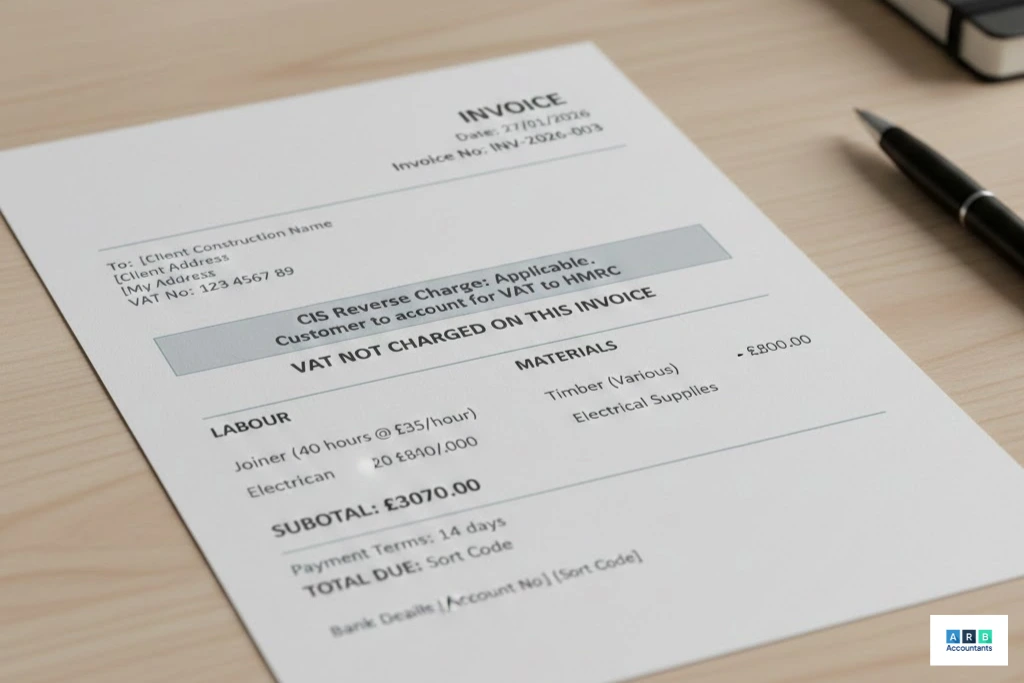

How should contractors raise invoices under the CIS reverse charge?

Correct invoicing is central to CIS reverse charge compliance. A CIS and VAT invoice must show the net value of services, include mandatory reverse charge wording, and clearly state that the customer must account for VAT. Contractors must not include VAT on qualifying supplies under the domestic reverse charge CIS framework.

Where do invoice errors usually happen?

Most errors arise when suppliers reuse old invoice templates or misunderstand reverse charge VAT on materials. Materials supplied with labour may still fall under CIS VAT reverse charge rules, but pure materials do not. Invoices that incorrectly show VAT create compliance risks for both parties and often trigger HMRC queries.

CIS reverse charge examples for common contractor scenarios

CIS reverse charge example for labour-only subcontractor

A VAT-registered subcontractor supplies labour-only services to a VAT-registered main contractor. The CIS reverse charge applies, no VAT is charged, and the invoice states that the customer must account for VAT under the CIS reverse charge. This CIS reverse charge example applies because the service is CIS-covered and the customer is not an end user.

CIS VAT reverse charge example with materials supplied

A subcontractor supplies labour and materials together under one construction contract. The CIS VAT reverse charge applies to the labour element, while the reverse charge VAT on materials depends on whether the materials are incidental or separately supplied. This CIS VAT reverse charge example shows why contractors must assess the contract structure, not just the invoice total.

End-user scenario where CIS reverse charge does not apply

A contractor supplies construction services directly to a property owner who confirms end-user status. Normal VAT rules apply, VAT is charged in the usual way, and the CIS reverse charge is disapplied. This scenario highlights the boundary between CIS and VAT and explains why end-user confirmation changes the VAT treatment entirely.

How does the CIS reverse charge affect VAT returns and cash flow?

The CIS reverse charge removes output VAT from subcontractor invoices, reducing short-term cash inflows. Contractors record output and input VAT simultaneously, often resulting in neutral VAT positions. However, many contractors experience increased VAT repayments because input VAT continues while output VAT reduces.

