New IR35 Rules Explained for Contractors

The new IR35 rules have become a major focus for contractors because they reshape how off payroll working is assessed across the UK contracting market. These rules affect how engagements are classified for tax purposes and determine whether a contractor must pay employment style taxes under IR35 legislation. To understand these developments, contractors need clarity on core terms such as off payroll working, deemed employer, PSC or Personal Service Company, and the Status Determination Statement or SDS. These concepts guide how IR35 regulations work in practice and help contractors understand their position in relation to ir35 tax rules and contractor tax ir35 obligations.

Recent reforms are significant because they include company size threshold changes, the introduction of the PAYE set off mechanism and wider adjustments to compliance behaviour across the supply chain. These changes mean contractors must understand how does IR35 work, who holds responsibility for decisions, and the wider ir35 implications that follow. According to HMRC, IR35 reform has already shifted more than 130,000 workers into deemed employment tax status since 2021, reflecting the scale of the framework and the impact it continues to have on the UK contracting workforce.

- What Are the Fundamental New IR35 Rules That Contractors Need to Know

- How Does the Change in Company Size Thresholds Impact IR35 from April 2025

- What Is the PAYE Set Off Mechanism and Why Does It Matter for Contractors

- How Do the New IR35 Rules Affect Contractor NICs and PAYE Costs

- What Should Contractors Do to Reassess IR35 Risk Under the New Rules

- Conclusion

- Frequently Asked Questions

What Are the Fundamental New IR35 Rules That Contractors Need to Know

The new IR35 rules include several core updates that change how the off payroll working regime functions. The first major development is the introduction of the PAYE set off mechanism. Historically, if a client failed to correctly apply IR35 legislation, HMRC could demand the full PAYE and National Insurance bill from the deemed employer without considering tax already paid by the PSC. The new set off rules allow HMRC to offset tax and National Insurance already paid at the contractor’s end when calculating liability. This closes a long discussed gap in the regime and aligns more closely with the principle of avoiding double taxation. HMRC explains the mechanism in its policy documentation which outlines how set off reduces the PAYE bill for non compliance cases.

Clarifying Who Issues the SDS

A second key element of the new IR35 rules relates to the consistency of status determinations. In the off payroll working regime, responsibility for issuing an SDS normally sits with the client. However, this is only true when the client qualifies as medium or large under UK company law. If the client is a small company, the responsibility shifts back to the contractor’s PSC. Understanding this distinction is central to ir35 compliance because it affects who must demonstrate reasonable care and who carries exposure if an incorrect classification is made.

Stronger HMRC Enforcement Across Supply Chains

A third change involves increased scrutiny of ir35 contractor rules. HMRC has stated repeatedly that it is strengthening enforcement around labour supply chains, umbrella companies and disguised employment patterns. This includes data cross checking and more targeted compliance interventions. These developments matter for both contractor uk ir35 engagements and limited company IR35 structures because they raise the likelihood of HMRC reviews across sectors such as IT, engineering, consulting and healthcare. These elements collectively create new ir35 implications for anyone operating a PSC or working through an intermediary.

READ RELATED ARTICLE: How Likely Are You to be Investigated by HMRC?

