How Likely Are You to be Investigated by HMRC?

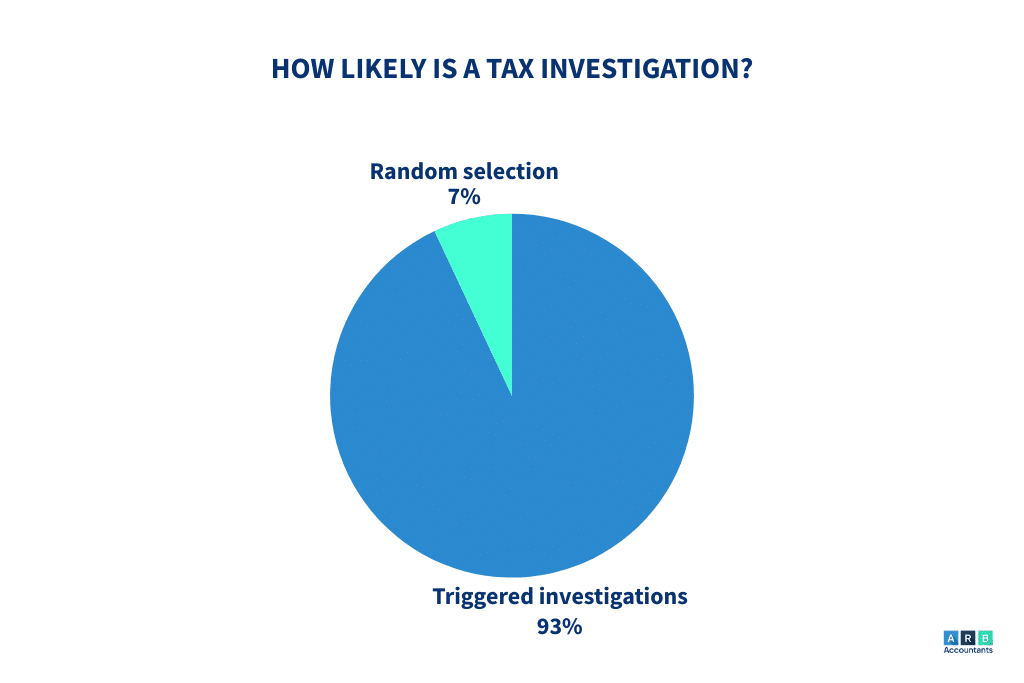

Technically, all businesses are at risk of being investigated by HMRC due to random selection; 7% of tax investigations per year are selected at random. But, In most cases, tax investigations are triggered through some kind of wrongdoing, mistakes on accounts, or through a tip-off.

HM Revenue & Customs (HM Revenue & Customs / HMRC) is the UK tax authority and uses a mix of data‑matching, information‑sharing (AEOI / FATCA / CRS), employer guidance and practical compliance tools to prioritise cases from routine HMRC compliance check activity to full HMRC tax investigations. Current HMRC guidance and the February 2026 Employer Bulletin emphasize a heightened focus on National Minimum Wage (NMW) compliance and Benefit-in-Kind (BiK) reporting, both of which are now being used as primary ‘gateways’ for HMRC to launch wider, more invasive business tax investigations.

So, how likely are you to be investigated by HMRC? 7% of all HMRC tax investigations are randomly selected, therefore all businesses, even if they haven’t done anything wrong, are at risk of being randomly selected for a HMRC tax investigation. However, you’re more likely to be investigated if your accounts are incorrect, or you are suspected of wrongdoing.

Read on to learn more about the likelihood of being selected for a HMRC tax investigation, as well as what can trigger a HMRC tax investigation, and how long they can take.

- How Likely Are You to Be Investigated by HMRC?

- How Common are HMRC Investigations?

- What Are the Latest HMRC Investigations and Payroll Compliance Checks?

- What Are the Chances of Being Investigated by HMRC?

- How HMRC Knows About Your Income & Assets

- Side Hustle Data Sharing (One Year In)

- What Triggers HMRC Investigation?

- R&D Tax Credit Scrutiny

- How Do HMRC Decide Who to Investigate?

- Can HMRC Check Bank Accounts Through Financial Institution Notices?

- Do HMRC Do Random Checks?

- What Are the 5 Stages of an HMRC Tax Investigation

- How Do HMRC Use Personal Expenditure Reviews

- How Do I Know If HMRC Are Investigating Me?