Why does this change cash flow patterns?

Construction businesses already operate on tight margins and extended payment terms. Industry data shows construction firms experience higher cash flow volatility than other sectors, making CIS VAT treatment critical to forecasting. HMRC estimates the VAT gap at billions annually, highlighting why tighter controls exist (source).

What are the most common CIS reverse charge mistakes contractors make?

Charging VAT when the CIS reverse charge applies

This mistake usually happens when contractors follow old invoicing habits or rely on software defaults that still add VAT automatically. The cis reverse charge removes the need for the supplier to charge VAT, but many subcontractors continue charging VAT out of caution. The consequence is an incorrect cis and vat invoice, delayed payment disputes, and potential HMRC assessments for misdeclared output tax.

Applying the reverse charge to end users incorrectly

Contractors often assume the cis reverse charge applies whenever CIS applies, which is not correct. End users are explicitly excluded from the domestic reverse charge cis, but this relies on the customer confirming their status. When no end user confirmation is obtained, contractors apply the reverse charge cis incorrectly. HMRC’s position is clear, responsibility sits with the supplier to establish status before invoicing.

Incorrect CIS reverse charge invoice wording

Invoices frequently fail HMRC checks because the required cis vat reverse charge wording is missing or incomplete. This usually occurs when accounting software templates are not updated or staff are unaware of wording rules. Incorrect wording on a cis and vat invoice increases penalty exposure and can invalidate the invoice for VAT purposes during inspections.

READ RELATED ARTICLE: How Likely Are You to be Investigated by HMRC?

How does Making Tax Digital interact with the CIS reverse charge?

The CIS reverse charge sits directly inside the Making Tax Digital framework, because both depend on accurate, timely VAT data. Under MTD, contractors must keep digital records that clearly show when the CIS reverse charge applies and when it does not. This removes any margin for casual adjustments, spreadsheet overrides, or late invoice corrections that were once common across CIS and VAT reporting.

Why does data accuracy matter more under MTD with the CIS reverse charge?

MTD requires line-level accuracy for CIS reverse charge VAT transactions. Errors in customer status, supply type, or vat treatment flow straight into VAT returns. When domestic reverse charge CIS rules are applied incorrectly, the VAT reverse charge CIS entry still appears digitally, creating a visible mismatch. HMRC data matching makes reverse charge cis errors far easier to detect than under paper-based systems.

What digital records are affected by the CIS reverse charge?

Every CIS and VAT invoice must show correct reverse charge CIS indicators in the accounting software. Digital records must distinguish labour, materials, and reverse charge VAT on materials clearly. Where CIS VAT reverse charge applies, systems must record output VAT as not charged while still capturing input VAT. Poor setup increases the risk of repeated cis reverse charge example errors across multiple quarters.

Why bookkeeping quality matters more under MTD and the CIS reverse charge

MTD exposes weak bookkeeping immediately. Inconsistent coding of CIS VAT, incorrect treatment of CIS VAT reverse charge example scenarios, or manual workarounds undermine compliance. Clean digital records allow contractors to manage cash flow shifts caused by the CIS reverse charge and spot reclaim opportunities early. This is why bookkeeping services often become a stabilising control rather than an admin cost.

