Lease Electric Car Through Limited Company to Save Tax

Electric vehicles (EVs) are no longer just an eco-friendly trend—they are a smart financial choice for businesses. Leasing an electric car through a limited company offers substantial tax savings while also providing a way for businesses to contribute to sustainability efforts.

Not only will your company be reducing its carbon footprint, but you can also benefit from significant tax incentives that make electric cars an attractive financial investment.

As businesses strive to align with the UK government’s environmental goals and take advantage of green initiatives, leasing an electric vehicle becomes a strategic move. With rising fuel costs and the growing push for carbon neutrality, businesses can leverage electric vehicle leases as a means to lower operational costs and enhance their corporate social responsibility profile.

If you’re a contractor managing company vehicles or EV leases, our specialist Accountants for Contractors can help you navigate the tax rules with confidence.

- What Are the Key Benefits of Leasing an EV Through a Limited Company?

- What Are the Tax Benefits of Leasing an Electric Car Through a Limited Company?

- How Does HMRC Handle VAT on Electric Car Leases?

- What Is Electric Car Corporation Tax Relief?

- How Does Company Car Tax Apply to Electric Vehicles?

- Are There Special Tax Benefits for Leasing an Electric Van?

- What Are the Rules for EV Charging and Reimbursement?

- What Support Does the Workplace Charging Scheme Offer?

- Lease vs Buy: Which Is Better for an Electric Car?

- How Can Your Limited Company Save with EV Grants and Charging Support?

- What Leasing Options Are Available for Electric Vehicles Through a Limited Company?

- Should I Buy or Lease an Electric Vehicle As A Limited Company?

- How ARB Accountants Can Help

- Frequently Asked Questions

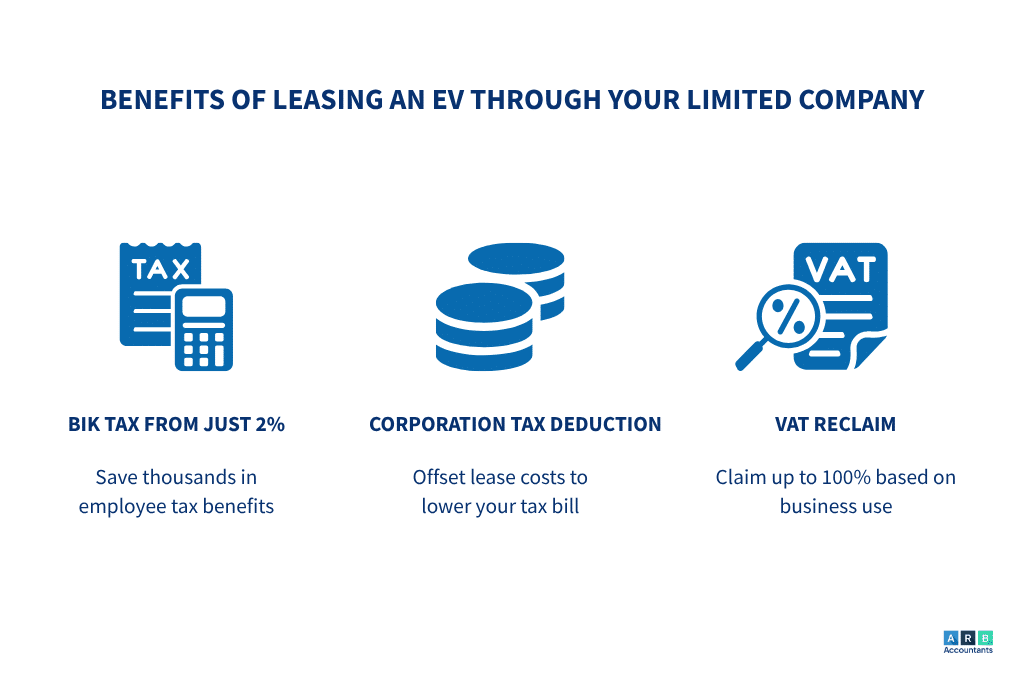

What Are the Key Benefits of Leasing an EV Through a Limited Company?

