What Makes a Strong Balance Sheet?

A strong balance sheet is the backbone of a financially stable business, yet many companies struggle with managing their assets and liabilities effectively. Without the right balance, businesses face cash flow problems, high debt, and difficulty securing funding. This can lead to missed opportunities for growth and even financial instability.

Strong balance sheets aren’t just for large companies, even small businesses and freelancers benefit from clear financial reporting, which is why many rely on specialist accountants for freelancers to keep everything on track.

So, what makes a strong balance sheet? It’s one that supports business goals, ensures liquidity, and maintains a balanced capital structure. In this article, we’ll break down the key components of a strong balance sheet and why it’s crucial for long-term success.

What Makes a Strong Balance Sheet?

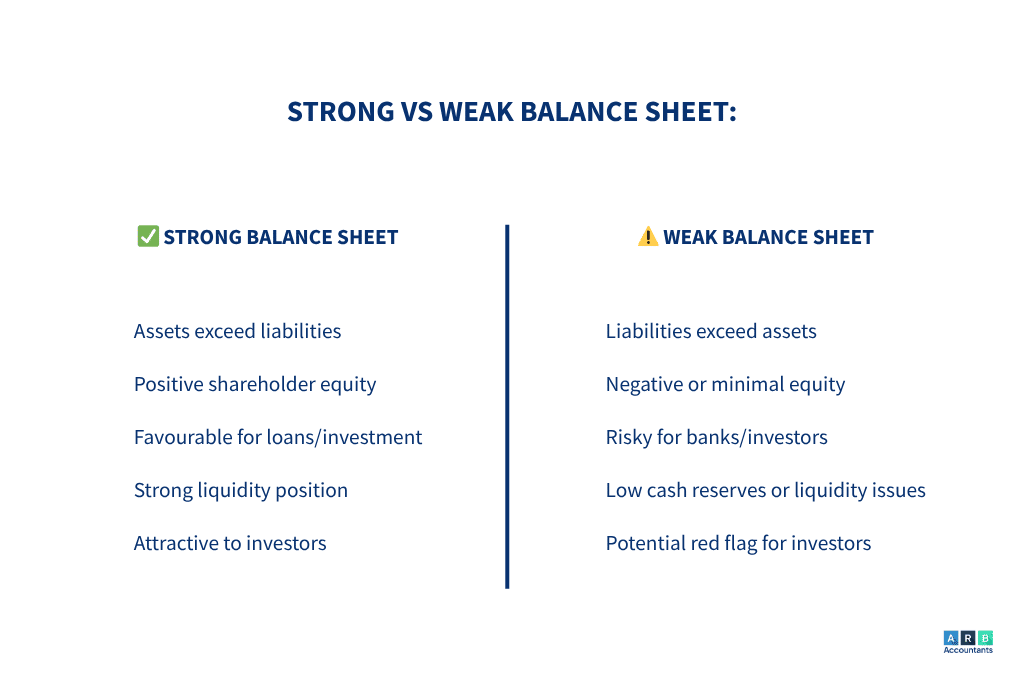

So, what is a strong balance sheet? A company with a strong balance sheet is structured to support business goals and maximize profits. A strong balance sheet should include:

- Intelligent working capital

- Positive cash flow

- A balanced capital structure

- Income-generating assets

Read on to learn more about what makes a strong balance sheet and the factors that impact it.

Contractors, in particular, depend on stable cash flow and low debt structures, making the guidance of experienced contractor accountants especially valuable when reviewing balance sheet health.

“One most common red flag on a weak balance sheet is assets, which some small companies don’t capitalise on the balance sheet. What I mean by that is, for example, let’s say Epic or even my business, ARB Accountants. Let’s say we buy furniture for the office, a sofa or a table or chairs or desk or computer, the things that we use in an office. Most businesses think, ‘Oh, it’s just an expense,’ because we’ve spent money for the business. But it’s not, it’s actually an asset.

And the reason is because it’s going to last more than a year. You’re not going to replace your desk or laptop every year. So they cannot be an overhead, they have to be capitalised. If they are capitalised on your balance sheet, suddenly you have assets that weren’t there before. Otherwise, you entered them in the profit and loss as an expense. So effectively, if you’re missing £5,000 worth of assets on your balance sheet, it will look weak because it’s just a misallocation of a transaction.”

How Do You Know if a Balance Sheet is Strong?

If you’re not an accountant, it can be difficult to know what a good balance sheet look like and assess your company’s financial health. The following steps below will help you to determine whether or not your company is financially strong based on balance sheet financial data.

- When deciding if your company’s balance sheet is healthy, begin by determining if the company has enough current assets to pay its financial obligations. A company that has more liabilities than assets is considered financially weak.

- Calculate the current ratio by dividing the total of your company’s current assets by current liabilities. A current ratio of 1 or greater is preferable when deciding financial strength.

- Calculate the quick ratio by subtracting inventory from current assets and dividing that result by current liabilities. A quick ratio higher than 1 means that your company is in a good financial position.

- Calculate the cash-to-debt ratio by adding cash and short-term investments and dividing that total by current and long-term liabilities. A favorable cash-to-debt ratio is anything equal to or exceeding 1.5.

- Determine whether important data on the balance sheet is improving or declining over time by examining past balance sheets and trends. Compare the financial data of your balance sheet to similar companies’ balance sheets and industry ratios.

If you’re wondering what does a healthy balance sheet look like, it’s one that meets these financial strength criteria.

