How to reduce tax in salary UK legally (2025 guide)

For many UK employees, a steady salary doesn’t always feel as rewarding once income tax and National Insurance (NI) deductions are applied. The rising cost of living, coupled with frozen tax thresholds, means a growing number of workers are slipping into higher tax bands without seeing a real increase in take-home pay. That’s where understanding how to reduce tax in salary UK becomes essential, not through loopholes, but through strategic, HMRC-compliant planning.

Many salaried professionals also run side projects or freelance work, and in those cases our accountants for freelancers help ensure income is structured in the most tax-efficient way.

In practical terms, tax efficiency for employees depends on a few key levers: your personal allowance (£12,570 for the 2025/26 tax year), your adjusted net income (which determines your eligibility for certain tax reliefs), and how you use mechanisms such as salary sacrifice, pension relief, and tax-efficient employee benefits. Each of these influences the portion of your gross pay that HMRC treats as taxable income.

The 2025 tax year is particularly challenging because personal allowance and higher-rate thresholds remain frozen, meaning more earners are drifting into the 40% band, a phenomenon known as “fiscal drag.” According to the Office for Budget Responsibility, these freezes are expected to pull nearly 4 million more workers into higher tax brackets by 2028 (OBR, 2024). This makes it even more critical to understand how to pay less tax UK and structure your salary in the most tax-efficient way possible.

At ARB Accountants, we work closely with salaried professionals and high-earning employees to design legal, compliant strategies that reduce taxable income without triggering HMRC scrutiny.

- What is the margin for reducing tax via salary in the UK in 2025?

- How does adjusting gross salary via salary sacrifice schemes help reduce tax in salary UK?

- How can increasing pension contributions reduce your taxable salary in the UK?

- How can you use employer-provided benefits and allowances to reduce taxable salary in the UK?

- How does the personal allowance taper trap affect salary tax and how can you avoid it?

- How can you restructure bonus, commission or variable pay to legally reduce tax in salary UK?

- How can tax-efficient savings (ISA/IFISA) and investments help alongside salary to reduce the tax burden?

- What are the key pitfalls and compliance risks when reducing tax in salary UK legally?

- Frequently Asked Questions

What is the margin for reducing tax via salary in the UK in 2025?

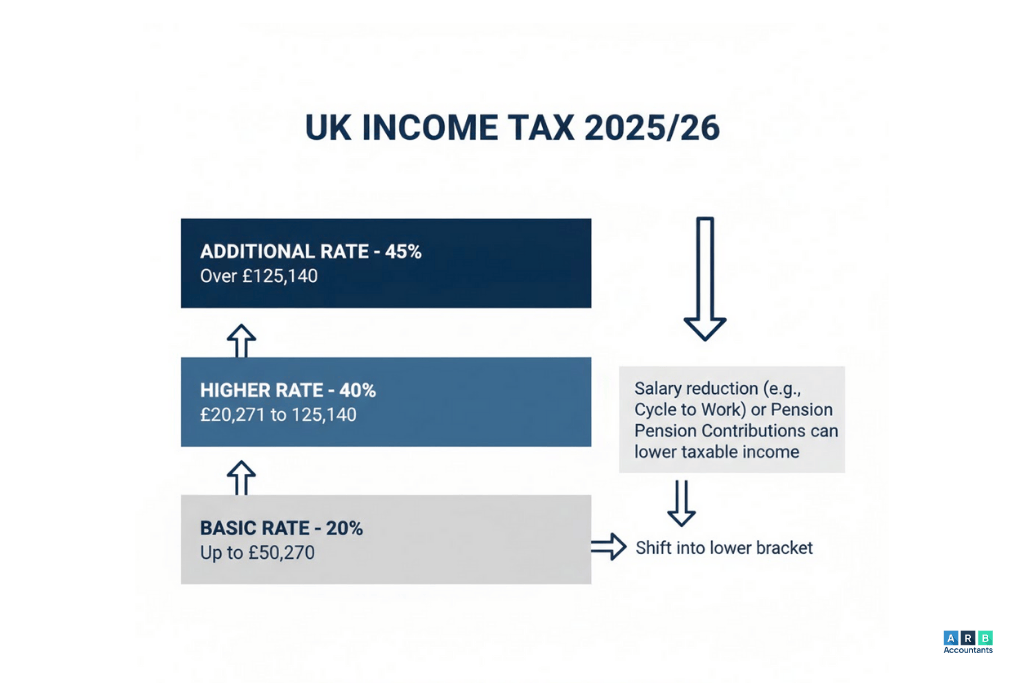

Understanding the limits of how to reduce tax in salary UK starts with the tax system itself. For 2025/26, the personal allowance remains at £12,570, meaning no income tax applies to your first £12,570 of earnings (GOV.UK). Income between £12,571 and £50,270 is taxed at 20%, while income above £50,271 is taxed at 40%.