- What Happens When You Report Someone to HMRC for Tax Evasion?

- What Happens During an HMRC Tax Investigation?

- When Does HMRC Investigate the Self-Employed?

- The April 2026 Cliff (MTD for ITSA)

- How Do I Know If HMRC Are Investigating Me?

- How Long Does it Take HMRC to Investigate Someone?

- How to Reduce the Chances of an HMRC Investigation

- Tax Advice Southend

- Frequently Asked Questions

How Likely Are You to Be Investigated by HMRC?

Since 7% of all HMRC tax investigations are randomly selected, any business—even those that have done nothing wrong—could be chosen. However, the likelihood of an investigation increases if your accounts contain errors or if there is suspicion of wrongdoing.

Read on to learn more about the likelihood of being selected for a HMRC tax investigation, what can trigger one, and how long the process takes.

“HMRC now receives international banking data under global information sharing agreements. One of our clients received a letter saying they had discovered undisclosed foreign interest income in this case, from fixed deposits in India.

Her previous accountant had never informed her that UK tax residents must declare worldwide income. We helped her prepare a disclosure, calculating interest, penalties, and the additional tax owed for several years. HMRC hasn’t responded yet, but we expect the matter to be resolved similarly with tax and penalties paid, and no further consequences.

This case highlights the importance of proper advice, especially for clients with overseas assets or accounts.”

How Common are HMRC Investigations?

Only 7% of all HMRC tax investigations are random checks that aren’t triggered by wrongdoing, or any kind of suspicious activity. However, if your tax return looks a little odd, even just one element of it, that could trigger a tax investigation.

Some claim that HMRC have an annual quota of tax investigations to achieve which, true or not, could provide insight into why so many individuals and businesses are investigated for small mistakes on their tax returns, or minor inconsistencies. That being said, you’re more likely to be picked up for investigation due to inconsistencies and criminal activity.

However, if your business is VAT registered or has PAYE employees, you should still expect routine tax audits every 5 years or so.

What Are the Latest HMRC Investigations and Payroll Compliance Checks?

Recent 2026 developments highlight a shift toward digital record-keeping audits ahead of the April 2026 MTD for Income Tax deadline. HMRC is currently prioritizing checks on P11D accuracy and real-time payroll data (RTI) to identify discrepancies between reported company profits and director withdrawals. This shift has created more targeted HMRC payroll checks sometimes referred to in industry commentary as HMRC wage raid payroll checks, where payroll and benefits data are examined as part of compliance work. If your payroll or benefits reporting is inconsistent, it can trigger an HMRC compliance check or a wider HMRC tax investigations response.

What Are the Chances of Being Investigated by HMRC?

If you’re wondering what are the chances of being investigated by HMRC, the answer depends on various factors. While some businesses and individuals are selected at random, most tax investigations are triggered by discrepancies in tax returns, unusual expense claims, or undeclared income.

Certain industries, particularly those dealing in cash transactions, face a higher likelihood of being investigated. If HMRC spots irregularities in your accounts, such as a significant drop or spike in income, it could lead to further scrutiny. Ensuring accuracy in your tax filings can help reduce how likely you are to be investigated by HMRC.

How HMRC Knows About Your Income & Assets

HMRC’s information‑gathering toolbox includes bank and building society returns and international information exchange (AEOI/CRS/FATCA). Banks and building societies submit annual bank and building society interest returns which help HMRC detect undeclared savings interest directly relevant to queries such as do banks notify HMRC of savings interest and do banks inform HMRC of interest earned. At the same time, automatic exchange of information means HMRC may receive data on offshore accounts and interest. These data feeds combined with property, company house and credit‑bureau data are how HMRC can often identify undeclared income or flag transactions that require further checks: in short, they explain how do HMRC know about undeclared income and how do HMRC know about capital gains when disposal/transaction data appear in their systems.

Side Hustle Data Sharing (One Year In)

While talk of the Side Hustle Tax began years ago as of January 2026 HMRC has now completed its first full cycle of receiving data from digital platforms like eBay Vinted and Airbnb. Because this platform data acts as an automated report many people ask do hmrc investigate all tip-offs including digital ones. The answer is that their Connect AI now flags these discrepancies automatically.