“Some clients don’t understand the difference between short-term liability and a long-term liability. A short-term liability needs to be paid within the next 12 months. Long-term is anything between 1 year and 5 years. Let’s say you have a bank loan of £30,000, only the portion due within the next 12 months should be current liabilities, say £4,000. The remaining £26,000 is long-term. If you put the full £30,000 under current liabilities, a third party might think the company is not doing great.”

What is a Weak Balance Sheet?

A weak balance sheet will typically reveal a poorly performing business. The balance sheet will often detail some of the following factors:

- Negative equity

- Negative or deficit retained earning

- Negative net tangible assets

- Low current ratio

What Factors Evaluate Financial Strength?

Businesses with strong balance sheets tend to go beyond just having more assets than liabilities; they are structured to maximise efficiency and performance and to support the goals of the entire business.

A strong balance sheet will usually tick the following boxes:

- They will have a positive net asset position

- They will have the right amount of key assets

- They will have more debtors than creditors

- They will have a fast-moving receivables ledger

- They will have a good debt-to-equity ratio

- They will have a strong current ratio

READ RELATED ARTICLE: Why Is a Balance Sheet Important for Decision Making?

What is the Most Important Thing on a Balance Sheet?

There are three key factors to look out for on a balance sheet; assets, liabilities, and equity.

Assets

Assets should be divided up into current assets and noncurrent assets. Current assets include cash, inventories, and net receivables. However, cash is the most important asset.

Liabilities

Again, like assets, liabilities are split into current and noncurrent liabilities, where Current liabilities are obligations due within a year. Analysts look for fewer liabilities than assets, particularly in comparison to cash flow.

Common liabilities include:

- Accounts payable

- Deferred income

- Long-term debt

- Customer deposits

Equity

Equity is equal to assets minus liabilities, and it represents how much the company’s shareholders actually have a claim to. Pay particular attention to retained earnings.

“In some businesses, debtors (people who owe you money) being higher than creditors (people you owe) can be a red flag. In my case, my debtors are always higher, but I don’t owe a lot to suppliers. That’s fine for me. But in some industries, if you pay your suppliers quickly but your customers don’t pay on time, your cash flow will suffer. You’ll face shortages or cash flow issues even if your balance sheet looks fine on the surface.”

What is a Good Balance Sheet Ratio?

You can get a better understanding of the financial situation of your business by performing a few quick calculations using information contained within your balance sheet.

Current Ratio

This allows you to know if your company has enough cash and short-term assets on hand to pay short-term bills. Use the Current Assets and Current Liabilities data to work this out:

Current Ratio = Current Assets ÷ Current Liabilities

From this calculation, a ratio of 1.5 to 2 would be adequate, but this also depends on the industry in which your company operates.

Quick Ratio

A quick ratio is similar to the above but removes inventories from the equation. Use the below calculation:

Quick Ratio = (Current Assets – Inventories) ÷ Current Liabilities

A quick ratio higher than 1 is generally considered as safe, but this also depends on the industry in which your company operates.

Working Capital

Working capital is the difference between current assets and current liabilities, but whether the calculation is positive or negative will depend on the industry in which your company operates. Work this out using the following formula:

Working Capital = Current Assets – Current Liabilities

While a positive working capital metric is desirable in certain industries, a negative working capital metric is viewed favourably in others.

Debt/Equity

One of the most important ratios derived from a balance sheet is debt/equity, detailing how much your business depends on debt. Work this out using the following calculation:

Debt-to-Equity Ratio = Total Liabilities ÷ Shareholders’ Equity

For most companies, a lower ratio is viewed more favourably, however, a ratio of 0 can look equally bad, indicating an inefficient capital structure.

These balance sheet ratios help determine financial health. Landlords also monitor assets and debt closely, and many work with accountants for landlords to keep their portfolios stable.

Why is a Strong Balance Sheet Important?

A balance sheet provides you with a snapshot of what your business both owns and owes within a financial year. This, when compared to previous balance sheets, gives you an indication of how well your business has done in the last 12 months.

This then lets investors the information they need to make informed decisions about lending. A balance sheet can also help you to make informed decisions and provide warnings of a weak financial position. This is why a balance sheet is important for both businesses and investors.

“I had a client, a tile business, they were doing over a million in turnover but always struggled with cash flow. Whenever I visited them, they looked busy but if you’re not making money or are just breaking even, what’s the point of employing 10 people and running like a headless chicken? We looked into it. They were buying too much stock to get supplier discounts. But they weren’t selling it fast enough.

They’d get 30-day payment terms from the supplier but it would take 6, 9, 12 months to sell the stock. So they’re paying for things much earlier than they’re getting money back. We had conversations and made changes: Don’t overbuy stock, Negotiate longer credit terms, say 90 days. You can apply this logic to any business whether tiles, clothes, or retail. You need a variety of stock to sell, but you also need a plan to keep your cash cycle healthy.”

Accounting and Bookkeeping Services Essex

ARB Accountants offer a wide range of accounting and bookkeeping services in Essex and across the UK, including the preparation of balance sheets. Our chartered accountants in Essex will calculate your annual balance sheet whilst ensuring that you fully understand your financial landscape, and how it can impact your business.

Get in touch with us today to learn more about how our team of experienced accountants in Essex can help you keep on top of your business’ finances.

I have worked with this company for 2 years now and it has been a great support for my business. They have helped me grow and succeed.