IFRS Climate-Related Financial Disclosures: A Guide for SMEs

As a small business owner, you may be interested in current changes being made to IFRS standards with regards to climate related financial disclosures. Despite only being compulsory for public listed companies, the IFRS regulations can be used by small to medium sized businesses, and you may find that there are some benefits to following the new prototype climate related financial disclosures.

So, what is the IFRS and what is changing? The IFRS is an organisation that sets global accounting standards to ensure comparability and transparency across publicly listed companies. In 2021, they introduced a number of new climate-related financial disclosures, as per the request of COP26 global leaders.

Read on to learn more about the IFRS and their prototype climate-related disclosures, as well the benefits of these disclosures for small to medium sized businesses.

- What is the IFRS?

- What IFRS Regulations are Changing?

- What Are the New Climate Related Financial Disclosures Proposed by the IFRS?

- What are the IFRS Regulation Changes in Relation to Climate-Related Financial Disclosures?

- What is the Aim of Climate-Related Financial Disclosures?

- What are the Benefits of New Climate-Related Financial Disclosures?

- Accountancy Services at ARB Accountants

- Frequently Asked Questions

What is the IFRS?

The IFRS stands for the International Financial Reporting Standards and represents a set of regulatory frameworks for companies to use when creating their financial statements. The IFRS are used all across 140 countries worldwide and help to maintain a certain standard of financial reporting that makes company’s financial information comparable, transparent and of high quality.

The IFRS are formed in conjunction with the IASB (International Accounting Standards Board) and newly created ISSB ( International Sustainability Standards Board) to ensure financial statements provide investors with reliable information on the company’s financial position, as well as information on the company’s sustainability factors that could affect company value.

The IFRS, or International Financial Reporting Standards, is a set of frameworks used by companies worldwide when preparing their financial statements. Adopted in over 140 countries, the IFRS ensures consistency, transparency, and high-quality financial reporting.

The standards are developed by the International Accounting Standards Board (IASB) and, more recently, the International Sustainability Standards Board (ISSB). These prototype standards are part of the broader IFRS sustainability disclosure standards, which aim to improve transparency in sustainability-related financial reporting. Together, they help companies provide accurate financial insights to investors—alongside reporting on sustainability factors that could affect company performance and valuation.

The IFRS is now extending its work to include IFRS sustainability standards, developed in collaboration with the ISSB, to address the growing demand for sustainability-focused disclosures.

What IFRS Regulations are Changing?

As part of COP26, global leaders, alongside the IFRS, decided that a new set of climate-related disclosures needed to be created in order to help alleviate and manage the climate impact of companies as a result of their accountancy reporting.

The UN Climate Change Conference was a catalyst for change within financial regulation and has demanded a new set of climate-related financial disclosures be produced by the middle of 2022 to help investors make wiser decisions with regards to investing in companies that significantly affect climate change.

What Are the New Climate Related Financial Disclosures Proposed by the IFRS?

As part of COP26, global leaders, alongside the IFRS, decided that a new set of climate related financial disclosures needed to be created in order to help alleviate and manage the climate impact of companies as a result of their accountancy reporting.

The UN Climate Change Conference was a catalyst for change within financial regulation and has demanded a new set of climate related financial disclosures be produced by the middle of 2022 to help investors make wiser decisions with regards to investing in companies that significantly affect climate change. These prototype standards are part of the broader IFRS sustainability disclosure standards, which aim to improve transparency in sustainability-related financial reporting.

Saurabh has been very thorough. Cleaning up sage and clear with his explanations. Arb have been a breath of fresh air. Highly recommended.

What are the IFRS Regulation Changes in Relation to Climate-Related Financial Disclosures?