Leasing an electric vehicle (EV) through your limited company isn’t just a nod to sustainability—it’s a powerful financial strategy. Here’s a quick overview of the most impactful benefits your business can gain from making the switch:

How Can Leasing an EV Provide Significant Tax Savings?

Leasing an EV unlocks a variety of tax advantages, including reduced Benefit-in-Kind (BIK) tax rates, deductible lease payments against corporation tax, and partial or full VAT recovery. These incentives combine to substantially reduce the overall cost of using an electric vehicle.

Do Electric Cars Have Lower Operational Costs for Businesses?

Electric vehicles have fewer moving parts and generally cost less to maintain than petrol or diesel alternatives. Charging costs are often cheaper than fuel, especially if charging infrastructure is installed on-site. This means ongoing savings in addition to the tax benefits.

Freelancers switching to EVs also benefit from tailored tax advice, our Accountants for Freelancers service ensures you claim every allowance correctly.

What Government Incentives Are Available for EV Leasing?

UK government initiatives like the Plug-in Car Grant and the Workplace Charging Scheme reduce upfront costs and support infrastructure investments, making EVs more affordable and practical for businesses of all sizes.

How Does Leasing an EV Improve Corporate Social Responsibility (CSR)?

Driving an EV reflects your company’s commitment to environmental sustainability. It helps reduce your carbon footprint and positions your brand as forward-thinking and eco-conscious—something that customers, investors, and employees increasingly value.

What Are the Tax Benefits of Leasing an Electric Car Through a Limited Company?

Leasing an electric vehicle (EV) through your limited company not only supports your sustainability goals but also offers significant tax advantages. The UK government has introduced several tax benefits, incentives, and green tax relief schemes that make EV leasing an attractive option for businesses. Here’s a breakdown of the key benefits:

What Is Benefit-in-Kind (BIK) Tax Reduction for Electric Cars?

When you provide a company car, Benefit-in-Kind (BIK) tax applies. This is the tax employees (including business owners) pay for using a company car for personal use. The amount of tax depends on the car’s value, its emissions, and how much personal use the employee has.

- Current Rate: As of the 2024/25 tax year, the Benefit-in-Kind (BIK) tax rate for fully electric vehicles is 2%. This rate is among the lowest for company cars, making EVs a cost-effective choice for businesses.

- Upcoming Changes: Starting from April 6, 2025, the BIK rate for electric vehicles will increase to 3%. This gradual rise is part of the government’s plan to align EV taxation more closely with that of other vehicles. However, even at 3%, EVs remain significantly more tax-efficient compared to traditional petrol or diesel cars, which can have BIK rates up to 37%.

Example: If your company car is valued at £30,000, the annual BIK tax at the current 2% rate would be £600, and at the future 3% rate, it would be £900—still far less than the tax for a petrol or diesel car.

Source: For detailed information on BIK rates and calculations, refer to the Pod Point Guide.

How Does Leasing an EV Help Reduce Corporation Tax?

- Deductible Expenses: Lease payments for electric vehicles are considered deductible operating expenses. This means the full monthly rental payments can be offset against your company’s taxable profits, effectively reducing your corporation tax liability.

- Example: If your company leases an electric vehicle at £6,000 per year, and your corporation tax rate is 19%, you could save £1,140 annually in tax.

Source: For more details on corporation tax implications, see the THP Guide.

READ RELATED ARTICLE: Do All Businesses Pay Corporation Tax?

Can a Limited Company Reclaim VAT on Electric Car Leasing?

VAT (Value Added Tax) is a tax that businesses pay on most goods and services. When you lease an electric car through your company, you can reclaim a portion of the VAT you pay on the lease.

- Standard VAT Recovery: When leasing an electric vehicle for business purposes, your company can reclaim 50% of the VAT on the lease payments, provided the vehicle is used for both business and personal use.

