Is Your Business Due for a VAT Health Check?

If you’re struggling to calculate your VAT return or worried about VAT return errors, or wondering whether a different VAT scheme might work better for your business, a VAT health check could be the solution. In this blog, ARB Accountants explains the difference between VAT schemes UK businesses use and VAT health checks, what a check typically includes, and how it could benefit your business. We also share insights into small business VAT advice and how to avoid costly VAT penalties UK.

So, what is a VAT health check? A VAT health check is an external audit of a businesses VAT processes to determine whether the VAT is being calculated correctly or whether there is an alternative VAT programme that is more suited. A VAT health check also helps to recognise any inaccuracies that could lead to financial penalties.

Keep reading to find out more about VAT health checks including what they are and the benefits of completing them for your businesses.

What is a VAT Health Check?

A VAT health check is an external review or VAT audit of your business’s VAT processes. It assesses whether your VAT is being calculated correctly and identifies if a different VAT scheme, such as the flat rate VAT scheme or standard VAT scheme, could better suit your business needs. It also helps pinpoint any VAT return errors, VAT risk assessment concerns, or compliance issues that could result in VAT penalties UK from HMRC.

Businesses often request VAT health checks when they’re unsure about their current VAT practices or want to improve efficiency. By auditing your VAT setup, a health check can save you time, reduce risk, and potentially lower your tax burden.

What is Included in a VAT Health Check UK?

A VAT health check typically involves a detailed VAT audit of your VAT-related records, procedures, and compliance. Some of the typical features of a VAT audit includes:

- Review of all accounting books to detect VAT return errors

- Review of VAT invoicing formatting under the standard VAT scheme or flat rate VAT scheme

- Detailed analysis of VAT input and output calculations

- Identification of technical mistakes that could lead to VAT penalties UK

- Implementation of VAT laws and regulations including an in-depth VAT risk assessment

- Identifying VAT risks and concerns

- Recommending whether the current VAT scheme is appropriate and cost-effective

- Suggesting remedies for technical areas of concern or inefficiency, improving accuracy for your next VAT return

As you can see, VAT health checks can be very thorough, therefore it is important that you have your financial records up to date so that an accurate assessment can be completed.

READ RELATED ARTICLE: Do all businesses pay corporation tax?

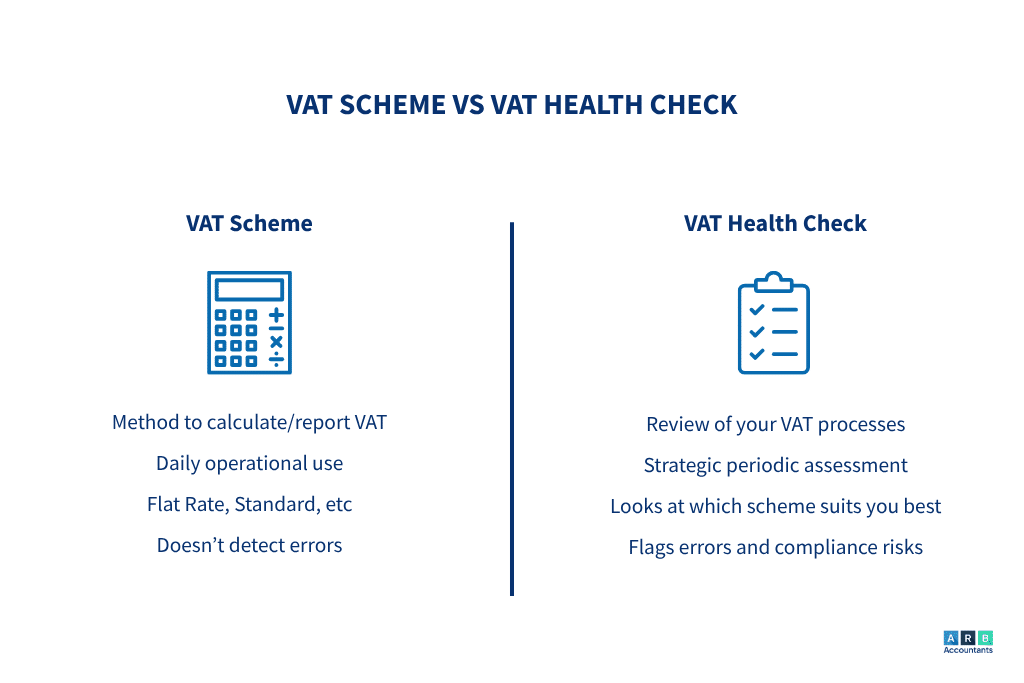

What is the Difference Between a VAT Scheme and a VAT Health Check?

A VAT scheme is the method your business uses to calculate and report VAT to HMRC—such as the flat rate VAT scheme, standard VAT scheme, or other options available under VAT schemes UK. In contrast, a VAT health check is a service that reviews your existing VAT processes and performs a comprehensive VAT risk assessment to determine if a better scheme is available.While the VAT scheme is a day-to-day operational choice, a health check is a strategic review aimed at improving your compliance, reducing VAT return errors, and minimising the risk of VAT penalties UK. They work hand-in-hand to help you submit accurate returns and optimise your VAT position.