How Does the Change in Company Size Thresholds Impact IR35 from April 2025

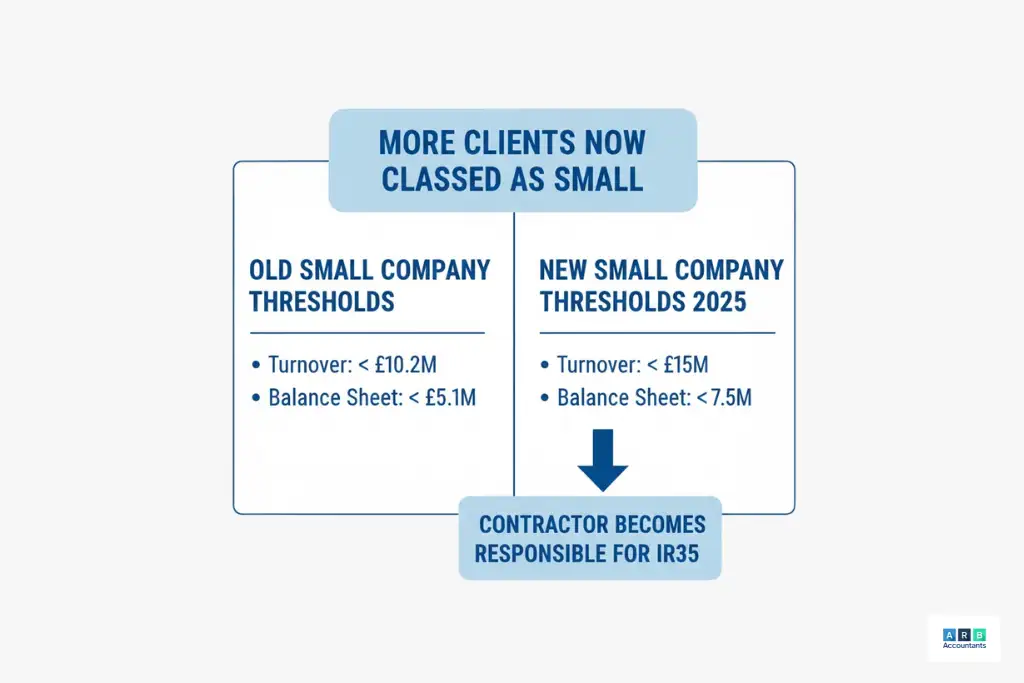

From April 2025, revised company size thresholds under the Companies Act will begin to influence future IR35 assessments. The thresholds for turnover and balance sheet size are increasing which means more clients will now fall into the small company category. Sherwin Currid highlights that an increased number of organisations will no longer meet the medium or large classification tests, which alters how ir35 regulations apply in practice

When Contractors Will Actually Feel the Impact

Although the thresholds take effect in April 2025, the impact on IR35 status determinations appears in the following tax year. Forvis Mazars notes that because IR35 assessments rely on the client’s accounts from the previous financial year, contractors will start to see practical changes for assignments beginning around April 2026. This staggered timeline is important because contractors need to understand when responsibility may shift back to their PSC under limited company IR35 rules.

More Roles Moving Back Under PSC Determination

A major market effect is the likelihood of reduced blanket inside IR35 decisions. Recruiter.co.uk reports that more clients becoming small companies will place the responsibility for IR35 determinations back onto PSCs which may increase opportunities for contractor outside IR35 roles. This shift interacts directly with how does IR35 work because it changes the decision maker and therefore the risk profile. The overall market could become more flexible as clients are no longer required to issue SDS documents in the same way and contractors regain control of their engagement assessments under ir35 contractor processes.

Why Contractors Must Track Year-to-Year Client Classification

Contractors must track these ir35 rule changes carefully because these threshold adjustments may affect different sectors unevenly. Clients with fluctuating revenue may move between classifications year to year which creates additional complexity for ir35 compliance planning. Understanding these patterns helps contractors evaluate whether a role is likely to be treated as contractor inside IR35 or outside for future engagements. The cumulative result is a more dynamic environment where ir35 tax rules and commercial decisions interact more closely.