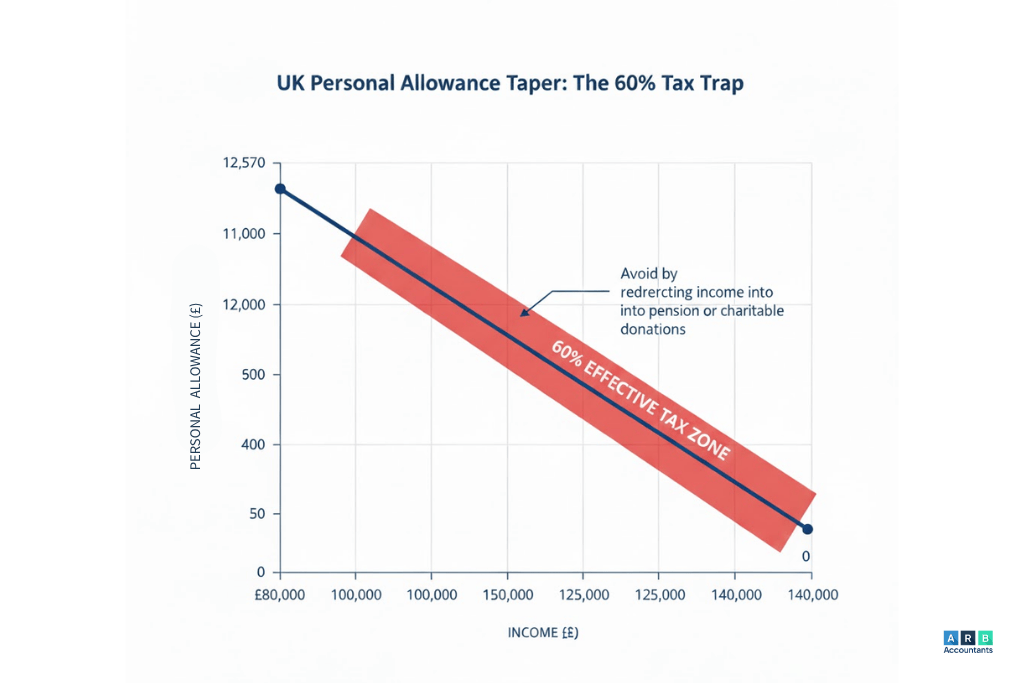

However, once your adjusted net income, that’s your gross salary minus certain reliefs like pension contributions and Gift Aid donations exceeds £100,000, your personal allowance begins to taper. For every £2 earned above £100,000, you lose £1 of your allowance. By £125,140, your allowance is completely gone, resulting in an effective marginal tax rate of 60% between £100,000 and £125,140 (GOV.UK).

This is the “tax trap” most high earners fall into, and it’s why ARB’s team often begins by modelling a client’s taxable salary base, that is, how much of their gross pay is actually subject to income tax and NI. Even modest adjustments can bring significant results:

| Gross Income | Adjusted Net Income | Tax Band | Annual Tax | Tax Saved by Reducing £5,000 via Pension |

|---|---|---|---|---|

| £55,000 | £55,000 | 40% | £7,486 | £1,000+ |

| £102,000 | £97,000 | 40% + 60% band | £25,500 | £2,200+ |

| £120,000 | £110,000 | 40% | £32,000 | £3,000+ |

Reducing taxable salary doesn’t mean earning less, it means restructuring your remuneration to maximise after-tax value. This can be done through mechanisms like pension contributions, salary sacrifice schemes, or benefit adjustments.

At ARB Accountants, we recommend running a full gross-vs-net modelling exercise before implementing any salary changes. This helps identify whether to prioritise pension relief, benefits in kind, or tax-efficient investments based on your personal circumstances. It’s a calculated, data-backed approach. It’s not a guessing game and ensures every adjustment aligns with compliance rules and your long-term goals.