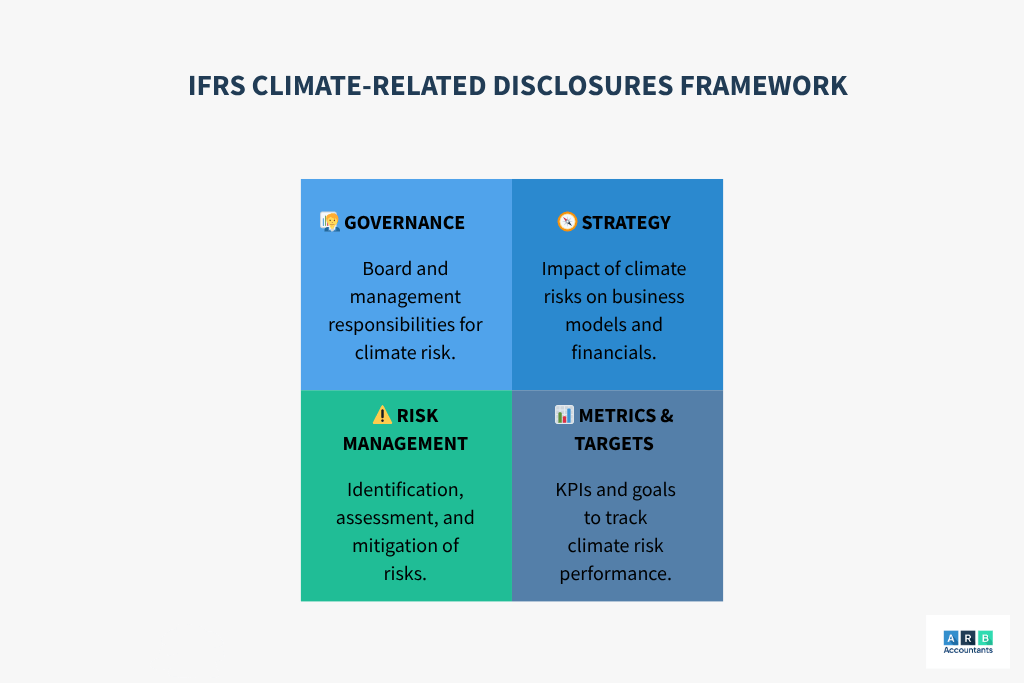

The initial climate-related disclosures prototype is based on the TCFD standards, which is a voluntary framework already being used by some companies. The IFRS decided to base the prototype framework on the TCFD standards to act as a baseline for climate-related reporting guidance whilst they take the time to develop some more complex and comprehensive standards that can be used globally. Below we have detailed a summary of the IFRS regulation changes in relation to the IFRS prototype climate-related disclosures.

Governance:

An entity must disclose information relating to financial reporting that is relevant to understanding governance processes, controls and procedures used to monitor and manage climate-related risks and opportunities. Included in this, the company must disclose a description of the board of committee that is in charge of the governance of the company and its climate-related management, including:

- How the body’s responsibility is reflected in terms of reference and policy

Strategy:

An entity must disclose information that enables users of financial reporting to understand its strategy for addressing climate-related risks as well as an explanation of the climate-related risks that are likely to affect the business model, strategy and cash flow over time. An entity must also disclose information on how they have assessed if and how any climate-related risks will affect their business model including potential transition plans.

Furthermore, an entity must also disclose areas in which climate-related risks would affect their financial statements, including financial position, cash flows and profits at year end of the addressed period. Simultaneously, the entity must also produce an assessment of the resilience of the entity’s strategy relating to climate issues.

Risk Management:

An entity must disclose information that enables users of financial statements to understand how climate-related risks have been identified, assessed, managed, and mitigated. In order to achieve this the entity must describe:

- For each risk, details on how it is being monitored, managed, and mitigated

This approach contributes to effective climate risk reporting and supports alignment with the IFRS’s climate related financial disclosures.

Metrics and Targets:

An entity must disclose information that enables users of financial statements to understand their performance in managing significant climate-related risks. To do so they must disclose:

- Cross industry metrics

- Industry based metrics

- Other key performance indicators used by the board or management to measure progress towards the targets that have been set

These metrics are essential for businesses to align with climate related financial disclosures, especially under evolving IFRS ESG reporting requirements.

What is the Aim of Climate-Related Financial Disclosures?

The aim of climate-related financial disclosures is to help stakeholders make better informed judgements, decisions and investments based on the information provided in financial statements. The climate-related disclosures will provide guidance on how to produce financial statements in line with climate-related issues, so that companies are more transparent about their climate impact.