What Is the PAYE Set Off Mechanism and Why Does It Matter for Contractors

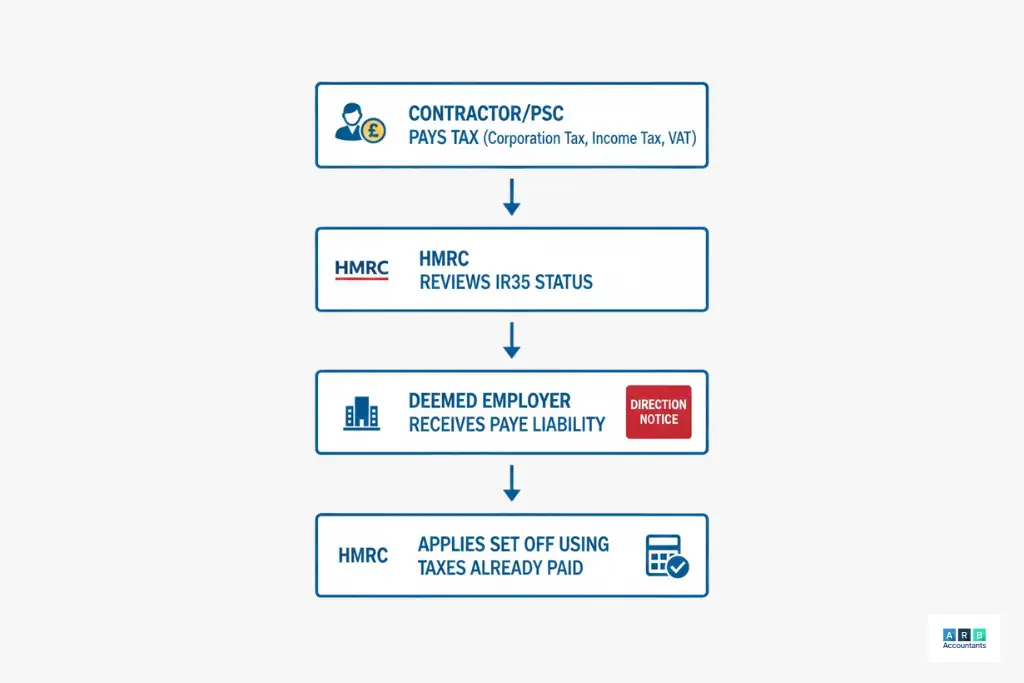

One of the most significant features within the new IR35 rules is HMRC’s PAYE set off mechanism which is designed to prevent double taxation in off payroll working cases. Under earlier ir35 legislation, if a client incorrectly determined a contractor’s status and treated an engagement as outside IR35 when it should have been inside, HMRC demanded the full PAYE and National Insurance bill from the deemed employer. This created cases where the contractor or PSC had already paid income tax on the same income under contractor tax IR35 rules. The new set off mechanism allows HMRC to offset tax already paid by the PSC against the liability of the deemed employer, creating a fairer approach to ir35 compliance. The policy update is detailed in HMRC’s consultation documentation which highlights the scope of correction in misclassified engagements.

Why the Old System Was Unfair

The previous system often resulted in an over collection of tax because HMRC did not factor in corporation tax, dividend tax or personal tax already paid by the contractor. Under the new IR35 rules, HMRC will calculate PAYE set off by reviewing the contractor’s historic filings and determining which amounts can legally reduce the deemed employer’s liability. This correction aligns more closely with ir35 regulations and improves fairness for both ir35 contractor PSCs and clients. The change does not offer refunds to contractors but instead adjusts the employer side liability which means the financial benefit is indirect.

How Direction Notices Work

The process relies on direction notices. Once HMRC concludes that IR35 should have applied, the department issues a direction to the client or fee payer confirming that set off will be considered. This direction outlines how PAYE will be recalculated and what evidence or tax records HMRC will use. Contractors may appeal if they believe the direction inaccurately represents the tax they previously paid. These appeals follow standard HMRC dispute routes which are consistent with other ir35 tax rules.

Benefits and Risks for Contractors

For contractors, the PAYE set off mechanism has both benefits and risks. The benefit is reduced exposure to double taxation particularly for contractor uk ir35 engagements where PSCs have paid substantial dividend tax. The risk is that contractors do not receive refunds even if they overpaid because set off only reduces the deemed employer liability, not the contractor’s final position. This is important when considering who does IR35 apply to and assessing whether a contract should be aligned with limited company IR35 arrangements. The mechanism supports fairness but does not replace the need for accurate status determinations under how does IR35 work frameworks.

READ RELATED ARTICLE: PAYE refund: How to Claim Your Overpaid Tax

How Do the New IR35 Rules Affect Contractor NICs and PAYE Costs

The new IR35 rules also influence National Insurance Contributions and PAYE obligations which directly affect contractor income. Employer NICs will rise from April 2025 which increases the cost of engaging workers under inside IR35 arrangements. Umbrella.co.uk highlights that the employer NIC rate is increasing to help fund wider public spending commitments and this affects both payroll employees and deemed employees within ir35 contractor rules (source). This increase matters because employer NIC is deducted from the assignment rate before calculating a contractor’s pay which influences both contractor inside IR35 and contractor outside IR35 negotiations.