Benefits of Having a VAT Health Check

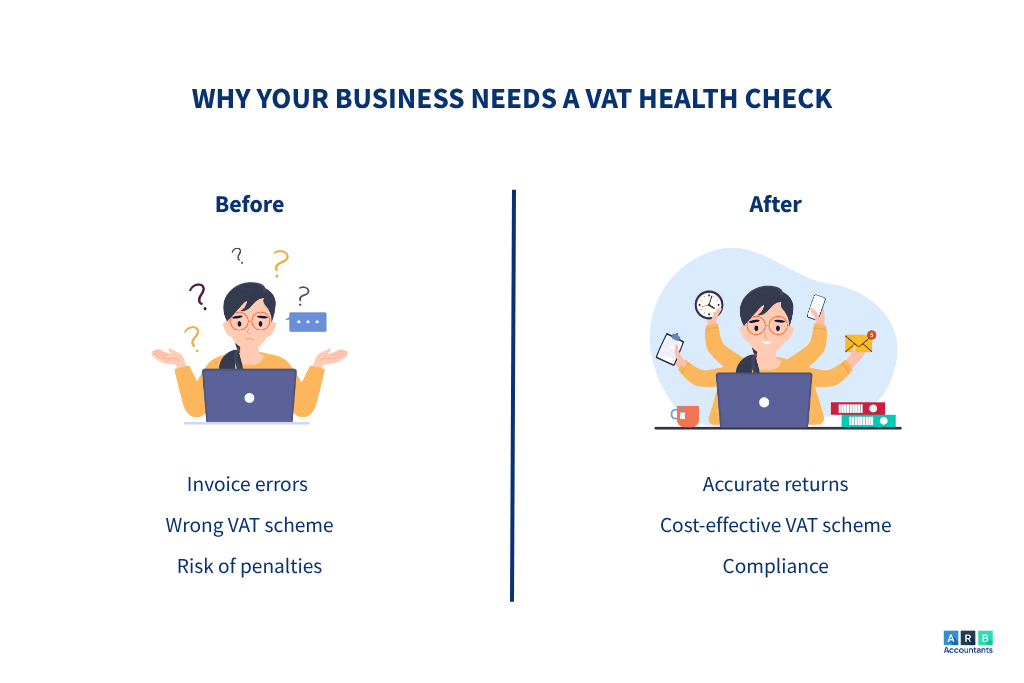

VAT health checks are not conducted to recognise the errors you have made within your VAT calculations. Instead, they can provide a variety of benefits to you and your business. To learn more about the benefits of completing a VAT health check, take a look at the table below.

| Flags Up New Opportunities | One of the main benefits of completing a VAT health check is that it can help you to identify opportunities to improve your VAT position. For example, if your business has been using the Point of Sale Scheme when calculating the VAT for the goods purchased, you may find that there are some inaccuracies. Unless your business has an electronic till that displays the VAT figure at the point of sale, it can be quite difficult to get an accurate figure. As a result, inconsistencies may be found during the VAT health check which suggest that alternative VAT schemes may work better for you. |

| Preempts Errors | By completing a VAT health check, you also open your business up to the opportunity to catch miscalculations or non-compliance through a thorough VAT audit and VAT risk assessment before you submit a VAT return, you reduce the risk of VAT penalties UK. This is significant because if you submit financial information that is miscalculated, you risk being fined by HMRC. Therefore, utilising a VAT health check service that is completed by a reputable accountant would be a great benefit for your business. |

| Opportunity to Ask Questions | Another advantage of completing a VAT health check is that it provides you with the opportunity to ask an expert questions on technical topics that you may not have the most experience in. VAT can be complex. A VAT health check gives you the chance to ask questions and get tailored advice from qualified accountants who specialise in VAT schemes and audits. Whether you’re unsure about calculations or choosing between the flat rate VAT scheme and the standard VAT scheme, expert insights can increase your confidence and reduce future errors. This may also make a difference to the amount of errors made in the future. |

| Considers the Impact of External Influences | VAT health checks are also beneficial because they take into account external events that may be impacting your VAT position. Events like Brexit, COVID-19, or new legislation can affect your VAT position. A VAT health check takes these changes into account during your VAT risk assessment, ensuring your VAT processes and chosen scheme remain fit for purpose under current conditions. For example, Brexit may have impacted your revenue which would then make it more of a priority to make the most out of the VAT scheme and save money. |

Common Causes of VAT Return Errors and How a VAT Health Check Helps

One of the most frequent issues businesses face is VAT return errors. These can stem from incorrect invoice formatting, misclassification of sales, or choosing the wrong VAT scheme. A detailed VAT audit as part of your VAT health check uncovers these problems early, helping avoid costly VAT penalties UK.

By conducting a VAT risk assessment, we identify weak points in your VAT processes and recommend adjustments to either the standard VAT scheme or the flat rate VAT scheme based on what suits your business model best. Our small business VAT advice ensures even the smallest errors don’t accumulate into large liabilities.

Saurabh and his team have been looking after our company statutory accounts, VAT returns and payroll for the last 4 years and I cant recommend them highly enough. Very professional and efficient.

VAT Health Checks at ARB Accountants:

ARB Accountants offer comprehensive VAT health checks and VAT audits in Essex to help businesses ensure they’re using the best VAT scheme and submitting accurate VAT returns free from VAT return errors. Our experienced chartered accountants provide tailored small business VAT advice including VAT risk assessment, helping you avoid VAT penalties UK and optimise your tax position.