What has changed HMRC is no longer waiting for data. They are actively cross-referencing 2024/25 platform data against the Self Assessment returns just submitted in January 2026. This data allows them to verify platform income against bank receipts which leads many to wonder do hmrc check bank accounts during this process. In reality they use power over financial institution notices to see if your lifestyle matches your declared earnings. Undeclared platform income has officially moved to a top tier trigger for a personal tax investigation this year. If your platform sales exceeded £1,000 and were not declared expect a nudge letter or a formal enquiry shortly.

What Triggers HMRC Investigation?

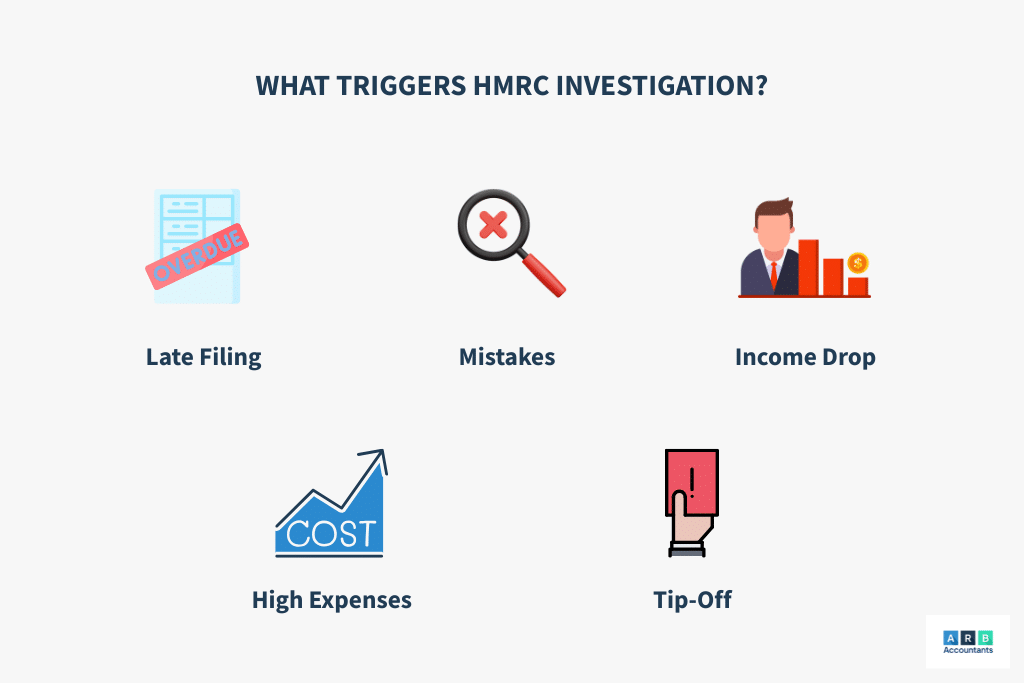

Since such a small portion of tax investigations are random, you might be wondering what triggers a HMRC compliance check. Generally, tax investigations are triggered by inconsistencies in tax returns, mistakes, late payments, and tip-offs.

A HMRC tax investigation may be triggered by:

- Lateness in filing tax returns or making payments

- Errors on your tax return

- Inconsistencies or substantial variations between different tax returns. This could be a large rise or fall in income or costs

- Abnormally high costs for your industry

- The tax return is inconsistent with how your business is performing, or with your standard of living

- You have offshore accounts

- You have income from property

- You operate in a high-risk industry

- A tip-off

“A client unknowingly failed to declare rental income from a second property. HMRC discovered it through a combination of land registry and council tax data. They knew he wasn’t living there and assumed rightly that it was being rented out.

He received a letter inviting him to disclose the income voluntarily. We went back through five years of records, calculated the unpaid tax, interest, and penalties, and submitted a full disclosure. HMRC accepted our offer, and the case was closed.

This case shows that HMRC has access to cross-government data and rental income is a common red flag.”

R&D Tax Credit Scrutiny

Since late 2025 HMRC’s R&D Anti Abuse Unit has moved to a volume compliance model. For 2026 research suggests that nearly 17% to 20% of all R&D claims are being flagged for enquiry. If you are a small business claiming R&D relief ensure your Additional Information Form is flawless as technical uncertainty is being scrutinized more aggressively than ever before.