How does adjusting gross salary via salary sacrifice schemes help reduce tax in salary UK?

A salary sacrifice scheme, also known as salary exchange, is one of the most effective and fully legal methods of reducing taxable income. It’s also one of the most practical answers to how to reduce tax in salary UK without breaching HMRC rules. It involves voluntarily giving up part of your gross salary in exchange for non-cash benefits provided by your employer, such as employer pension contributions, cycle-to-work schemes, EV leasing, or additional holiday purchase.

The sacrificed portion isn’t counted as salary for Income Tax or National Insurance, which directly lowers your taxable pay. For instance, an employee earning £52,500 who sacrifices £2,300 into a company pension effectively reduces their taxable salary to £50,200, dropping them out of the higher-rate band and saving roughly £900 in combined tax and NI annually (The Guardian, 2024).

Employers benefit, too: they save on employer NI contributions (currently 13.8%), making it a win-win when implemented strategically. This is why many firms are expanding these programmes in 2025 to support employee tax planning while containing payroll costs.

However, not all salary sacrifice arrangements are created equal. At ARB, we always evaluate the net impact of a proposed scheme before recommending it. Our internal framework considers:

- Mortgage or lending implications – since nominal salary decreases, lenders may adjust affordability assessments.

- Pension reference salary – some employer schemes base contributions or benefits on pre-sacrifice salary; others on post-sacrifice.

- Statutory benefits – maternity pay, redundancy pay, and death-in-service benefits may be affected.

This is where professional guidance matters. Miscalculating can cost more than you save. The agreement must also be formally documented in payroll, not handled informally, to meet HMRC compliance requirements.

A common question we hear is: “Is salary sacrifice really a legal way to reduce tax in salary UK?” The answer is absolutely yes, provided it’s structured correctly and reflects a genuine exchange of salary for a qualifying benefit.

Ultimately, salary sacrifice demonstrates that how to reduce tax in salary UK isn’t about loopholes, it’s about using government-approved mechanisms like this one strategically. As thresholds remain frozen and more workers approach the 40% bracket, schemes like these are among the most sustainable ways to reduce taxable income and stay compliant.

At ARB Accountants, we don’t just recommend salary sacrifice; we model the entire remuneration package to show the exact impact on take-home pay, NI savings, and long-term pension value. That’s how we help clients move beyond one-off tax saving tips and build a truly tax-efficient salary structure.

For readers who work on contracts or mixed PAYE–contract roles, speaking with our contractor accountants can help you plan salary and variable income without triggering unexpected tax charges.

How can increasing pension contributions reduce your taxable salary in the UK?