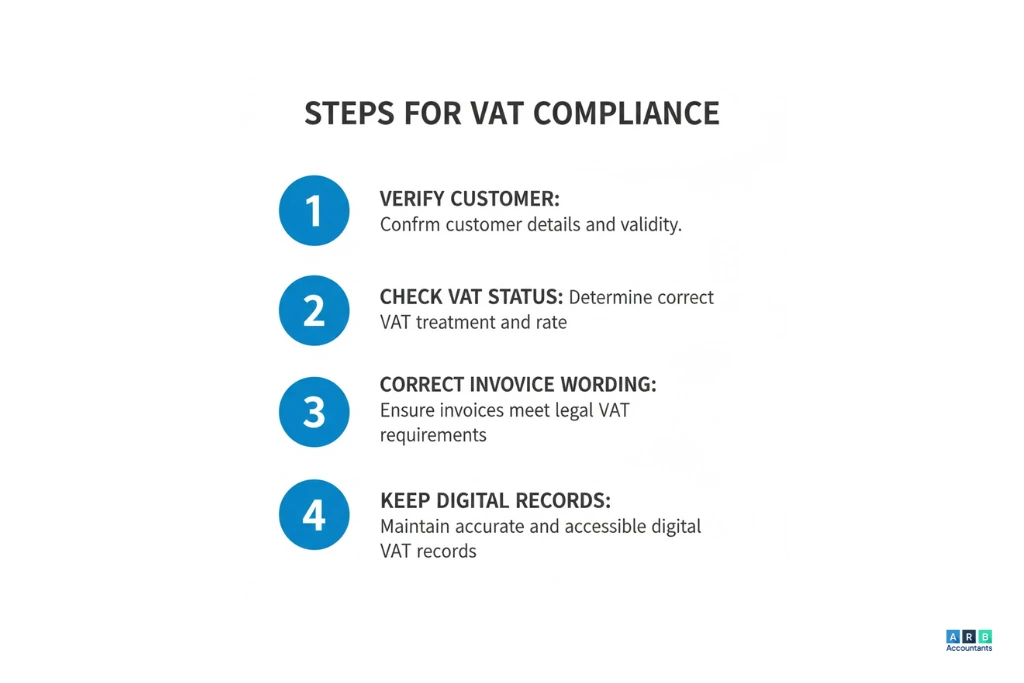

What should contractors do to stay compliant with CIS and VAT going forward?

The cis reverse charge demands process discipline rather than reactive fixes. Contractors need repeatable checks before every invoice is raised, especially where CIS and VAT obligations overlap within layered supply chains.

What internal checks should happen before invoicing?

Before issuing a CIS and VAT invoice, contractors should confirm customer status, end user position, and service classification. Verifying whether the CIS reverse charge applies prevents incorrect VAT reverse charge CIS treatment. Materials should be reviewed separately to confirm whether reverse charge VAT on materials applies or normal VAT rules remain in place.

How should customer status be verified under the CIS reverse charge?

Customer verification should be documented digitally. Written confirmation of end-user status supports correct domestic reverse charge CIS decisions. Without this evidence, applying the CIS reverse charge becomes an assumption, not a control. HMRC inspections often focus on missing documentation rather than intent.

What process controls reduce CIS reverse charge risk?

Process level controls include standard invoice templates, locked VAT codes, and review checkpoints for CIS VAT reverse charge entries. A compliance led approach treats CIS reverse charge decisions as part of system design, not judgment calls. This reduces exposure to penalties linked to CIS VAT errors and misapplied reverse charge CIS entries.

Do contractors need specialist advice for CIS reverse charge compliance?

The CIS reverse charge is manageable at low complexity, but risk increases quickly as turnover, subcontracting layers, and VAT reclaim volumes grow.

When does DIY compliance break down?

DIY approaches fail when multiple CIS reverse charge example scenarios exist in one period. Mixed supplies, partial materials, and varying customer status increase error rates. Repeated CIS VAT reverse charge example mistakes usually indicate process gaps rather than one-off errors.

What triggers justify a professional review?

Triggers include frequent VAT repayments, HMRC queries, or inconsistent cis and VAT outcomes. According to HMRC data, construction remains one of the most error-prone sectors for VAT compliance. A joined-up review aligns CIS reverse charge treatment with VAT returns, bookkeeping, and cash flow planning.

Why must CIS, VAT, and cash flow be managed as one system?

The CIS reverse charge removes output VAT, alters cash timing, and increases reliance on accurate input VAT claims. Treating CIS VAT, CIS reverse charge VAT, and cash flow separately leads to blind spots. Integrated systems reduce volatility and protect working capital.

Conclusion

The CIS reverse charge continues to confuse because it sits at the intersection of CIS, VAT, invoicing, and cash flow management. For contractors, getting it right is less about memorising rules and more about having reliable processes, accurate records, and clear decision checks before invoicing. This is where working with contractor accountants who understand construction-specific VAT risks makes a measurable difference, especially when compliance needs to align with wider tax and cash flow planning. For businesses operating locally, choosing an accountant Southend firms trust ensures advice is grounded in HMRC expectations and real contractor supply chain scenarios.