Be aware that if HMRC suspects a claim was intentionally inflated or fraudulent the enquiry can escalate into a serious cop9 investigation under the Contractual Disclosure Facility. This is a severe civil fraud investigation that can lead to significant penalties or even criminal prosecution if not handled correctly.

How Do HMRC Decide Who to Investigate?

Many businesses and individuals ask, how do HMRC decide who to investigate? HMRC uses a combination of data analysis, risk assessments, and reports from third parties to identify potential tax discrepancies. They cross-check tax returns with banking records, property ownership, and even online transactions.

Common triggers for an HMRC investigation include undeclared income, repeated late tax filings, or expenses that seem abnormally high for your industry. In some cases, HMRC may receive a tip-off or notice patterns that suggest potential tax evasion. While random checks do occur, ensuring compliance with tax regulations significantly reduces how likely you are to be investigated by HMRC.

READ RELATED ARTICLE: Do I need to register for self-assessment?

Can HMRC Check Bank Accounts Through Financial Institution Notices?

HMRC’s legislative toolkit includes Financial Institution Notices (FINs) and other third‑party notice powers which allow HMRC to require banks and financial institutions to provide records in relation to a named taxpayer this is central to answering questions like can HMRC see your bank account, can HMRC check bank accounts, does HMRC have access to bank accounts, and HMRC checking bank accounts. FINs are used only where HMRC reasonably requires the information to check a taxpayer’s tax position or collect a debt; they are different from account freezing powers (Account Freezing Orders) which are issued by the courts where criminal or recovery action may be pursued.

Do HMRC Do Random Checks?

HMRC does conduct random checks at a rate of 7% per year. However, they will not turn up unannounced; HMRC will usually contact you beforehand by phone or post to request various pieces of information, and to schedule a visit. It is important to respond to any HMRC correspondence about tax investigations as soon as possible in order to avoid penalties.

What Are the 5 Stages of an HMRC Tax Investigation

Practical timelines and stages are often asked about framed here as the 5 stages of tax investigation in plain terms:

(1) Initial contact and information request

(2) Document submission and clarification

(3) Detailed review and technical assessment

(4) Findings, adjustments and penalty consideration

(5) Closure, appeal or further recovery action.

Typical HMRC compliance interventions may last weeks to months: a smaller HMRC compliance check or aspect enquiry can be resolved in a few months, while a full HMRC investigation or HMRC audit may take considerably longer. Taxpayers frequently ask how long does a hmrc compliance check take and how long can hmrc go back for self assessment, the normal enquiry window is usually 4 years in most cases but can extend to 20 years where deliberate concealment is suspected or discovery assessments apply; HMRC’s technical manuals and guidance cover these hmrc enquiry window 4 years parameters and the exceptional longer look‑back windows.

Many self-employed individuals handle their own tax reporting, which increases the risk of errors. If you’re self-employed, you might wonder, when does hmrc investigate self-employed professionals? HMRC typically investigates when they detect inconsistencies in reported earnings, unusually high expenses, or late tax filings.

If your declared income doesn’t match your standard of living, or your expenses seem excessive compared to industry norms, it could trigger an HMRC investigation. Freelancers, tradespeople, and cash-based businesses are especially at risk. To avoid issues, it’s essential to keep accurate financial records and file tax returns on time.

How Do HMRC Use Personal Expenditure Reviews

A growing focus in recent compliance work has been the hmrc personal expenditure crackdown. HMRC looking more closely at personal spending that appears to be funded from undeclared business income and hmrc wage raid payroll checks that drill into payroll records and benefits. These themes mean that self-employed people who mix personal and business spending, or who use informal payroll arrangements, are more likely to draw a compliance check or a tax investigation.

How Do I Know If HMRC Are Investigating Me?