These disclosures play a key role in shaping IFRS ESG reporting, helping businesses align their environmental, social, and governance data with global financial expectations.

Clear climate related financial disclosures also make it easier for both stakeholders and investors to assess long-term risks and sustainability strategies.

READ RELATED ARTICLE: What is the difference between CSR and ESG?

What are the Benefits of New Climate-Related Financial Disclosures?

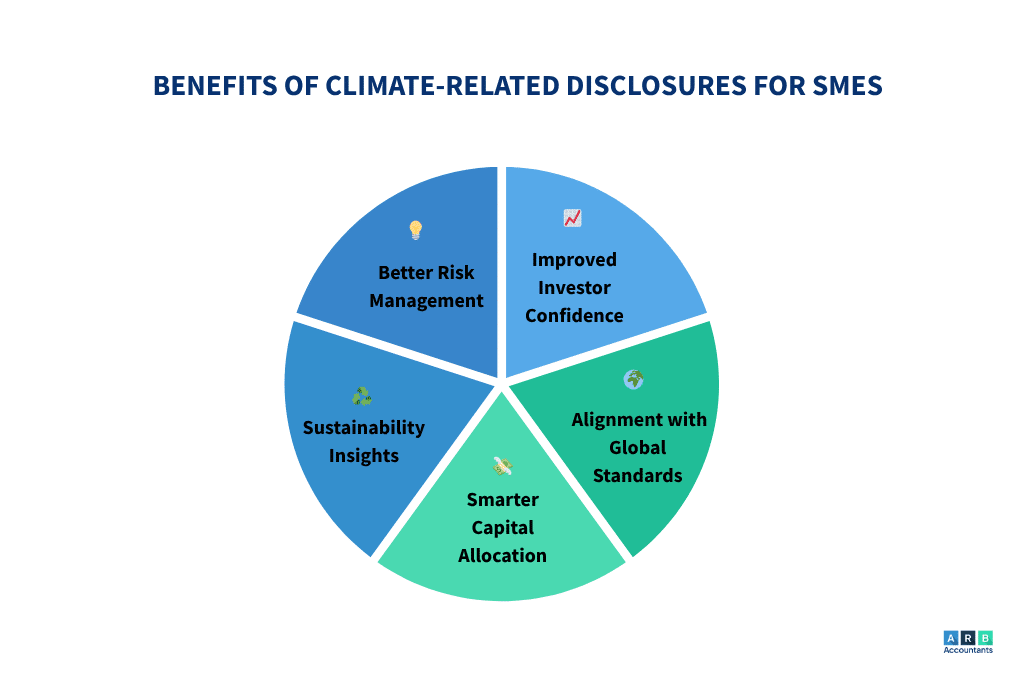

You may be wondering whether the new climate-related disclosures hold any benefits, especially for small to medium sized businesses. Firstly, disclosures are beneficial in that it helps streamline the assessment of climate-related risks all the way through the business, from suppliers and competitors, through to customers.

This means that it allows both businesses and stakeholders to see the overall climate impact of the business, rather than just one area of production. This can be beneficial to smaller businesses because it can help to identify small changes that can be made quite easily. This may encourage significant investment to help grow the business further.

Climate-related disclosures can also be beneficial in terms of cash flow and capital allocation, especially with regards to smaller to medium sized businesses. Smaller businesses tend to have less capital available and therefore need to be more strict with what they invest in to ensure they get the most out of their investment. The climate-related disclosures can help businesses to identify where it is best to invest their capital to get the most out of it and if that just so happens to be into climate risk reduction, then even better.

The climate-related disclosures can also help businesses to become better at risk management across the whole company, including climate-related risks. The regulations encourage a thorough evaluation and assessment of climate-related risks which can encourage a more efficient business, because it helps to encourage risk mitigation as soon as possible. If this structure is used for general risk management it can also be just as effective.

Accountancy Services at ARB Accountants

ARB Accountants are a team of experienced chartered accountants in Essex. Our accountants can help save you time, money, and hassle, as well as providing you with financial statements that align with up to date regulations from the IFRS, including climate-related disclosures.

Learn more about our services, or get in touch today for a free 60 minute consultation.