- Full VAT Recovery: If the vehicle is used exclusively for business purposes, you may be eligible to reclaim 100% of the VAT. This is particularly advantageous for businesses that can demonstrate the vehicle’s sole use for business activities.

Example: If your lease payment is £6,000 annually, the VAT would be £1,200. Reclaiming 50% would save your company £600 each year.

Source: For comprehensive information on VAT recovery, refer to the VAT recovery guide.

Do Electric Cars Pay Vehicle Excise Duty (VED)?

Vehicle Excise Duty (VED), commonly known as road tax, is typically paid annually for using a vehicle on public roads.

- Standard Rate: From 1 April 2025, electric vehicles are subject to VED. The standard rate is £195 per year.

- First-Year Rate: New electric vehicles registered on or after 1 April 2025 will pay the lowest first-year rate of £10.

- Expensive Car Supplement: Electric vehicles with a list price exceeding £40,000 will incur an additional £425 per year for the first five years from the second year of registration.

How Does HMRC Handle VAT on Electric Car Leases?

One of the biggest considerations when leasing an electric car through a limited company is how VAT is handled. HMRC rules allow businesses to reclaim part—or in some cases all—of the VAT paid on lease rentals.

- 50% VAT Reclaim: If the EV is used for both business and personal journeys, you can usually reclaim 50% of the VAT on the lease.

- 100% VAT Reclaim: If you can prove the vehicle is used solely for business purposes, HMRC permits a full VAT reclaim.

For example, if your annual lease payments total £12,000, and VAT is £2,400, your company could reclaim £1,200 under the 50% rule. That’s a significant saving that reduces the overall cost of your electric car business lease.

This makes VAT recovery one of the most practical electric car lease tax benefits for limited companies looking to optimise cash flow.

What Is Electric Car Corporation Tax Relief?

In addition to VAT, there are corporation tax savings available when you lease electric vehicles. Lease payments are treated as an operating expense, which means they can reduce your company’s taxable profits.

Let’s say your business spends £8,000 annually on an electric car business lease. If your corporation tax rate is 25%, that’s a direct saving of £2,000 in reduced tax liability.

This form of electric car corporation tax relief can help companies free up cash for other investments while still supporting a greener fleet strategy. It’s one of the lesser-known but powerful incentives behind electric car company tax benefits.

How Does Company Car Tax Apply to Electric Vehicles?

When it comes to providing a company car, the Benefit-in-Kind (BIK) rate is critical. Electric vehicles attract a far lower BIK compared to petrol or diesel alternatives.

- Current Rate: 2% BIK for electric vehicles until April 2025.

- Future Rate: Increasing gradually to 3% from 2025–2028, still much lower than traditional cars.

This means directors and employees driving a leased electric vehicle enjoy much lower personal tax bills. For instance, a £40,000 EV under the 2% rate results in just £800 taxable benefit—far less than a similar petrol car.

If you’re weighing up company car options, the reduced electric car BIK makes EVs a no-brainer for businesses seeking to reward staff while keeping costs manageable.

Are There Special Tax Benefits for Leasing an Electric Van?

Electric vans offer similar advantages to cars, with additional benefits for businesses that depend on transportation or deliveries.

- Grants Available: The UK’s Plug-in Van Grant can reduce upfront costs significantly.

- Tax Relief: Lease rentals are deductible against corporation tax, just like cars.

- Operational Savings: Lower running costs make EV vans particularly attractive for logistics-heavy companies.

A electric van lease not only cuts emissions but also signals to customers that your business is committed to sustainability. For trades, delivery services, or SMEs, vans can be more than just vehicles—they can be a brand statement.

