Can Capital Allowances Create a Loss?

Can capital allowances create a loss? That’s a common question we hear from business owners and the answer is, yes, capital allowance claims can sometimes push your accounts into a loss position. But whether that’s a good or bad thing depends on your business status. Can capital allowances create a loss if you’re already under the tax threshold? Possibly. Can capital allowances create a loss when you’re planning to close your business? Likely and that could have consequences. In this blog, ARB Accountants discusses exactly why you might not make a claim for capital allowances, helping you decide what’s best for your situation.

So, why would you not claim capital allowances? It is recommended not to claim for capital allowances if your business earns under £12,570, as you will be covered by your personal tax allowance resulting in no effect to your taxes. If your business is coming to the end of its life, or you own seasonal hire purchase machinery, you should also reconsider not claiming too.

Keep reading to find out more about capital allowances including what items you can claim capital allowance for and how capital allowance is calculated for cars.

Why Would You Not Claim Capital Allowances?

Many believe you should always claim capital allowances for sole traders or small businesses to reduce taxes. However, in some cases, it can actually be more beneficial not to claim for capital allowances. Take a look below at the main reasons why you may choose to avoid claiming capital allowances.

| Low Profits | In some cases, particularly if you are a start-up or a sole trader, your profits may only reach a level whereby your costs are covered by personal allowances (£12,570). This means that any claims for capital allowance will not contribute to a reduction in taxes or NIC liability. Can capital allowances create a loss in such cases? Technically yes, but it wouldn’t help you reduce tax and might just create paperwork without a return. |

| Business Cessation | If your business is unfortunately coming to the end of its life, then preserving the value of plants and machinery in the business is also highly valuable. This is because the cost of plant and machinery can strategically be brought forward to alleviate any potential balancing charges when closing down your business. Again, can capital allowances create a loss here? Yes but generating a loss during cessation could backfire if not planned correctly. |

| Hire Purchase Agreements | Under hire purchase agreements, hire purchase capital allowance rules say capital allowances apply only when. If the plant and machinery you have purchased falls under a hire purchase agreement, claims are only liable for outstanding payments when the item is in use. In the case of seasonal equipment that only gets used for a couple of months a year, you may find that the costs fall into a completely different financial year. As a result, you would not want to claim capital allowance on these items for said financial year. |

For more information on capital allowances, take a look at the informative video below.

What Items Can You Not Claim Capital Allowances On?