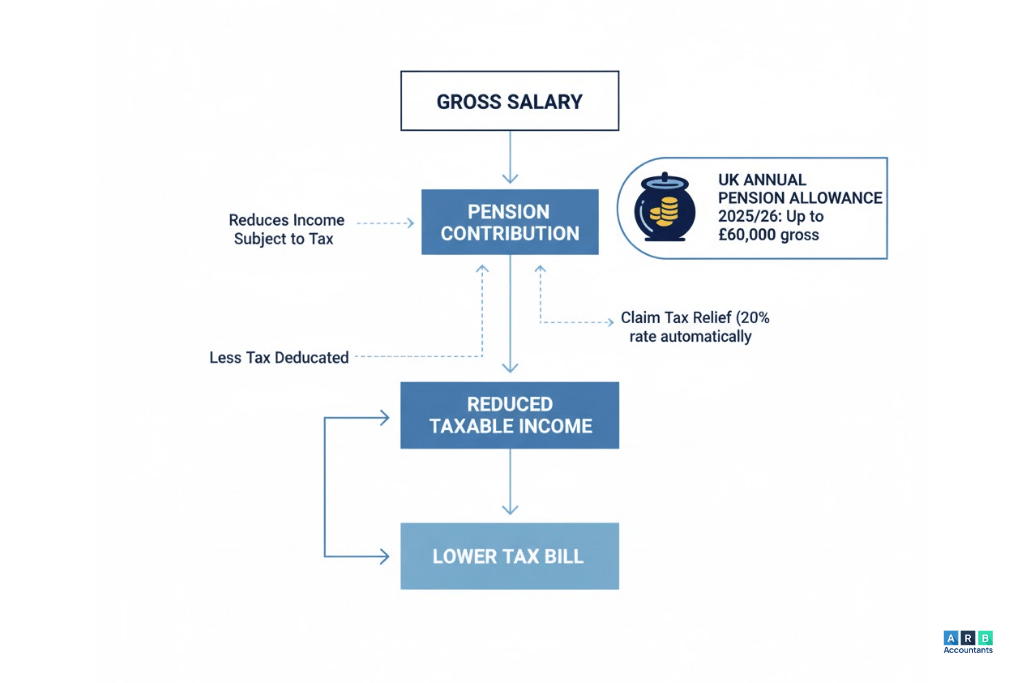

When exploring how to reduce tax in salary UK, pension contributions remain one of the most effective and legitimate strategies. Contributions into an approved workplace pension or a Self-Invested Personal Pension (SIPP) are deducted from gross pay before tax is calculated, meaning you only pay income tax on the remaining amount. This structure directly reduces taxable income and therefore the overall tax bill (freetrade.io).

For 2025/26, the annual pension allowance is £60,000 or 100% of earnings, whichever is lower (future-cloud.co.uk). Employees earning above £100,000 face the well-known 60% marginal tax trap, where the personal allowance tapers off, dramatically increasing effective tax rates. By increasing pension contributions, high earners can bring their adjusted net income below key thresholds and recover lost personal allowance (St. James’s Place).

In practice, ARB recommends that employees review pension top-ups during the final quarter of the tax year, especially if bonuses or pay reviews are approaching. This timing allows salary-earners to project total annual income and make targeted contributions to stay within optimal tax bands.

For example, a senior employee anticipating a £15,000 year-end bonus might choose to redirect £10,000 into their pension. This reduces taxable salary by that amount, cutting both income tax and National Insurance while growing long-term savings. The impact is twofold: immediate tax relief and greater financial security at retirement.

Where employees have unused pension allowances from the past three years, the carry-forward rule can be applied to make larger contributions without breaching annual limits. This is especially valuable for high earners with fluctuating income.

Understanding these pension mechanisms is central to how to pay less tax UK and how to reduce taxable income UK, as they allow employees to transform taxable salary into future wealth without crossing regulatory limits.

How can you use employer-provided benefits and allowances to reduce taxable salary in the UK?

Another important aspect of how to reduce tax in salary UK is making full use of employer-provided benefits and allowances under the PAYE system. Certain benefits, when structured correctly, reduce taxable salary while improving employee wellbeing.

The most common tax-efficient benefits include employer pension contributions, electric company cars, cycle-to-work schemes, and low-emission vans. Each of these replaces a portion of cash salary with a benefit-in-kind taxed at a lower rate or fully exempt from tax. For example, electric vehicles attract minimal benefit-in-kind rates compared to traditional cars, and cycle-to-work schemes reduce both income tax and National Insurance.

Beyond these mainstream options, employees can also benefit from less-utilised allowances. Professional subscriptions paid directly by employers for memberships to approved bodies (such as ACCA or CIPD) are tax-deductible. The same applies to work uniforms, protective tools, and charitable donations made through payroll under the Gift Aid scheme. These collectively contribute to how to save tax in UK without altering headline salary figures.

ARB’s approach focuses on auditing each employee’s total remuneration package rather than looking only at base pay. In many payroll reviews, we find missed opportunities where employees could shift part of their income into non-taxable benefits, significantly increasing take-home pay.

For example, if an employee opts for a £3,000 cycle-to-work benefit, their taxable salary reduces by that amount, producing direct savings on both tax and NI. This structure is an excellent demonstration of how to pay less tax as an employee UK and a practical example of ways to reduce taxable income.

By strategically balancing salary, benefits, and allowances, employees become more tax-efficient without breaching compliance boundaries. This forms part of broader UK tax savings strategies that align with government-approved incentive schemes.

READ RELATED ARTICLE: Lease Electric Car Through Limited Company to Save Tax

How does the personal allowance taper trap affect salary tax and how can you avoid it?

A crucial factor in how to reduce tax in salary UK for higher earners is understanding the personal allowance taper. Under current UK tax rules, the standard personal allowance of £12,570 decreases by £1 for every £2 earned over £100,000. This means that between approximately £100,000 and £125,140, the effective marginal tax rate is close to 60% (GOV.UK).