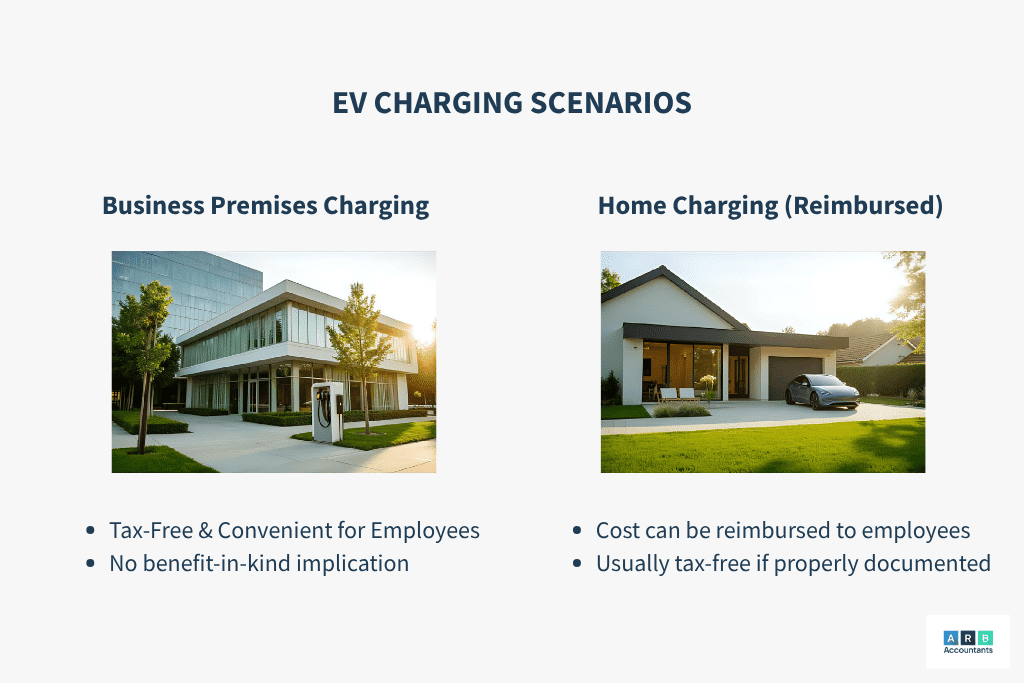

What Are the Rules for EV Charging and Reimbursement?

Electric vehicle charging expenses whether at home or at the business premises can offer tax advantages when managed properly. Here’s how businesses can handle and benefit from EV charging costs:

What Charging Costs Can a Business Claim for EVs?

When it comes to charging the electric vehicle, the costs can also offer some tax benefits:

- Business Charging: Charging an electric vehicle at your business premises is generally not subject to tax.

- Home Charging: If employees charge the vehicle at home, the company can reimburse the cost, which is typically considered a tax-free benefit.

Can a Company Reclaim Electricity Costs for EV Charging?

Charging an electric vehicle is an ongoing expense that should be factored into your company’s budget. Whether the EV is charged at your business premises or an employee’s home, electricity costs can accumulate—but there are tax-efficient ways to manage them.

- Example: If employees need to charge the vehicle at home, the company can reimburse the cost of electricity used for charging, and this reimbursement is typically tax-free.

Source: For more details on how HMRC handles fuel and electricity costs for company cars, refer to HMRC’s Advisory Fuel Rates for electric vehicles.

What Support Does the Workplace Charging Scheme Offer?

One common barrier to EV adoption is charging infrastructure. That’s where the Workplace Charging Scheme (WCS) steps in.

This government-backed initiative provides a grant covering up to 75% of the cost of installing EV charge points, capped at £350 per socket. Even if you’re only just beginning your electric car business lease, you can still apply for support.

For businesses, installing charge points:

- Encourages employees to switch to EVs.

- Reduces reliance on public chargers.

- Strengthens your green credentials.

Pairing an electric car lease tax benefits strategy with the Workplace Charging Scheme ensures both financial and operational advantages.

Lease vs Buy: Which Is Better for an Electric Car?

Many directors ask: should we lease or buy an electric car through a limited company? Each approach has its strengths.

- Leasing an Electric Car:

- Lower upfront costs, predictable monthly payments.

- Access to tax relief on lease rentals and VAT reclaim.

- No depreciation risk—upgrade to new models easily.

- Lower upfront costs, predictable monthly payments.