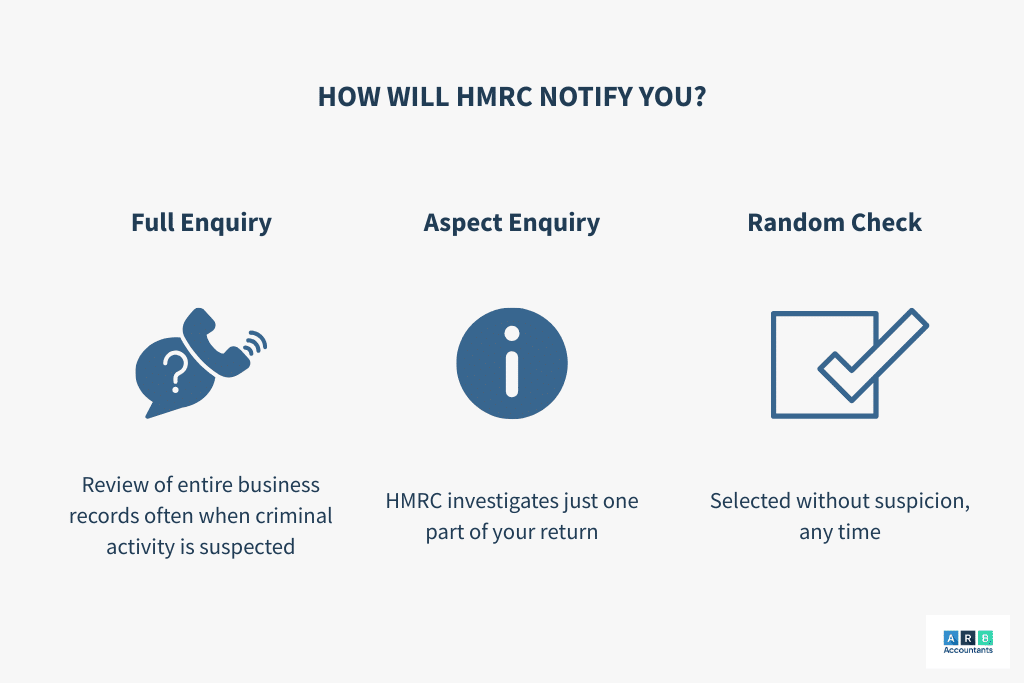

HMRC will not turn up out of the blue to conduct a tax investigation; you will be notified by phone or post when HMRC opens a case on your business. They will either request information or simply inform you that an investigation has been opened.

However, the type of investigation opened depends on whether HMRC is conducting a random check, or what they suspect you of:

Full Enquiry – HMRC will review the entirety of your business records under the belief that there is a significant risk of an error in your tax. This may also be triggered by criminal activity

Aspect Enquiry – HMRC will look at a particular aspect of your accounts, such as inconsistencies

Random Check – Random Checks can happen at any time to any business, not necessarily because of mistakes or wrongdoing

What Happens When You Report Someone to HMRC for Tax Evasion?

If you’re wondering what happens when you report someone to HMRC, HMRC will triage the tip‑off via its fraud reporting system and decide whether the intelligence merits further work. Reports can lead to initial screening, risk‑scoring and where relevant a compliance check or full HMRC investigation; sometimes reports simply produce no action if there is insufficient evidence. If you have reported someone, don’t assume immediate enforcement; the process is confidential and the reporter will not be routinely updated on case progress.

What Happens During an HMRC Tax Investigation?

If HMRC opens an investigation into your tax affairs, the process usually begins with a formal letter. This letter outlines what they’re reviewing whether it’s a specific part of your tax return or a broader examination of your overall finances. Depending on the scope, they might request supporting documents such as bank statements, sales records, VAT filings, payroll data, or contracts.

Once the initial request is made, HMRC may:

- Ask for records to be sent digitally or by post

- Schedule a phone call or in-person meeting

- Visit your business premises or, in some cases, your home

- Interview you or your accountant regarding the accounts in question

During the investigation, HMRC is focused on confirming the accuracy of the information you’ve reported. The process can feel intrusive, but having accurate documentation and a self assessment accountant on your side can make it significantly more manageable. Investigations may result in no further action, adjustments to tax owed, or penalties if errors are found. That’s why knowing how HMRC decides who to investigate and keeping clean records can make a major difference.

“One of our clients had sold her business after 20 years and claimed Business Asset Disposal Relief on her tax return, saving a significant amount in tax by paying only 10%. About 12 years later, HMRC sent a compliance check letter asking for clarifications. We prepared a response with all documentation, answered follow-up questions, and the case was closed successfully with no penalties. It’s important to note this wasn’t a full-blown investigation. HMRC didn’t accuse her of wrongdoing they just wanted to verify the claim. This is a good example of a compliance check that looked serious but was resolved smoothly.”

When Does HMRC Investigate the Self-Employed?

Many self-employed individuals handle their own tax reporting, which increases the risk of errors. If you’re self-employed, you might wonder, when does HMRC investigate self-employed professionals? HMRC typically investigates when they detect inconsistencies in reported earnings, unusually high expenses, or late tax filings.