For employees within this range, small salary increases or performance bonuses can result in disproportionate tax losses. Planning ahead becomes essential to avoid crossing this threshold. Increasing pension contributions or utilising salary sacrifice arrangements can help bring adjusted net income below £100,000, restoring lost allowance and reducing tax exposure.

ARB advises modelling adjusted net income at the start of each tax year. Employees expecting variable income, such as bonuses or commissions, can defer payments or make additional pension contributions before year-end to remain within the tax-efficient band.

Consider a case study: an employee earning £105,000 with a £5,000 bonus would lose part of their personal allowance, facing a higher tax bill. By diverting that £5,000 into a workplace pension, they lower adjusted income to £100,000, regain full allowance, and cut total tax payable.

Beyond direct salary taxation, crossing the £100,000 threshold can also impact entitlement to other benefits such as Child Benefit, certain NI credits, or Universal Credit tapering. For this reason, the taper trap is particularly relevant to employees under PAYE rather than self-employed individuals.

ARB’s methodology focuses on payroll-based adjustments that maintain compliance while improving tax efficiency. Through accurate modelling and proactive communication with employers, employees can mitigate the taper’s impact and better understand how to reduce income tax UK within existing HMRC rules.

READ RELATED ARTICLE: UK Personal Tax Allowance 2025/26: Key Changes & Guide

How can you restructure bonus, commission or variable pay to legally reduce tax in salary UK?

For many professionals exploring how to reduce tax in salary UK, variable pay such as bonuses, commissions, and share-based incentives are often overlooked areas of planning. Under PAYE rules, these payments are treated as part of gross salary and taxed in the same way as regular earnings. Without planning, one-off variable payments can push employees into higher tax bands or trigger loss of personal allowance.

To be tax-efficient, employees can negotiate part of their bonus as a pension contribution or salary sacrifice arrangement before it is paid. By doing this, the amount is excluded from taxable pay and channelled into tax-advantaged schemes. Another approach is to defer or split bonus payments across two tax years to manage annual income thresholds and avoid crossing the 40% or 45% bands.

ARB’s guidance for clients is to engage HR and payroll teams early in the tax year rather than after bonuses are declared. Timing is critical because salary and bonus adjustments must be agreed and documented before payment. Through proactive planning, we help employees forecast total earnings, identify potential tax spikes, and structure their variable pay accordingly.

For example, an employee expecting a £20,000 annual bonus might elect to contribute £10,000 directly into a workplace pension and allocate another £5,000 into a salary sacrifice benefit such as an electric vehicle scheme. As a result, their taxable salary reduces by £15,000, lowering both income tax and National Insurance while maintaining valuable benefits.

These strategies must comply with HMRC rules and cannot be applied retrospectively. All changes must be processed via payroll and recorded in employment documentation. When structured correctly, this method aligns with best practices for how to pay less tax UK and represents one of the most powerful ways to reduce taxable income.

How can tax-efficient savings (ISA/IFISA) and investments help alongside salary to reduce the tax burden?

Understanding how to reduce tax in salary UK is only one part of building long-term tax efficiency. Once employees have optimised salary and pension structures, the next step is protecting the returns on their savings and investments.