- Buying an Electric Car:

- Higher upfront investment, but ownership at the end.

- Capital allowances available, including 100% first-year allowance for EVs.

- Potentially better for long-term usage and high mileage.

- Higher upfront investment, but ownership at the end.

For most SMEs and limited companies, leasing often provides better cash flow management and easier access to electric car company tax benefits. However, businesses planning to retain vehicles long-term may prefer ownership.

Ultimately, comparing lease vs buy electric car scenarios with a qualified accountant helps ensure you choose the most tax-efficient route.

How Can Your Limited Company Save with EV Grants and Charging Support?

The UK government offers various grants and incentives to make the transition to electric vehicles more affordable for businesses. These initiatives not only help reduce the upfront costs but also support businesses in their commitment to a greener future.

What Is the Plug-in Car Grant (PiCG) and Who Can Claim It?

The Plug-in Car Grant helps reduce the upfront cost of purchasing an electric vehicle. Businesses can claim up to £1,500 towards the purchase of certain electric vehicles.

- Grant Amount: Depending on the model of the electric vehicle, businesses may receive up to £1,500 off the purchase price, reducing the financial burden of switching to an electric fleet.

- Eligibility: This grant is only available for specific vehicles that meet the government’s criteria for emissions and range, so it’s important to check whether the vehicle you’re considering qualifies.

- Source: For further information, refer to the official Plug-in Vehicle Grants page for more details on the grant’s terms and eligibility.

What This Means for You

If you’re leasing a standard electric car for your company, the PiCG is no longer applicable. However, if your company is considering electric vans, you may still qualify under the Plug-in Van Grant.

How Does the Workplace Charging Scheme (WCS) Help Businesses?

The Workplace Charging Scheme offers businesses a grant to install electric vehicle charging points at their premises.

- Grant Details: Businesses can receive a 75% grant for the cost of installing charging points, with a maximum grant of £350 per socket. This is a great opportunity for businesses to reduce their upfront costs when setting up charging stations for their electric vehicle fleet.

- Stat: Since its launch in 2016, the Workplace Charging Scheme has funded over 57,000 charging points across the UK, making it an invaluable resource for businesses transitioning to electric vehicles.

- Source: For further information and to apply, visit the Electric Vehicle Charging Device Grant Scheme Statistics.

What This Means for You

If you want to install EV charging infrastructure at your office, WCS can significantly lower setup costs. You can apply even if you lease your EVs, and you don’t need to have EVs already in the fleet to qualify.