If your declared income doesn’t match your standard of living, or your expenses seem excessive compared to industry norms, it could trigger an HMRC investigation. Freelancers and Contractors are especially at risk. It’s essential to have accountants for freelancers and contractor accountants to keep accurate financial records and file tax returns on time.

The April 2026 Cliff (MTD for ITSA)

As of February 2026 we are only two months away from the biggest shake up in tax history. From April 6 2026 all sole traders and landlords with a qualifying income over £50,000 must comply with Making Tax Digital for Income Tax.

What you must do now

- Digital Records You can no longer rely on paper receipts. You must keep digital records of all transactions.

- Quarterly Updates Instead of one annual return you must submit light touch digital updates to HMRC every three months.

- Software is Mandatory You must use HMRC compatible software. Warning HMRC has confirmed that failure to sign up for compatible software is now a high priority red flag and the first step in the modern HMRCtax investigation procedure which can trigger a compliance check.

Note If your income is between £30,000 and £50,000 your deadline is April 2027.

How Do I Know If HMRC Are Investigating Me?

HMRC will not turn up out of the blue to conduct a tax investigation; you will be notified by phone or post when HMRC opens a case on your business. They will either request information or simply inform you that an investigation has been opened.

However, the type of investigation opened depends on whether HMRC is conducting a random check, or what they suspect you of:

- Full Enquiry – HMRC will review the entirety of your business records under the belief that there is a significant risk of an error in your tax. This may also be triggered by criminal activity

- Aspect Enquiry – HMRC will look at a particular aspect of your accounts, such as inconsistencies

- Random Check – Random Checks can happen at any time to any business, not necessarily because of mistakes or wrongdoing

How Long Does it Take HMRC to Investigate Someone?

The duration of an HMRC tax investigation varies based on its scope:

- Small investigations: 3-6 months

- Full-scale investigations: Up to 16 months

Providing full compliance and responding swiftly to HMRC requests can help shorten the investigation timeline.

READ RELATED ARTICLE: How to make a voluntary disclosure to HMRC

How to Reduce the Chances of an HMRC Investigation

While tax investigations are selected at random, the majority are triggered by inconsistencies, late filings, or unusual patterns. To lower your chances of being investigated by HMRC, it’s worth tightening up your financial habits and tax reporting.

Here’s how:

- Keep your records clean and consistent: Use cloud-based accounting tools to maintain clear, well-organised financial data.

- Double-check all income is declared: Omitting rental income, freelance earnings, or dividends increases the risk.

- Stay up to date with tax rules for your industry: Especially if you’re self-employed or run a cash-based business — when HMRC investigates the self-employed, it’s often due to industry-specific risks.

- Avoid claiming non-allowable expenses: Only include deductions that HMRC permits for your profession.

- Get your return reviewed by a professional: Even if you handle bookkeeping yourself, an accountant can catch red flags before HMRC does.

The Rising Cost of Being Wrong

As of February 2026, HMRC’s interest rates for late payments remain significantly higher than in previous years. Following recent adjustments, the late payment interest rate is now 7.25% (down slightly from its 7.75% peak in January, but still triple the 2022 rates).

Understanding what are the chances of being investigated by HMRC depends largely on how accurate and transparent your tax submissions are. Taking a proactive approach not only gives peace of mind but may help avoid the stress of an enquiry altogether.

“One client had a PAYE job and some rental income, so we submitted a self-assessment. He forgot to mention that he had an outstanding student loan, so it wasn’t included in the return. HMRC noticed the omission and sent a letter. We replied, explaining it was a genuine oversight, and because it was his first error, they allowed us to correct it without penalties. These types of cases are surprisingly common people forget to tick the student loan box or assume their employer has handled it. It’s a simple mistake, but still triggers inquiries.”

Tax Advice Southend

ARB Accountants offers a range of tax services in Southend, including for tax audits. Our tax investigation accountants in Southend will help to remove the worry and stress from your HMRC investigation, whether you’re facing a single issue dispute, formal enquiry, special enquiry, or just a random check.

Get in touch with us today to see how ARB, one of the trusted accountancy firms Southend businesses rely on, can help ease the burden of a HMRC tax investigation while saving you time and, potentially, a lot of money.