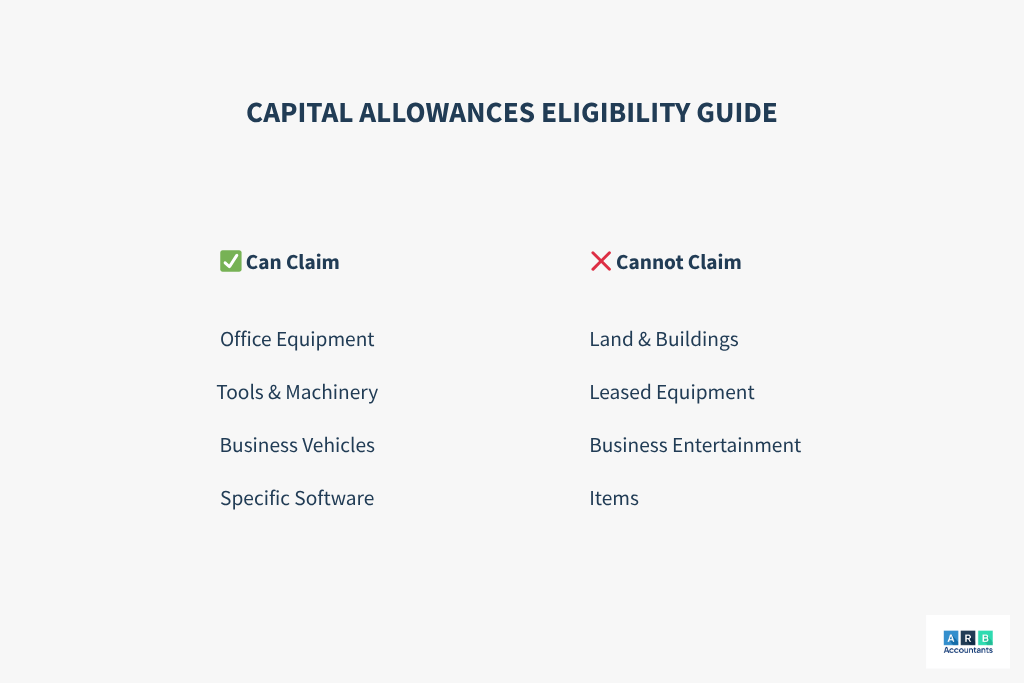

Typically capital allowances are claimed on items that are used within your business and come under the category of ‘plant and machinery’. This is significant because it means that you can deduct the cost of these items from your profits before being taxed which will increase your net profit. However, to stop people from exploiting this, there are some regulatory frameworks which determine what you cannot claim capital allowances on and to help you out we have detailed them below.

Items Used For Business Entertainment:

You cannot claim capital allowances for items that are used for entertainment with your business. Examples of these types of items include karaoke machines, parties, or ping pong tables. Although some businesses do wish to invest in these to create a particular type of company culture, it does not mean that they are imperative to the day-to-day running of the business and therefore cannot be claimed as a capital allowance to receive a deduction from your annual profit.

Land & Structures:

Land and structures such as bridges, roads and docks are also examples of things that you cannot claim capital allowances on for your business costs. This is because they are considered to be assets rather than plant and machinery. Therefore, therefore hold a significant value which can later be sold by the business and added to the company capital, resulting in added value.

Leased Items:

Leased items are another example of products that cannot be claimed for capital allowance. Leased offices, leased equipment or leased products are not eligible for capital allowance deductions because companies are not liable for the cost of maintaining these products to run their businesses, therefore are already making a saving.

Can capital allowances create a loss if you mistakenly try to claim for non-qualifying assets? Possibly but it could also lead to HMRC scrutiny or rejected claims.

READ RELATED ARTICLE: Do all businesses pay corporation tax?

How are Capital Allowances Calculated for Cars?

If you purchase and use vehicles within your business you will also be able to claim for a capital allowance reduction. This means that you will be eligible for a deduction of part of the value from your profits before you pay tax, which ultimately reduces the taxes you pay.

According to the Government website, you can claim the following rates for your car:

- The full value of the car as first year allowances

- 18% of the car’s value (main rate allowances)

- 6% of the car’s value (special rate allowances)

It is important to note that which rate you choose also depends on when you bought the car and the level of its CO2 emissions. Capital allowances on cars allow you to reduce your tax burden efficiently but can capital allowances create a loss if claimed incorrectly or without profits to offset? Absolutely. For more information on this, click here.

Mileage & Expenses:

If you are a sole trader, you are eligible to claim for mileage expenses undertaken by your company vehicles. For the first 10,000 miles completed by the car, you can claim 45p per flat mile, and after 10,000 miles 25p per mile. If you’ve claimed for fuel costs, you cannot also claim under capital allowances on cars.

What Qualifies for Capital Allowances?

Understanding what qualifies for capital allowances is key before submitting any claim. Generally, these include:

- Office equipment

- Tools

- Vehicles used for business

- Certain types of software

- Plant and machinery

Can capital allowances create a loss even if the asset qualifies? Yes, especially when your profit margins are slim or zero.

Saurabh is capable, helpful and professional. We have been very impressed by his work . He is a vital part of our company ensuring that all our statatuary responsibilities are fulfilled on time and correctly.

Tax Advice at ARB Accountants

ARB Accountants offer Tax Advice services in Essex that includes expertise on capital allowance claims. Our experienced chartered accountants in Southend will support you with all of your capital allowance requirements and questions to make sure that you make the most beneficial claims for your business.

If you are interested in our tax advice service, don’t hesitate to get in touch today.