Threshold Adjustments Adding More Complexity

Threshold changes for employer NICs also add complexity. If thresholds fall or remain static relative to rising wages, more deemed employers will incur additional NIC liabilities. This could lead end clients or agencies to adjust day rates or reconsider resourcing strategies for ir35 contractor engagements. In practice, these NIC adjustments interact with ir35 implications because they increase the total cost of placing a contractor inside IR35 and may push clients to explore alternative delivery models, including project based consulting or fixed fee service contracts.

Mandatory Payrolling of Benefits from 2026

Another major change is mandatory payrolling of benefits which becomes compulsory from April 2026. Umbrella.co.uk explains that benefits such as medical cover or company perks must be taxed through payroll rather than through P11D reporting. This adjustment is relevant to contractors who operate inside IR35 and receive benefits in kind because it changes the timing and method of taxation. This connects directly with how does IR35 work and the mechanics of deemed employment.

How These Changes Affect Take-Home Pay

These NIC and PAYE adjustments influence contractor income under ir35 tax rules because the total tax load is shared across the supply chain. Contractors operating under limited company IR35 conditions must track these changes carefully to evaluate whether an engagement remains commercially viable. Contractors who understand these adjustments will be in a stronger position to negotiate fair day rates that reflect the true cost of working under the new IR35 rules.

What Should Contractors Do to Reassess IR35 Risk Under the New Rules

Step 1: Review Contracts and Working Practices

Contractors should take proactive steps to review their IR35 risk profile now that the new IR35 rules are coming into force. The first step is assessing contracts and working practices because these factors drive classification under ir35 legislation. Contractors should review substitution clauses, control indicators and mutuality of obligation. HMRC’s CEST tool remains an important reference point for understanding how does IR35 work although it should be used alongside professional judgement. The tool offers structured guidance which helps contractors identify gaps in ir35 compliance and document reasoning for future enquiries. HMRC provides the tool here.

Step 2: Reassess Clients Based on New Size Thresholds

Contractors should also reassess existing clients because company size thresholds will soon determine whether clients or PSCs carry responsibility for issuing SDS documents. This means contractors may need to revisit roles previously treated as inside IR35 or outside IR35 under earlier rules. Reclassification may influence decisions for contractor uk ir35 engagements and shift the risk back toward the PSC which creates new ir35 implications.

Step 3: Seek Professional IR35 Advice When Needed

Professional tax advice can help contractors interpret borderline cases. High day rate engagements and long term contracts often present greater scrutiny under ir35 regulations and benefit from professional review. Specialists can help contractors understand where they sit in relation to who does IR35 apply to and whether their structure aligns with limited company IR35 expectations.

Step 4: Document Evidence for HMRC Protection

Finally, contractors should document all factors related to status, including SDS discussions and evidence of working practices. Clear documentation strengthens the contractor’s position if HMRC reviews the engagement. This step supports risk management and helps contractors maintain clarity when dealing with ir35 contractor rules, contractor inside IR35, or contractor outside IR35 situations. Accurate record keeping also supports negotiations with clients who are adjusting policies in response to the new IR35 rules.

Conclusion

The new IR35 rules represent a structural shift for the contracting sector because they influence who manages status decisions and how liabilities flow through the supply chain. For many PSCs, the reclassification of small clients means greater control over assessments, which allows an ir35 contractor to apply IR35 legislation and IR35 regulations more accurately to their own working practices. This shift can improve outcomes for contractor outside IR35 positions, but it also increases responsibility for evidence gathering, tax forecasting, and long term IR35 compliance, areas where firms like ARB Accountants increasingly support contractors.

The updated framework introduces new expectations around documentation and reporting. Contractors must understand how does IR35 work from a practical tax administration standpoint, especially where PAYE set off and contractor tax IR35 calculations interact with direction notices. Although these changes may reduce unnecessary exposure for some limited company IR35 engagements, they create new ir35 implications in the form of heightened bookkeeping requirements and more scrutiny of ir35 contractor rules.

Contractors who want to reduce risk under IR35 rule changes should review contracts, monitor client size status, and prepare financial buffers for unexpected liabilities. Contractor Accountants become valuable when interpreting how ir35 tax rules will apply to specific engagements. A proactive strategy that includes contract reviews, updated risk assessments, and readiness for HMRC engagement helps ensure stability as the new IR35 rules reshape the contracting landscape.