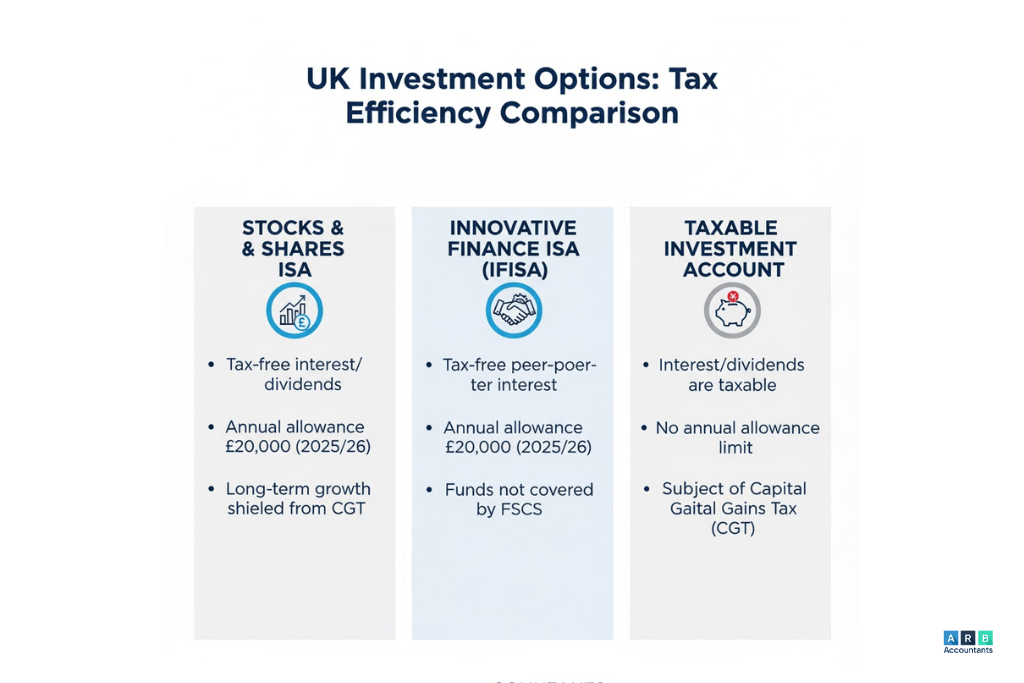

For the 2025/26 tax year, the Individual Savings Account (ISA) allows up to £20,000 per person, with all interest, dividends, and capital gains entirely tax-free (growthcapitalventures.co.uk). Higher earners can also explore Innovative Finance ISAs (IFISAs), which allow investments in peer-to-peer loans and qualifying securities while still sheltering returns from tax (easyMoney).

These vehicles complement salary strategies. For instance, when employees reduce their taxable salary through pension contributions or salary sacrifice, they often increase their net available income. This surplus can be redirected into ISAs or IFISAs to build tax-efficient savings over time.

ARB integrates both areas, salary tax planning and investment structuring within a unified financial strategy. This approach ensures clients not only reduce income tax on salary but also maximise post-tax returns on savings. It represents how to save tax in UK both immediately and over the long term.

Consider a practical example: after contributing to a pension via salary sacrifice, an employee uses the extra take-home cash to invest in a Stocks and Shares ISA. Over time, dividends and growth within that ISA are completely exempt from further tax. This balance between income reduction and tax-free growth defines how to be tax efficient UK and supports sustainable wealth management.

READ RELATED ARTICLE: Salary vs Dividends: What Is the Best Way to Pay Yourself

What are the key pitfalls and compliance risks when reducing tax in salary UK legally?

While exploring how to reduce tax in salary UK, employees must also understand potential compliance risks. The most common issues arise from poorly executed salary sacrifice agreements, incorrect payroll processing, or breaching minimum wage regulations when reducing cash salary.

Salary restructuring must follow HMRC’s salary sacrifice framework. Any agreement that appears solely designed for tax avoidance rather than genuine benefit provision may attract scrutiny. Documentation must clearly show employee consent and employer acceptance before changes take effect.

Reducing gross salary can also affect future benefits. A lower contractual salary might reduce the base used to calculate employer pension contributions, maternity pay, or redundancy entitlements. It can also influence mortgage affordability checks since lenders typically assess nominal salary rather than overall package value.

ARB conducts salary tax impact audits to map out these implications before changes are made. Our process includes modelling adjusted net income, reviewing employment contracts, and confirming that any restructuring meets both tax and employment law requirements. We also check that employees remain above statutory wage thresholds and that payroll teams implement the changes accurately.

Timing remains critical. Adjustments made late in the tax year may miss payroll cut-offs or fail to influence total taxable income for that period. For variable pay, restructuring must occur before the bonus is due.

To manage these factors effectively, employees should follow an action checklist:

- Review employment contracts for flexibility clauses.

- Confirm eligibility and scheme rules with HR.

- Run before-and-after net pay calculations.

- Ensure all documentation is signed and recorded with payroll.

These steps align with how to reduce income tax UK safely while maintaining compliance. ARB’s holistic review process ensures that each adjustment enhances UK tax savings without exposing employees or employers to unnecessary HMRC risk.

If part of your income falls outside PAYE, a self assessment accountant can help ensure your total taxable income is calculated correctly across all sources.