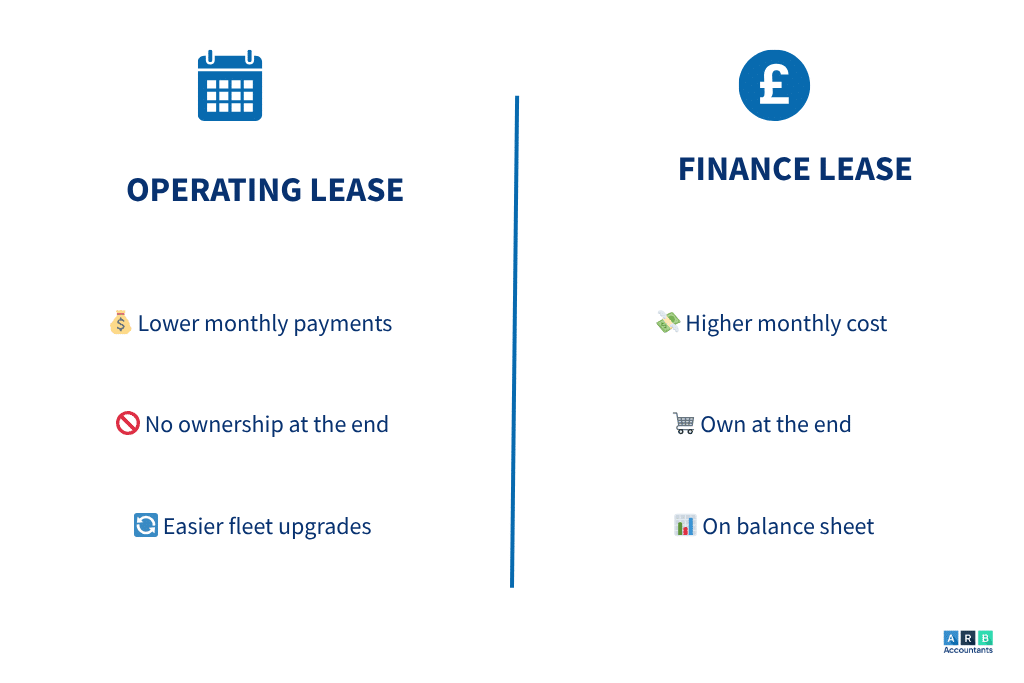

What Leasing Options Are Available for Electric Vehicles Through a Limited Company?

When it comes to leasing an electric vehicle through your limited company, there are two primary options: Operating Lease (Contract Hire) and Finance Lease. Each has its own set of benefits and considerations, depending on your business’s needs and financial strategy.

Here’s a detailed explanation of the two primary leasing options available for UK businesses considering electric vehicle (EV) leasing:

What Is an Operating Lease (Contract Hire) for EVs?

An Operating Lease, commonly known as Contract Hire, is a straightforward leasing arrangement where your business rents the vehicle for a fixed period, typically 2 to 4 years, with regular monthly payments.

Key Features:

- No Ownership: At the end of the lease term, you return the vehicle to the leasing company. There is no option to purchase the vehicle.

- Fixed Monthly Payments: Payments are typically lower than finance leases, making it easier to manage cash flow.

- Maintenance Packages: Many operating leases include maintenance and servicing, reducing unexpected costs.

- Tax Efficiency: Lease payments are fully deductible as operating expenses, reducing your company’s taxable profits thereby saving corporation tax.

- VAT Benefits: If the vehicle is used exclusively for business purposes, you can reclaim 100% of the VAT on the lease payments. If it’s used for both business and personal purposes, you can reclaim 50% of the VAT.

Ideal For:

- Businesses that prefer to avoid the risks associated with vehicle ownership.

- Companies looking to regularly update their fleet with the latest models.

- Firms seeking predictable monthly expenses without the hassle of vehicle depreciation.

What Is a Finance Lease for EVs?

A Finance Lease is a more complex arrangement where your business leases the vehicle with an option to purchase at the end of the term.

Key Features:

- Balance Sheet Asset: The vehicle appears on your company’s balance sheet, and you are responsible for its maintenance and insurance.

- Depreciation: You can claim depreciation on the vehicle, potentially reducing taxable profits.

- Option to Purchase: At the end of the lease term, you have the option to purchase the vehicle for a nominal fee.

- Higher Monthly Payments: Payments are typically higher than operating leases, reflecting the option to purchase.

- VAT Benefits: Similar to operating leases, you can reclaim VAT on lease payments based on the business use percentage.

Ideal For:

- Businesses that plan to keep the vehicle for a longer period.

- Companies seeking to eventually own the vehicle.

Firms that prefer to manage the vehicle’s maintenance and insurance directly.

How Do Operating and Finance Leases Compare for EVs?

| Feature | Operating Lease (Contract Hire) | Finance Lease |

| Ownership | No | Yes (with option to purchase) |

| Balance Sheet Impact | No | Yes |

| Maintenance Responsibility | Leasing company | Business |

| Depreciation | Not applicable | Applicable |

| VAT Reclaim | 50%-100% based on usage | 50%-100% based on usage |

| Monthly Payments | Lower | Higher |

| End-of-Term Options | Return vehicle | Purchase vehicle |

Which Lease Type Is Best for My Limited Company?

The choice between an operating lease and a finance lease depends on your business’s specific needs and financial strategy:

- Choose an Operating Lease if you prefer lower monthly payments, regular fleet updates, and minimal responsibility for vehicle maintenance and depreciation.

- Opt for a Finance Lease if your business plans to keep the vehicle for an extended period, desires ownership, and is prepared to manage maintenance and depreciation.

It’s advisable to consult with a financial advisor or leasing expert to determine the best option for your business’s circumstances.

If you have any further questions or need assistance in selecting the right leasing option for your electric vehicle needs, feel free to ask!

I contacted ARB accountants at short notice to help me verify some documentation required for a probate process. Saurabh was extremely helpful, accommodating and communicative. I would definitely work with them again. Thank you, Saurabh!

Should I Buy or Lease an Electric Vehicle As A Limited Company?

Deciding whether to buy or lease an EV depends on several factors, including your business needs, financial situation, and long-term goals. Below is a breakdown of the key points to consider when deciding between buying or leasing an electric vehicle for your business:

| Aspect | Leasing | Buying |

| Financial | Lower upfront & monthly costs; tax-deductible payments; no depreciation risk | Higher upfront cost, full ownership, potential depreciation, and capital allowances available |

| Maintenance | Often included in the lease | Owner is responsible for all costs |

| Mileage | Mileage limits apply; excess charges are possible | Unlimited mileage |

| Flexibility | Short-term contracts, easy to upgrade | Long-term investment; can sell anytime |

| Incentives | Easier access to grants & BIK savings, handled by the provider | Plug-in Grant available; varies by model |

When Should a Business Lease an Electric Car?

- Lower your upfront cost and enjoy lower monthly payments.

- Keep your fleet fresh and newer, avoiding concerns about depreciation and resale.

- Enjoy the simplicity of included maintenance and easy access to tax deductions and VAT recovery.

- Have predictable costs with mileage limits that align with your business needs.

When Should a Business Buy an Electric Car?

- Own your vehicle outright and have no mileage limits.

- Keep the car for a longer period and benefit from long-term value.

- Avoid monthly lease payments and have more flexibility regarding modifications or usage.

Ultimately, leasing is great for businesses that prefer lower upfront costs, flexibility, and the ability to upgrade frequently, while buying is ideal for businesses planning to keep a car for a longer time and build equity in the vehicle.

If you need assistance deciding which option is right for your business or help navigating the tax benefits available, feel free to contact ARB Accountants! We can help you maximize your savings and make the most informed decision.

Why Leasing is a Great Option for Limited Companies

Leasing an electric vehicle (EV) through your limited company offers several advantages that make it a smart choice, especially when it comes to managing your finances, cash flow, and vehicle fleet. Here’s why leasing is a great option for businesses:

Flexibility and Cash Flow Management

Leasing avoids large upfront costs and spreads payments into predictable monthly instalments. This helps you preserve cash flow and allocate capital to other areas of your business, especially useful for growing companies.

No Depreciation Worries

With leasing, you don’t worry about your car losing value. Just return the vehicle at the end of the term and upgrade to a newer model—no resale hassles, no loss on investment.

Predictable Costs

Leasing gives you fixed monthly costs, making budgeting easier. Many leases include maintenance and servicing, helping you avoid unexpected repair bills and ensuring smooth operations.

If your business wants deeper compliance checks, our tax investigation accountants can review your EV-related claims to ensure full HMRC accuracy.

How ARB Accountants Can Help

Leasing an electric vehicle through your limited company can unlock major tax savings, from Benefit-in-Kind (BIK) reductions to VAT reclaims and corporation tax deductions. But making the most of these incentives requires the right strategy.

At ARB Accountants, we specialise in helping UK businesses navigate the complexities of EV leasing. Whether you’re deciding between an Operating Lease or Finance Lease, or trying to reclaim VAT correctly, we’ll guide you through the process and tailor our advice to your specific setup.

We also offer full accounting support to keep your business compliant and tax-efficient:

- Accurate VAT reclaims on lease payments and charging costs

- Smart financial strategy to help you plan and grow with confidence

Let’s make sure your EV lease works for your business, not against it. Get in touch with ARB Accountants Southend today to explore your best options and start saving.